How much does Medicare cost? (2026 Coverage Breakdown)

How much Medicare costs varies by the plan you pick. Original Medicare (Parts A and B) has standardized premiums, with Part A often being free and Part B costing $174/month. Medicare Advantage and Part D plans have varying costs. Medicare Savings Programs and Medigap plans can help reduce monthly rates.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Jeff Root

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshir...

Kristen Gryglik

Updated August 2025

How much does Medicare cost? That depends on the plan you choose. Original Medicare costs are typically the same for everyone, but Medicare Advantage plans vary in price based on company and where you live.

How much does Medicare cost per month? When it comes to Original Medicare, Part A premiums are usually free. Most people are only responsible for Medicare Part B premiums, which cost $174/month. If you’re comparing Medicare Advantage vs. Original Medicare, you still have to pay Part B premiums with each plan.

Each type of Medicare plan comes with different premiums, deductibles, and out-of-pocket maximums. Start comparing Medicare costs below and enter your ZIP code to find affordable Medicare coverage near you.

- Medicare Part A is free for most beneficiaries

- Medicare Part B premiums cost $174/month

- Medicare Part C costs vary by plan and company

Breaking Down Medicare Costs

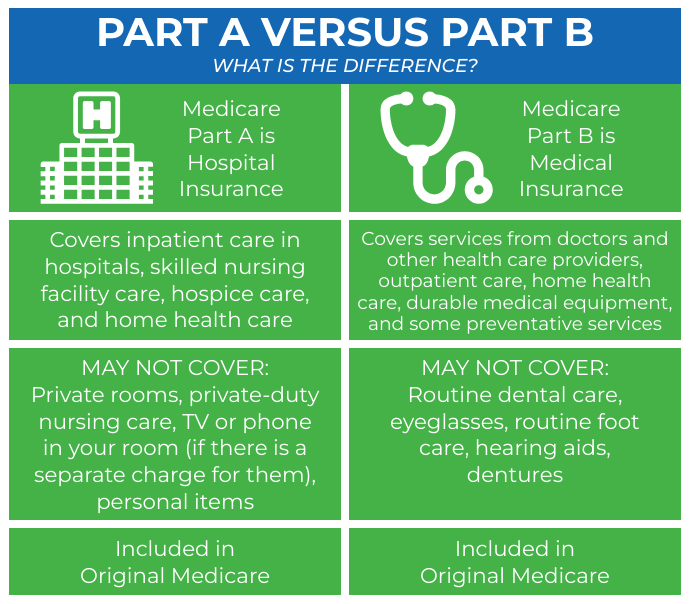

How much does Medicare cost at age 65? How much Medicare costs per month depends on the type of plan you buy. Original Medicare Parts A and B cover hospital and medical costs and come with set premiums everyone pays. Learn if you’re eligible for Medicare.

Medicare Costs by Plan Type

Medicare Plan Monthly Premium Annual Deductible Out-of-Pocket Max

Part A $0-$505 $1,632 N/A

Part B $174 $240 N/A

Part C $0-$200 $0-$200 $8,850

Part D $34 $0-$545 $2,000

Medigap $35-$488 $0-$2,800 $3,500-$7,500

Since Medicare Part A is hospital insurance, deductibles reset after every stay. This means you pay $1,632 every time you stay in a hospital or skilled nursing facility before Medicare pays.

Medicare Part B only covers 80% of costs, so you are responsible for the remaining amount plus your monthly premiums. The following sections explain each type of Medicare premium and deductible in detail.

What You Pay for Medicare Part A

Is Medicare Part A free? If you qualify for premium-free Part A, your premium is $0/mo.

However, if you or your spouse didn’t work or retired early, you could pay either $278 or $505 based on how much Medicare taxes you paid.

What You Pay for Medicare Part B

Medicare Part B premiums are the same for everyone unless you earn more than $103,000 annually. Premiums increase by about $70/mo for every $20,000-$30,000 more you earn. Learn more at Medicare.gov.

Everyone has the same $240 deductible, which you must pay upfront before Part B pays for any coverage. Even if you meet the deductible, Part B only covers 80% of your medical costs. You are responsible for paying the remaining 20% plus premiums or copayments.

What You Pay for Medicare Part D

How much does Medicare Part D cost? Medicare Part D costs are based on income. The average is around $34/mo, but you could pay more or less depending on the plan you choose and the types of drugs you need.

Beneficiaries who filed less than $103,000 on their tax return may not have to pay any extra premiums for prescription coverage.

Thanks to a new prescription drug law, many people qualify for additional savings on their Medicare drug coverage (Part D) costs. Don’t wait – see if you qualify for Extra Help today at https://t.co/6Xe02cDHmd. pic.twitter.com/hoWhTnHyVd

— Medicare.gov (@MedicareGov) June 21, 2024

Unlike Parts A and B, Medicare Part D does come with an out-of-pocket maximum. Starting in 2025, Part D plans cap at $2,000. After you reach this amount, the policy covers 100% of your prescriptions for the rest of the year.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

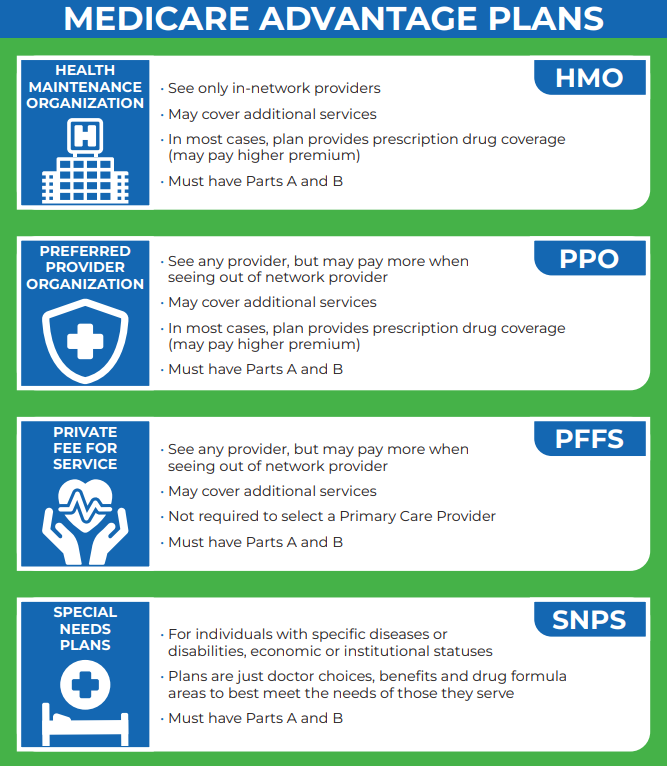

Comparing Medicare Advantage Costs

How much does Medicare cost? Medicare Advantage (Part C) is sold by private insurance companies, so premiums and deductibles will vary by company and plan.

Most people choose Health Maintenance Organization (HMO) or Preferred Provider Organization (PPO) plans, which average around $20/mo in most states.

Most Medicare Advantage plans include Part D, combining all three Original Medicare plans into one convenient monthly premium. Compare Medicare Advantage plans near you to get the best rates.

How to Save Money on Medicare

Is Medicare free at age 65? Medicare Part A is free if you paid Medicare taxes, but you are still responsible for deductibles and copays. You also have out-of-pocket costs to pay for Medicare Parts B, C, and D.

Don’t stress if you can’t afford your Medicare costs. The federal and state governments offer an array of programs and supplemental insurance plans to help pay for coverage.

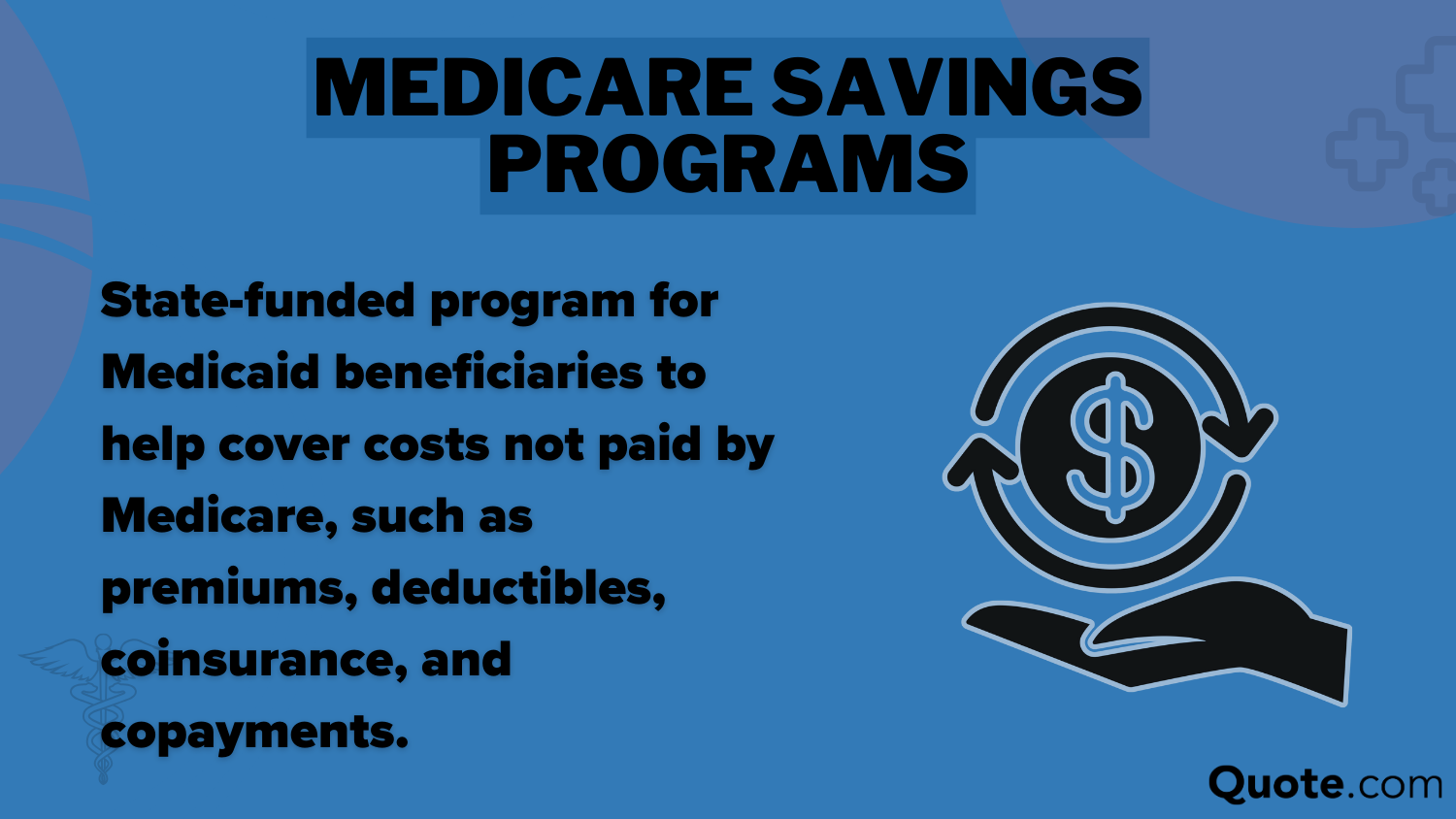

Medicare Savings Programs (MSP)

Medicare Savings Programs (MSPs) cover Original Medicare premiums, deductibles, coinsurance, and copayments through your state’s Medicaid program.

Each plan comes with different income requirements and provides different types of assistance:

- Qualified Medicare Beneficiary (QMB) Program: Covers Part A and Part B costs but not Part D copayments.

- Specified Low-Income Medicare Beneficiary (SLMB) Program: Covers Part B premiums and some Part D costs.

- Qualifying Individual (QI) Program: Must apply every year to cover Part B premiums.

You don’t need to be enrolled in Medicaid to apply, but you can receive additional benefits with certain MSPs.

Read More: What is Medicaid?

Medicare Supplement Insurance (Medigap)

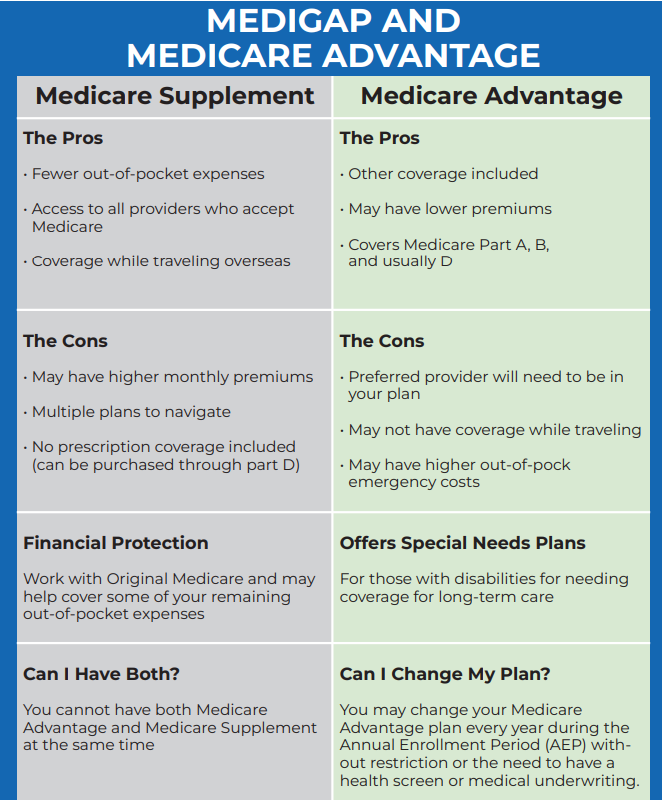

Supplemental insurance, also known as Medigap, will help finance what your health insurance won’t cover by paying a portion of your doctor and hospital bills.

Medigap plans are not stand-alone policies and are therefore limited in the amount of coverage they can provide. Medicare Advantage plans offer similar benefits at a better price.

Use our Medigap guide to compare insurance plans and find the best fit for you. Just be aware that you cannot buy Medigap if you choose a Medicare Advantage plan.

The Bottom Line: How much does Medicare cost?

How much is Medicare? Here is a breakdown of how much Medicare costs:

- Medicare Part A: Premium-free for many but costs up to $505/mo if you don’t meet the tax requirements.

- Medicare Part B: Premiums start at $174/mo for most beneficiaries, with additional costs for high earners.

- Medicare Advantage (Part C): Provided by private insurers and prices vary between $0-$200/month based on location and the insurance company.

- Medicare Part D: Averages around $34/month, but costs are income-dependent and include an out-of-pocket maximum starting in 2025.

Original Medicare (Parts A and B) has standardized premiums, deductibles, and out-of-pocket costs, while Medicare Advantage varies by state and company. Compare Medicare Advantage vs. Original Medicare to learn more.

Since Medicare costs vary, comparing health plans is essential to finding the most cost-effective coverage. Certain supplemental and savings plans can also cover some of these costs for you. Enter your ZIP code below to start shopping for affordable Medicare plans today.

Frequently Asked Questions

What does Medicare cover?

Medicare pays for medical services, hospital stays, nursing home and hospice stays, medical equipment, and prescription drugs for seniors aged 65 or older.

What is the average monthly cost for Medicare?

Compare how much Medicare costs. If you choose Original Medicare (Parts A and B), you will pay at least $174/mo for Medicare Part B. Medicare Part A is usually premium-free.

Does everyone pay $170 for Medicare?

All beneficiaries pay $174/mo for Medicare Part B premiums unless they qualify for Medigap or a Medicare Savings Program (MSP).

How much does Medicare Part B cost per month?

The monthly Medicare Part B premium is $174/mo while the policy deductible is $240. However, Part B only covers 80% of the total price after you meet your deductible. You are responsible for the remaining 20%.

Can I get Medicare Part B for free?

Beneficiaries who qualify for Medicare Savings Programs based on income can have their Medicare Part B costs wholly or partially covered.

How much a month is Medicare Part C (Medicare Advantage)?

Medicare Part C costs vary depending on the plan and company you pick. In general, monthly rates average at $20/mo. Enter your ZIP code to start comparing Medicare Advantage costs near you.

Is Medicare Advantage or Original Medicare with Medigap cheaper?

The cost of Medicare depends on how much coverage you need. However, more than 75% of Medicare beneficiaries are enrolled in Advantage plans, which speaks to Part C affordability and flexibility. Learn more about the differences between Medicare Advantage vs. Original Medicare.

How much does Medicare pay for hospice per day?

Medicare covers up to $207 per day for up to 90 days of routine care. It covers up to $1,068/day for continuous care.

How much do most seniors pay for Medicare?

Most seniors qualify for premium-free Part A insurance, meaning they only pay $174/mo for Part B. Most seniors who choose Medicare Advantage plans pay around $20/mo plus their Part B premiums.

What happens if you can’t afford to pay for Medicare?

If you can’t afford your monthly Medicare payments, use our Medigap guide to find affordable plans in your area. This type of supplemental insurance can help cover Original Medicare premiums and deductibles.

How much income is too much for Medicare?

What happens to Medicare if your income is too high?

Can you switch back and forth between Original Medicare and Medicare Advantage?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.