10 Best Life Insurance Companies in 2026 (Check Out These Providers)

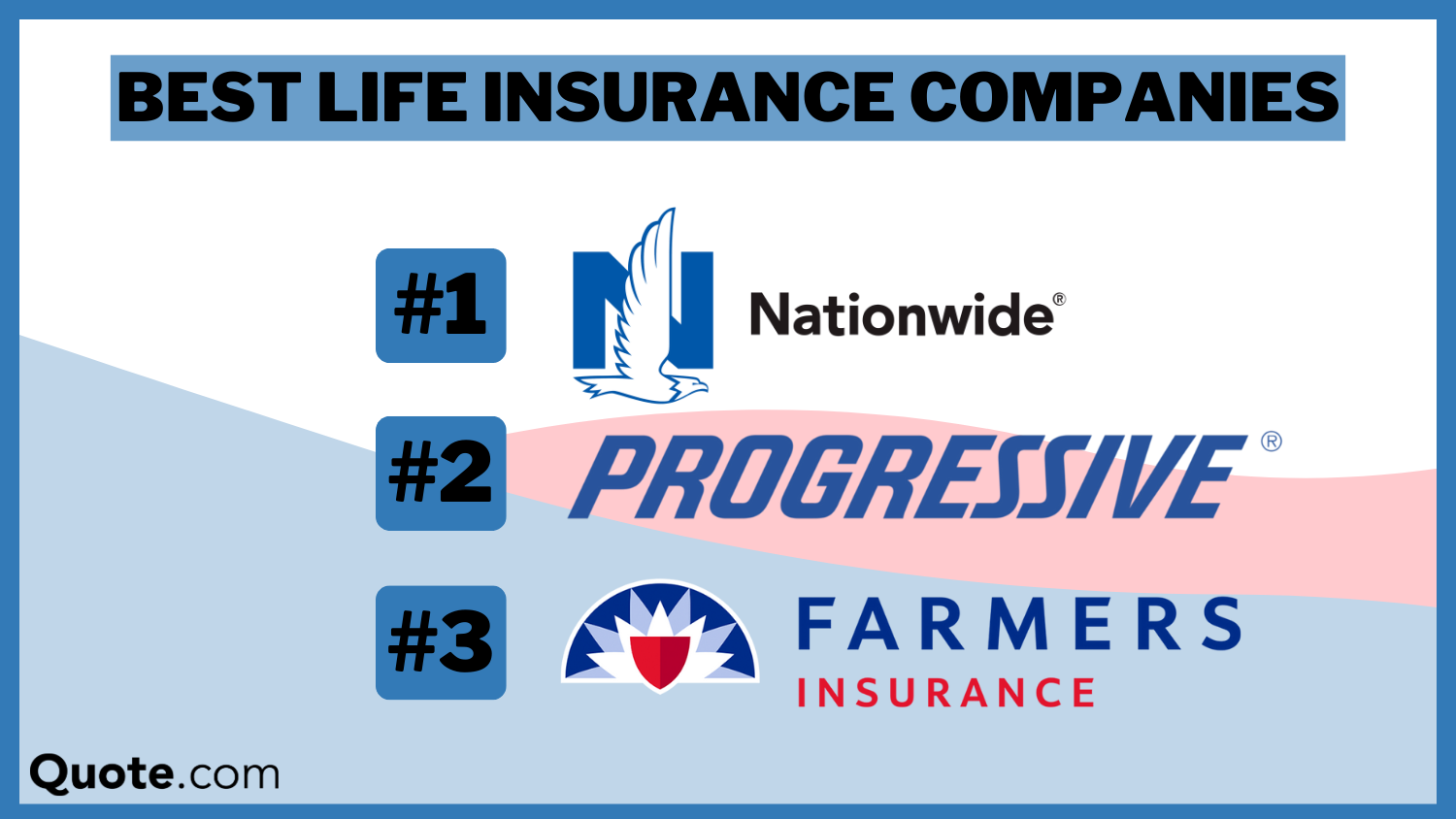

The top providers for best life insurance companies comes from Nationwide, Progressive, and Farmers, featuring budget-friendly rates at $24 per month. These companies offer comprehensive coverage, excellent customer service, and various policy options. Compare them to find the best fit for your needs.

Read more Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Life insurance policies starting at less than $1/day

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding co...

Meggan McCain

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Michael Vereecke

Updated November 2025

State Farm, Guardian, and MassMutual are the best life insurance companies. Rates start at just $23 monthly for a 20-year term policy.

State Farm stands out as the top pick overall for its claims satisfaction and reliable service. Check out our life insurance guide for more information.

Our Top 10 Picks: Best Life Insurance Companies| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Comprehensive Coverage | Nationwide |

| #2 | 10% | A+ | Customer Service | Progressive | |

| #3 | 10% | A | Policy Options | Farmers | |

| #4 | 10% | A+ | Excellent Service | Erie |

| #5 | 25% | A+ | Financial Stability | Allstate | |

| #6 | 10% | A | Flexible Options | Liberty Mutual |

| #7 | 17% | B | Customer Focused | State Farm | |

| #8 | 12% | A++ | Competitive Rates | Auto-Owners | |

| #9 | 10% | A++ | Military Expertise | USAA | |

| #10 | 13% | A++ | Trusted Provider | Travelers |

These insurers lead the industry by balancing affordability and exceptional benefits, ensuring that policyholders receive both cost-effective coverage and high-quality service.

- State Farm ranks #1 in our rating for highest customer satisfaction

- Many insurers, including Guardian, offer no-exam policies up to $250,000

- MassMutual stands out for its policy options and annual dividends

Safeguard your family’s future while saving on coverage. Enter your ZIP code to instantly compare life insurance quotes with our free tool today.

Comparing Life Insurance Costs

This guide offers a detailed comparison of monthly life insurance rates from leading providers, covering both term and whole life insurance options.

It also highlights various discounts offered by top companies, helping you identify opportunities to maximize your savings.

Life Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | 20-Year Term life | 30-Year Term life | 40-Year Term life | Whole Life |

|---|---|---|---|---|

| $25 | $35 | $55 | $150 | |

| $22 | $33 | $53 | $140 | |

| $21 | $31 | $52 | $135 |

| $27 | $37 | $58 | $160 | |

| $24 | $34 | $54 | $145 |

| $23 | $32 | $53 | $140 |

| $26 | $36 | $57 | $155 | |

| $20 | $30 | $50 | $128 | |

| $24 | $34 | $54 | $145 | |

| $22 | $32 | $52 | $135 |

It also highlights various discounts offered by top companies, helping you identify opportunities to maximize your savings.

- Life Insurance

- Whole vs. Term Life Insurance in 2026: Differences Explained (+What You Need)

- Pacific Life Insurance: Everything You Need to Know

- Colonial Life and Accident Insurance: An Overview for Businesses

- Prudential Insurance Review

- One Quote That Convinced Me to Get Life Insurance

- Mutual of Omaha® Review

- How Allianz Became the World’s Largest Insurer

- The Life Insurance Guide: How to Get the Best Plan Possible for the Lowest Premium

- MassMutual Review

For term coverage, rates range from $23 with Protective to $30 with Northwestern Mutual. For a whole policy, rates range from $185 with Protective to $230.

Life insurance rates vary for several reasons, including age, health, and coverage amount, making it critical to compare life insurance quotes from multiple insurers before buying a policy (Learn More: How to Get Life Insurance Quotes).

Ready to find out what coverage could cost near you? Compare life insurance quotes today and see personalized options in minutes.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Life Insurance Coverage Options

Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years, and is more affordable than permanent life insurance because it only pays out if the insured dies within the term.

Term policies expire with no benefit if the insured is still alive, and renewals can be costly. They also don’t build cash value or offer investment options.

Jeff Root Licensed Insurance Agent

It is ideal for individuals who need coverage until their children graduate or a mortgage is paid off. Advantages include lower premiums, simplicity, and flexibility. Some term policies may also qualify for conversion to whole life insurance, depending on your insurer.

Permanent life insurance offers lifelong coverage as long as premiums are paid. There are several types of permanent policies:

- Whole Life Insurance: Provides fixed premiums, guaranteed cash value growth, and a guaranteed death benefit, though it’s the most expensive option.

- Universal Life Insurance: Offers flexible premiums and death benefits, with cash value based on interest rates or market performance.

- Variable Life Insurance: Includes investment options for your cash value, which can yield higher returns but also carries investment risk.

Learn More: Whole vs. Term Life Insurance

Factors Affecting Life Insurance Rates

Understanding the factors that influence life insurance rates is crucial for securing the best coverage at an affordable price. Life insurance premiums can vary significantly based on individual circumstances, and recognizing the elements that drive higher costs can help you make informed decisions.

- Age: Health risks become more prevalent as people age, leading to higher life insurance premiums. Insurers see age as a significant risk factor, resulting in higher costs for older applicants.

- Health Conditions: Pre-existing conditions like diabetes, heart disease, or cancer drive premiums higher. Insurers carefully evaluate medical histories, and chronic illnesses increase the likelihood of claims, driving up costs.

- Smoking: Smokers pay much higher life insurance rates. Since smoking is tied to respiratory and heart diseases that shorten life expectancy, insurers charge significantly more to offset the added risk.

- Occupation: Construction, mining, and firefighting often result in higher rates of injury. These high-risk professions increase the likelihood of accidents or health problems, which insurers factor into their pricing.

- Lifestyle Choices: Activities like extreme sports or substance abuse can raise premiums. Risky lifestyles increase the likelihood of injury or illness, so insurers raise rates to offset potential claims.

By being aware of these factors, you can better navigate the life insurance market and make choices that may help reduce your premiums (Read More: The Complete Guide to Health Insurance).

Whether you’re seeking to lower your current rates or planning for future coverage, understanding these influences allows you to take proactive steps in managing your life insurance costs effectively.

Proven Strategies to Save Money on Life Insurance

To save money on life insurance, start by comparing quotes from multiple providers to find the most competitive rates. Check out our step-by-step guide on how to get life insurance quotes and save big. You can also qualify for life insurance discounts to save on your premiums.

[table “1274” not found /]You can also opt for term life insurance rather than permanent coverage if you need temporary protection, as it is generally more affordable. Use our guide to help you determine how much life insurance you need.

Maintain a healthy lifestyle, avoid smoking, and manage chronic conditions to lower premiums. Bundle life insurance with auto or home insurance for discounts, and select a policy term that fits your needs to avoid over-insuring.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Life Insurance Companies in the U.S.

State Farm, Guardian, and MassMutual are the best life insurance companies. Check out our list of pros and cons below to see why we chose these top providers:

#1 – State Farm: Top Pick Overall

Pros

- Customer-Centered Life Insurance: State Farm prioritizes customer needs, offering life insurance policies that cater to individual preferences. For a complete list, read our State Farm review.

- Strong Customer Support: State Farm’s life insurance customer support is dedicated to helping policyholders with their questions and concerns.

- User-Friendly Policies: State Farm designs its life insurance policies to be easy to understand and accessible for all customers.

Cons

- Premium Costs: The customer-focused approach of State Farm may lead to higher premiums for life insurance policies.

- Limited Online Resources: The emphasis on customer service might result in fewer online resources for managing life insurance policies.

#2 – Guardian: Best for No-Exam Coverage

Pros

- No-Exam Policies: Offers simplified issue policies up to $250,000 without a medical exam, while term life coverage is available up to $3 million to protect beneficiaries.

- Financial Strength: Guardian has an A++ rating from A.M. Best, reflecting long-term stability for policyholders’ families.

- Few Complaints: Guardian receives fewer complaints than other top insurers, which usually means smoother claims handling.

Cons

- Few Digital Tools: Many policies require you to speak with an agent, and you can’t get online quotes.

- Limited Service Hours: Customer service isn’t available 24/7 to handle questions or claims.

#3 – MassMutual: Best for Financial Strength

Pros

- Great Financial Ratings: MassMutual boasts an A++ rating from A.M. Best, so policyholders can trust their coverage is backed by a stable insurer. Learn more in our MassMutual insurance review.

- Policy Options: Offers many term, whole, variable, and universal life insurance options.

- Dividend Potential: Policyholders may earn annual dividends to boost their cash growth.

Cons

- Exam Often Required: Most MassMutual policies require you to undergo a medical exam.

- Limited Online Tools: You can’t get a digital quote for every policy type, so you’ll have to call an agent for one.

#4 – Northwestern Mutual: Best for Paying Dividends

Pros

- Dividend Payments: Northwestern Mutual has a history of paying dividends to policyholders, which helps build long-term cash value for their policies.

- Convertible Policies: Policyholders can convert term policies to permanent life insurance (Learn More: Single Premium Life Insurance).

- Financial Stability: Northwestern Mutual’s A++ rating from A.M. Best shows their trustworthiness and reliability.

Cons

- Lack of Policy Details: There isn’t much information online about Northwestern Mutual’s policy options.

- Can’t Apply Online: You’ll need to speak with a Northwestern Mutual agent to apply for life insurance.

#5 – Nationwide: Best for Bundling Policies

Pros

- Comprehensive Life Insurance Coverage: Nationwide offers extensive life insurance policies covering various needs and scenarios.

- Customizable Policies: Nationwide allows for comprehensive customization of life insurance policies, ensuring that you get the coverage that best fits your unique requirements.

- Inclusive Coverage Options: Nationwide’s life insurance plans include various riders and add-ons, providing comprehensive protection for policyholders.

Cons

- Higher Premiums: The comprehensive life insurance coverage offered by Nationwide may come with higher premiums compared to basic plans.

- Complex Policy Choices: The extensive options for life insurance coverage can be overwhelming for some customers, making it harder to choose the right plan.

#6 – Mutual of Omaha: Best for Seniors

Pros

- Senior-Friendly Policies: Offers simplified issue and guaranteed issue life insurance coverage, making it easier for seniors to get coverage without a medical exam. See our Mutual of Omaha life insurance review for more details.

- Free Living Benefits: An accelerated death benefit is included at no extra cost on all term life and indexed universal life policies.

- Coverage Variety: Mutual of Omaha offers various life insurance products, such as term, whole, and universal life.

Cons

- No Online Quotes: You can’t get a life insurance quote online through Mutual of Omaha’s website.

- Limited Whole Life: Mutual of Omaha’s whole life insurance coverage caps at $25,000.

#7 – Pacific Life: Best for Annuities

Pros

- Annuity Products: Pacific Life is well known for its life insurance annuity products and retirement options.

- Many Coverage Options: Provides term, whole, universal, and indexed universal life insurance.

- Conversion Rider: Pacific Life allows policyholders to convert term life insurance to permanent coverage.

Cons

- Limited Availability: Not all types of life insurance are available nationwide, and New York residents aren’t eligible for life insurance.

- Few Online Tools: Pacific Life provides limited policy information online, and you can’t get a quote on its website.

#8 – Protective: Best for Lowest Premiums

Pros

- Lowest Rates: Protective’s life insurance rates start at just $23 per month, making it the cheapest provider in our ranking.

- Flexible Policy Terms: Term life policies with Protective go up to 40 years, longer than most other competitors.

- Few Complaints: Protective has fewer complaints than average.

Cons

- Not Many Riders: Protective offers fewer riders compared to other insurers.

- Typically Requires Exam: Usually, you’ll need to undergo a medical exam when applying for life insurance coverage.

#9 – John Hancock: Best for Wellness Rewards

Pros

- Wellness Program: John Hancock’s wellness programs lets policyholders earn discounts and gift cards for healthy habits.

- Various Riders: Offers term, universal, indexed universal, and variable universal life insurance.

- High Policy Limits: John Hancock offers high death benefit limits if you need greater coverage.

Cons

- No Whole Life Policies: You can’t get whole life insurance through John Hancock.

- Few Online Resources: John Hancock lacks email or live chat customer support, and doesn’t offer online quotes.

#10 – MetLife: Best for Employer Coverage

Pros

- Group Coverage: MetLife leads in group life insurance, bringing lower rates to eligible employees (Learn More: MetLife Insurance Review).

- Extra Benefits: A MetLife policy includes additional benefits, such as travel assistance and grief counseling.

- No-Exam Coverage: Certain group policies don’t require a medical exam.

Cons

- No Direct Sales: Only those with employer-sponsored coverage qualify for MetLife.

- High Customer Complaints: MetLife has fewer policy types than other top competitors.

Find the Best Life Insurance Provider for You Today

Discover the best life insurance companies, including State Farm, Guardian, and MassMutual, known for their competitive rates and comprehensive coverage.

State Farm excels as the leading life insurance provider, delivering unmatched comprehensive coverage and competitive rates to meet diverse needs.

Michelle Robbins Licensed Insurance Agent

Compare monthly rates, explore the differences between term and permanent life insurance, and learn how factors like health and lifestyle impact your premiums before you buy to find the right company for you (Learn More: Comparing Plans and Getting an Insurance Plan That Works for You).

Protecting your family financially doesn’t have to be expensive. Enter your ZIP code in our free comparison tool to find affordable life insurance.

Frequently Asked Questions

What makes a life insurance company the best?

The best life insurance companies offer a balance of competitive rates, comprehensive coverage, excellent customer service, and strong financial stability. Companies like Nationwide and Progressive are often highlighted for their overall performance in these areas.

Which are the best life insurance companies?

The best life insurance companies include Nationwide, Progressive, Farmers, Erie, and Allstate. These companies are known for their strong financial stability, customer service, and comprehensive coverage options. They consistently rank high in industry evaluations.

Avoid overpaying for life insurance by comparing rates with our free tool. Simply enter your ZIP code below to get started.

What are the best life insurance companies according to rankings?

According to industry rankings, the best life insurance companies include Nationwide, Progressive, and Farmers. These companies consistently receive high marks for their financial stability, customer service, and comprehensive policy options, making them top choices for consumers.

For deep insights, consult our guide titled “Everything You Need to Know About Farmers Insurance.”

Where can I find cheap life insurance companies?

Cheap life insurance companies that still offer quality coverage include Nationwide, Progressive, and Farmers. These companies provide affordable options without compromising on the quality of service and coverage.

Who are the leading life insurance companies?

Leading life insurance companies such as Nationwide, Progressive, and Farmers are recognized for their competitive rates, comprehensive coverage options, and high customer satisfaction. These companies are frequently listed in top industry rankings.

How can I find the best life insurance quotes?

To find the best life insurance quotes, compare rates from multiple insurers. Companies like Nationwide, Progressive, and Farmers offer competitive pricing and comprehensive coverage. Using online comparison tools can help you quickly find the best quotes tailored to your needs.

To expand your knowledge, check out our handbook titled “Everything You Need to Know About Progressive Insurance.”

What is the average price of life insurance?

The average price of life insurance varies based on factors such as age, health, coverage amount, and policy type. Generally, minimum coverage can start as low as $24 per month, while full coverage can range from $63 to $80 per month with companies like Travelers and USAA.

What are the most popular life insurance companies?

The most popular life insurance companies include Nationwide, Progressive, Farmers, Erie, and Allstate. These companies are well-known for their comprehensive coverage, excellent customer service, and competitive pricing.

What are the best life insurance companies for overweight individuals?

The best life insurance companies for overweight individuals often consider overall health and lifestyle factors rather than just weight. Leading companies like Nationwide, Progressive, and Farmers are known for their comprehensive coverage and competitive rates, making them good options for those concerned about weight-related premiums.

For a comprehensive overview, explore our detailed resource titled “How to Finance What Your Health Insurance Won’t Cover.”

Who is life insurance best suited for?

Life insurance is best suited for individuals who have dependents, financial obligations like mortgages, or anyone who wants to ensure their loved ones are financially protected in the event of their passing. It is particularly important for primary breadwinners and parents.

See how much you can save on whole life insurance by entering your ZIP code below into our free comparison tool.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.