10 Best Pet Insurance Companies for 2026 (Find the Top Providers Here!)

The best pet insurance companies comes from State Farm, Nationwide and Progressive, providing affordable rates starting at $28 per month. These companies stand out for their affordability, comprehensive coverage, extensive options, and flexible plans to ensure the best protection for your pet.

Read more Secured with SHA-256 Encryption

Save Money by Comparing Insurance Quotes

Compare Free Pet Insurance Quotes Instantly

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Michael Vereecke

Updated August 2025

Company Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

3,071 reviews

3,071 reviews

Company Facts

Full Coverage

A.M. Best Rating

Complaint Level

The best pet insurance companies comes from State Farm, Nationwide and Progressive, recognized for its outstanding affordability and all-encompassing protection.

These companies provide a wide range of coverage options and flexible plans, distinguishing themselves with their extensive and tailored insurance solutions. Their offerings are designed to address various needs, from routine care to unexpected emergencies, ensuring that you have the right level of protection for your pet.

Our Top 10 Picks: Best Pet Insurance Companies| Company | Rank | A.M. Best | Multi-Pet Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | 20% | Comprehensive Coverage | State Farm | |

| #2 | A+ | 15% | Extensive Options | Nationwide |

| #3 | A+ | 10% | Flexible Plans | Progressive | |

| #4 | A++ | 8% | Member Benefits | USAA | |

| #5 | A | 7% | Reliable Service | Farmers | |

| #6 | A++ | 6% | Extensive Network | Geico | |

| #7 | A+ | 6% | Competitive Rates | Allstate | |

| #8 | A+ | 5% | Trusted Reputation | The Hartford |

| #9 | A | 5% | Membership Perks | AAA |

| #10 | A | 5% | Customer Service | American Family |

Their services are designed to ensure that your pet remains well-protected and receives the care it needs, giving you peace of mind that you’re making a sound investment in your pet’s health and well-being. Explore our pet insurance guide for additional details.

Don’t let expensive insurance rates hold you back. Enter your ZIP code above and shop for affordable premiums from the top companies.

- State Farm is the top pick with comprehensive pet insurance coverage

- Affordable rates starting at $28/month ensure financial protection for your pet

- Top pet insurance companies provide flexible plans and extensive options

#1 –State Farm: Top Overall Pick

Pros

- All-Inclusive Pet Insurance Plans: Offers comprehensive coverage that includes accidents, illnesses, and, in some cases, routine care through pet insurance.

- Reliable Claims Process: State Farm’s extensive experience ensures efficient handling of claims for pet insurance. Find out more in our State Farm review.

- Well-Established Insurance Brand: Known for its longstanding reputation in the insurance industry, which extends to their pet insurance offerings.

Cons

- Potentially Higher Cost: The broad range of coverage options may lead to higher premium rates, especially when it comes to pet insurance.

- Limited Customization Options: The standard pet insurance plans might not offer much flexibility, which can make it difficult to customize coverage to meet your pet’s specific needs.

Free Pet Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Extensive Options

Pros

- Diverse Plan Choices: Offers a broad spectrum of pet insurance plans, allowing you to select the one that best fits your pet’s needs.

- Inclusive Coverage: Plans frequently offer distinctive features such as wellness coverage, which might not be provided by other pet insurance companies.

- Strong Nationwide Presence: Well-regarded for providing reliable pet insurance across various regions.

Cons

- Complex Plan Selection: The numerous choices can be daunting, making it challenging to navigate and choose the most suitable pet insurance plan.

- Higher Premiums for Comprehensive Plans: The broad range of coverage options could result in higher monthly premiums for pet insurance.

#3 – Progressive: Best for Flexible Plans

Pros

- Adjustable Coverage Levels: Offers considerable flexibility in selecting coverage limits and add-ons, tailored to individual needs, including options for pet insurance.

- Cost-Effective Options: Frequently offers competitive rates and the flexibility to adjust your pet insurance plan as required.

- Variety in Add-Ons: Offers a range of optional extras, enabling you to enhance your pet insurance as required. Read our State Farm vs. Progressive review to learn more.

Cons

- Possible Coverage Gaps: The flexibility could lead to overlooking essential coverage if the pet insurance plan isn’t chosen with care.

- Complex Policy Details: The customizable nature of the pet insurance plans can make it more challenging to understand the policy details.

#4 – USAA: Best for Member Benefits

Pros

- Exclusive Member-Only Perks: Special benefits and discounts on pet insurance are available exclusively for military families and their dependents.

- Comprehensive Pet Coverage: Offers a wide range of coverage options tailored to meet the varied needs of pets, including pet insurance, which you can learn about in our USAA review.

- Support Tailored to Military Families: Offers outstanding service and advantages specifically designed to meet the unique needs of military personnel, including pet insurance.

Cons

- Eligibility Restrictions: Pet insurance plans are only accessible to current and former military personnel and their families.

- Potential Premium Increases: Member-specific benefits could result in higher pet insurance costs compared to standard plans.

Free Pet Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Reliable Service

Pros

- Consistent Service Quality: Known for dependable customer service and a trustworthy claims process for pet insurance.

- Broad Coverage Options: Offers extensive coverage to address a wide variety of pet health needs, including pet insurance.

- Proven Track Record: Farmers has a reputation for stability and reliability in the pet insurance sector. For a complete list, read our Farmers review.

Cons

- Potentially Higher Premiums: Dependable service might involve additional expenses, possibly leading to increased monthly premiums, including for pet insurance.

- Less Plan Flexibility: Limited options for customizing pet insurance plans compared to more flexible providers.

#6 – Geico: Best for Extensive Network

Pros

- Wide Network of Providers: Provides access to an extensive network of veterinarians, giving you greater flexibility in selecting your pet’s care provider.

- Affordable Insurance Plans: Known for providing competitively priced pet insurance options, which you can learn about in our Geico review.

- Comprehensive Care Coverage: Offers comprehensive pet insurance coverage for a wide range of veterinary services and treatments.

Cons

- Possible Network Limitations: Even with an extensive network, some specialized care may not be included in the coverage of pet insurance.

- Inconsistent Customer Experience: Service quality can vary, affecting overall satisfaction with the pet insurance policy.

#7 – AAA: Best for Membership Perks

Pros

- Exclusive Discounts for Members: Provides unique discounts and benefits for AAA members, adding extra value to pet insurance, which you can check out in our AAA review.

- Broad Coverage: Offers extensive coverage options, making it suitable for a variety of pet health situations with pet insurance.

- Additional Membership Benefits: Includes other AAA perks that complement pet insurance, like roadside assistance.

Cons

- Membership Requirement: Benefits and discounts, including pet insurance, are available exclusively to AAA members, restricting access for those who are not part of the organization.

- Higher Premiums for Member Benefits: The additional benefits and discounts could lead to higher overall premiums compared to standard plans, including those for pet insurance.

Free Pet Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Competitive Rates

Pros

- Budget-Friendly Premiums: Offers attractive rates for pet insurance, making it a cost-effective choice. Read our Allstate review to learn what else is offered.

- Wide Coverage Options: Offers extensive coverage that caters to a range of pet health requirements through pet insurance.

- Responsive Customer Service: Renowned for its effective and supportive customer service, improving the experience of pet insurance.

Cons

- Limited Customization: Coverage options might be less flexible compared to those offered by more adaptable pet insurance providers.

- Potential for Higher Costs with Extensive Coverage: Although the rates for pet insurance are competitive, more extensive plans could still be quite costly.

#9 – American Family: Best for Customer Service

Pros

- Exceptional Customer Support: Renowned for offering top-notch service and support for pet insurance policyholders. Find out more in our American Family vs. Travelers review.

- Extensive Coverage Choices: Offers a wide variety of choices to guarantee thorough coverage for pets, including pet insurance.

- Discounts for Multiple Pets: Offers financial advantages for those who insure multiple pets, helping to lower the total expenses through pet insurance.

Cons

- Potentially Higher Premiums: Top-notch support might involve higher premiums than those offered by some other providers, especially when it comes to pet insurance.

- Limited Coverage for Specialized Treatments: Some specialized or alternative treatments might not be included in their standard pet insurance plans.

#10 – The Hartford: Best for Trusted Reputation

Pros

- Well-Established Trust: Known for a solid reputation and reliability in the insurance industry, including pet insurance.

- Broad Coverage: Offers extensive pet insurance that covers a wide array of health issues and treatments. Compare The Hartford vs. Auto Club Enterprises review for a full comparison.

- Reliable Claims Handling: Highly regarded for its effective and reliable management of pet insurance claims.

Cons

- Potentially Higher Insurance Costs: The excellent reputation and extensive coverage may result in higher premium costs for pet insurance.

- Less Flexible Coverage Options: Limited customization compared to more flexible pet insurance plans.

Free Pet Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pet Insurance Costs and Discounts: Monthly Rates and Savings Across Top Providers

When choosing pet insurance, both cost and discounts play crucial roles in finding the right plan for your furry friend. A plan that balances affordability with comprehensive coverage ensures that your pet receives necessary medical care without causing financial strain.

State Farm stands out as the top overall pet insurance provider for its competitive rates and comprehensive coverage.

Jeff Root Licensed Insurance Agent

To help you navigate your options, we’ve compiled a detailed overview of monthly rates and available discounts from leading pet insurance providers. Careful consideration of these factors allows you to select a pet insurance plan that fits your budget while offering the best protection for your pet’s health and well-being.

Pet Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Cats Dogs

$20 $40

$30 $50

$32 $53

$29 $60

$30 $50

$32 $54

$29 $50

$25 $45

$30 $55

$25 $45

Compare monthly rates for pet insurance across various providers. For minimum coverage, rates start at $28 with State Farm and go up to $33 with Allstate and Nationwide. For full coverage, prices range from $55 with State Farm to $64 with Allstate. Enhance your understanding with our resource titled “State Farm vs Farmers, Geico, Progressive, Allstate: The Best?”

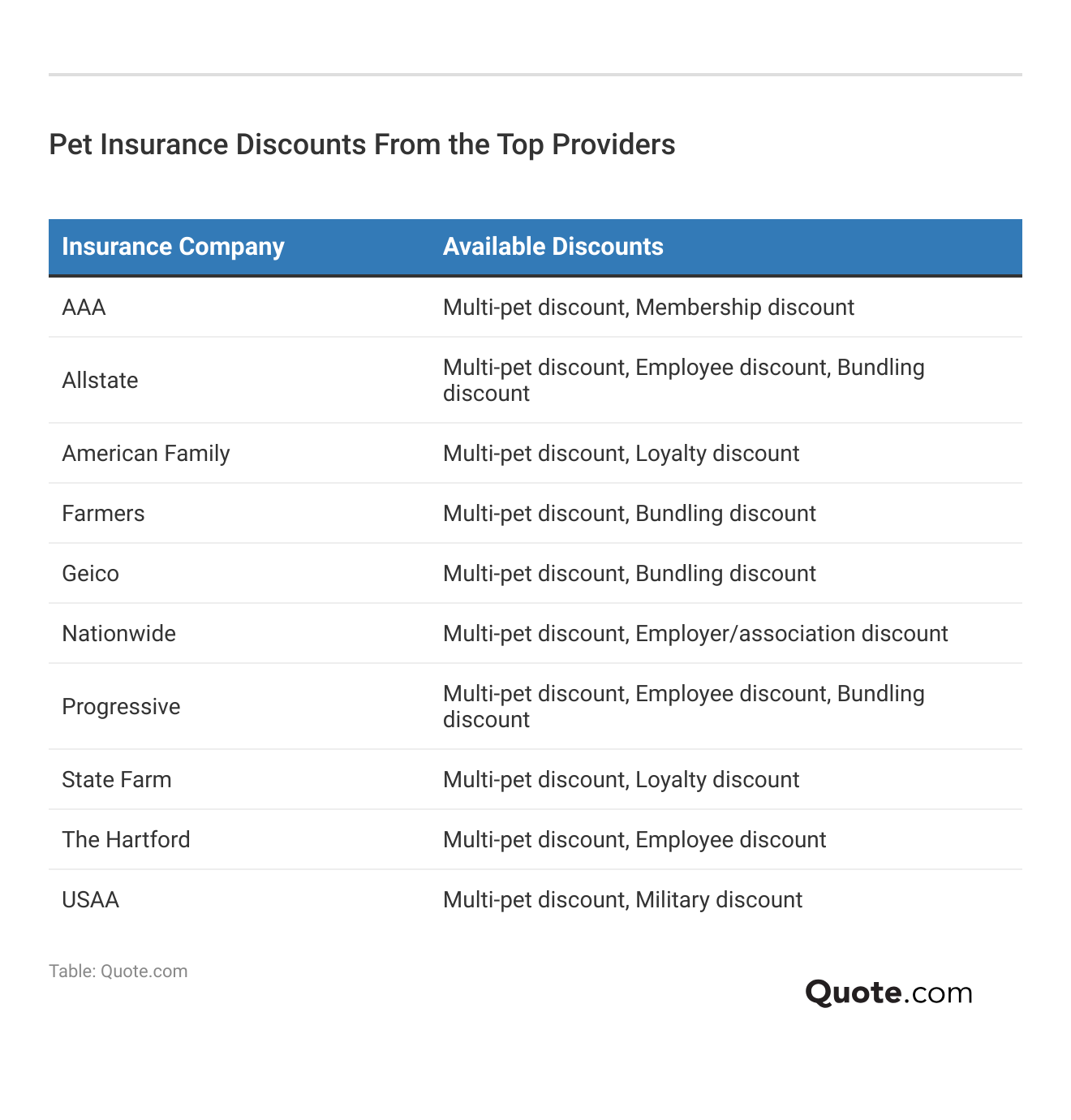

Save on pet insurance with top discounts: AAA has multi-pet and membership savings, Allstate and Progressive offer multi-pet, employee, and bundling deals, and American Family and State Farm provide multi-pet and loyalty discounts.

Farmers and Geico feature multi-pet and bundling options, Nationwide adds employer discounts, The Hartford offers multi-pet and employee savings, and USAA provides military discounts. Explore these for the best savings.

By comparing monthly rates and exploring the various discount opportunities, you can make an informed decision that balances affordability and comprehensive coverage for your pet. Take advantage of these insights to secure the best protection at the most cost-effective price.

Key Considerations for Selecting the Best Pet Insurance Company

Choosing the right pet insurance company is an important decision for pet owners. It provides peace of mind knowing that your furry friend will be protected in case of accidents or illnesses. When considering different pet insurance companies, there are several factors to take into account.

- Coverage: When choosing pet insurance, review the coverage details to ensure it includes accidents, illnesses, and hereditary conditions. Some policies also cover routine care like vaccinations and check-ups. Be aware of limitations and exclusions, such as breed-specific restrictions or pre-existing conditions, to select a policy that best suits your pet’s needs.

- Cost: electing pet insurance, compare premiums, deductibles, and out-of-pocket expenses to find a policy that fits your budget. Consider the coverage provided, as a higher premium might offer more comprehensive protection. Evaluate co-pays and any additional costs to determine the policy’s overall affordability.

- Customer Service: Choose a pet insurance company known for reliable and responsive customer service and quick claim processing. Read reviews and testimonials from other pet owners to gauge the company’s service quality. Contact companies directly to ask about their customer support and responsiveness.

- Claim Process: Understand the claim process before choosing pet insurance. Check the requirements for filing, such as necessary veterinary records, and if online submission is available. Consider the average processing time and the company’s reputation for handling claims efficiently and fairly to ensure timely reimbursements.

By considering these factors, you can make an informed decision when choosing a pet insurance company. For additional details, explore our comprehensive resource titled “8 Questions to Ask When Considering Pet Insurance.”

Remember to thoroughly research each provider, compare their offerings, and assess their customer service and claim processes. Taking the time to find the right pet insurance company will provide you with the necessary coverage and support for your beloved pet.

Tips for Selecting the Ideal Pet Insurance Plan

Choosing the right pet insurance plan is crucial for ensuring that your furry friend receives the best possible care without causing financial strain. With numerous options available, it’s important to carefully evaluate various factors to find a policy that suits your pet’s unique needs and your budget.

- Assess Your Pet’s Needs: Consider your pet’s age and breed-specific health risks, as well as whether the plan covers any pre-existing conditions, to ensure it provides comprehensive coverage tailored to your pet’s needs. Read our “One Quote That Convinced Me to Get Life Insurance” to learn what else is offered.

- Compare Coverage Options: Examine each policy’s coverage for accidents, illnesses, hereditary conditions, and routine care, while also checking for exclusions or limitations like breed-specific conditions or age-related restrictions to ensure it meets your pet’s specific health needs.

- Evaluate Costs: Compare monthly or annual premiums, assess annual and per-incident deductibles, and evaluate co-pays and reimbursement levels to find a plan that fits your budget and financial needs.

- Check Claim Processing: Understand the claim submission process, including available methods (online, mail, or app), required documentation (vet records and invoices), and average processing times to ensure a user-friendly and efficient experience.

- Research Customer Reviews: Assess customer service by reading reviews for feedback on responsiveness and support during the claims process, and choose a provider with a strong reputation for efficient and fair claim handling based on positive experiences from other pet owners.

By carefully considering these factors, you can select a pet insurance plan that provides the necessary coverage and support for your pet while fitting your financial situation.

Taking the time to research and compare options will help you make an informed decision and ensure peace of mind for you and the health of your beloved pet.

Free Pet Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Conclusion: Finding Affordable Coverage for Your Furry Friend

Pet insurance provides peace of mind and financial protection for pet owners. By understanding the factors to consider, reviewing top pet insurance companies, and comparing their pros and cons, you can make an informed decision that suits both your pet’s healthcare needs and your budget.

With a range of discounts and extensive coverage options, you can ensure your pet receives the best care without breaking the bank. Compare quotes and explore various plans to find the perfect fit for your pet’s needs and your budget. For more insights, see our guide titled “Comparing Plans and Getting an Insurance Plan that Works for You.”

See which companies have the cheapest rates for you by entering your ZIP code in our free comparison tool below.

Frequently Asked Questions

Who has the best-rated pet insurance?

The best-rated pet insurance companies according to customer reviews and expert analysis are Embrace, Petplan, and ASPCA. These companies consistently receive high marks for their customer service and claim handling.

What is the best pet medical insurance for puppies?

When it comes to puppy insurance, companies like Nationwide and Pets Best offer excellent coverage. They have plans specifically designed for puppies, including coverage for vaccinations and preventive care.

Enter your ZIP code below to compare quotes instantly and find the cheapest insurance available.

What are the top animal insurance companies?

The leading animal insurance companies this year include State Farm, Nationwide, Progressive, and Healthy Paws. These providers are known for their competitive rates and comprehensive coverage options for pets.

Read our Nationwide insurance review for a full list.

Which pet insurance company provides the best quality coverage?

For top-quality coverage, companies such as Trupanion and Healthy Paws are often considered the best. They provide comprehensive plans that cover a wide range of medical needs and offer high reimbursement rates.

Who offers the best pet insurance for older pets?

Companies like Embrace and Petplan are known for offering good coverage options for older pets. They provide flexible plans that can accommodate the specific health needs of aging animals.

What’s the best pet insurance company for comprehensive coverage?

If you’re looking for comprehensive coverage, Healthy Paws and Trupanion are frequently highlighted as top choices. Their plans cover a broad range of treatments, including surgeries and chronic conditions.

For a comprehensive overview, explore our detailed resource titled “The Complete Guide to Health Insurance.”

Which pet insurance company is best for affordable premiums?

For affordable premiums without sacrificing coverage quality, consider companies like State Farm and Nationwide. They offer competitive rates that start at around $28 per month for basic coverage.

Who is the best pet insurance provider for customer service?

Companies such as Embrace and ASPCA are often praised for their exceptional customer service. They have responsive support teams and a reputation for handling claims efficiently.

Which company offers the best comprehensive pet insurance?

For comprehensive pet insurance, Healthy Paws and Trupanion are highly recommended. They offer extensive coverage that includes accidents, illnesses, and even some wellness care, providing a broad range of protection for your pet.

For detailed information, refer to our comprehensive report titled “Traffic Collision Reconstruction.”

Which pet insurance company is considered the best overall?

The best overall pet insurance company can vary based on individual needs, but Healthy Paws and Trupanion are frequently cited as top choices due to their comprehensive coverage, high customer satisfaction, and excellent claim processing.

You can find the cheapest insurance coverage tailored to your needs by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.