Who is eligible for Medicare in 2026? (Get the Facts)

Seniors who are 65 or older are eligible for Medicare. Requirements for Medicare also include being a U.S. citizen and receiving Social Security benefits. You can get Medicare early with a qualifying disability, such as end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS).

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Jeff Root

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the...

Heidi Mertlich

Updated August 2025

You could automatically receive Medicare if you’re over 65 and already receiving Social Security benefits, but what about everyone else? Who is eligible for Medicare?

Only seniors over 65 are eligible for Medicare. Sign up for Medicare as early as three months before your 65th birthday. You can get coverage at a younger age if you have a qualifying disability. People with end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS) qualify for Medicare at any age.

Keep reading to learn who is eligible for Medicare and what you need to verify your age and medical history. Enter your ZIP code above to find affordable Medicare plans in your area.

- Most seniors automatically get Medicare coverage when they turn 65

- No one younger than 65 can get Medicare without a qualifying disease or disability

- Original Medicare typically costs $174/mo

Medicare Eligibility Requirements

If you aren’t eligible for Social Security or retirement benefits, you’re still eligible for Medicare as long as your spouse worked and paid Medicare taxes. Otherwise, you can still enroll but must pay higher premiums.

You can’t sign up for Medicare until your Initial Enrollment Period (IEP), which starts three months before your 65th birthday. You will not be able to access Medicare benefits until then, although you can research and compare health insurance plans online to get Medicare eligibility verification.

How to Get Medicare Before You Turn 65

Can I get Medicare at 55? No. Age is the most important Medicare eligibility requirement. You must be 65 or older to enroll. Learn why in our expert guide to Medicare.

However, you can sign up for Medicare if you’ve received Social Security Disability Insurance (SSDI) over the past two years. Run a Medicare eligibility check on the official website to verify.

What disabilities qualify for Medicare under 65? Individuals under 65 can get Medicare if they’ve been diagnosed with end-stage renal disease or Lou Gehrig’s disease.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

What Medicare Covers

What does Medicare cover? Plans pay for hospital stays, medical equipment, prescriptions, and more depending on which you choose.

Is it mandatory to sign up for Medicare at age 65? No, but you may be penalized if you go without health insurance. You’ll be automatically enrolled in Original Medicare if you’re already receiving Social Security benefits, but you can benefit from choosing your own plan.

Original Medicare vs. Medicare Advantage

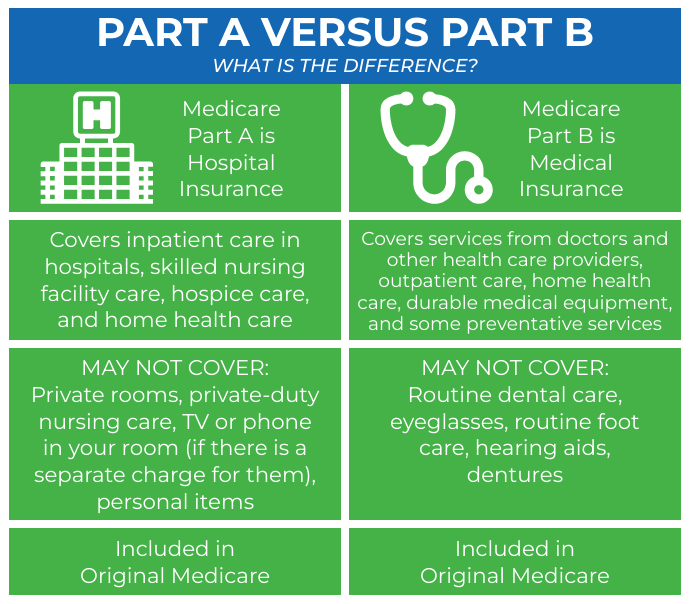

It helps to compare Medicare Advantage vs. Original Medicare plans before you turn 65 so you know what kind of coverage you want. Original Medicare is made up of:

Medicare Part C is also known as a Medicare Advantage Plan. Medicare Advantage eligibility requirements are the same as Original Medicare, but you have the flexibility to choose more comprehensive healthcare.

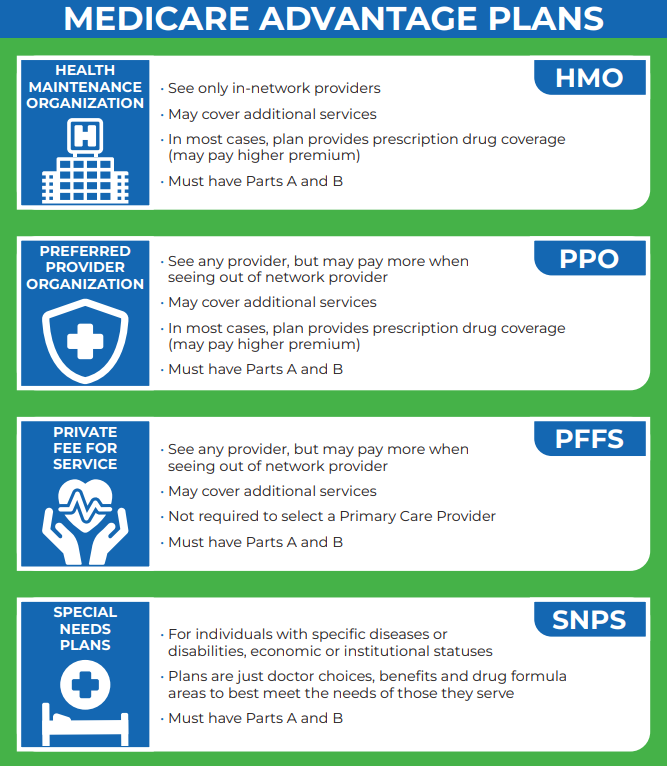

For instance, Medicare Advantage combines all of Original Medicare coverage into one policy. Then you can choose between different types of plans to find one that fits your needs and budget:

HMO and PPO are the most popular plans with beneficiaries. PFFS plans are more common among beneficiaries with few healthcare needs and who can afford high out-of-pocket costs. SNPS are only available to beneficiaries on Medicaid.

Who is eligible for Medicare and Medicaid? Seniors aged 65 or older who meet the Medicaid income requirements in their state are eligible for Medicare and Medicaid. Learn more in our expert guide to Medicaid.

Medicare Part D Coverage

Medicare Part D covers prescription drug costs. Who is eligible for Medicare Part D? Seniors are eligible to sign up for Part D as soon as they turn 65 during their IEP.

Original Medicare (Parts A and B) doesn’t include prescription drug coverage, so you must buy Part D to pay for your medications. Many Medicare Advantage plans bundle Part D with Parts A and B for one monthly premium.

How to Pay for Medicare

Here is a breakdown of how much Medicare costs by plan. Your monthly rates will vary based on where you live and the provider you choose.

Medicare Costs by Plan Type| Medicare Plan | Monthly Premium | Annual Deductible | Out-of-Pocket Max |

|---|---|---|---|

| Part A | $0-$505 | $1,632 | N/A |

| Part B | $174 | $240 | N/A |

| Part C | $0-$200 | $0-$200 | $8,850 |

| Part D | $34 | $0-$545 | $2,000 |

| Medigap | $35-$488 | $0-$2,800 | $3,500-$7,500 |

Research and compare local Medicare insurance companies online before you turn 65 to find the best plan for your health and your budget. Enter your ZIP code now to start comparing Medicare costs near you.

Bottom Line on Who is Eligible for Medicare

Medicare provides essential health coverage primarily for seniors aged 65 and older, though individuals under 65 with qualifying disabilities or specific conditions like End-Stage Renal Disease or Lou Gehrig’s disease can also enroll.

Who is eligible for Medicare? Your Medicare eligibility hinges on meeting the age and citizenship requirements.

You can sign up for Medicare during the Initial Enrollment Period (IEP), which starts three months before your 65th birthday. Remember, the three requirements for Medicare eligibility are:

- Age: You must be 65-years-old to qualify for Medicare (unless you have a qualifying disease or disability).

- Citizenship: You must be a U.S. citizen or lived in the United States for at least five years before enrolling in Medicare.

- Social Security: You must be eligible for Social Security or railroad retirement benefits.

You must be a U.S. citizen or have lived in the country for at least five years, and you or your spouse must have paid Medicare taxes. Start comparing Medicare insurance companies online to see if you’re eligible and price plans available near you.

Frequently Asked Questions

Do I automatically get Medicare when I turn 65?

You will be automatically enrolled in Medicare if you’re already receiving Social Security benefits before or when you turn 65. Otherwise, you can sign up for Medicare as early as three months before your 65th birthday.

Can I get Medicare at age 62?

You can only buy Medicare before turning 65 with a qualifying disease or disability.

What are the three requirements for Medicare?

The three Medicare eligibility requirements are being at least 65-years-old, being a U.S. citizen, and having paid Medicare taxes.

How much will Medicare cost me when I turn 65?

How much Medicare costs depends on the plan you choose. Original Medicare costs are around $174/mo for Part B while Part A is usually premium-free.

What qualifies a person to be on Medicare?

Turning 65 is the most common way to qualify for Medicare. You’ll also be eligible for Medicare if you have a qualifying disease or disability, including End-Stage Renal Disease (ESRD).

At what age does a woman qualify for Medicare?

All seniors qualify for Medicare at 65 regardless of sex or gender identity.

Why would someone be denied Medicare?

Anyone under the age of 65 will be denied Medicare coverage. Get all the requirements in our expert Medicare guide.

Who is ineligible for Medicare?

Anyone under the age of 65 is ineligible for Medicare unless they have a qualifying disease or disability.

Who is not eligible for Medicare at age 65?

Anyone who did not pay Medicare taxes or work in Social Security-covered employment may not be eligible for Medicare.

Is Medicare Advantage or Original Medicare with Medigap cheaper?

You will always pay at least $174/mo for your Part B premiums with either plan, but Medicare Advantage is cheaper if you require additional coverage for dental or vision insurance.

How do I check my Medicare eligibility?

What documents do I need to apply for Medicare?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.