How to Sign up for Medicare in 2026 (Expert Guide)

Medicare is available as soon as you turn 65. You can enroll in Medicare coverage starting three months before your 65th birthday. You're automatically enrolled if you already receiving Social Security benefits. Use this guide to learn how to sign up for Medicare online to speed up the application process.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Michael Vereecke

Updated August 2025

You’re eligible to sign up for Medicare online three months before your 65th birthday. This is the Initial Eligibility Period (IEP), but there are different Medicare enrollment periods.

We’re here to walk you through the Medicare application process. This guide will compare health insurance plans and explain everything you need to know about how to sign up for Medicare.

If you have questions about how to get started, we’d love to help you understand your options. Enter your ZIP code to see what’s available in your area.

- Step #1: Determine Eligibility – Eligibility starts three months before your birthday

- Step #2: Gather Documents – Collect proof of residence and Social Security number

- Step #3: Fill Out Application – Include personal details and when you want coverage to start

- Step #4: Submit Application – Sign up online at the Social Security website

- Step #5: Receive Medicare Cards – Arrives in the mail within 30 days

How to Sign Up for Medicare

Who’s eligible for Medicare? Anyone turning 65. You’ll be automatically enrolled in Original Medicare Part A and Part B if you’re already receiving Social Security benefits for at least four months before your 65th birthday. You’ll receive your Medicare card in the mail three months before your 65th birthday.

However, if you’re covered under another creditable plan when you turn 65, for example, if you’re still working or covered under a spouse’s plan, you can defer enrollment until you lose that coverage.

If you aren’t automatically enrolled, take the following steps to sign up for Medicare:

- Determine Eligibility Period: You sign up for Medicare at different times depending on your birthday month. To determine when your enrollment eligibility starts, go to the first of the month, three months before your month of birth

- Gather Necessary Documents: This includes your birth certificate or proof of legal residence, Social Security number, and current health insurance information.

- Fill Out Medicare Application: Fill out the application form with personal details, including your current health insurance information, and specify the date you want your Medicare coverage to start.

- Submit Medicare Application: Use the Social Security website to learn how to sign up for Medicare online or visit your local Social Security office to apply in person.

- Receive Medicare Cards: After your application is processed, you’ll receive a Medicare card in the mail within 30 days. Your card will show your Medicare Part A and Part B start dates.

If you want additional coverage with Medicare Advantage, you can enroll in these plans separately during your IEP or during the annual Open Enrollment Period (OEP) from October 15 to December 7. You can buy a Medigap policy during your Medigap Open Enrollment Period, which is within six months of turning 65 and enrolling in Part B.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

When to Sign Up for Medicare

Typically you have up to three months before or three months after your 65th birthday to sign up for Medicare coverage. This is known as the Initial Enrollment Period (IEP).

If you miss this deadline or already have health insurance, you can sign up for Medicare during Open Enrollment or by qualifying for Special Enrollment.

Scroll down to learn more about Medicare enrollment periods.

Initial Enrollment Period

What is the Initial Enrollment Period (IEP)? The IEP starts on the first day of the month, three months before the month of your birth. The day of your birth has no bearing on your enrollment period. For example, someone born on January 1 will have the same enrollment period as someone born on January 31.

To determine when your enrollment eligibility starts, go to the first of the month, three months before your month of birth. If your birthday is in January, initial enrollment starts on October 1. If your birthday is in June, your initial enrollment starts on March 1.

This initial period extends three months past your birth month. So those born in January can enroll until April 30, and those born in June can enroll until September 30. This period gives everyone seven months to enroll, so there’s no need to panic as your 65th birthday approaches. You have several months to work through your options.

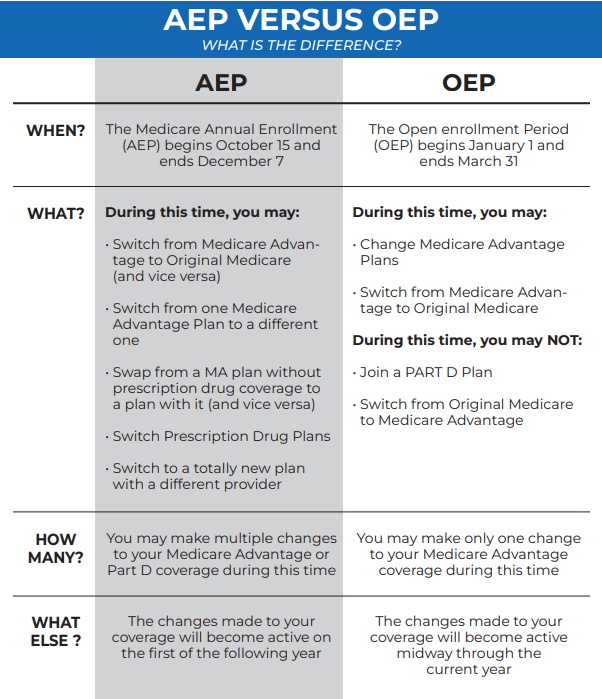

Annual Election Period

What is the Annual Election Period (AEP)? Each year from October 15th until December 7th, Medicare open enrollment occurs. This period is often referred to as the Annual Enrollment Period, or AEP.

During this period, you can switch your current Medicare Advantage plan or your Part D plan for any reason. You can also choose to enroll in a Medicare Advantage period for the first time if you are currently on Original Medicare or drop a Medigap plan and enroll in a new Medicare Advantage plan.

When you change your plan during the Annual Enrollment Period, your new coverage will start on January 1. If you’re getting ready to enroll in Medicare or considering switching plans, we can help you understand your options. Give us a call to speak with a knowledgeable licensed insurance agent about your options.

Open Enrollment Period

What is the Open Enrollment Period (OEP)? The Medicare Open Enrollment Period (OEP) is similar to the annual Open Enrollment Period (AEP), but you must already be enrolled in a Medicare Advantage plan.

During OEP, you can make a one-time change to an Advantage plan, switch prescription drug coverage, or opt to drop Medicare Advantage and switch to Original Medicare and enroll in a Part D plan. Medicare Advantage Open Enrollment runs from January through March each year.

Special Enrollment Period

What is a Special Enrollment Period (SEP)? Special enrollment periods (SEP) are times when individuals can sign up for Medicare or change plans outside the Annual Enrollment Period (AEP). You have to meet the criteria to be eligible. Some of the circumstances that allow for a special enrollment period include the following:

- You move. This can include moving into or out of an assisted living or skilled nursing facility. Special enrollment also opens up for individuals who move outside their plan coverage area or in their plan coverage area but have new options available.

- You lose your health coverage. If you had Medicaid and are no longer eligible or if your retirement health plan or COBRA plan ends, you could be eligible to enter a Medicare special enrollment period (SEP).

- You’re eligible for another type of health coverage. If you’re still employed or on a spouse’s insurance plan, you can keep that coverage and enroll in Medicare later.

- Your Medicare plan provider changes its contract with Medicare. If you buy a Medicare Part C plan from a private company that no longer provides that coverage, you’re allowed to enroll in Medicare coverage at your policy’s end.

Several other situations qualify you for special enrollment. If you experience a major life change, you should evaluate your eligibility for special enrollment.

No one will force you to enroll. It’s important to know that if you don’t sign up when you’re first eligible, you may have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B, and the penalty goes up the longer you wait to sign up.

When Medicare Coverage Starts

When does Medicare coverage start? If you qualify for premium-free Part A, your coverage starts on the first day of the month you turn 65. If your birthday is the first of the month, your coverage will start the month before you turn 65.

Medicare Part A and Part B coverage starts based on the month you sign up. So if you sign up the month before turning 65, coverage will start the month you turn 65. If you sign up the month you turn 65 or during the three months after, your Medicare coverage starts based on when you sign up.

The sooner you sign up for Medicare, the faster your coverage will start. The Initial Enrollment Period is your first chance to sign up and the best time to get covered. This is often when you turn 65 and lasts for seven months. It begins three months before you turn 65 and ends three months after the month you turn 65.

Read More: Millennial’s Guide to Health Insurance

Picking the Best Medicare Plans

If you’re having trouble deciding which is the best Medicare plan for your health needs, you’re not alone. There are a lot of options, and the process of evaluating what’s available can often feel overwhelming.

If choosing the best Medicare plan was easy, there would be one plan that fits everyone. The best way to find out how Medicare works is to first determine what kind of health coverage you need:

- Do you need more than basic coverage? While Original Medicare could be considered basic coverage, you should ask yourself if that’s enough.

- Are you looking for coverage for prescription drugs? Or, perhaps you want coverage to help with medicare copayments.

- What is your budget? Plans that cover more than Original Medicare may have a monthly premium. If you know your budget before you get started, you can narrow down your options. Many Medicare Advantage programs have $0 premiums.

- What are your retirement plans? If you plan to travel or have a summer home, the best Medicare plan for you may be different than if you will stick mostly to one home area.

If you have friends and family on Medicare, then it’s likely they have each chosen something different. Ask for their recommendations and do your research before buying a plan.

Complete List of Medicare Plans

What’s the difference between Medicare Advantage vs. Original Medicare? Which plan is better? This question is the one that everyone wants the answer to.

A Medicare Advantage plan or Original Medicare with a Medigap and Part D plan are comparable, and both types of coverage provide excellent options.

With Original Medicare and Medigap plans, you don’t usually need to have hospital stays or procedures pre-approved. With Medicare Advantage, you typically must have those same treatments pre-approved to have them covered.

Individuals who live in metropolitan areas often have several hospital and physician options that are part of Medicare Advantage HMOs and PPOs. Those living in rural areas won’t have as many options. Their local hospital may not be part of an HMO, giving them a lack of coverage for many medical treatments they may receive there. For individuals without nearby HMO-participating providers, Medicare Advantage plans are often not the best option.

Medicare Advantage plans are becoming increasingly popular, and if their present growth continues, more Medicare-eligible individuals will soon choose Medicare Advantage over Original Medicare. Enter your ZIP code to speak with a licensed insurance agent about your Medicare needs.

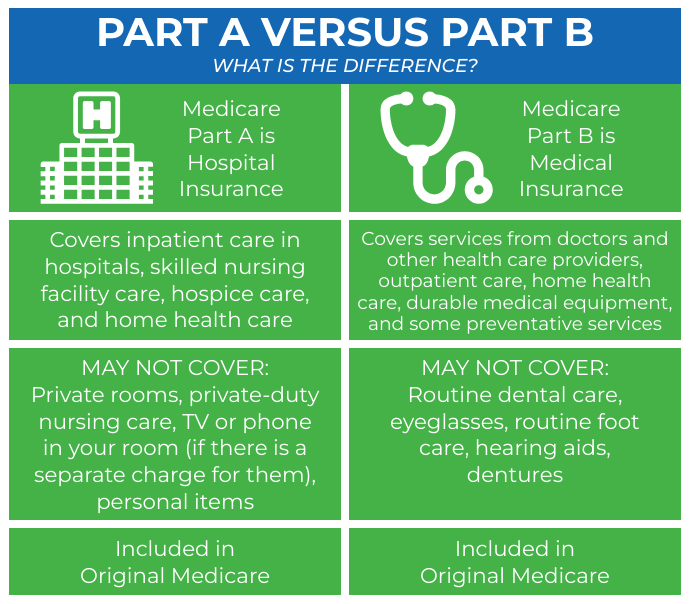

Original Medicare Plans

Original Medicare is the combination of Medicare Part A and Part B. Each part covers different services:

- Medicare Part A is hospital insurance. Part A also covers hospice, limited home health care, and skilled nursing facility stays.

- Medicare Part B is medical insurance. Medicare Part B covers outpatient doctor visits and services and medical equipment.

Original Medicare covers any visit with a doctor who accepts Medicare anywhere in the U.S., but there might be copays and coinsurance costs involved.

For example, Medicare Part A has a deductible per benefit period. A benefit period is one hospital stay. So, if you are in the hospital for a week, go home for a day, and go back to the hospital, you’ll start a new benefit period requiring another deductible.

How do Medicare deductibles work? Once the deductible is met, Medicare covers inpatient hospital stays up to 60 days requiring $0 coinsurance. From days 61-90, you’ll be required to pay a $400 per day coinsurance. And beyond 90 days, Medicare will cover up to 60 reserve days in your lifetime, requiring an $800 coinsurance. For the first 20 days at a skilled nursing facility, Medicare covers the whole cost of staying. Then, each additional day to 100 days requires a $200 copayment, and starting at day 101, Medicare provides no coverage.

Medicare Part B covers outpatient doctor visits and doctor services at 80% once you’ve met your deductible. Part B also covers medical equipment at 80%. Unlike Part A’s deductible, which must be paid with every hospital stay, the deductible with Part B only needs to be met once a year.

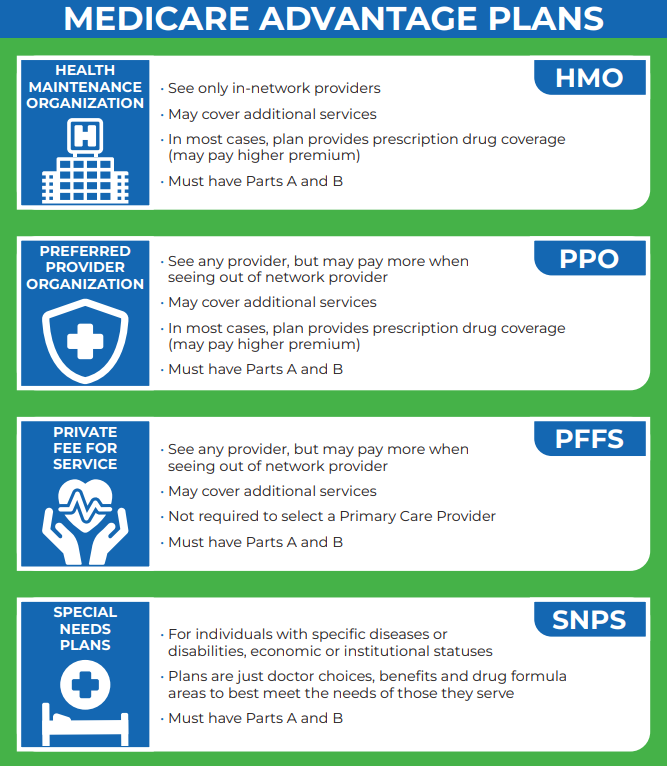

Medicare Advantage Plans

What is Medicare Advantage? Medicare Advantage policies, also called Medicare Part C, are an alternative to Original Medicare. They’re offered by independent insurance companies but must adhere to the same minimum coverage as Original Medicare.

There are four main types of Medicare Advantage Plans, and this is where many people can start to feel confused. You don’t need to worry, though, because we’ll help you work through the differences in a way you can understand and act on.

These are the four main types of Medicare Advantage plans. Most individuals who choose a Medicare Advantage plan opt for an HMO or PPO.

Health Maintenance Organization (HMO) Plans

HMO plans provide coverage for doctors and hospitals within a network. You don’t have the freedom to choose whatever hospital or doctor you want. However, if your established primary care physician and hospital are already in the HMO, you can easily transition to a Medicare Advantage HMO plan.

Generally, the only types of care that are covered by out-of-network hospital systems or physicians are emergency care, urgent care, and temporary dialysis. An HMO plan is best for individuals who do not travel and have a good network of participating doctors and specialists in their region.

Preferred Provider Organization (PPO) Plans

As with an HMO, a PPO will have an organization of in-network providers. The difference is that PPO plans will cover other out-of-network hospitals and physicians who accept Medicare, though the coverage will be better with those in the network.

You can choose any hospital or specialist you want with a PPO, but you’ll pay less if you choose an in-network provider or hospital.

Private Fee-for-Service (PFFS) Plans

These plans do not require the policyholder to have a primary care physician. So, individuals with a PFFS plan do not need to get a referral to see a specialist. Depending on the plan, there may be coverage for out-of-network providers, or there might not. 20 Your Guide to the Ins and Outs of Medicare PFFS plans tend to be more expensive and less popular than HMO and PPO plans. Most individuals who choose a Medicare Advantage plan opt for an HMO or PPO.

Special Needs Plans (SNPs)

Special Needs Plans (SNP) are specific plans for specific situations related to having chronic or critical illnesses and conditions, for beneficiaries who are in institutional care, or for beneficiaries who qualify for some form of Medicaid from their state. The typical person eligible for Medicare isn’t eligible for an SNP. If you become eligible, you can switch to an available SNP plan at that time

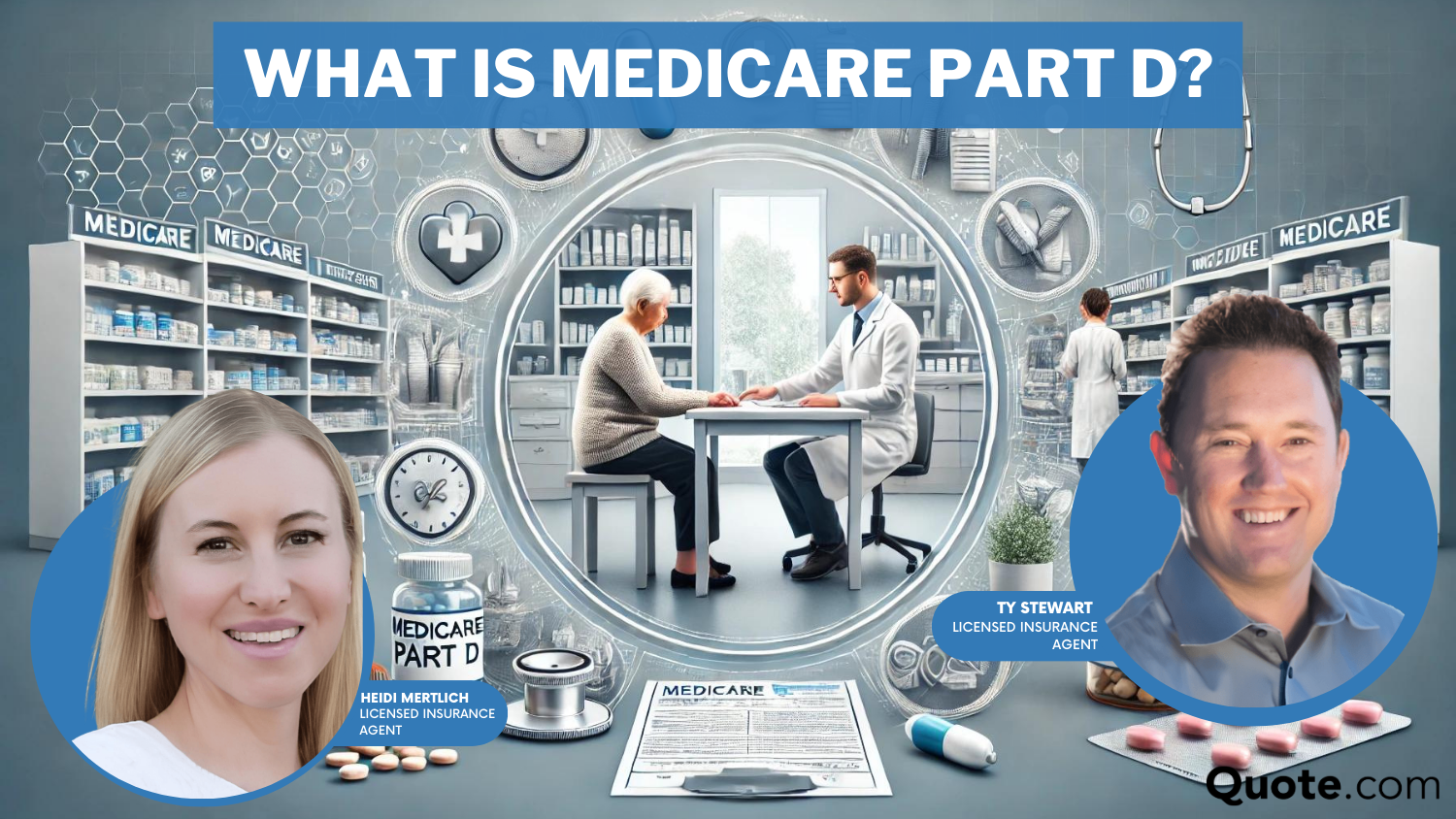

Medicare Part D Plans

You may have realized that Original Medicare doesn’t cover prescription drugs. That’s where Medicare Part D comes in. You can enroll in a prescription drug plan when you enroll in Medicare.

You don’t have to enroll in a Part D plan. But if you don’t enroll in Medicare Part D during your initial enrollment, and you are not receiving creditable coverage under another health plan, and then enroll in a plan later, you’ll pay a 1% penalty for every month you went without coverage. Because of this penalty, most people sign up for drug coverage upon initial enrollment.

Most Medicare Advantage plans include Part D coverage for prescription drugs. So if you choose a Medicare Advantage plan that includes prescription drug coverage, you don’t need to purchase a separate Part D policy.

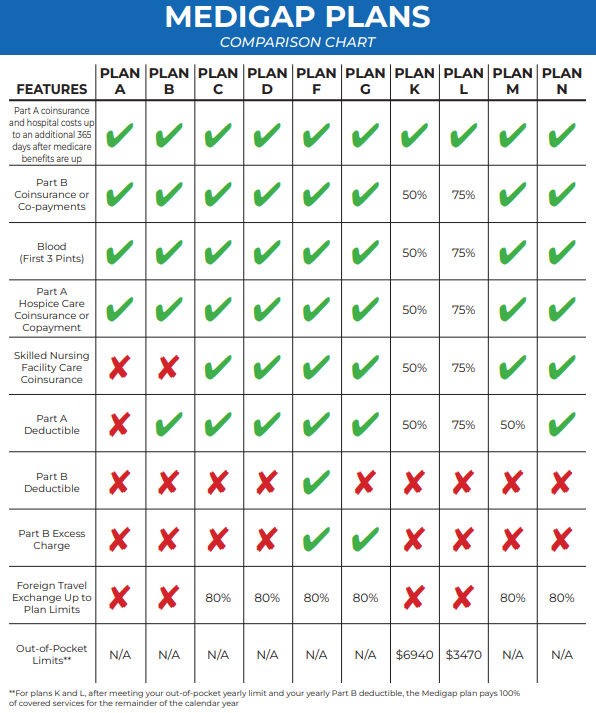

Medigap Plans

What is Medigap? Medigap is a supplemental policy. As the “gap” in its name implies, this supplemental coverage fills some of the gaps in the Original Medicare coverage.

Many people on Original Medicare purchase a supplemental insurance plan called a Medicare Supplement plan, also known as a Medigap plan. Note that a Medicare beneficiary cannot have both a Medigap plan and a Medicare Advantage plan at the same time.

When you choose a Medigap plan, Medicare will cover its portion of the doctor and hospital bills. The Medigap plan will then cover deductibles, copays, and coinsurance according to the individual policy terms. It’s one of the easiest ways to finance what your health insurance won’t cover.

Unlike Original Medicare and Medicare Advantage, there’s no open enrollment period for Medigap. Instead, you can sign up for a plan wherever you want. However, if you don’t sign up within six months of enrolling in Part B, Medigap insurers can charge higher premiums or refuse to offer coverage based on pre-existing conditions.

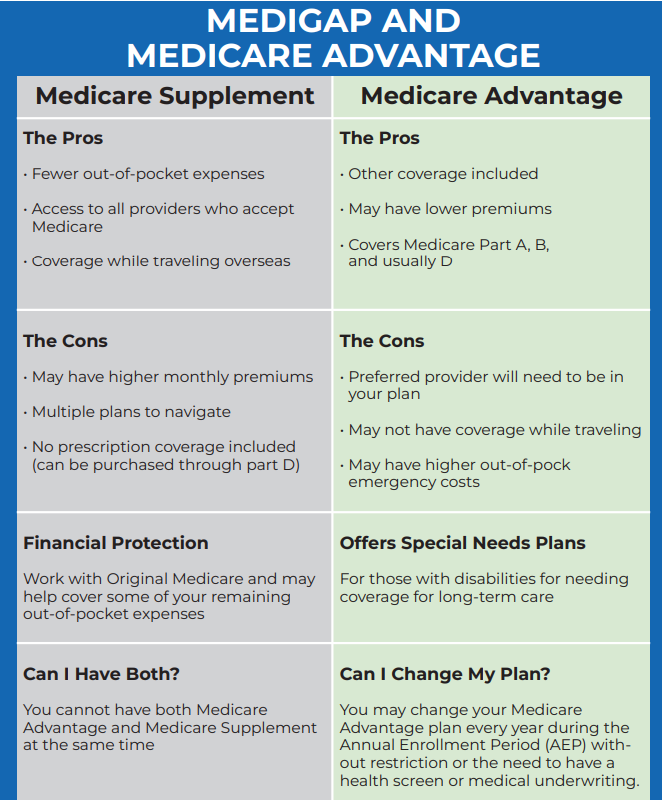

Medigap vs. Medicare Advantage

While they may provide similar coverage, Medigap and Medicare Advantage are not the same:

Medigap is a supplemental coverage for Original Medicare while Medicare Advantage is a private insurance option that provides coverage that at a minimum is equivalent to Original Medicare but oftentimes includes additional coverage as well.

Who should get Medigap coverage? Medigap plans may be a better option for travelers because they don’t have a preferred network.

Medigap will pay for care covered by Original Medicare provided by any doctor or hospital that accepts Medicare, and Medigap plans don’t require a referral by a primary care physician. Additionally, some Medigap plans cover medical costs outside the U.S.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

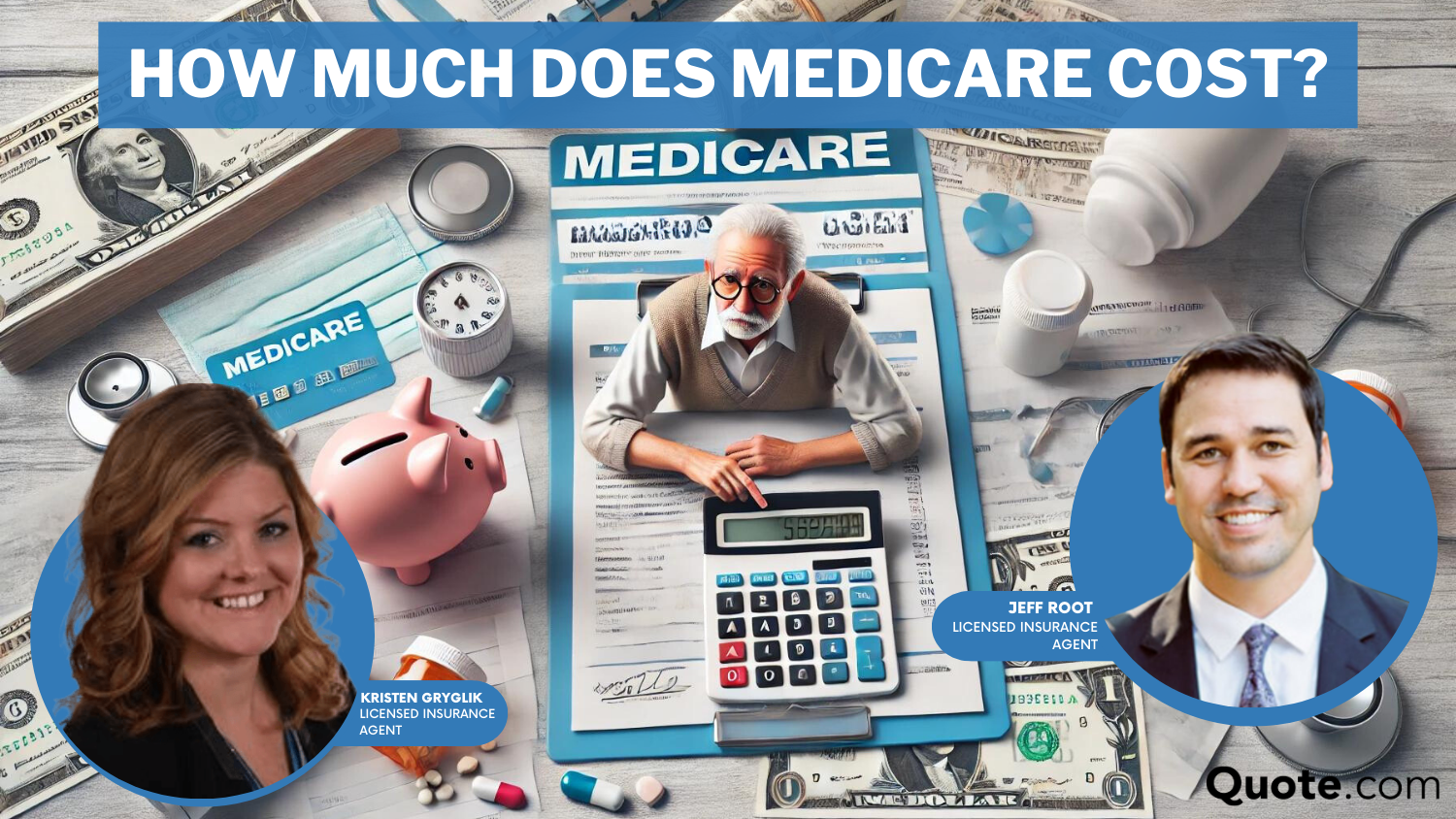

Medicare Premiums and Deductibles

How much does Medicare cost per month? When it comes to Original Medicare premiums and costs, most individuals do not have to pay a premium with Part A. That’s why you should enroll in Part A as soon as you’re eligible, even if you have other insurance. You have nothing to lose because in most cases you won’t pay a premium, but you could receive a benefit.

Medicare Costs by Plan Type| Medicare Plan | Monthly Premium | Annual Deductible | Out-of-Pocket Max |

|---|---|---|---|

| Part A | $0-$505 | $1,632 | N/A |

| Part B | $174 | $240 | N/A |

| Part C | $0-$200 | $0-$200 | $8,850 |

| Part D | $34 | $0-$545 | $2,000 |

| Medigap | $35-$488 | $0-$2,800 | $3,500-$7,500 |

If you don’t sign up for Medicare Part B when you’re first eligible, and you don’t qualify for a special enrollment period, you’ll pay a penalty based on how long you went without coverage in addition to the base premium.

In addition to your Part B monthly premium, it’s important to understand that Original Medicare only covers 20% of your medical costs, so there is no limit to how much you can spend on your medical care with Original Medicare. That’s why most people choose to have a supplemental form of insurance, either a Medigap plan or a Medicare Advantage plan.

How to Save Money on Medicare Insurance

If you can’t afford your average Medicare premiums per month, you can sign up for different Medicare Savings Programs (MSPs).

The following programs are offered through your state Medicaid program:

- Qualified Medicare Beneficiary (QMB) Program: Those who qualify will not be charged by Medicare for Part A premiums (if applicable) and Part B premiums, deductibles, coinsurance, or copayments for Medicare-covered services. They may receive a bill for a copayment for Part D prescriptions from Medicaid. QMB program participants are not eligible for full Medicaid benefits.

- Qualified Medicare Beneficiary Plus (QMB+) Program: Eligible individuals can receive full Medicaid benefits. This program is similar to the QMB program but offers a higher level of coverage.

- Specified Low-Income Medicare Beneficiary (SLMB) Program: Those who qualify will not need to pay Part B premiums and will also receive assistance for prescription drug costs. Participants will be required to pay cost-share for most medical services as this program does not provide full Medicaid benefits.

- Specified Low-Income Medicare Beneficiary Plus (SLMB+): Qualifying individuals are not responsible for paying Part B premiums. SLMB+ provides full Medicaid benefits. This program also offers limited assistance from state Medicaid agencies to cover cost-shares. Services covered by both Medicaid and Medicare require 0% cost-share.

- Qualifying Individual (QI) Program: Qualifying individuals are eligible to have Part B premiums covered. This program is offered on a first-come, first-served basis, and you must apply yearly. Therefore, not all who qualify will receive benefits. The state Medicaid office is not responsible for cost-share.

- Qualified Disabled Working Individual (QDWI) Program: This savings program will cover Part A premiums. Individuals must meet income and disability requirements. State Medicaid offices will not pay cost-share. This program does not offer full Medicaid benefits.

- Full Benefits Dual Eligible (FBDE) Program: Individuals who qualify for this program are eligible for full Medicaid benefits and may receive limited assistance from Medicaid for Medicare cost-share. These savings programs are administered by each state. To apply, you must contact your state Medicaid program.

Individuals who meet income and resource requirements may be eligible for assistance paying for Medicare premiums, deductibles, coinsurance, and copayments.

Medicare Savings Programs Monthly Income and Resource Limits by Policy Type| Qualifying Program | Individual | Married Couple |

|---|---|---|

| QMB Income Limit | $1,275 | $1,724 |

| QMB Resource Limit | $9,430 | $14,130 |

| SLMB Income Limit | $1,526 | $2,064 |

| SLMB Resource Limit | $9,430 | $14,130 |

| QI Income Limit | $1,715 | $2,320 |

| QI Resource Limit | $9,430 | $14,130 |

| QWDI Income Limit | $5,105 | $6,899 |

| QWDI Resource Limit | $4,000 | $6,000 |

Read our expert guide to Medicare to learn more.

How to Sign Up for Medicare Near You

Knowing when and how to sign up for Medicare is crucial to ensuring you have the health coverage you need as you get older. Remember, your Initial Enrollment Period (IEP) is your first opportunity to sign up and spans seven months, giving you plenty of time to pick a plan and get coverage.

The Annual Enrollment Period (AEP) and Special Enrollment Periods (SEPs) offer opportunities to adjust your coverage if your circumstances change. These periods are vital for making sure your Medicare plan continues to meet your evolving needs. You can also sign up for additional coverage options like Medicare Advantage (Part C), Medigap, and Part D prescription plans during those times.

Automatic enrollment makes the transition seamless but only applies to those already receiving Social Security benefits before turning 65. If you’re not automatically enrolled, following the steps outlined — determining your eligibility period, gathering necessary documents, filling out the application, and submitting it — ensures you don’t miss out on essential health coverage.

Take advantage of our free health insurance guide and get all the guidance you need from our specialized insurance agents by entering your ZIP code below.

Frequently Asked Questions

How do I enroll in Medicare for the first time?

You can enroll in Medicare online as soon as three months before your 65th birthday. This is when your Initial Enrollment Period starts. If you miss it or still have private insurance, you will have to wait until the Annual Enrollment Period to sign up for Medicare.

Do you automatically get Medicare when you turn 65?

Yes, you’ll be automatically enrolled in Original Medicare Part A and Part B if you’re already receiving Social Security benefits for at least four months before turning 65. Learn who is eligible for Medicare.

Is it mandatory to sign up for Medicare at 65?

You aren’t required to sign up for Medicare, but you could face penalties and higher premiums if you enroll later. Enter your ZIP code to get covered today.

What documents do I need to apply for Medicare?

You need your birth certificate, proof of legal residence (like a utility bill or banking statement), Social Security number, and current health insurance information.

Can you use Medigap with Medicare Advantage?

You cannot use both coverages. In fact, it’s illegal for someone to sell you a Medigap policy if you have Medicare Advantage. Learn more about Medigap coverage.

Can you switch back and forth between Original Medicare and Medicare Advantage?

You can switch from one to the other during the Annual Enrollment Period or if you qualify for a special enrollment period. Compare the differences between Medicare Advantage and Original Medicare.

Can you get the same Medigap plan after dropping it?

If you had Original Medicare with Medigap and switch to Medicare Advantage for the first time, you can switch back to your Medigap plan within 12 months if you’re unhappy with your Medicare Advantage Plan. If your Medigap plan is no longer available, you can choose a new one.

Can you use Medicaid with Medicare?

If you’re eligible for Medicaid and Medicare, you can use Medicaid as your supplemental coverage to Medicare. Each state has a different criteria or set of rules for Medicaid eligibility, starting with income requirements. If you are eligible for Medicaid, services such as personal care and nursing home care would be provided, which are not services covered by Medicare. For more information or to find out if you are eligible for benefits, contact the eligibility office in your state.

What’s the difference between Medicare Advantage and Medigap?

Medicare Advantage plans are offered by private insurance companies and must meet coverage minimums and be approved by Medicare. Medicare Advantage plans are intended to replace your coverage from Original Medicare. Medigap plans are offered by private insurers and are is a supplement to Original Medicare. You must have Original Medicare, which is a government program to buy a Medigap plan.

Is Medicare Advantage or Original Medicare with Medigap cheaper?

When you consider the total cost, the comparisons can be similar. Some people may discover that one option is better for them than the other. Nearly half of all Medicare beneficiaries were enrolled in a Medicare Advantage plan, while only 23% of beneficiaries are enrolled in a Medigap plan, an indication of the growing popularity of Part C plans.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.