Comprehensive Guide: How to Estimate Home Insurance Costs Based on Where You Live

Secured with SHA-256 Encryption

Save Money by Comparing Insurance Quotes

Compare Free Home Insurance Quotes Instantly

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding co...

Meggan McCain

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Michael Vereecke

Updated October 2024

Buying a new home can be an exciting time.

You’ve got a bucket list filled with fun things to consider, like your upgrades, fixtures, cabinets, colors.

And then you’ve got a list of the not-so-fun things.

Things like your home inspection, downpayment, finding the best mortgage, and how to get rid of that nosy neighbor across the street.

However, in the middle of all this excitement, sometimes we forget all about one other seemingly innocent detail—one that can sometimes turn out to be not so innocent: your homeowners insurance.

It seems like a small detail, but homeowners insurance can actually be a pretty big deal if you live in a location where homes cost more to insure.

Did you know that the top three most expensive states in the nation for homeowners insurance are Florida, Louisiana, and Oklahoma?

And according to the Federal Reserve Bureau, the average cost of an annual premium for homeowners insurance is between $300 and $1,000.

That’s simply the cost of homeownership.

But why the wide variation?

Why are some homes more costly to insure than others?

Why is homeowners insurance such a key factor?

I’ll cover all these questions, and more, in this article.

The bottom line is that no matter where you are, if you’re looking to buy a home, it’s important that you factor homeowners insurance into your budget.

Even if you’re getting a great deal on the home, the homeowners insurance may be enough to push you above your budget, and make the home less appealing.

Especially if it’s prone to disaster and the area puts your safety and security at risk.

In this article, I’ll walk you through what homeowners insurance is all about, and how to find out how much you’ll likely pay based on where you live.

The Basics

What is homeowners insurance?

You’ve heard of car insurance, health insurance, but what exactly is homeowners insurance?

Homeowners insurance is a type of insurance policy that protects your house if something unexpected happens.

For example, if your house gets flooded, is burglarized, or a natural disaster, like a hurricane, strikes it, your homeowners’ policy would kick in.

Homeowners insurance is essential because life is full of surprise—some are pleasant, some aren’t.

And you definitely don’t want to be caught without a lifeboat to help you get through the unpleasant ones.

Especially when it concerns your family’s home.

I remember when Hurricane Irma was forecasted to hit close to where we live.

Our home, of course, had homeowners insurance, but beyond that, there was a lot of prepping we did before the storm.

We had to anticipate the worst.

Evacuation was a possibility, so we knew it could get really bad, and there was a possibility we might not come back to find our home still intact.

So we prepared.

We bought plywood, groceries and personal supplies.

All in all, we dropped about $1,000 to protect our home and make sure we were well stocked with food, supplies, and gas.

That’s $1,000 we had to dish out, even after paying for homeowners insurance.

But having that insurance gave us peace of mind.

Because this policy allows your insurance company to pay for your home to be rebuilt or repaired in the event your home is ever damaged.

In fact, if you’re going through a lender to pay for your home, most of them will require you to have homeowners insurance.

They won’t even approve your loan without it.

That’s because the home still technically belongs to the bank until you pay it off.

It’s the bank’s collateral, so the bank rightfully wants it protected in case something happens.

With insurance, they can ensure you still have a place to live, and that you can continue making good on your loan payments to them.

Insurance companies take on the responsibility of paying for your home to be rebuilt or repaired if something untoward happens to it.

This lets banks rest easy knowing that their investment in your home is protected.

But even if you already paid your home off in full, homeowners insurance remains a must-have because anything can happen.

And like the bank, you’d want to protect your home to the fullest, in case it was ever damaged or demolished.

After all, it’s likely your largest asset.

If you’re renting, there’s something called renters insurance that’s an absolute must-have.

The bottom line is, make sure you and your home are protected.

Insurance is key.

But why is it more costly in some places than it is in others?

That’s the question of the day, and the one we’ll tackle next.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cost Factors

Why do some homes cost more to insure than others, and what factors influence how much you pay?

Going back to our earlier point, your home’s insurance cost could vary based on several factors.

Here are the most common ones that you can expect to affect how much you pay.

Exposure to natural disasters. Insurance companies take into account where your home is located.

Is it in an area that’s prone to natural disasters like floods, hurricanes, tornadoes, and earthquakes?

Some areas and states have a greater propensity for natural disasters.

Say for example you’re looking to buy a small home in California, but your home happens to fall on a fault line.

Even though you may get a great deal on the home, you might find that your homeowners insurance premiums are through the roof.

If you live in Florida, you’re more likely to encounter a hurricane than someone who lives in say Pennsylvania.

So your insurance will be more expensive because the likelihood of disaster striking is greater.

Keep in mind that most homeowners’ policies don’t offer coverage for things like earthquakes andfloods in their basic package.

These are additional protections you’ll need to add into your insurance.

If you’re going through a lender, that lender will likely require those additions to your policy before they approve your loan.

This is good because it means you’re protected, and so are they.

Crime rates. The level of crime in your area also influences your insurance rates.

For example, New Mexico is reputed to have dangerously high crime rates.

This means you’ll pay higher insurance if you live there than if you live in a low-crime state.

Exposure to environmental threats. Your home’s location, and exposure to hazards like storm damage and wildfires, can impact your rate.

For example, if you live near a forest that’s known for wildfires, your home would cost more to cover.

Because the probability of you claiming insurance is significantly higher.

As you may have noticed by now, there’s a general rule with insurance premiums.

The more likely a disaster or unforeseen circumstance is expected to happen, the more likely you are to have a higher premium.

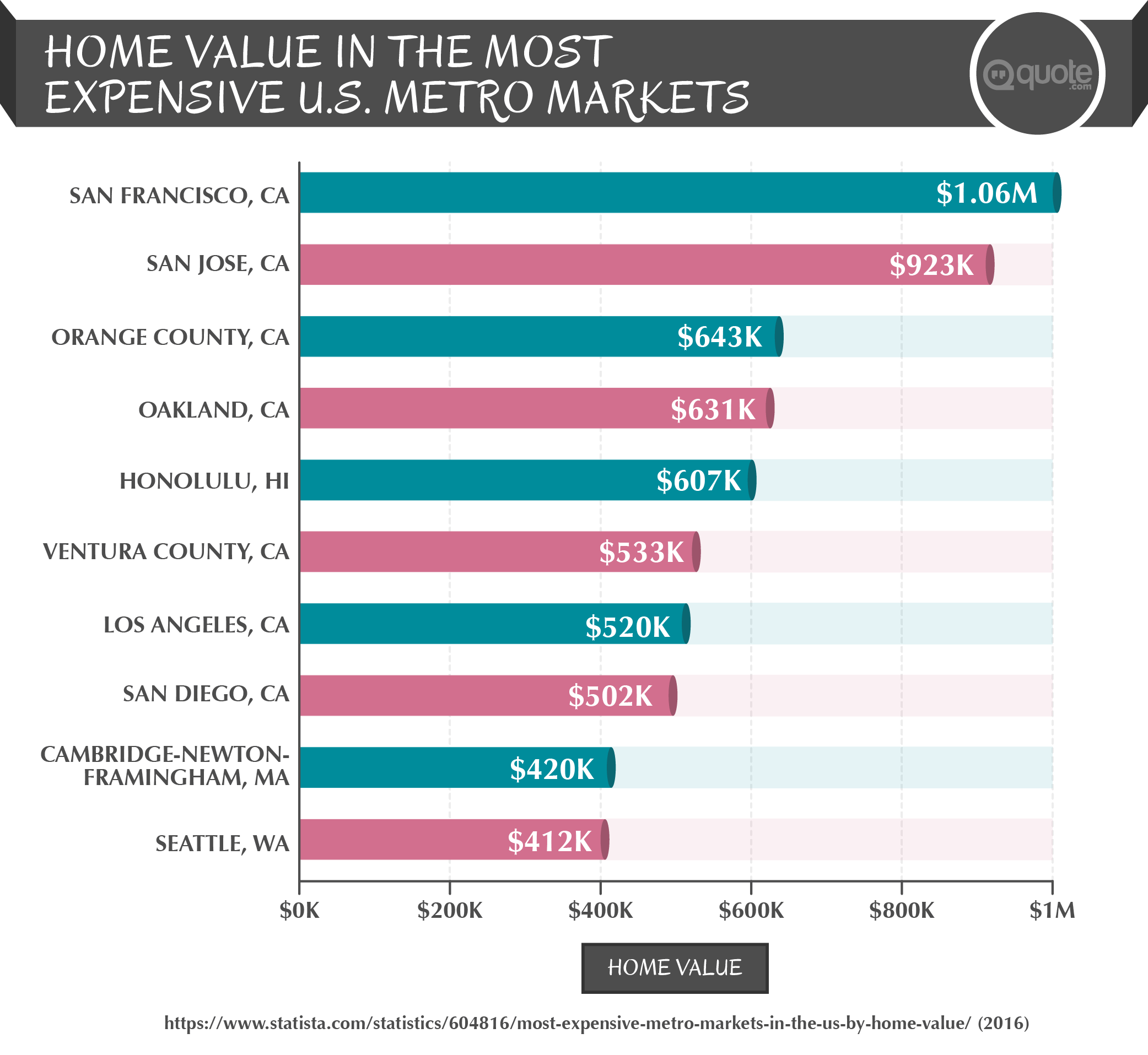

Home value. Your home’s value and what it would cost to rebuild also play a big role in how much you pay for insurance.

The more expensive your home, the more you’ll end up paying for insurance.

Home’s age. The age of your home is another factor that’s considered.

The older your home, the more likely that something may or could go wrong with it, regardless of location.

For example, your home’s structure may have weakened over time, increasing the chances of sudden damages and repairs.

Your history. With any type of insurance, the insurance company will always be interested in knowing about you before they offer you a rate.

This means they’ll review your claims history to find out how often you’ve filed claims in the past to predict how many times you’ll file in the future.

If you’re the type of person who files a claim for every little damage and leak, that’s a good indicator that you’ll be costly to the insurance company.

So they’ll make you pay more for your insurance premium.

Another factor is your insurance score.

Put simply, your insurance score shows the likelihood of you filing a future claim.

It’s based off your previous history and your credit score.

But what does your credit score have anything to do with your insurance rate?

Statistically, it’s proven that the lower your credit score, the more likely you are to file an insurance claim.

That’s why insurance companies consider your credit score when they’re determining a rate, and underwriting your policy.

In the end, your insurance score plays a huge role in how much you’re ultimately charged for insurance.

To get the most favorable rates, limit the number of claims you file, and work to improve your credit before you enter into homeownership.

What does standard homeowners insurance typically cover?

Just because you have home insurance doesn’t mean that you can already breathe easy.

You still need to understand what all your home insurance policy covers, and whether that coverage is enough for you.

The typical policy has basic coverage.

This means it covers your home, its structure, plumbing, electrical wiring, central air, and heat systems.

It also covers any structures on your property, such as sheds and fences.

Things inside your home, like your electronics, appliances, and clothes are generally covered as well.

Most policies also include loss of use.

Loss of use means that in the event something happens to your home and you’re not able to live there, you’re covered.

The insurance company will shoulder the cost of your accommodation (most likely in a hotel) while your home is being rebuilt or repaired.

Additionally, policies typically have personal liability coverage.

Meaning if someone gets hurt on your property, and decides to sue you, your insurance can cover the costs associated with that.

They also typically cover medical payments (up to a certain limit) for people who suffer an injury on your property.

When you get coverage, it’s always a good idea to make sure you can cover 100% of the cost of rebuilding your home.

This way you’re safe in the unfortunate event it gets completely destroyed.

Estimating Insurance

How can you estimate your home insurance costs and get the right policy?

When you’re getting ready to purchase a home, estimating your homeowners’ policy is a wise first step.

And the great news is, it’s not all that difficult to do.

To find out how much coverage you’ll need, answer these questions first.

Replacement cost. First and foremost, what would it cost to rebuild your home today? This is particularly important if you’re buying a used home.

Remember, the cost of building becomes more expensive over time.

This is because materials tend to become more expensive every year.

The best way to determine your replacement cost is to have your insurance agent calculate the replacement cost of your home.

Another alternative would be to contact local home builders to find out the building cost per square foot of your area.

Then multiply by your home’s square footage.

Personal valuables. Next, think about what valuables you’ll have in your home.

Your grandmother’s prized antique ring?

Your state-of-the-art sound system for your home theatre?

Tally up how much those valuables would cost to replace.

Liability. Then, think about if someone were to get hurt on your property.

How much coverage do you want for that kind of liability to cover their medical costs or potential lawsuits against you?

Are there certain aspects of your home that would make it more prone to accidents?

A steep porch? A tricky step?

If so, you might want to go for higher liability coverage to account for potential incidentals.

Keep in mind that sometimes lawsuits are enough to wipe you clean of your home, car, or other assets, so don’t take personal liability coverage lightly.

Once you’re through crunching these numbers, the hard part is over.

Now all you have to do is plug these figures into any online homeowners insurance calculator.

The only thing you have to make sure of is that the calculator factors in your location by zip code.

That way you can get an accurate estimate for your particular area.

Once you have a number, factor it into your home buying budget.

Perhaps your insurance is much higher than you anticipated.

Or maybe you didn’t realize you were smack dab on top of a fault line and your insurance rates have pushed the home out of your budget.

Whatever the case, factoring in this rate can make or break a deal, or prompt you to negotiate a better deal on the home.

Just make sure whatever number you end up with is manageable for you.

Policies

What are the different kinds of home insurance policies?

The final thing you should know is that homeowners insurance isn’t a one-size-fits-all kind of deal.

There are different types of homeowners insurance for different needs.

The policies are labeled differently and range from HO-1 through HO-8.

I won’t go through all the different kinds of insurance, because the one that’s right for most people is HO-3.

The HO-3 policy is a special form policy that is pretty comprehensive and covers a wide range of perils such as fire, wind, and theft.

It insures your home and any attached structures, including your belongings.

And it also has personal liability coverage.

Your insurance premiums are typically paid monthly, along with your monthly mortgage payment.

Whatever kind of insurance you go with, it’s important to remember that just because you’re signed up and approved, doesn’t mean your work is over just yet.

Because of different factors that could change throughout the life of your home, it’s always a good idea to review your insurance policy every year.

Make sure to look it over with your insurance agency to make sure you have enough coverage.

For example, the crime rate in your area might change, or your home may become older and become more prone to damage and repairs.

You want to make sure you account for all of these factors as time goes by to make sure you’re always fully covered against unforeseen circumstances.

Get Your Estimate

Figuring out how much you’ll pay for your homeowners insurance is a simple thing with these easy steps

While home buying can be an exciting time, it’s important to keep sight of all the factors that will affect your budget and your home-buying decision.

One of these is your homeowners insurance.

Consider your location, and remember that it can have a huge impact on how much you pay for insurance premiums.

To get an accurate estimate for how much you’ll pay, find out how much it would cost to replace your home, cover liability costs.

Also, consider how much your valuables are worth so you can make sure they’re properly insured.

Once you have an idea of these basic numbers, you can find an online home insurance calculator.

It’ll let you plug in these figures and offers you an estimate based on your area.

A good calculator will let you enter in your zip code or location, and it will spit out an accurate estimate based on those factors.

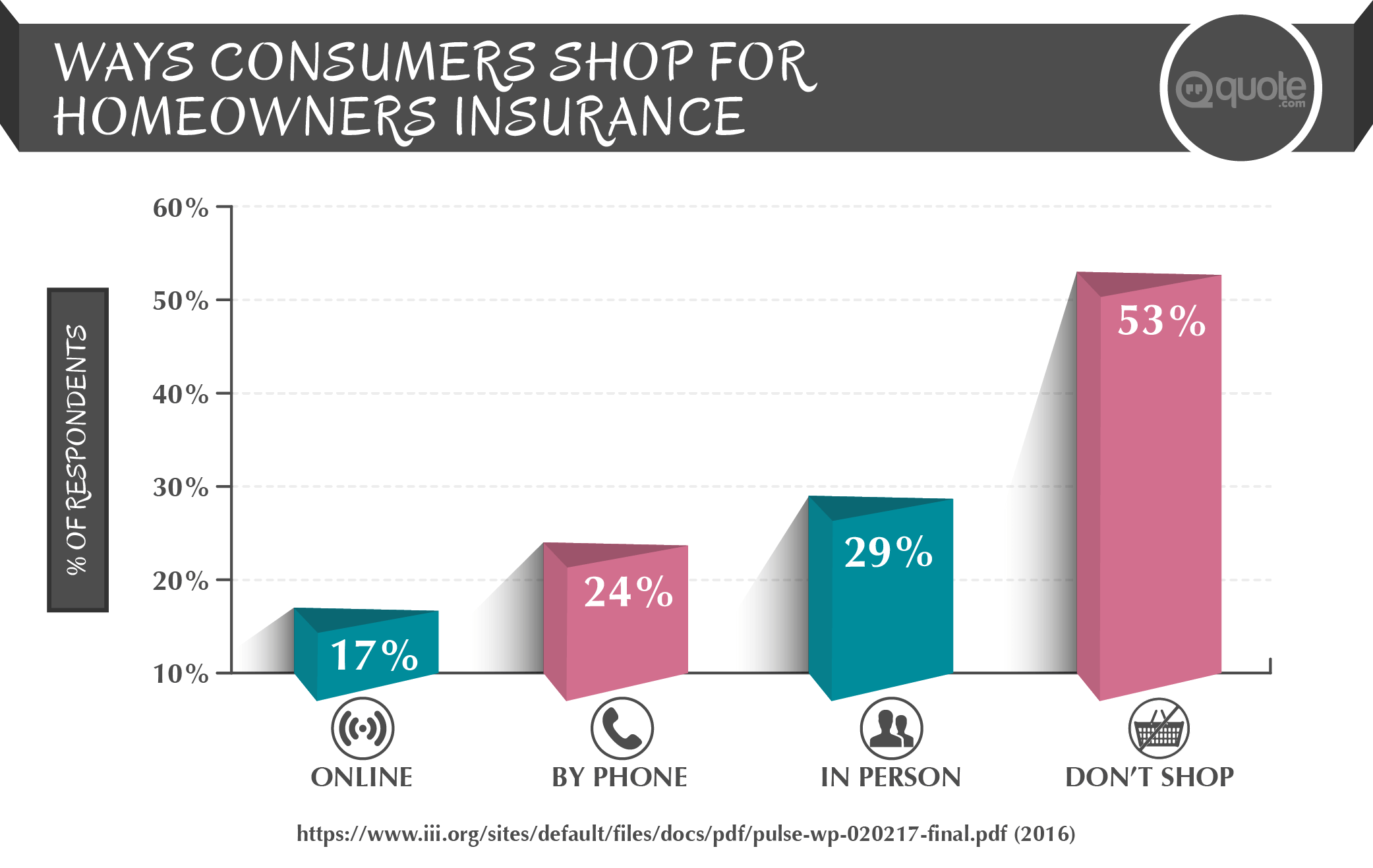

Of course, if you’re paying more than you’d like for coverage that doesn’t meet your needs, you can always find a better deal by shopping around the homeowners insurance market.

It never hurts to look at your options, and you might be surprised by how much money you could save.

That’s where our free homeowners insurance quote tool might come in handy. So go ahead and check it out.

What’s the most confusing thing about homeowners insurance to you?

Feel free to let us know.

We’d love to hear from you in the comments below!

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.