Walk-In Tubs: Everything You Need to Know, From the Pros

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding co...

Meggan McCain

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Michael Vereecke

Updated January 2026

- Walk-in tubs help seniors and mobility-limited users bathe safely

- Costs vary widely by model, features, size, and installation

- Most insurance won’t cover upgrades unless medically necessary

So to make the decision to upgrade your bath to include a walk-in tub a little easier, we talked to leading experts in interior design and home improvement and asked them for their tips. Check out their advice below.

What is a Walk-In Tub?

A walk-in tub is a specialized bathtub that helps people safely and comfortably bathe without stepping over a high edge like a traditional tub. They feature a watertight door that opens inward or outward with minimal effort, allowing users to walk directly into the tub.

Walk-in tubs are especially popular with seniors, people with mobility challenges, or anyone recovering from an injury.

Typically, walk-in tubs come with seating, anti-slip flooring, and handrails.

Many models also include advanced features like hydrotherapy jets, fast draining, and heated backrests.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Walk-In Tub Cost & What to Consider

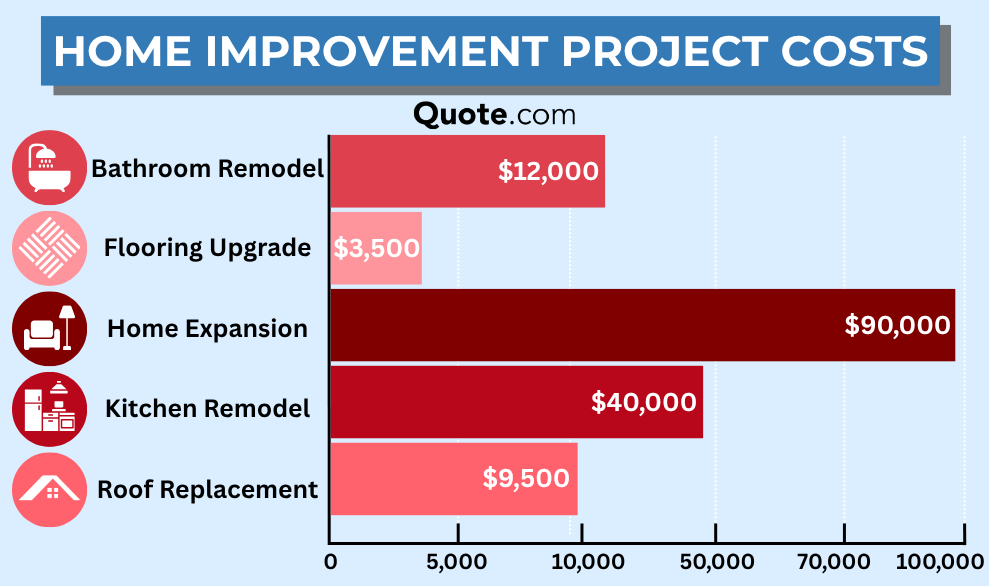

The cost of a walk-in tub varies by model, size, and features. On average, basic models start at around $2,000 to $5,000.

On the other hand, premium hydrotherapy models can cost $10,000 to $20,000, including installation.

Before purchasing, consider the following:

- Requirements: Some tubs may need extra plumbing or electrical work before installation.

- Bathroom Space: Measure your bathroom to ensure the tub fits comfortably without cramping it.

- Warranty/Service: Look for a trusted manufacturer with a solid warranty and good customer support.

- User Needs: Consider the user and what features matter most, like easy access, comfortable seating, or relaxing jets.

Consider these factors before installation to save time, money, and future maintenance headaches. While the initial cost may be high, a walk-in tub offers long-term value and better safety for homeowners.

Benefits of Getting a Walk-In Tub

Walk-in tubs offer many safety and health benefits to help homeowners increase comfort and independence. With low step-in entries and built-in grab bars, these tubs reduce the risk of slips and falls, one of the most common bathroom hazards.

Many models include hydrotherapy and air jets designed to ease muscle tension, soothe arthritis pain, and improve joint comfort.

Accessibility features make it easier for individuals with limited mobility or disabilities to bathe safely without assistance.

Select models also offer luxury upgrades such as chromotherapy lighting, aromatherapy systems, and quick-fill technology for a spa-like experience.

Home Safety & Care for Aging Parents

As your parents get older, creating a safe and accessible home becomes essential to help them stay independent and prevent accidents. Bathrooms are one of the most common places for slips and falls, so thoughtful design and accessibility upgrades are important.

Installing a walk-in tub along with safety features like grab bars, non-slip flooring, and a hand-held showerhead can greatly reduce fall risks and help your aging parents maintain independence.

Consider widening doorways, brightening dim areas, and reducing floor thresholds to make movement safer for your loved ones as they age.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does Home Insurance Cover Walk-In Tubs?

Generally, home insurance coverage doesn’t include the cost of purchasing or installing a walk-in tub since it’s considered a home upgrade rather than a repair for covered damage.

However, there are certain situations where insurance may help:

- Covered Damage: Home insurance can cover the cost to replace a walk-in tub damaged by a covered peril, such as a burst pipe or house fire.

- Total Loss: Your dwelling coverage typically includes walk-in tub replacement if the home is destroyed by a covered event.

- Medical Necessity: If a doctor prescribes a walk-in tub as medically necessary, certain insurers or programs cover part of the expense.

Homeowners insurance typically won’t cover the cost of walk-in tubs for comfort or senior accessibility upgrades unless they’re needed to repair damage from a covered loss. It also excludes wear and tear, faulty installation, or gradual leaks.

Be sure to review your policy exclusions carefully and keep documentation if the tub is related to a medical necessity.

Coverage options can vary widely between insurers. Compare home insurance rates now to make sure your policy includes what matters most before renewing.

What Experts Say About Walk-In Tubs

Tell us what you’re looking for,

and we’ll sort the expert tips for you!

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.