Medicare Advantage vs. Original Medicare in 2026 (Differences Explained)

Medicare Advantage vs. Original Medicare both offer excellent coverage but differ in key ways: coverage, plan flexibility, provider networks, and cost. Original Medicare plans cost $174/month. Advantage plan premiums vary by company, and rates go up when you add benefits that Original Medicare doesn't cover.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshir...

Kristen Gryglik

Updated August 2025

What’s the difference between Medicare Advantage and Original Medicare? Original Medicare requires separate Part D for prescription drugs, whereas most Medicare Advantage plans include it.

Which is better, Medicare Advantage or Original Medicare? Medicare Advantage often has lower premiums but higher deductibles and an out-of-pocket maximum but limits your medical services to in-network physicians and hospitals. Fortunately, you can compare both plans online.

We break down your coverage options below so you can make the best decision regarding Original Medicare and Medicare Advantage plans. Enter your ZIP code above to compare Medicare Advantage vs. Original Medicare plans near you.

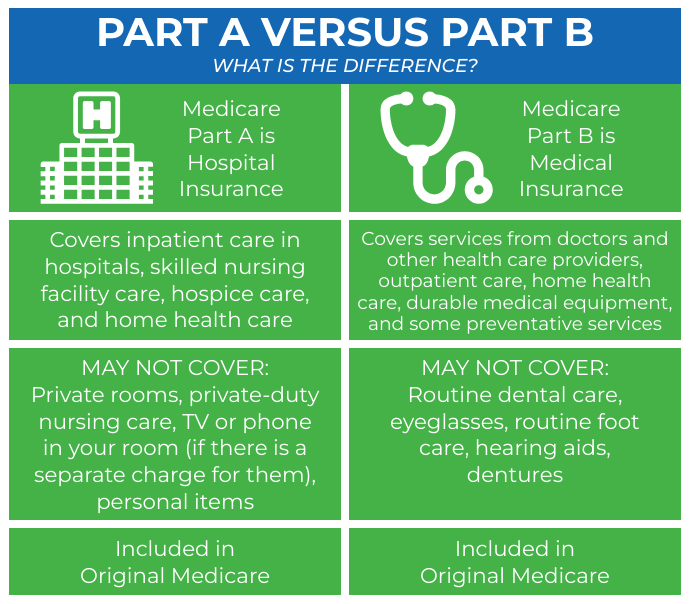

- Original Medicare includes Part A and Part B

- Medicare Advantage includes Part A, Part B, and Part D for prescriptions

- Medicare Advantage also offers various plan types (HMO, PPO, PFFS, SNP)

The Difference Between Medicare Advantage vs. Original Medicare

Medicare Advantage and Original Medicare offer similar benefits to people over 65, but there are six key differences between these plans.

Plan Flexibility and Benefits

Original Medicare is a standardized plan that covers only what’s necessary without any additional coverage. This ensures consistent coverage across the country but isn’t very flexible when it comes to adding coverage.

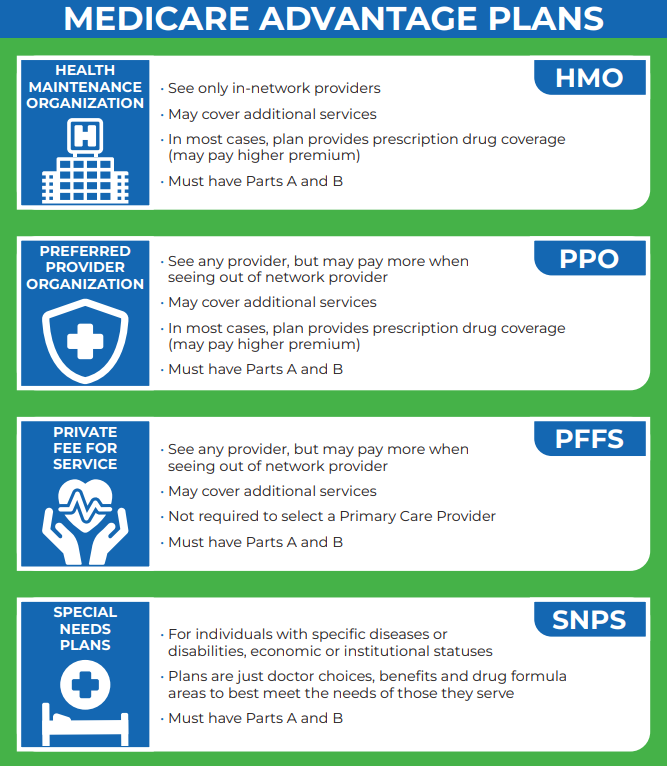

On the other hand, Medicare Advantage offers various plan types (HMO, PPO, PFFS, SNP) and includes extra benefits such as dental, vision, hearing, and wellness programs, which are not covered by Original Medicare.

However, one reason why Medicare Advantage plans are bad is that availability and benefits vary widely by region. Sign up for Medicare to compare plans near you.

Provider Networks

Original Medicare plans are accepted wherever Medicare is accepted, which includes a wide national network of hospitals and physicians.

With Medicare Advantage, you may be limited to a specific network of providers. Out-of-network healthcare can get expensive unless you have the right Advantage plan.

Prescription Drug Coverage

Original Medicare coverage does not include prescription drugs. You have to sign up for Medicare Part D, which can raise your monthly premiums.

However, most Medicare Advantage plans automatically include prescription drug coverage.

Premiums and Deductibles

Original Medicare typically comes with Part B deductibles and 20% coinsurance, meaning your traditional plan only covers 80% of your healthcare. You’re responsible for the rest, and with no out-of-pocket maximum, you could end up paying more than your insurance policy.

This table breaks down how much Medicare costs on average:

Medicare Costs by Plan Type| Medicare Plan | Monthly Premium | Annual Deductible | Out-of-Pocket Max |

|---|---|---|---|

| Part A | $0-$505 | $1,632 | N/A |

| Part B | $174 | $240 | N/A |

| Part C | $0-$200 | $0-$200 | $8,850 |

| Part D | $34 | $0-$545 | $2,000 |

| Medigap | $35-$488 | $0-$2,800 | $3,500-$7,500 |

Medicare Advantage often has cheaper premiums but may have higher deductibles depending on the type of plan you choose. However, Medicare Advantage plans have an annual out-of-pocket maximum, capping how much you have to spend each year on healthcare.

Policy Management

Private insurance companies sell and manage Medicare Advantage policies. Premiums will vary by region, as will customer service experiences and coverage options. To avoid the worst Medicare Advantage plans in your area, enter your ZIP code and start comparing local providers.

Original Medicare is administered by the federal government, providing a more uniform experience when it comes to billing and claims, albeit slower.

Referral Requirements

The most common Medicare Advantage nightmares are the referrals. Advantage plans require a specialist referral from your primary care physician before covering certain services.

Original Medicare doesn’t require any referrals as long as the facilities accept Medicare.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

Understanding Traditional Medicare Coverage

Traditional Medicare benefits start for Americans when they turn 65. It’s also available to anyone under 65 who has a disability. Check your local Medicare eligibility.

Original Medicare is the combination of Medicare Part A and Part B. Parts A and B allow you to visit any hospital, physician, and medical facility that accepts Medicare, but it only covers necessary services. Routine things like dental appointments and eye exams aren’t covered.

Original Medicare doesn’t cover prescription drugs. You have to enroll in Medicare Part D if you need prescription coverage, which can raise premiums. You don’t have to enroll, but you could face a 1% penalty for every month you went without coverage when you do sign up.

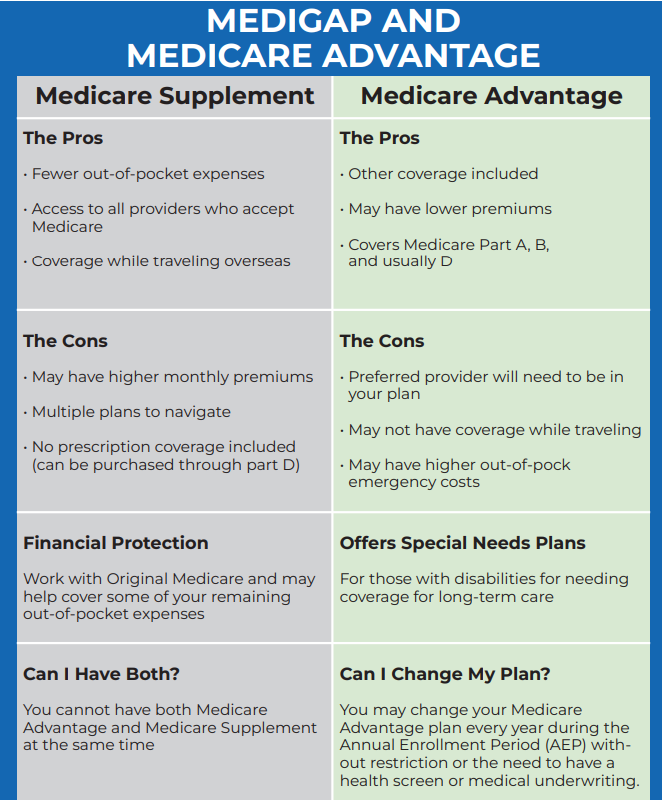

If you choose Original Medicare, you can also buy supplemental insurance known as a Medigap plan to fill in the gaps in your coverage.

Medicare Supplement plans cover things like deductibles, copays, and coinsurance. Keep reading to compare Medigap vs. Medicare Advantage.

Read More: Millennial’s Guide to Health Insurance

Medicare Advantage Plans Explained

What is Medicare Advantage? Medicare Advantage is also called Medicare Part C. It’s offered by independent insurance companies near you as an affordable alternative to Original Medicare.

A major difference between Original Medicare vs. Medicare Advantage lies in the network of providers. For example, most Medicare Advantage plans require you to stay within a prescribed network of doctors and hospitals while Original Medicare lets policyholders visit any facility that accepts Medicare.

Let’s explore the different Medicare coverage choices.

Types of Medicare Advantage Plans

These are the four main types of Medicare Advantage plans. Private insurance companies sell Advantage plans, so coverage and premiums will vary based on where you live. Most people pick an HMO or PPO:

Why do doctors not like Medicare Advantage plans? Compare the pros and cons of Medicare Advantage plans vs. Original Medicare to learn more.

Here are the top five disadvantages of Medicare Advantage plans:

- Restricted Networks: Some Advantage plans limit policyholders to specific physician networks and charge more for out-of-network visits.

- Prior Authorization: Treatments and hospital stays might need prior approval, which can delay necessary or life-saving care.

- Expensive Rates: Medicare Advantage plans cost more than Original Medicare the more benefits and coverage you add.

- No Medigap Coverage: Policyholders cannot sign up for any supplemental insurance to help cover deductibles, copays, or other out-of-pocket costs.

- Annual Changes: Coverage and benefits change every year, forcing policyholders to research and find new plans during their renewal period.

Based on your medical history and lifestyle, you may not need an Advantage plan — Original Medicare could be enough coverage. Read reviews online, including Medicare Advantage vs. Original Medicare on Reddit, to see what local policyholders think of their plans.

Comparing health insurance plans will help you determine which is best between Original Medicare vs. Advantage.

Medicare Advantage vs. Medigap

Despite offering similar types of coverage, Medigap and Medicare Advantage are not the same.

Medigap is a supplemental plan, while Advantage plans are private insurance policies that can include additional coverages (often the same coverages also provided by Medigap plans).

You cannot have Medigap and Medicare Advantage at the same time, either. Medigap is only available with Original Medicare Parts A and B.

Medicare Advantage plans often cost less, but you typically need pre-approval for certain treatments before your policy covers them, if at all. If you have Original Medicare with Medigap, you don’t need approval.

Read More: What are Medicare Savings Programs?

Medicare Advantage vs. Original Medicare: The Bottom Line

There are six key differences between Medicare Advantage and Original Medicare:

- Plan flexibility

- Physician benefits

- Prescription coverage

- Costs

- Policy management

- Referrals

Medicare Advantage is a more comprehensive health plan, but more doctors and hospitals accept Original Medicare. However, Advantage plans are more cost-effective if you want to add additional coverage for vision and hearing.

How much does Medicare cost? You’re responsible for deductibles and 20% of your medical costs. And there is no out-of-pocket maximum on Original Medicare, so these costs can add up quickly.

Thanks to a new prescription drug law, many people qualify for additional savings on their Medicare drug coverage (Part D) costs. Don’t wait – see if you qualify for Extra Help today at https://t.co/6Xe02cDHmd. pic.twitter.com/hoWhTnHyVd

— Medicare.gov (@MedicareGov) June 21, 2024

Supplemental plans like Medigap can help cover some, but only Medicare Advantage caps out-of-pocket costs every year. Once you reach your annual limit, your Medicare Advantage plan pays for everything.

However, since private insurance companies sell Medicare Advantage plans, premiums can vary significantly. Compare multiple health insurance companies in your city to get the best rates.

Frequently Asked Questions

What is the biggest difference between Medicare and Medicare Advantage?

The key difference between Medicare Advantage and Original Medicare is plan coverage. Medicare Advantage provides the same as Original Medicare plus additional benefits, including prescription drug coverage.

What does Medicare Advantage cover that original Medicare does not?

Medicare Advantage plans can cover routine eye exams, dental visits, prescription costs, hearing aids, and wellness memberships. Coverage options will vary by plan and state, so compare health insurance providers near you to find the right Advantage plan.

Can you switch between Original Medicare and Medicare Advantage?

Yes, but the only time to switch is during the Annual Enrollment Period, Otherwise, you have to qualify for a special enrollment period to change plans. Learn how to sign up for Medicare.

What is not covered by Original Medicare?

Original Medicare does not include prescription drug coverage. You need to buy Medicare Part D to cover prescription costs.

Which is more expensive, Original Medicare or Medicare Advantage?

Original Medicare costs at least $174/mo for Part B, but Medicare Advantage plans vary by company. Find out how much Medicare costs.

Why do people choose Original Medicare over Medicare Advantage?

Better access to doctors and hospitals is a major reason why people choose traditional coverage. However, only 23% of beneficiaries are enrolled in Original Medicare with a Medigap plan, showing that Advantage plans are more popular.

Do I still pay for Medicare Part B if I have Medicare Advantage?

You still have to pay your Part B premiums along with your Advantage plan premiums.

Which is better for Medicare coverage, a Supplement or an Advantage plan?

It depends on the kind of insurance you need. Use our health insurance guide to determine the level of coverage you need. If you want additional vision and hearing coverage, an Advantage plan is better.

What’s the difference between Medicare Advantage and Medigap?

Medicare Advantage plans are offered by private insurance companies and must meet coverage minimums and be approved by Medicare. Medicare Advantage plans are intended to replace your coverage from Original Medicare. Medigap plans are offered by private insurers and are a supplement to Original Medicare. You must have Original Medicare, which is a government program to buy a Medigap plan.

Can you use Medigap with Medicare Advantage?

You cannot use both coverages. It’s illegal for someone to sell you a Medigap policy if you have Medicare Advantage.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.