What is Medicare Advantage? (2026 Coverage Explained)

Medicare Advantage, also known as Medicare Part C, is an alternative to Original Medicare. It combines Parts A and B coverage with additional benefits like dental, vision, and prescription drug coverage. Medicare Advantage costs include $174/month for Part B premiums plus fees for extra benefits.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated August 2025

What is Medicare Advantage? Should you choose an Advantage plan over Original Medicare? If you’re eligible for Medicare, these are important questions to ask.

Medicare Advantage plans include all the same coverage as traditional Medicare but with additional benefits, like dental, vision, and prescription drug coverage. It’s one of the cheaper health plan options, but you could have higher deductibles or be limited to a specific network of providers.

Keep reading to learn how Medicare Advantage works. We’re here to explain what Medicare Advantage is and what it covers. Then use our free comparison tool to find affordable Medicare Advantage plans near you.

- There are four types of Medicare Advantage Plans

- All Advantage plans include Original Medicare Part A and Part B coverage

- Most Medicare Advantage plans include Part D prescription coverage

How Medicare Advantage Works

Medicare Advantage is still Medicare, but policies are provided by local insurance companies. You can sign up for Medicare Advantage starting three months before you turn 65.

Most Medicare Advantage plans include Medicare Part D. You don’t need to buy it separately if you choose an Advantage plan that already includes coverage for prescription drugs.

What Medicare Advantage Covers

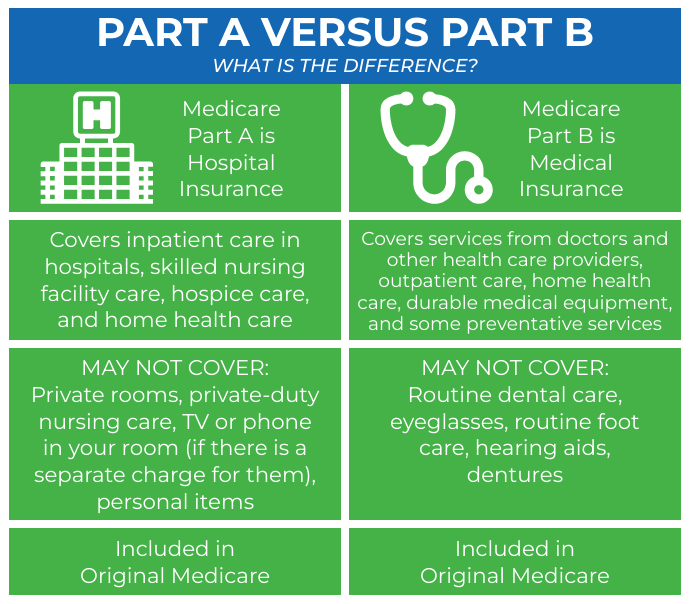

What is Medicare Advantage vs. Medicare? Medicare Advantage plans cover exactly what Original Medicare Part A and Part B cover. That means your hospital insurance and medical equipment costs are completely or partially covered by Medicare Advantage.

Medicare Advantage insurance goes beyond traditional coverage. For instance, most Advantage plans cover prescriptions, helping beneficiaries save money on Part D insurance. You can also pick from plans that provide dental and vision coverage, pay for gym memberships, and cover hearing aids.

Unlike Original Medicare, Medicare Advantage has annual out-of-pocket limits on Parts A and B. Once you reach that limit, you pay nothing for the rest of the year.

The only things Medicare Advantage will not cover are clinical trials and kidney transplants. Hospice coverage may also be limited depending on the plan you choose.

Read More: Millennial’s Guide to Health Insurance

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

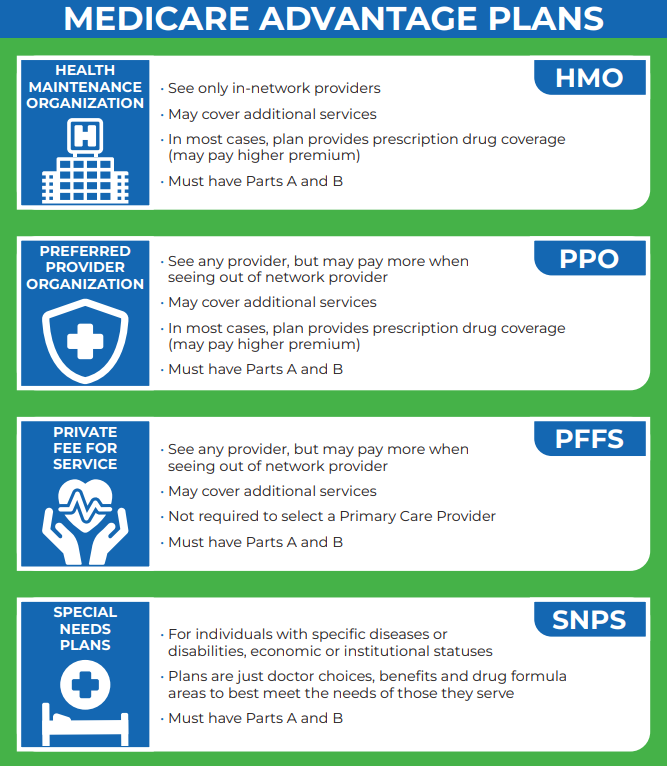

Different Types of Medicare Advantage Plans

Medicare Advantage Part C plans are varied, and coverage options won’t be the same with every company. Determine what type of Medicare Advantage plan you’re interested in and start comparing health insurance plans from multiple companies to get the best rates.

Most people opt for an HMO or PPO, but you may want a different type of plan. Scroll down to explore these plans more in-depth.

Health Maintenance Organization (HMO)

HMO plans provide coverage through an in-network of physicians and facilities, and you need referrals from a primary care doctor before visiting any specialists. Getting any medical care out-of-network costs more.

You won’t have the freedom to visit any hospital or doctor you want with an HMO.

HMOs are the most popular plan but work best for people who don’t travel and live in a region with a convenient network of participating physicians. Enter your ZIP code to find affordable providers in your area.

Preferred Provider Organization (PPO)

PPOs also have an organization of in-network providers, but these plans still cover any out-of-network doctors or hospitals that accept Medicare.

You still pay more to use out-of-network physicians with a PPO, but costs are much cheaper than with an HMO.

This type of plan is best for people who have a favorite doctor, specialist, or facility that may not be included in the network.

Private Fee-for-Service (PFFS)

Fee-for-service plans come with predetermined amounts regarding what the provider will pay versus what you’ll pay for different procedures.

With PFFS, you’re allowed to see any doctor or hospital that accepts Medicare, and you get to see your medical costs upfront.

However, doctors and hospitals decide on a case-by-case basis whether to accept a PFFS plan or not, so verify if your physician accepts your plan’s terms before receiving any kind of care.

Special Needs Plans (SNPs)

SNPs aren’t available to everyone. Only beneficiaries in institutional care or those who have chronic or critical conditions can enroll.

In some states, beneficiaries who qualify for Medicaid can sign up for SNPs.

You can switch plans whenever you become eligible as you’ll qualify for a special enrollment period. Learn the difference between Medicare vs. Medicaid plans.

Comparing Medicare Advantage Costs

Medicare insurance costs start at $174/mo but start to increase if you add additional plans or benefits. Medicare Advantage rates are affordable but vary by company.

Medicare Costs by Plan Type| Medicare Plan | Monthly Premium | Annual Deductible | Out-of-Pocket Max |

|---|---|---|---|

| Part A | $0-$505 | $1,632 | N/A |

| Part B | $174 | $240 | N/A |

| Part C | $0-$200 | $0-$200 | $8,850 |

| Part D | $34 | $0-$545 | $2,000 |

| Medigap | $35-$488 | $0-$2,800 | $3,500-$7,500 |

If you choose an Advantage Plan, Medicare pays a set amount to your provider for coverage. You’re still responsible for any out-of-pocket costs, including deductibles and monthly premiums.

Medicare Advantage vs. Original Medicare

The biggest difference between Medicare Advantage vs. Original Medicare is that Advantage plans go beyond just the traditional Part A and B coverage to provide more comprehensive care.

Here are more ways Medicare Advantage is different from Original Medicare:

- Flexibility and Benefits: Medicare Advantage offers various plan types with extra benefits like dental, vision, and wellness programs. Original Medicare does not.

- Provider Networks: Some Medicare Advantage plans restrict healthcare to a specific network, but Original Medicare is accepted anywhere that accepts Medicare.

- Costs: Medicare Advantage deductibles are higher, but plans often have lower premiums and annual out-of-pocket maximums, while Original Medicare has no out-of-pocket maximum, potentially leading to higher costs.

- Prescription Drugs: Original Medicare doesn’t include prescription drugs, so you need to sign up for Medicare Part D when most Advantage plans include prescription coverage.

- Referrals: Some Medicare Advantage plans require referrals for specialist services, but Original Medicare does not require referrals if the facilities accept Medicare.

Medicare Advantage also covers more than Medicare Supplemental Insurance (Medigap), as you’ll see below.

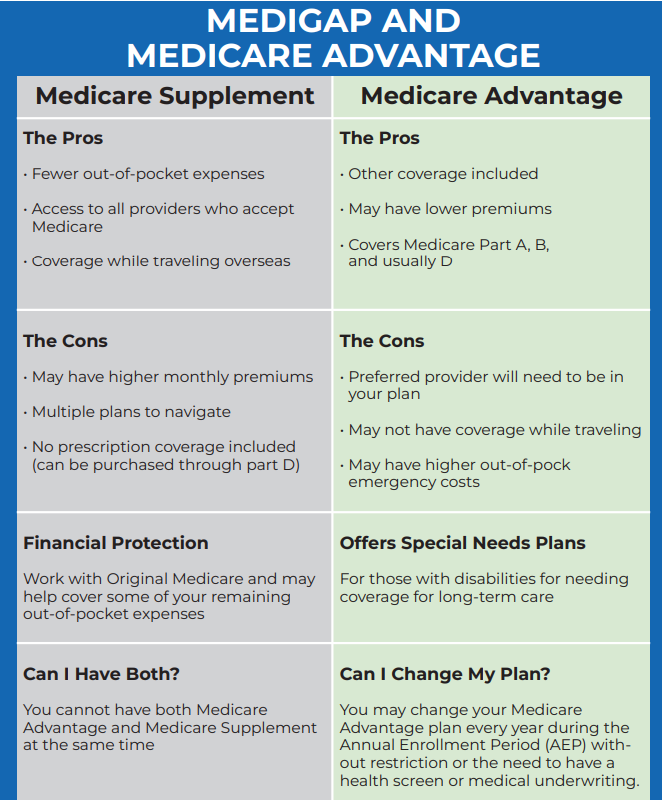

Medicare Advantage vs. Medicare Supplement Plans (Medigap)

Medicare Advantage plans often provide the same coverage as a Medigap plan, but Advantage policies are comprehensive while Medigap is only supplemental.

Medicare Advantage combines Original Medicare coverage with different additional benefits into one single policy. Medigap is not a standalone policy, so you must sign up for Original Medicare first.

Your Advantage plan might limit you to a specific physician network, but you’ll get more benefits at a better price than with Medigap. Medigap plans are a better fit for people who travel or want more access to doctors and hospitals of their choice.

You cannot have Medigap and Medicare Advantage at the same time. Medigap is only available with Original Medicare.

Learn More: What are Medicare Savings Programs?

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

Medicare Advantage Plan Overview

What is Medicare Advantage? Medicare Advantage combines Parts A and B coverage with additional benefits like dental, vision, and prescription drug coverage.

Advantage plans often feature lower premiums but higher deductibles compared to Original Medicare. They also generally include prescription drug coverage, which can eliminate the need for separate Medicare Part D policies.

However, some people may wonder why Medicare Advantage plans are bad. For instance, Medicare Advantage plans for seniors restrict healthcare access to a network of providers and require referrals for specialists:

- Health Maintenance Organizations (HMOs): Require in-network care and referrals for specialists, making them ideal for those who do not travel often and prefer a consistent network of providers.

- Preferred Provider Organizations (PPOs): Offer more flexibility by covering out-of-network care at a higher cost, suitable for those who want to maintain relationships with specific doctors or facilities.

- Private Fee-for-Service (PFFS) plans: Provide clear upfront costs and allow visits to any Medicare-accepting doctor or hospital, though acceptance of the plan can vary by provider.

- Special Needs Plans (SNPs): Tailored for beneficiaries with specific conditions or circumstances, such as chronic illnesses or institutional care, and offer continuous enrollment options for eligible individuals.

These plans are provided by private insurance companies. Health plan options and availability will vary based on where you live. Enter your ZIP code to find Medicare Advantage companies near you.

Frequently Asked Questions

What is Medicare Advantage and how does it work?

Medicare Advantage is sometimes called Medicare Part C because it includes all parts of Original Medicare plus additional benefits, such as dental, vision, and prescription drug coverage.

What is the difference between regular Medicare and Medicare Advantage?

Original Medicare only covers hospital and medical costs. With Medicare Advantage, all the coverage you need is conveniently included in one policy without the need for supplemental plans. Compare Medicare Advantage vs. Original Medicare to learn more.

What is the downside of Medicare Advantage?

Some Medicare Advantage plans can have higher monthly premiums, which you are required to pay along with your Part B premiums.

Do I still pay Medicare premiums with an Advantage plan?

Yes, you are still responsible for paying your Medicare Part B premiums with an Advantage plan. Compare how much Medicare costs by plan.

Can I drop my Medicare Advantage plan and go back to Original Medicare?

You can switch back to Original Medicare within one year of your Medicare Advantage plan start date.

Can you switch back and forth between Original Medicare and Medicare Advantage?

You can sign up for Medicare and switch insurance plans during the Annual Enrollment Period or a special enrollment period if you qualify.

What is the best Medicare insurance?

The best Medicare insurance plan depends on your health needs. Compare the differences between Medicare Advantage and Original Medicare to pick the best plan for you.

What is the monthly cost for Medicare Advantage?

Medicare Advantage premiums vary by state and plan. Enter your ZIP code to see how much Medicare Advantage costs near you.

Which is cheaper, a Medicare Supplement or Medicare Advantage plan?

Medicare supplements may be cheaper if you don’t need too many extra benefits. However, if you want health insurance that covers prescriptions, vision, and dental care, Medicare Advantage plans are the better pick.

What’s the difference between Medicare Advantage and Medigap?

Medicare Advantage plans replace Original Medicare by providing the same coverage with additional benefits all in one policy. Medigap plans are supplemental insurance you buy after enrolling in Original Medicare and not a stand-alone policy.

Can you use Medigap with Medicare Advantage?

Why do doctors not like Medicare Advantage plans?

Then why are they pushing Medicare Advantage plans?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.