How much homeowners insurance do you need in 2026? (Expert Explanation)

The value of your home determines how much homeowners insurance you need. Always follow the 80% rule in home insurance and buy coverage for at least 80% of your home's value. Most homeowners buy more, so create a home inventory to assess the value of your property and compare home insurance quotes online.

Read more Secured with SHA-256 Encryption

Save Money by Comparing Insurance Quotes

Compare Free Home Insurance Quotes Instantly

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated January 2026

How much homeowners insurance do you need? Before you start calculating, it’s important to know the 80% rule in homeowners insurance — you must insure your home for at least 80% of its replacement value.

For example, if your home is valued at $200,000, buy at least $160,000 in coverage to avoid penalties. You can choose to carry more homeowners insurance coverage and add endorsements if you live in a high-risk area. Keep reading for a step-by-step guide to estimating your home insurance needs.

Scroll through detailed steps like assessing your home’s value, creating a home inventory, and comparing local building costs, before comparing home insurance quotes online.

- Home insurance covers the structure of your home and your personal belongings

- You must buy home insurance that covers at least 80% of your home’s value

- The size and location of your home impact its value and premium rates

Estimating-Homeowners-Insurance

Your insurance company can charge a penalty if you insure less than 80% of the home’s value. However, you’ll likely want to insure your property for more than that, especially considering any personal items you own or other structures on the property.

How much is homeowners insurance on a $400,000 house? Compare home insurance quotes online to get an idea of how much different levels of coverage cost near you.

Homeowners Insurance Monthly Rates by Provider & Coverage Amount| Insurance Company | $150,000 Policy | $200,000 Policy | $300,000 Policy | $500,000 Policy | $750,000 Policy | $1 Million Policy |

|---|---|---|---|---|---|---|

| $112 | $132 | $176 | $140 | $185 | $220 | |

| $127 | $150 | $200 | $165 | $205 | $250 | |

| $117 | $138 | $184 | $150 | $190 | $230 |

| $114 | $135 | $180 | $145 | $185 | $225 |

| $107 | $126 | $168 | $135 | $175 | $210 | |

| $122 | $144 | $192 | $160 | $200 | $240 |

| $120 | $141 | $188 | $155 | $195 | $235 |

| $117 | $138 | $184 | $145 | $190 | $230 | |

| $117 | $138 | $184 | $150 | $190 | $230 | |

| $122 | $144 | $192 | $160 | $200 | $240 |

| $188 | $221 | $294 | $250 | $310 | $370 |

How much is homeowners insurance on a $150,000 house? Insurance for a home valued at $150,000 will cost between $100-$200/month.

How do I know if I have too much homeowners insurance? The five steps below break down how to estimate how much home insurance you need to get your budget right.

Understand Replacement Value vs. Actual Cash Value

Home insurance settlements offer replacement or actual cash value (ACV). Some policies automatically default to one or the other; other times you can choose the value you want.

If you choose a replacement policy, your property is protected against depreciation. The insurance company will pay to repair or place your property with the same quality items. On the other hand, an ACV policy only pays out what the item is worth at the time.

Assess Your Home’s Value

Insurance companies use their own metrics to evaluate home value. The most common things to consider are the size and location of your home. The age of the roof is also a factor.

Do you live in a flood basin? Or in an area with high crime rates? You may want to increase your coverage limits or add endorsements to cover these risks.

Also consider how you use your home and the type of property you own, such as swing sets or trampolines. Guests could be injured on your property, and you’ll need ample liability and medical payment coverage to pay for any associated costs.

Create a Home Inventory

Creating a home inventory is very helpful if you ever need to file a homeowners insurance claim, especially with replacement coverage. Keep receipts, appraisals, and any information regarding the date and place of purchase. Photos or video footage can be used to confirm ownership and value.

Standard home insurance sets limits on coverage. So if you own high-value assets or collectibles, you may want more comprehensive coverage.

Compare Local Building Costs and Rental Rates

Local housing trends, ordinances, and rent prices all impact how much it costs to repair or replace your home. For example, suppose the price of homes and apartments went up in your area. In this case, you might want to increase your coverage limits to match the new value of your home.

Supply-chain issues could increase the cost and time of repairs, so research building and labor trends in your city and consider a policy that includes loss-of-use coverage. Learn how to estimate home insurance costs based on where you live.

Consider Adding Endorsements

Get endorsements on your policy to provide additional protection against common homeowners insurance exclusions:

- Termite damage

- Flood damage

- Earthquake damage

- Mold and fungus damage

- Identity theft

- Home business coverage

Different companies offer different types of endorsements, so shop around with multiple providers until you find the coverage you need.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Homeowners Insurance Plans

Compare the eight types of homeowners insurance policies for homeowners, condo owners, and renters to get the best protection:

Types of Homeowners Insurance Policies and What They Cover| Type | Name | Coverage |

|---|---|---|

| HO-1 | Basic Form | Only covers 10 named perils, including fire, theft, and falling objects. |

| HO-2 | Broad Form | Covers HO-1 perils plus certain water damages and electric surges |

| HO-3 | Special Form | Open coverage for all perils except listed exclusions |

| HO-4 | Contents Broad Form | Renters insurance for personal belongings, liability, and loss of use |

| HO-5 | Comprehensive Form | Same open coverage as HO-3 at replacement value |

| HO-6 | Unit-Owners Form | Condo insurance for personal belongings, liability, and loss of use |

| HO-7 | Mobile Home Form | Mobile home policy with same open coverage as HO-3 |

| HO-8 | Modified Coverage Form | Historic home coverage for dwellings more than 40 years old |

Most insurance companies won’t sell HO-1 policies since they don’t often meet mortgage lenders’ requirements. HO-3 and HO-5 are the most popular homeowners policies.

Factors That Impact Home Repair Costs

How much personal property coverage do I need? The cost of repairing or rebuilding your home will ultimately determine how much homeowners insurance you need. The most common factors that impact repair costs are:

- Type of Construction: Brick homes and custom-built homes cost more to repair.

- Style of the Home: The number of rooms and bathrooms can increase repair costs.

- Special Features: Items like fireplaces, arched windows, and crown moldings will be more expensive to repair.

- Renovations and Upgrades: Your repair costs could go up if you added or upgraded any rooms in the house.

- Roof Materials: Wood materials and slate roofs are more costly to repair than asphalt shingles or metal roofs.

Consider any additional structures on your property, including sheds and garages, and factor in their materials and repair costs as well. This way you know you have enough coverage.

Don’t wait for a storm to hit before taking action. Prepare your home and loved ones with these simple safety steps. https://t.co/ZOq5Nml31h pic.twitter.com/BQCPZw6cSN

— State Farm (@StateFarm) July 5, 2024

Every home insurance company weighs these factors differently when setting rates. Compare rates from multiple companies to find the right fit for your budget.

The Ultimate Home-Insurance Checklist

How much homeowners insurance do I need? Reddit recommends getting enough to rebuild your home if it’s declared a total loss.

You may want more or less coverage depending on where you live and the type of home you own. Let’s recap the steps to accurately estimate your home insurance costs:

- Step One: Pick replacement value or ACV.

- Step Two: Assess your home value.

- Step Three: Create a home inventory.

- Step Four: Compare local repair and rental costs.

- Step Five: Add endorsements if needed.

Home insurance coverage protects the structure of your home and your personal belongings, so consider the total cost of all building materials and personal items on the property when picking policy limits.

You may want to increase your limits or buy policy endorsements if you live in a high-risk area.

Daniel Walker Licensed Auto Insurance Agent

Homes at risk for natural disasters can benefit from earthquake or flood endorsements, but there are many types of add-ons available from different companies. Enter your ZIP code to start comparing homeowners insurance policies near you.

Frequently Asked Questions

What is the appropriate amount of insurance that you should have on your house?

A policy protecting at least one-third of your property value is appropriate. Most insurance companies charge a penalty if you insure less than 80% of the value, and your mortgage lender or homeowners association may also require a set policy amount.

What is the 80% rule in homeowners insurance?

The 80% rule in homeowners insurance requires you to insure your home for at least 80% of its replacement value. So if your home is valued at $200,000, you must buy at least $160,000 in coverage.

What is the most common home insurance coverage?

HO-3 policies are the most popular type of homeowners insurance. HO-3 forms cover a wide range of perils and offer more flexible coverage with endorsements. Compare all eight types of home insurance to learn more.

How much homeowners insurance do I need for a mortgage?

Most mortgage lenders require you to get a policy that covers at least 80% of your home’s replacement value.

Do I need homeowners insurance if my house is paid for?

Even if your home loan is paid off, don’t short yourself on coverage. You should carry at least enough homeowners insurance to cover repairs and injuries if someone is hurt on your property.

How much does the average person spend on home insurance?

Home insurance rates are around $160/month for up to $500,000 in policy coverage. Estimate home insurance costs based on where you live to get the most accurate quotes.

How do I calculate how much homeowners insurance I need?

What is considered high-value home insurance?

HO-5 policies are high-value homeowners insurance for homes worth more than $1 million.

Should I insure my home to its full value?

A top question readers ask is, “Show you insure your home to its full value?” You need to insure at least 80% of your home’s value but consider the value of your personal belongings and other property you own. Creating a home inventory and assessing your budget will help you decide if you need to insure your home to its full value.

How many quotes should you get for homeowners insurance?

We recommend comparing home insurance quotes from at least three companies to get an idea of how much coverage costs in your area.

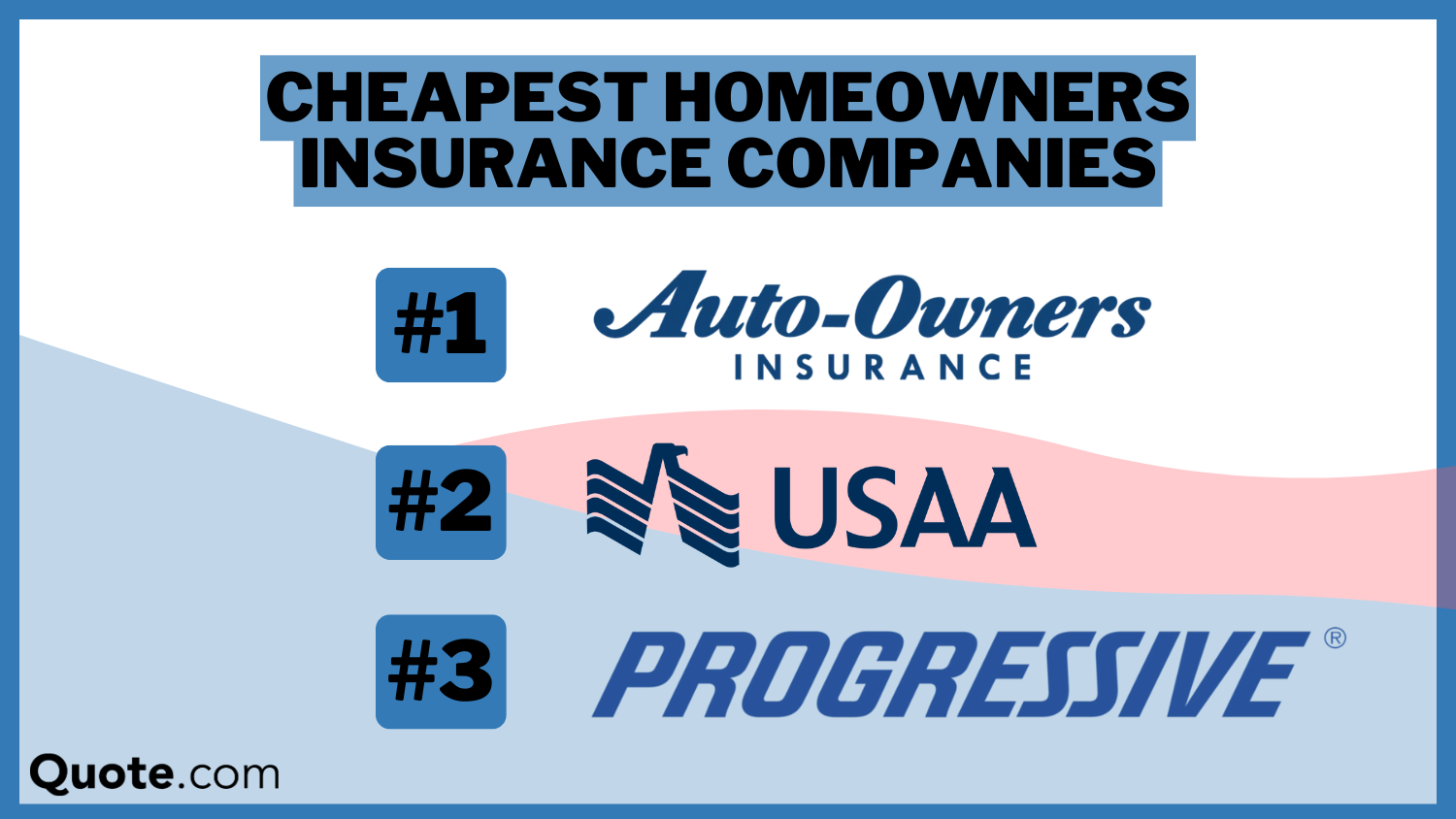

What company has the best homeowners insurance?

What state has the most expensive home insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.