10 Best Renters Insurance Companies for 2026 (Check Out These Providers)

The best renters insurance companies comes from State Farm, Geico, and Progressive, offering exceptional coverage starting at $22 per month. These companies excel in their customizable coverage options, numerous discounts, and local agent support to protect your belongings effectively.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insurance...

Leslie Kasperowicz

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Michael Vereecke

Updated August 2025

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Renters

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews

Company Facts

Full Coverage for Renters

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Renters

A.M. Best Rating

Complaint Level

13,283 reviews

13,283 reviews

The best renters insurance companies comes from are State Farm, Geico, and Progressive, offering exceptional coverage starting at $22/month. State Farm is known for its personalized service, Geico for its affordable rates and discounts, and Progressive for its flexible coverage options.

This article will help you understand renters insurance by explaining its importance, outlining key factors to consider when selecting a provider, and reviewing the top companies to help you make an informed choice.

Our Top 10 Picks: Best Renters Insurance Companies

Company Rank Security System A.M. Best Best For Jump to Pros/Cons

#1 20% A++ IntelliDrive Program Travelers

#2 15% A++ Customer Service USAA

#3 15% A+ Drivewise Program Allstate

#4 10% A++ Local Agent State Farm

#5 10% A++ Claims Handling Chubb

#6 10% A+ Customizable Coverage Progressive

#7 10% A+ Bundling Policies Nationwide

#8 10% A Accident Forgiveness Liberty Mutual

#9 7% A+ Personalized Service Farmers

#10 5% A++ Numerous Discount Geico

Whether you’re looking for affordable premiums, extensive coverage options, or superior customer support, you’ll find valuable insights to help you make an informed decision. Check out our rental insurance guide for more information.

Don’t let expensive insurance rates hold you back. Enter your ZIP code above and shop for affordable premiums from the top companies.

- State Farm is the top pick, offer customizable coverage and numerous discounts

- Providers offers excellent customer service and comprehensive protection for renters

- Choose from top providers for affordable rates starting at $22 per month

#1 – State Farm: Top Overall Pick

Pros

- Personalized Guidance: State Farm’s local agents provide tailored advice, ensuring your renters insurance is specifically suited to your individual circumstances.

- Immediate Support: With local agents available, you can get quick and direct assistance for any renters insurance-related issues. Learn more in our State Farm review.

- Community-Based Service: State Farm’s local presence fosters a strong community connection, enhancing the customer experience for renters insurance.

Cons

- Inconsistent Availability: The level of service and expertise of local agents can vary significantly between regions, affecting your renters insurance experience.

- Potentially Higher Costs: The personalized service provided by local agents may come with slightly higher premiums for renters insurance compared to purely online options.

Free Rental Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Numerous Discount

Pros

- Diverse Savings Opportunities: Geico offers a broad range of discounts on renters insurance, allowing you to maximize your savings.

- Cost-Effective Renters Insurance: With multiple discount options, Geico makes it easier to find an affordable renters insurance policy. Find out more in our Geico review.

- Flexible Discount Application: Geico’s numerous discounts can be tailored to your specific situation, potentially reducing your renters insurance costs further.

Cons

- Complex Discount Structure: Navigating Geico’s variety of discounts can be confusing, making it harder to understand how they affect your renters insurance premium.

- Limited Personalized Service: As an online-centric company, Geico may offer less individualized support for renters insurance compared to companies with local agents.

#3 – Progressive: Best for Customizable Coverage

Pros

- Adaptable Insurance Solutions: Progressive allows you to adjust your renters insurance coverage, providing a personalized fit for your unique needs.

- Flexible Policy Options: The ability to modify coverage options ensures that Progressive’s renters insurance aligns with your specific requirements.

- Tailored Protection Plans: Customization options with Progressive help ensure your renters insurance provides the precise coverage you need. Read our Progressive review for a full list.

Cons

- Potential Complexity: The range of customizable options can make the process of selecting the right renters insurance more complicated.

- Higher Premium Possibility: Customizing your renters insurance with Progressive could lead to increased costs, depending on the coverage levels you choose.

#4 – Allstate: Best for Drivewise Program

Pros

- Reward for Safe Driving: Allstate’s Drivewise program offers renters insurance discounts for safe driving, rewarding responsible behavior, which you can learn about in our Allstate review.

- Enhanced Premium Savings: By participating in Drivewise, you can reduce your renters insurance costs through performance-based discounts.

- Integrated Insurance Benefits: Drivewise not only benefits auto insurance but also translates into savings for your renters insurance policy.

Cons

- Limited Impact on Renters Insurance: The primary focus of Drivewise is on auto insurance, which might not significantly impact your renters insurance savings.

- Eligibility for Discounts: Drivewise discounts rely on driving behavior, so renters who don’t drive may not qualify. Renters insurance, however, is still available to them.

Free Rental Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Stable Premiums: Liberty Mutual’s accident forgiveness ensures your renters insurance premiums won’t increase after an accident, maintaining consistent costs.

- Risk Management Benefit: The accident forgiveness feature provides added reassurance, knowing that your renters insurance rates are protected from sudden hikes.

- Stress-Free Coverage: With accident forgiveness, you can enjoy peace of mind, knowing your renters insurance remains affordable even after a claim. Read more in our review of Liberty Mutual.

Cons

- Higher Initial Premiums: Accident forgiveness may result in higher starting premiums for renters insurance compared to policies without this feature.

- Not Available Everywhere: This feature might not be offered in all regions, potentially limiting its availability for renters insurance customers.

#6 – Nationwide: Best for Bundling Policies

Pros

- Bundling Savings: Nationwide offers attractive discounts on renters insurance when combined with other policies, leading to lower overall costs.

- Simplified Insurance Management: Bundling policies with Nationwide makes it easier to manage your renters insurance alongside other coverage.

- Comprehensive Coverage Solutions: Bundling improves your coverage options by offering a more comprehensive approach to your insurance needs, including renters insurance.

Cons

- Dependency on Multiple Policies: To maximize bundling discounts, you need multiple Nationwide policies, including renters insurance, which may not be ideal for everyone.

- Potential for Higher Combined Costs: Bundling might cost more if the other policies, like renters insurance, have higher premiums than buying them separately.

#7 – USAA: Best for Customer Service

Pros

- Top-Notch Assistance: USAA is renowned for its exceptional customer service, providing robust support for renters insurance needs. Discover more about the USAA review.

- Efficient Claims Process: With excellent customer service, USAA ensures that renters insurance claims are handled swiftly and effectively.

- Specialized Service for Military Families: USAA’s customer service is tailored to meet the specific needs of military families, enhancing their renters insurance experience.

Cons

- Eligibility Restrictions: USAA’s renters insurance is only available to military members and their families, excluding a broader audience.

- Limited In-Person Support: USAA’s support is mainly online and by phone, which might not be ideal for those who prefer in-person interactions, and they also offer renters insurance.

Free Rental Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Personalized Service

Pros

- Tailored Coverage Options: Farmers provides highly personalized service, helping you craft a renters insurance policy that meets your specific needs. For a complete list, read our Farmers review.

- Dedicated Insurance Advisors: With Farmers, you receive individualized advice from dedicated agents, ensuring your renters insurance is well-suited to your situation.

- In-Depth Policy Customization: Personalized service at Farmers allows for thorough customization of your renters insurance policy.

Cons

- Potentially Higher Premiums: The personalized approach may come with higher premiums compared to more generic renters insurance options.

- Less Emphasis on Online Tools: Farmers’ focus on personalized service may result in fewer online management tools for renters insurance.

#9 – Chubb: Best for Claims Handling

Pros

- Prompt Claims Processing: Chubb is known for its efficient and timely handling of renters insurance claims, ensuring quick resolution. For additional information, refer to our guide titled “Comparing Plans and Getting an Insurance Plan that Works for You.”

- High-Quality Claims Support: Known for its excellent claims handling, provides dependable support and guidance during the claims process, including for renters insurance.

- Comprehensive Claims Service: Chubb provides thorough and attentive service for renters insurance claims, addressing all aspects of your needs.

Cons

- Higher Premium Costs: The emphasis on excellent claims handling might come with higher premiums for renters insurance.

- Limited Discount Opportunities: Chubb might provide fewer discounts than other insurers, which could result in higher total costs, especially for renters insurance.

#10 – Travelers: Best for IntelliDrive Program

Pros

- Behavior-Based Discounts: The IntelliDrive program offers renters insurance discounts based on driving behavior, providing potential savings for safe drivers.

- Incentive for Safe Practices: Participation in IntelliDrive can encourage safer driving habits, benefiting both your auto and renters insurance premiums. Read our Travelers review to learn what else is offered.

- Personalized Savings Opportunities: IntelliDrive’s data-driven approach allows for more personalized renters insurance discounts based on your driving data.

Cons

- Focus on Driving Data: The IntelliDrive program’s benefits are largely tied to driving behavior, which may not impact renters insurance if you don’t drive much.

- Privacy Concerns: Some customers may have privacy concerns about sharing their driving data with IntelliDrive, even with renters insurance in place.

Free Rental Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Renters Insurance: Monthly Rates and Discounts by Provider

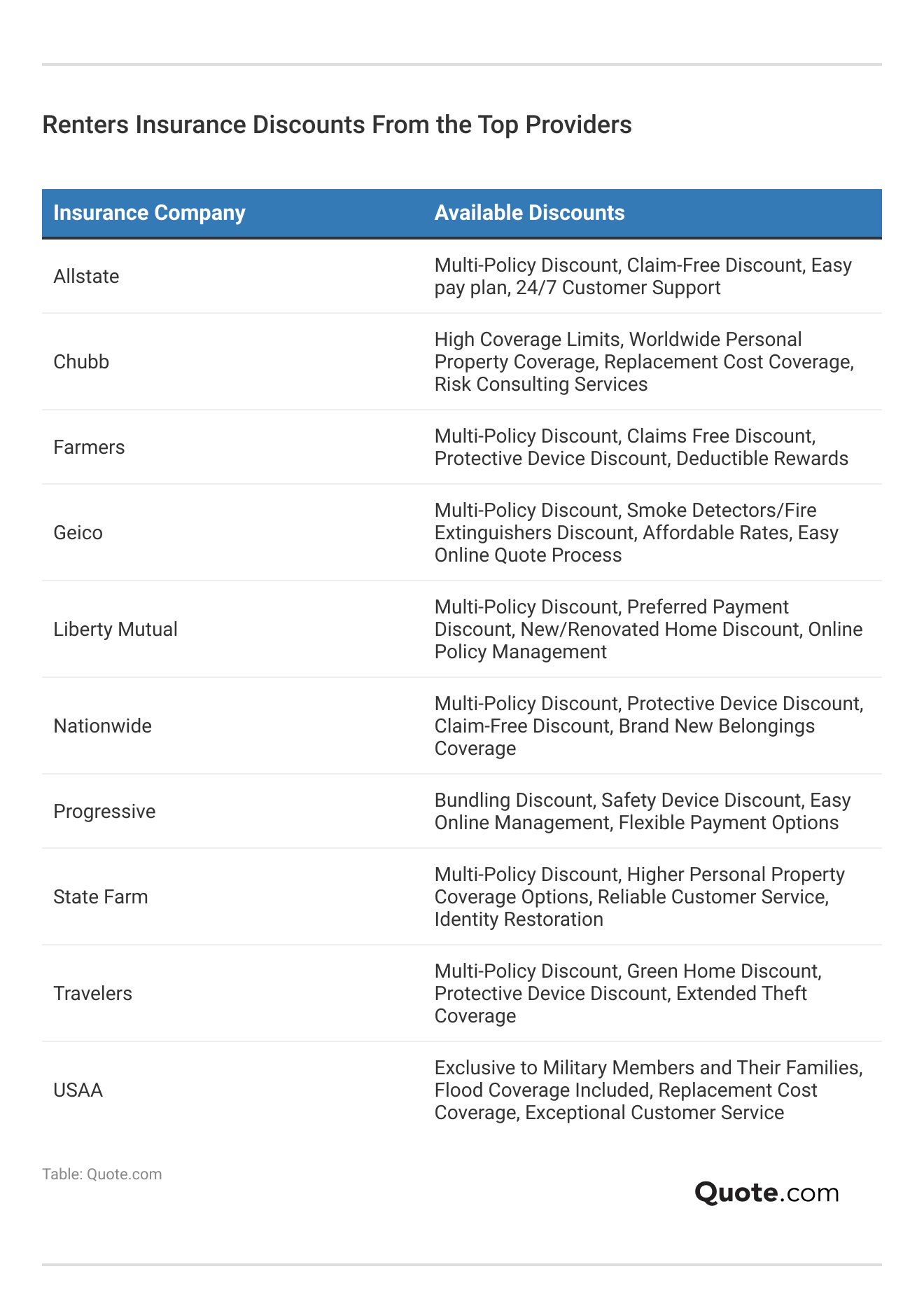

Looking to save on renters insurance? Many top providers offer a variety of discounts to help you get the best deal. For instance, multi-policy savings allow you to bundle renters insurance with other policies like auto or home insurance, reducing overall costs.

State Farm is the top choice for renters insurance, offering personalized service and comprehensive coverage.

Michelle Robbins Licensed Insurance Agent

Additionally, some companies provide discounts for protective devices such as smoke detectors and security systems, as well as for having a new or renovated home.

Renters Insurance Monthly Rates by Coverage Level & Provider

Insurance Company $500 Deductible $1,000 Deductible $2,000 Deductible

$19 $16 $13

$25 $21 $18

$20 $17 $15

$18 $15 $12

$22 $18 $14

$21 $19 $16

$17 $14 $11

$16 $13 $10

$23 $20 $17

$15 $12 $9

This guide provides a snapshot of monthly renters insurance rates based on coverage levels across various providers. The minimum coverage rates range from $22 with USAA to $68 with Liberty Mutual. For full coverage, costs vary from $59 with USAA to $174 with Liberty Mutual. Compare these rates to find the best option for your needs and budget.

Save on renters insurance with discounts from top providers. Allstate and Geico offer multi-policy savings, while Chubb and Travelers provide extensive coverage options. Farmers and Liberty Mutual also feature discounts for protective devices and new or renovated homes. For more details, see our guide titled “Homeowners Insurance Coverage Explained.”

Nationwide and Progressive offer additional savings, and USAA provides exclusive benefits for military members. By exploring these discounts, you can tailor your renters insurance to fit both your needs and your budget. Whether you’re seeking comprehensive coverage or simply looking to save, there’s likely a discount that suits you.

The Essentials of Renters Insurance

Renters insurance is essential for anyone renting a home. It covers personal belongings, liability, and living expenses if your home becomes uninhabitable due to theft, fire, or vandalism. For further insights, dive into our detailed guide titled “Understanding the 8 Types of Homeowners Insurance Policies.”

It also offers liability protection if someone is injured while visiting your place and covers living costs if you need to temporarily move out due to damage. Overall, renters insurance ensures you’re financially protected and provides peace of mind. Renters insurance is essential for shielding yourself from unexpected costs, such as replacing damaged items or covering liability for injuries, and may also be required by landlords.

Factors to Consider When Choosing a Renters Insurance Company

Choosing the right renters insurance company is crucial for ensuring you receive the protection and support you need. To make an informed decision, it’s essential to evaluate several key factors that can impact your coverage and overall experience.

- Coverage Options: Review coverage types for personal belongings, liability, living expenses, and specific events like theft or natural disasters. Check if the policy offers replacement cost or actual cash value coverage and limits for high-value items. For further information, see our detailed insurance guide, “When Animals or Natural Disasters Damage Your Vehicle.”

- Customer Service: Evaluate the company’s customer service quality by reviewing online ratings and feedback, and seek out providers with responsive, reliable support, 24/7 assistance, and user-friendly mobile apps or online portals.

- Pricing and Discounts: Compare quotes from different providers to find an affordable policy while exploring discounts for bundling, safety features, non-smoking, loyalty, and full upfront payments, and consider flexible payment plans to manage expenses.

- Claims Process: Assess the ease and efficiency of the claims process by checking if the company has a streamlined system and reviewing customer feedback on claim resolutions.

- Financial Stability: Research the insurance company’s financial strength and stability, its reputation for handling claims, and check ratings from independent agencies assessing its reliability.

By carefully considering these factors—coverage options, customer service, pricing and discounts, claims process, and financial stability—you can make a well-informed choice when selecting a renters insurance company.

Taking the time to research and compare different providers will help ensure you find a policy that offers comprehensive protection and reliable support, giving you peace of mind and security in your rental home.

Free Rental Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating the Renters Insurance Application Process

Applying for renters insurance is a simple process. Start by providing basic information like your name, contact details, and rental address. You’ll also need to list your personal belongings’ value and provide details about the property, such as its construction and security features.

After submitting your application, you’ll receive a quote outlining coverage limits, pricing, and any deductibles. Review this quote carefully to ensure it meets your needs. Look for optional endorsements that can offer extra protection for specific risks. This will help you choose the best policy for your situation.

After selecting a renters insurance provider and securing your policy, it’s crucial to fully understand how to make the most of it. To start, you can lower your premium by increasing your deductible, but ensure that the amount is manageable for you in case of a claim.

Additionally, bundling your renters insurance with other policies like auto insurance can unlock multi-policy discounts, further reducing your overall costs. In the event that you need to file a claim, act promptly by contacting your insurance company to report the incident and submit any required documentation. For detailed information, refer to our comprehensive report titled “How to File an Auto Insurance Claim & Win It Each Time.”

Conclusion: Essential Guide to Choosing the Best Renters Insurance

This guide provides a detailed overview of renters insurance, highlighting top providers like State Farm, Geico, and Progressive, which offer coverage starting at $22/month. It explains the importance of renters insurance, which protects personal belongings, liability, and living expenses if your rental becomes uninhabitable. Read our Geico vs. Allstate review to learn more.

The article covers how to compare rates and discounts from various companies, factors to consider when choosing a provider, and tips for maximizing your policy’s benefits. It also includes advice on the application process, filing claims, and dealing with claim denials.

Comparing quotes is integral to finding the best rates possible. Enter your ZIP code below into our free tool today to see what quotes might look like for you.

Frequently Asked Questions

What makes State Farm the best company for renters insurance?

State Farm is considered one of the best companies for renters insurance due to its strong reputation, customizable coverage options, and extensive network of local agents who provide personalized service.

How can I find the best auto renters insurance?

To find the best auto renters insurance, look for companies that offer bundled policies, such as Geico and Progressive. These providers often provide discounts when you combine auto and renters insurance.

Stop overpaying for your insurance by entering your ZIP code below to find the lowest rates in your area.

Which providers offer the best apartment insurance?

The best apartment insurance providers are State Farm, Geico, and Progressive. They offer extensive coverage tailored to renters, including protection for personal belongings and liability.

Check out our ranking of the top providers: Best Homeowners Insurance Companies

What should I consider when choosing the best apartment renters insurance?

When choosing the best apartment renters insurance, consider coverage limits, deductible amounts, available discounts, and customer service quality. Providers like State Farm and Geico offer tailored policies that cater specifically to renters.

Which are the best insurance companies for renters insurance?

The best insurance companies for renters insurance include State Farm, Geico, Progressive, and USAA. These companies are known for their reliable coverage, affordability, and strong customer support.

What are the best auto and renters insurance companies?

The best auto and renters insurance companies include State Farm, Geico, Progressive, Allstate, and USAA. These companies are recognized for their comprehensive coverage options, customer service, and competitive pricing.

Find out more in our State Farm vs. Progressive review.

What is the best place to buy renters insurance online?

The best place to buy renters insurance online is through reputable insurance providers’ websites, such as those of Geico, Progressive, and State Farm. These platforms offer user-friendly quote comparisons and policy options.

Where can I find the best low-cost renters insurance?

For the best low-cost renters insurance, consider providers like Geico and USAA. They offer affordable premiums and various discounts, making it easier to find a cost-effective policy.

What are the best insurance companies for renters and auto coverage?

The best insurance companies for both renters and auto coverage include State Farm, Geico, and Progressive. These providers offer multi-policy discounts and seamless coverage options for both auto and renters insurance.

For a comprehensive analysis, refer to our detailed guide titled “Geico vs. Allstate: The Auto Insurance Showdown.”

How do I determine the best home rental insurance?

To determine the best home rental insurance, compare coverage options, premium rates, and customer reviews from top providers. Companies like Progressive and Allstate offer comprehensive coverage that can be tailored to your needs.

Avoid expensive premiums by using our free comparison tool below to find the lowest rates possible.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.