An In-Depth Review of ObamaCare

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding co...

Meggan McCain

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Michael Vereecke

Updated December 2023

Does Obamacare and health care reform still confuse you?

Obamacare was supposed to tackle the high cost of healthcare and shrink the number of uninsured Americans. Its goal was shifting some of the country’s medical debt to the big insurance companies.

But since the Affordable Care Act is over 1,000 pages long, we don’t blame you if you haven’t read it cover to cover. However, you still need to know what’s going on so you don’t find yourself charged a hefty tax penalty come tax season.

Even though President Donald Trump hopes to repeal Obamacare, today we’re going to break down everything about the Affordable Care Act as it still stands.

We’ll cut through the confusion and give you the intel you need to know to protect yourself and your family.

Let’s start with why Obamacare was created and what it actually does for Americans.

What is Obamacare?

Democrat President Barack Obama may be the namesake of the Affordable Care Act, but the first universal health care policies were actually started under a Republican.

Roots of the Affordable Care Act

Health care reform pushed through Massachusetts in 2006 when Mitt Romney, the Republican Governor, signed a three-point bill into effect with the following guidelines:

- Insurance companies could not discriminate against people with pre-existing medical conditions

- Citizens had to purchase a health insurance plan or face a tax penalty

- Lower-income citizens would have help from the government to pay for their medical coverage

Insured Massachusetts residents went from 90% to 98% and the state boasted the highest citizen-insured rate in the country.

I’m proud of what we’ve done. If Massachusetts succeeds in implementing it, then that will be the model for the nation.

And boy was he right.

During the 2008 presidential race, both Hillary Clinton and Barack Obama proposed health plans to cover the millions of Americans estimated to be without medical insurance.

After winning the election, President Barack Obama signed the federal statute—The Patient Protection and Affordable Care Act of 2010—and it was phased into law slowly over the next five years.

That long name is usually shortened to the Affordable Care Act (ACA) and more generally known as Obamacare.

Who’s Supposed to Benefit from Obamacare?

There were two main goals of Obamacare:

First, to increase the number of insured Americans by making health care premiums more affordable. And second, to improve the healthcare industry so it provides better healthcare coverage for all Americans.

Using those goals and ideals, everyone benefits in some way from the ACA.

How and Where Do You Use Obamacare?

Obamacare does not create or offer insurance plans; it regulates the insurance industry.

You’ll fill out an application for Obamacare at HealthCare.gov.

When you’re approved, you’ll be taken to the Healthcare Marketplace, an online portal where you’ll be able to compare insurance plans meeting the needs specified on your application.

Certain states operate their own marketplace, called exchanges, but most rely on the one created by the federal government.

Here you’ll browse through Bronze, Silver, Gold, and Platinum health insurance plans from different insurance companies.

Each category tier offers plans with different coverage, deductibles, out-of-pocket expenses, and more so you’ll need to compare your options.

After you select one and make your first premium payment, you will be an insured American.

This means you’ll be able to visit doctors in your network for no-cost preventive care, help pay for your prescriptions, and have coverage for serious medical expenses like hospital emergencies.

While one downside of having health insurance is needing to pay your premium every month even if you don’t use any medical services, the upside is having your insurance company pay for a majority (if not all) of your medical expenses when you do need them.

Let’s go over the pros and cons of Obamacare as a whole now.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Pros and Cons of Obamacare for the General Population?

Does Obamacare do more harm than good? Let’s go over the ups and downs of the Affordable Care Act now.

PRO: More Americans Have Access to Health Insurance Coverage than Ever Before

30–45 million Americans were estimated to be without health insurance coverage before Obamacare.

But the number of uninsured Americans dropped from 16% in 2010, to 8.9% during January–June of 2016 (Centers for Disease Control and Prevention (CDC) report) after its passing.

An estimated 20 million adults between the ages of 18–64 have received coverage thanks to Obamacare.

PRO: More Insured Americans Lowers the Budget Deficit

When more Americans have health insurance coverage, the government spends less on healthcare costs associated with covering uninsured patients.

Insurance companies will now be on the hook for medical expenses instead of the government so the spending budget for healthcare should decrease.

Plus, the ACA also raised taxes for certain businesses and the top 2% of income earners to help offset some of the costs.

CON: Higher Taxes for High-Earning Americans

To help cover the expense of insuring Americans earning the least, you may have seen an income tax hike if you’re one of the million Americans earning over $200,000 a year.

And if you filed your taxes jointly as a couple, you’ll likely see an increase if you earned over the combined $250,000 threshold.

Check out all the Obamacare-related taxes here if you happen to be part of the 2%.

PRO: You Can’t Be Denied Coverage for Pre-Existing Medical Conditions

Insurance companies used to be able to deny coverage to individuals based on their pre-existing medical conditions. Certain high-risk patients—such as cancer, HIV, and diabetes patients—incur high medical bills insurance companies would rather not pay.

If you struggled with a pre-existing medical condition, it was nearly impossible to find affordable medical coverage.

Now, insurance companies are not allowed to turn you away due to your pre-existing medical condition. Furthermore, they cannot drop you as a policyholder or raise your premiums if you get sick. They also cannot deny treatment for your condition.

PRO: Insurance Premiums Get Fair Treatment with Gender and Age

Insurance companies are now required to offer the same monthly premium rate to applicants of the same age living in the same approximate location.

That means you cannot be charged a higher rate for the same plan based on your gender.

Also part of the ACA, the premiums for older applicants cannot be more than 3x higher than premiums offered to the youngest applicants.

PRO: Government Credits Will Help You Pay for Health Insurance Coverage

If your adjusted gross income falls between 100% and 400% of the Federal Poverty Level (FPL), you’ll qualify for premium tax credits from the government to help you pay your monthly premiums.

That means if you earn between $12,060 and $48,240 a year as an individual, you’ll receive premium tax credits. How much you receive will depend on your adjusted gross income.

Let’s say you earn $25,000/year and qualify for a monthly tax credit of $250.

You’ll be able to use all of this credit to help pay your premium or you may only use a portion of it.

If you select a health insurance plan with a $275 premium, you will only have to pay $25 every month for insurance coverage after your government credit is applied ($250).

It’s expected that nearly 70% of Americans who purchase their health plans via Obamacare will pay less than $75/month for coverage by 2017.

Be warned that you’re not eligible for these tax credits if you enroll in health insurance coverage offered by your employer or seek private health insurance outside of the HealthCare.gov Marketplace or your state exchange.

CON: Certain People Won’t Be Eligible for Premium Tax Credits

Americans earning over 400% of the FPL (or have an annual adjusted gross income over $48,240 as an individual) will not be offered government subsidies to help lower their premium costs.

Those who just barely cross this threshold will face a hard decision as they don’t qualify for help, but their monthly premiums may still be too expensive to afford. They may even choose to pay the penalty as it will be cheaper than paying for a year of coverage.

This doesn’t do anything to solve the uninsured crisis or help citizens reduce their medical expenses.

PRO: You’ll Always Be Covered for these 10 Essential Health Benefits

Before the ACA was passed, routine visits and screenings used to cost policyholders money in the form of co-payments, deductibles, or co-insurance.

Thanks to Obamacare, all insurance plans must cover the expenses associated with these 10 essential health benefits:

-

Preventive Care

To cover all wellness visits, chronic disease management, and everything on this list of preventive care benefits for adults

-

Maternity and Newborn Care

To cover your pregnancy before and after the birth of your child

-

Treatment for Mental/Behavioral Health and Substance Abuse

Such as counseling, psychotherapy, and substance abuse programs

-

Rehabilitative and Habilitative Services and Equipment for People Dealing With Injuries, Disabilities, or Chronic Diseases

To help policyholders recover from or manage their injuries and disabilities

-

Lab tests and medical screenings

Like if a doctor orders tests to diagnose an illness

-

Pediatric Care

Including dental and vision coverage and services from this list of preventive care for children

-

Prescription Drugs

– At least one prescription drug in every category is covered

-

Outpatient Care

Like ambulatory patient services outside the hospital

-

Emergency Room Services

-

Hospitalization

Coverage for surgery and overnight stays

Remember, these services are only no-cost when they’re administered by a doctor or other medical provider in your health insurance plan’s network.

CON: Insurance Companies Dropped and Increased Certain Premiums to Cover these Essentials

Since Obamacare makes covering 10 essentials mandatory, several insurance companies had to revamp their coverage plans to include them.

As a result, some private health insurance holders lost their coverage because their former plans didn’t meet these standards.

When their insurance company reformatted their plans to include coverage for these 10 essentials, many members saw their premiums rise to cover the additional services.

People complained that they were forced to pay for services by default that they may never use or need coverage for (i.e., maternity care for those out of childbearing age).

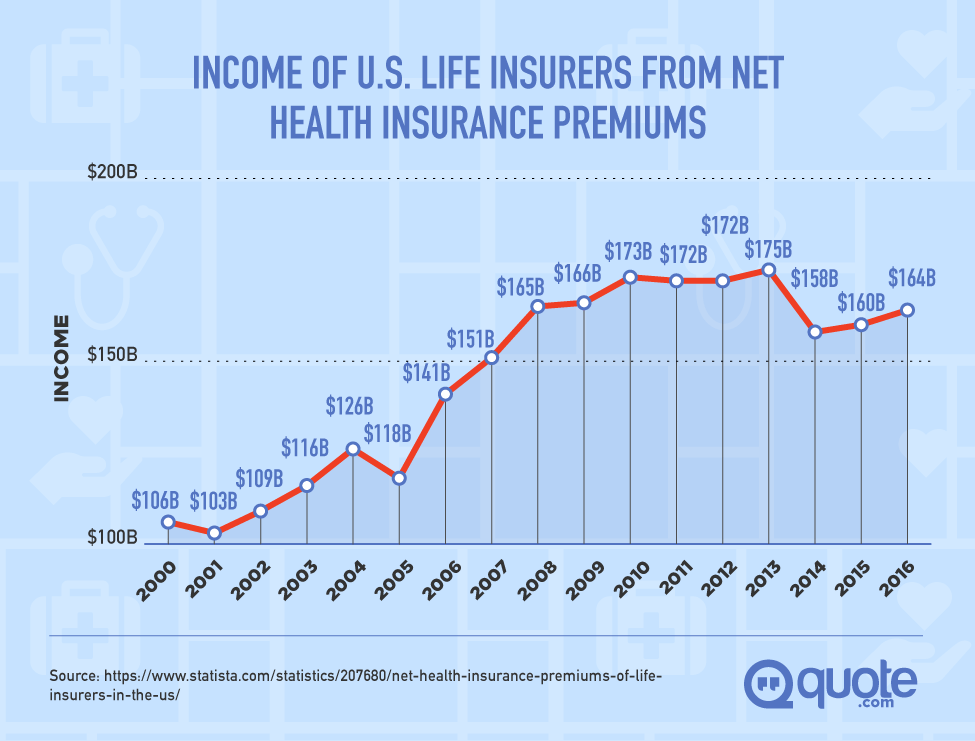

PRO: Two Rules to Curb Premium Rate Hikes

Before Obamacare was passed, the typical annual premium increased 3–4% every year even though the actual costs of healthcare services only rose 0.5%.

That’s because insurance companies spend your premium dollars on business expenses such as administrative overhead, executive salaries, and marketing campaigns.

A report from the Kaiser Family Foundation showed that health care premiums for employer-covered plans rose 69% during 2000–2005.

These costs are more about doing business than providing top-notch care to policyholders.

Obamacare makes insurance companies comply with two rules when it comes to spending and raising their customers’ premiums:

The Rate Review Provision, which forces insurance companies to justify premium increases over 10% to the state and federal government. They’ll also need to post these reasons publicly on the HealthCare.gov website.

The “80/20” Rule, which mandates that insurance companies must spend 80% of your premium on providing high quality coverage (85% for large group plans) and only spend 20% on business-related expenses (15% for large group plans).

Health insurance companies will now be required to hand over data showing how much they spent on clinical services and improving the quality of their coverage network.

These strict rules about what they can spend your premium money on should give them less incentive to inflate your rates.

If your insurance company spends less than 80% (85% in large group plans) on improving your plan, policyholders will receive a rebate for the difference in the form of a check or a future discounted premium.

As a result of these new rules, employer-covered premiums increased just 27% from 2010–2015, and only 3% between 2015–2016.

CON: Obamacare Health Plans May Be More Limited than Employer-Provided Health Plans

Dr. Elisabeth Rosenthal, a medical journalist and author, wrote an article in the New York Times mentioning the results of several studies between Obamacare plans and employer health plans.

She learned that out-of-pocket prescription costs were twice as high in the most popular Obamacare plan as they were in the average employer offering.

And 41% of the most popular plans only offered a “narrow or very narrow” selection of doctors. Part of this offering was 42% fewer cancer and cardiac specialists than employer plans.

Health plans on the California exchange specifically had “34 percent fewer hospitals than those sold on the open market.”

Additionally, most insurance coverage follows you when you travel from state-to-state. Some Obamacare plans do not cover services (aside from emergencies) outside of the state they are issued in.

This may pose a problem for your child living in another state for college, or if you travel a lot for work.

PRO: No More Lifetime and Annual Coverage Limits

Before the rules of Obamacare, insurance companies used to be able to set annual and lifetime limits for policyholders.

These caps set aside a reserved amount of money that policyholders could spend on health services in any given year or during the entire time they were enrolled in their health insurance plan.

If you went over this limit, you were forced to pay everything on your own without the insurance company’s help.

The ACA banned annual and lifetime coverage caps for essential benefits on all health plans and insurance policies.

Now, every health insurance policy sold in the U.S. must provide their members with an annual maximum out of pocket (MOOP) payment cap for their medical expenses. Once a policyholder reaches this cap, all further expenses are paid for by the insurance company—not the member.

PRO: Children Can Stay on their Parents’ Insurance Plan Until Age 26

Whether your child moved out of the house, stopped being a dependent, finished school, or got married, they’re eligible for coverage under your policy until they reach age 26.

It’s estimated that over 3 million young people received health insurance coverage from their parents’ policies thanks to Obamacare.

A double benefit of this is that since these young insurance holders are paying monthly premiums—but not using the services they’re covered for because they’re healthy—insurance companies make a profit.

This additional revenue for the insurance companies should help even out the expenses older adults cost them.

PRO: New Rules for Companies Offering Health Insurance

Under Obamacare, businesses employing more than 50 workers must offer health insurance.

Small businesses employing less than 25 full-time employees may qualify for tax credits that could help them save up to 50% of their employees’ health care premiums.

CON: Businesses May Still Drop Health Insurance Coverage as Long as they Pay the Penalty

Even though the law requires businesses of certain employee sizes to offer health insurance to their crew, companies can skirt around this law by paying a tax penalty for not doing so.

Stats from the Congressional Budget Office show that 3–5 million Americans lost their employer-sponsored health insurance plans because it was cheaper for companies to pay the tax instead of pay for health insurance coverage for all their employees.

Businesses that do not qualify for government tax credit assistance may encourage their employees to choose a plan from the Marketplace as the premiums will be cheaper.

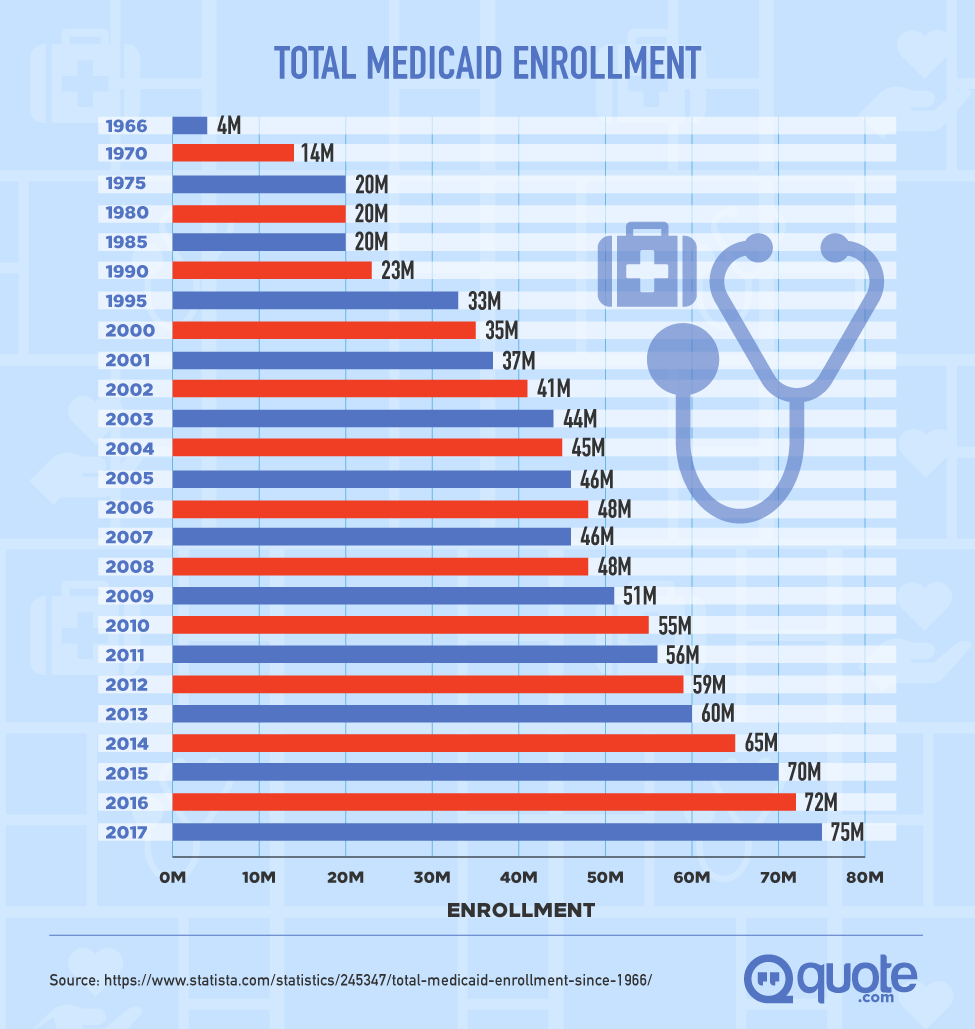

PRO: Expansion of Medicaid (in certain states)

Medicaid is a jointly-funded health insurance program paid for by the state and federal government for low-income and needy citizens.

Obamacare expanded Medicaid eligibility so it’s now being offered for the first time to low-income adults without disabilities and adults without dependent children.

As long as your annual adjusted gross income falls below 138% of the poverty level (or you earn less than $16,642 as an individual), you’ll qualify for Medicaid coverage solely on your income.

Up to 16 million men, women, and children have been estimated to receive coverage as a result of Medicaid expansion. States that expanded Medicaid had an average 7.3% uninsured rate during the first quarter of 2016.

But not all states chose to expand Medicaid so you’ll need to check the current status of Medicaid expansion in your area.

CON: Not All States Chose to Expand Medicaid

Many states refused to expand Medicaid, leaving close to 6 million of the country’s poorest families without health insurance coverage.

The uninsured rates of adults in the 18–64 age range living in non-expansion Medicaid states during the first quarter of 2016 were over 14%! That’s almost double the rates of those in Medicaid expansion states.

CON: Fewer Medical Deductions

Sometimes you have to pay for medical or dental expenses not covered by your insurance plan.

Before the ACA, you used to be able to deduct these expenses from your income taxes as long as they exceeded 7.5% of your annual income.

Now individuals and families may only deduct medical expenses that exceed 10% of their income.

Though we’ve covered the pros and cons of Obamacare for most people, let’s dive deeper into the specific benefits (and downsides) of the Affordable Care Act for women, senior citizens, and low-income families next.

Pros and Cons of Obamacare: For Women

Research conducted before the ACA passed showed that women could pay up to 1.5 times more for health insurance than their male counterparts because insurance companies would pass on the expenses of pregnancy, childbirth, and other female medical needs directly onto them.

And data shows this unfair practice costs women up to $1 billion every year.

On top of being charged extra, many female-related health services were only offered for a co-pay or deductible. Just 12% of health care plans before Obamacare covered maternity coverage.

Maternity and newborn care is now part of the ACA’s 10 essential benefits that all insurance companies must provide coverage for.

Plus, pregnancy is considered a pre-existing condition so you cannot be denied coverage or dropped from your policy because of it. All Marketplace and Medicaid plans will cover your pregnancy and childbirth—even if you became pregnant before you received insurance coverage.

The average national cost for a routine vaginal delivery is $8,775.

Women also have standard coverage for screenings, tests, and preventive care such as mammograms, STI counseling and testing, domestic violence screening and counseling, birth control and contraceptive coverage, and much more.

Check out this infographic about the insurance wins women gained with Obamacare.

Pros and Cons of Obamacare: For Senior Citizens

Since Americans over the age of 65 qualify for Medicare, the federal health insurance program for elderly citizens, many residents will switch from their private health insurance to this type of coverage as they get older.

However, the ACA set rules for insurance companies to protect older Americans from being overcharged for their necessary health services.

PRO: No More Price-Gouging Senior Citizens

Insurance companies charge older adults higher premiums than younger adults because they use more of their coverage.

Before Obamacare, insurance companies were allowed to charge policyholders in their 50s and 60s an unlimited amount more than what they charged policyholders half that age.

Now, insurance providers are only allowed to charge older people 3x as much as they charge their youngest members and no more.

PRO: Covered Screenings, Tests, and Prescriptions

Senior citizens used to have to pay for preventative screenings and tests out of their own pockets before the ACA.

To prevent costly emergency visits, Obamacare’s 10 essential benefits expands preventive screenings and health services for senior citizens.

It also subsidizes part of the costs of certain prescriptions to keep seniors healthy on their small fixed incomes.

PRO: Closing the Prescription “Donut Hole” in Medicare

Before the ACA, Medicare recipients had to deal with a frustrating problem known as the “donut hole”, which happened when Medicare stop paying part of the costs for prescription drugs and forced seniors to pay for the remainder at full price.

According to one study from the Kaiser Family Foundation, senior citizens who could not afford to pay for their prescriptions simply stopped taking them.

The ACA has been slowly closing the donut hole coverage gap to help seniors save over $23 billion in prescription drug costs.

CON: Higher Premiums Mean Nothing for those Outside the Prescription “Donut Hole”

In order to close the “donut hole”, many Medicare Part D beneficiaries may see an increase in their premiums.

Research indicates that this premium hike may affect more people than closing the prescription coverage hole actually helps.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of Obamacare: For Low-Income Families

A major priority of Obamacare was giving insurance to the poorest individuals and families in our country.

Obamacare works on a sliding scale so the less you earn, the more help you’ll receive from the government to pay for your health insurance premiums. This makes health insurance affordable for everyone.

Plus, Medicaid was expanded (in certain states) to cover an additional 15 million estimated low-income individuals and families who were previously uninsured.

If you’re in a state that expanded Medicaid, you may now qualify for low-cost healthcare when you previously were not eligible.

This is the first time Medicaid approval based solely on your income—instead of if you have a disability or dependent—has been allowed.

How Does Obamacare Specifically Affect Me?

Even if you don’t want health insurance, Obamacare makes it a tax-penalty if you refuse to have it.

Therefore you’ll either need to enroll in a health plan from your employer, go through a private insurance company, or use the Marketplace or your state’s exchange to find an insurance plan under Obamacare.

Certain individuals are exempt from having health insurance and paying the tax, but they are a minority of the population.

What is the Obamacare Tax Penalty?

All Americans who can afford health insurance must have medical coverage. This helps reduce the government’s financial costs of supplying premium tax credits.

If you don’t have health insurance, you’ll be fined a fee known as the individual shared responsibility payment.

This fee (also called an “individual mandate”) is a penalty for any month you, your spouse, or your tax dependents fail to have qualifying health coverage.

You’ll be charged for each month you don’t have minimum essential coverage when you file your federal tax return for the year you lack insurance.

If you only lapsed coverage for less than three months, the fine will be waived. That’s what’s known as the short gap exemption.

How Much Is It Going to Cost?

The IRS will take two calculations to determine your penalty for skipping out on coverage:

First, a 2.5% tax of your household income for every month you don’t have coverage will be determined.

The maximum penalty amount cannot be more than the total yearly premium for the national average price of a Bronze plan sold through the Marketplace.

Second, they’ll calculate a flat fee per person in your household.

Uninsured adults cost $695 and you’ll be charged $347.50 per child for children under the age of 18. The maximum amount you can pay here is $2,085.

You will be responsible for paying the higher number of the two calculations.

To help you figure this out, you can estimate your individual responsibility payment with this handy tool courtesy of the IRS.

There are Only Two Ways You Can Avoid Paying the Penalty

You can either enroll in a qualifying health care plan or qualify for an exemption.

Over 20 million people were exempt from the fee in 2016 because they met certain exemptions based on income, financial hardships (like filing for bankruptcy or being evicted), or living abroad.

Use the Exemptions Screener from Healthcare.gov to see if you’re eligible for any health coverage exemptions.

If you don’t pay the penalty the IRS can simply take the money out of your future tax refund automatically.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How and Where Do I Apply for Obamacare?

You can enroll in an Obamacare health plan anytime if you’re eligible for a Special Enrollment Period.

These happen as a result of certain life events such as losing your job, getting married, or having or adopting a baby.

If you meet one of these special life circumstances, you can apply for Obamacare online at the HealthCare.gov website.

Don’t qualify for any of those?

You’ll have to wait for Open Enrollment Period, the short span of time when individuals and families are able to purchase Obamacare health plans sold on the Marketplace exchanges.

Downside: Open enrollment only lasts from November through January each year.

Even if you’re outside the open enrollment period, you should still sign up for an account on the HealthCare.gov Marketplace, especially if you plan to sign up during open enrollment.

You’ll be able to see if you’re eligible for Medicaid (if expanded in your area) and find out if you qualify for premium tax credits.

How does the exchange work?

Create Your Account online at the HealthCare.gov website.

See if You Qualify for Premium Tax Credits by entering your social security number and income information.

During an open enrollment period, you’ll be able to Review Health Care Plans in four tiers (Bronze, Silver, Gold, and Platinum). Each category includes plans with different levels of coverage so you’ll want to compare each plan’s monthly premium, deductibles, copays, MOOP, and list of in-network providers.

The all you need to do is Enroll In the Plan.

If you qualify for Medicaid or CHIP, you can enroll in Obamacare anytime by visiting the HealthCare.gov website at https://www.healthcare.gov/.

Do I Qualify for Obamacare?

You can only enroll in health coverage through the Marketplace if you live in the United States, are a U.S. citizen or national (or be lawfully present), and are not incarcerated.

You cannot apply for an Obamacare plan if you have Medicare coverage.

What is the Obamacare Application Process Like?

The Obamacare application process should take less than 15 minutes to complete.

Here’s how to get started:

-

Online by applying on the HealthCare.gov website.

-

Over the phone with a customer service representative to help you fill out your application, review your options for coverage, and enroll in the plan right for you.Contact the Marketplace Call Center 24 hours a day, 7 days a week, at:1-800-318-2596 (TTY: 1-855-889-4325).The Marketplace Call Center is closed Memorial Day, July 4th, Labor Day, Thanksgiving Day, and Christmas Day.

-

With in-person help from your community members with special Marketplace training. These assisters will help you fill out an application and enroll at a location in your neighborhood.Enter your zip code here for a list of groups and community members near you.

-

Through an agent or broker in your neighborhood who will help you apply and enroll. You won’t pay higher premiums for choosing an agent or broker for help, but an agent may work for a specific insurance company and only offer plans from that company.Enter your zip code here and look for the “Agents and Brokers” tab in the list of results for your area.

-

Via mail-in application. Download a paper copy of the application instructions and a paper application for coverage.

Fill out your application and mail it to:

Health Insurance Marketplace

Attn: Coverage Processing

465 Industrial Blvd

London, KY 40750-0001

You’ll receive your results about eligibility within two weeks

You’ll need to create an online account at the HealthCare.gov website or use the Marketplace Call Center to browse insurance plans and enroll in one from there.

Am I Too Late to Enroll in Obamacare?

Open Enrollment for 2017 health coverage started November 2016 and ended January 31, 2017.

Still need health insurance for the rest of 2017?

Open enrollment for 2018 will run from November 1, 2017 – January 31, 2018.

To guarantee coverage for January 1st, make sure to enroll by December 15, 2017.

If you qualify for a Special Enrollment Period due to a major life event (like getting married or losing your job), you can apply and enroll in Obamacare without waiting for open enrollment.

Applicants who qualify for Medicaid or CHIP can apply and enroll any time.

How Long Do I Have to Wait to Find Out About the Status of My Obamacare Application?

If you apply for Obamacare online, the application is usually an immediate process.

Sometimes you’ll need to provide extra documentation for verification purposes, but you should receive notifications, either through your HealthCare.gov account, in the mail, or via email, if you need to take additional steps.

If you need help with your application, or want to check the status of your application, just contact the Marketplace Call Center 24 hours a day, 7 days a week, at: 1-800-318-2596 (TTY: 1-855-889-4325).

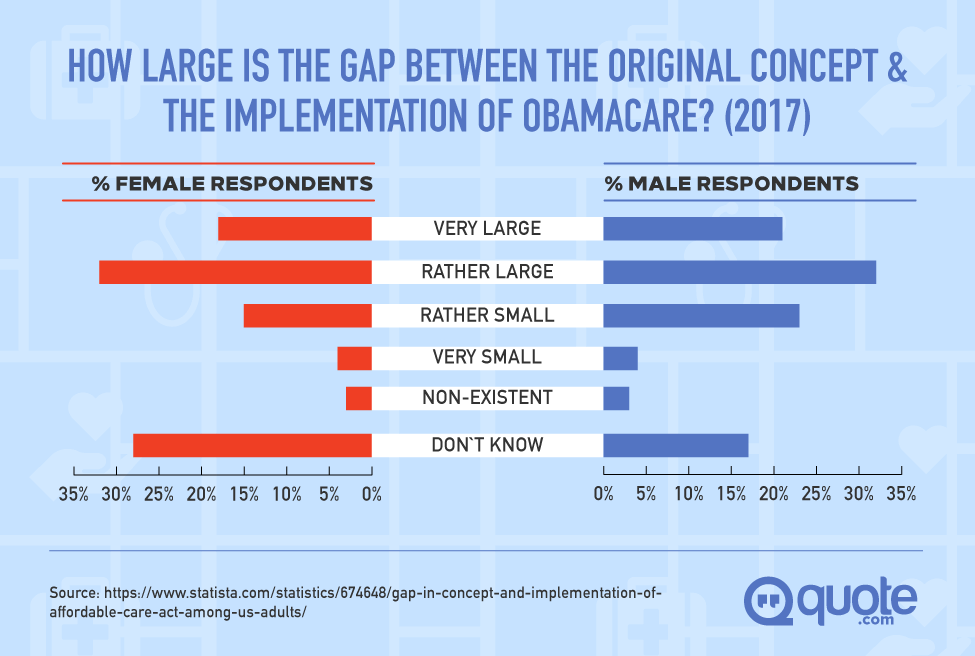

What are the Strengths and Weaknesses of Obamacare?

Obamacare is strongest in its goal to protect Americans from the big insurance companies.

It tilts health insurance in their favor by making all insurance companies provide better quality care, justify premium increases, and provide coverage for pre-existing conditions. Providers also can’t price gauge based on age or gender.

However, Obamacare has weaknesses when it comes to cutting the expense of health care.

An estimated 20 million people purchased plans from the Marketplace. And 20 million people will be paying monthly premiums to the insurance companies.

Though insurance companies have complained about losing money after Obamacare, the Marketplace was the biggest lead generator they’ve ever had.

Yet the prices of prescriptions, tests and screens, and other medical expenses haven’t changed. It’s these costs which need to be addressed and lowered.

What are the Most Frequent Complaints About the ACA?

Citizens against Obamacare frequently complain that the ACA infringes on their basic American rights, freedoms, and liberties by forcing people to buy a product (health insurance) and taxing them if they don’t.

People also express disappointment in the subpar network of participating doctors. And the fact that they have to buy plans that include essential health services they may never use (yet still wind up paying for).

Private businesses with strong religious beliefs have tried fighting Obamacare’s essential coverage for contraception citing religious freedom.

While others think businesses shouldn’t have the same freedom of religion individuals have, the Supreme Court ruled in favor of Hobby Lobby’s petition to exclude certain contraceptives from the health insurance plans.

Under religious freedom, they no longer have to offer these covered services to their employees even though it’s an essential mandated by Obamacare for other businesses.

Still, the most frequent complaint is that implementing Obamacare will cost the country too much money. The Congressional Budget Office estimates that the ACA will cost about $1.34 trillion over the next 10 years.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Happens with Obamacare In Relation to Medicare and Medicaid?

If you’re enrolled in Medicare Part A (Hospital Insurance), you do not need to find a health care plan on the Marketplace because you’re considered to have qualifying health coverage.

Americans only covered for Medicare Part B (Medical Insurance) don’t meet this requirement. You’ll need to purchase a qualifying health plan or pay the tax for not having insurance.

Obamacare is supposed to help close the Medicare doughnut hole by 2020.

States that chose to expand Medicaid coverage now provide benefits to those without a qualifying disability or dependent. As long as you meet the income requirement, you’re eligible for health care.

Frequently Asked Questions about Obamacare

We’ve covered a lot of ground today in our discussion about Obamacare, but you may still have a question we haven’t touched on yet.

Check out these most commonly asked questions about the Affordable Care Act:

Is the Affordable Care Act (ACA) the same as Obamacare?

Yes. President Obama signed The Patient Protection and Affordable Care Act of 2010, which is frequently shortened to the Affordable Care Act (ACA).

It’s more often to referred to by its namesake as Obamacare.

How does the Affordable Care Act (ACA) affect the economy?

Since more Americans are signing up for health insurance and using the benefits they’re covered for, jobs in the healthcare sector have been on the rise. More nurses, administrative staff, and doctors are required to provide services.

However, certain employers are deciding to drop down their full-time employees to part-time so they do not have to pay for their health insurance coverage. This has the potential to increase unemployment rates.

There’s no evidence that the ACA has had a negative impact on economic growth or jobs or that its reforms have undermined full-time employment.

In fact, evidence indicates that Obamacare is actually acting:

As an economic stimulus, in part by freeing up private and public resources for investment in jobs and production.

Why are people against Obamacare?

Americans do not like being told that they have to purchase health insurance or face a tax penalty if they choose to go without it.

Many citizens are also unhappy that their health plans were changed or increased in price as a result of covering essential benefits.

Additionally, Americans who earn too much to qualify for premium tax credits may feel it unfair that Medicaid has expanded coverage for low-income citizens while they’re paying full price without any subsidies or help.

How many people are on Obamacare?

It’s hard to figure out the exact number of insured Americans on Obamacare as Megan McArdle notes in her article for Bloomberg, “How Many are Insured Because of Obamacare? Great Question.

McArdle says that between Congressional Budget Office projections, Gallup polls, information from the Census Bureau, and data from the Centers for Disease Control, we still don’t have a definite number.

When you combine the coverage from the Marketplace plans, expanded Medicaid, and children being allowed to stay on their parent’s insurance plans, an estimated 20 million Americans have received health insurance thanks to Obamacare.

And an unexpected 12 million Americans signed up for Obamacare just during the 2017 enrollment period!

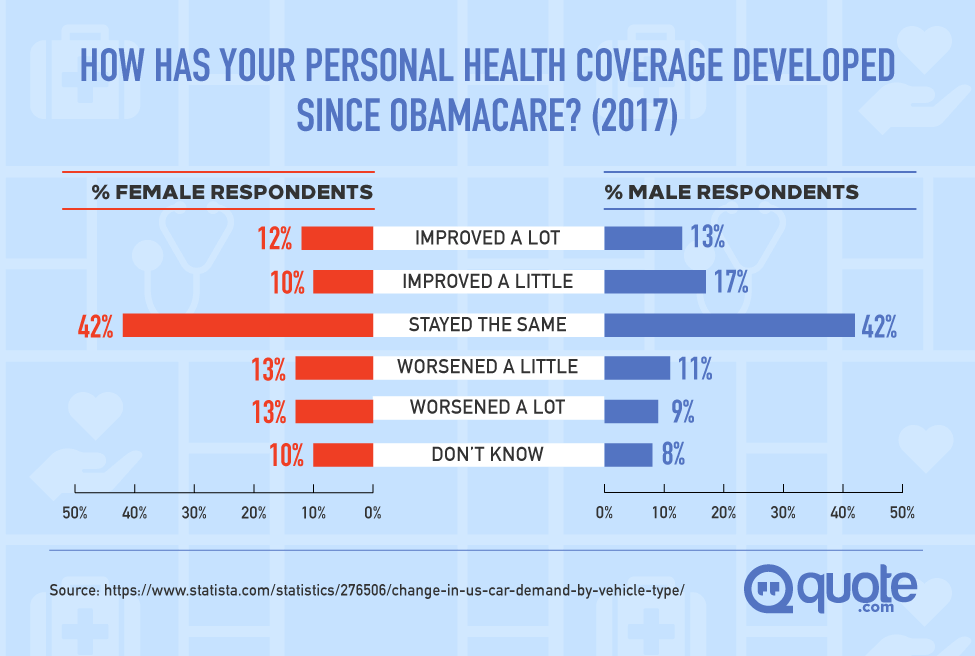

What are the effects of Obamacare on insurance companies?

Insurance companies have to step up their game and clean up their act.

They can no longer deny coverage for pre-existing conditions, charge people more based on their gender or age, and they can’t spend more than 20% of your premium on business-related expenses.

Plus, they must provide all their policyholders with plans that cover 10 essential benefits.

Because of these regulations, many insurance companies claim they’re losing money.

When citizens started signing up for health insurance on the Marketplace, insurance companies underestimated their poor health. They say they spent more on covered services than they earned in premiums.

Major insurance companies such as Aetna, United, and Humana have all pulled out of the Marketplace as a result.

What’s the impact of Obamacare on small and large businesses?

Small businesses employing less than 25 people will receive tax credits from Obamacare to help offset the costs of providing health insurance plans for their employees.

These businesses have typically had the hardest time giving their employees affordable coverage since they don’t qualify for the discounts larger companies receive for group health plans.

Large businesses that employ 50 or more full-time employees must offer health insurance or get penalized with a tax.

Known as the employer mandate, this provision is similar to the individual mandate and is supposed to encourage employers to provide insurance so the government spends less in subsidies.

Though this has led some to speculate that employers will start cutting their employees’ hours to part-time, there’s no evidence to suggest it has happened.

What’s the impact of the Affordable Care Act (ACA) on health care providers?

A study from The Heritage Foundation revealed predictions that Obamacare will be straining an already overburdened healthcare system that’s not staffed to handle the influx of new insured patients.

When more people have insurance, more people will visit their doctors and undergo essential preventative care and routine screenings and tests. This means more medical staff will be needed.

It’s estimated that Obamacare will add “190 million hours of paperwork annually” to the healthcare industry and the shortage of medical personnel will cause “increasing wait times, limited access to providers, shortened time with caregivers, and decreased satisfaction.”

These are only estimates so we’ll need to wait for the actual data to come in before we draw a conclusion about the real impact of Obamacare on healthcare providers.

Do all insurance companies have to comply with Obamacare?

Yes, all insurance companies must follow the rules and regulations set into law under The Patient Protection and Affordable Care Act of 2010.

What do doctors and physicians think about Obamacare?

Results are polarized when you ask doctors, physicians, and medical personnel about Obamacare.

According to one Kaiser Family Foundation poll:

Older, more conservative-leaning doctors who’ve been practicing medicine for 20+ years don’t see the ACA favorably; they gripe about excessive administrative duties, paperwork, and coordinating with Obamacare’s bureaucratic red tape.

Many physicians also report not being reimbursed for the services they’re providing to Obamacare patients.

On the other hand, younger, more liberal-leaning doctors see Obamacare as a great starting point for the poor, less fortunate citizens who can’t afford medications, treatment, or testing.

The ACA was never meant to be a finished product. It was meant as a place to start by covering more people with health insurance.

Maybe that’s why a 2016 survey by Merritt Hawkins for the Physicians Foundation showed that only 3.2% of physicians gave the Affordable Care Act an “A” grade. Most gave the law a “C.”

But another survey showed that nearly 75% of general practitioners favored making changes to Obamacare instead of repealing the whole thing.

Does health insurance cover pre-existing conditions?

The Department of Health & Human Services says:

“Health insurance companies can’t refuse to cover you or charge you more just because you have a “pre-existing condition”, that is, a health problem you had before the date that new health coverage starts.”

Your insurance provider must cover treatment options to handle your pre-existing condition and they cannot limit benefits for that condition or refuse to cover treatment for it.

Can I get health insurance without Obamacare?

Yes. You can choose to enroll in a health insurance plan on your own from a private insurance company directly or you may enroll in health coverage offered by your employer.

Can I cancel my Obamacare?

You can cancel your Obamacare health plan anytime. Just follow the steps from the HealthCare.gov website to cancel a Marketplace Plan.

You’ll have to provide the reason you’re ending your health insurance coverage, such as if you’re moving to an employer-sponsored health plan, became eligible for Medicare, etc.

You’ll only have a three-month grace period to replace your Obamacare coverage with another qualifying health plan or prepare to pay the tax penalty for the months you lacked coverage.

Will the new Trump government repeal and replace Obamacare?

Even though Obamacare has resulted in the lowest uninsured rate in history, President Donald Trump is seeking to repeal the ACA.

Yet on May 4, 2017, the House just barely approved legislation to repeal and replace parts of Obamacare.

The new bill eliminates the individual mandate so you won’t have to pay a tax for going without health insurance. It also removes the Obamacare taxes for high-earning citizens.

Trump is seeking a repeal for the expansion of Medicaid, which would cut health coverage for the country’s lowest-income individuals and families.

Plus, it allows states to decide whether they want to require maternity and mental health care as part of covered essential health benefits. And it allows insurance companies to go back to using pre-existing conditions as ways to deny coverage.

Instead of giving citizens premium tax credits with Obamacare, Trump wants to offer tax credits between $2,000 and $4,000 a year to Americans to use for health insurance. The amount you receive will no longer be based on your income, but your age.

Additionally, Trump wants to remove the Obamacare rule that insurance companies cannot charge older policyholders more than 3x what they charge younger members.

Trump would allow insurance companies to set limits up to 5x or 6x times what younger policyholders pay—or remove the premium limit entirely.

One study from the Rand Corporation and the Commonwealth Fund discovered that charging premiums five or six times higher will price nearly 400,000 older citizens out of health insurance.

It’s estimated that it will cost $350 billion to replace Obamacare over the next ten years. For now, Obamacare is still the law and we’ll just have to see what’s next for President Trump’s camp.

Will my insurance premiums be cheaper or more expensive if I have Obamacare?

The health plans in the Marketplace range in price so there’s always an affordable option.

If you’re eligible to receive premium tax credits, you’ll have government assistance to help you pay for your monthly premium. This helps lower your premiums so they’re cheaper and easier to afford.

If you’re not eligible for premium tax credits your premiums may be more expensive as you’ll be paying for them on your own.

Can I keep my doctor or is there a list of doctors that I need to pick from with Obamacare?

Insurance providers offer coverage for doctors and medical facilities in their network. If you choose to use a doctor or hospital out of your network, your insurance company will only cover a portion (instead of most) of the expense.

Unlike traditional insurance coverage, certain plans on the Marketplace will not cover any of your expenses to see a doctor or use a medical facility out of your plan’s network.

It will be as if you don’t have any insurance because you’ll have to pay for everything out of your own pocket.

That’s why if you’re super loyal to your trusted physician or medical practice, check to see if they participate in a health care plan in the Marketplace before you choose one.

Just head over to the provider search on the HealthCare.gov website.

Enter your doctor’s name or the name of the medical facility you want to continue using and browse the plans they participate in.

Knowing this information will help you decide if you want to select the plan your doctor is on or choose another.

Can I opt out of Obamacare?

Yes, you can opt out of Obamacare by following the steps at the HealthCare.gov website to cancel a Marketplace Plan.

Be warned that you will only have a three-month grace period between cancelling your current coverage and opting for a new health insurance plan either on your own, through the Marketplace, or from your employer before you’ll be taxed the penalty.

Does Obamacare increase taxes in general? If yes, how does it affect me?

There are only two taxes that apply to individuals as a result of Obamacare:

The tax on high earners, which taxes households with an earned income above $200,000 (or above $250,000 if you’re married and filing jointly).

This top 2% of earners will also pay an extra 0.9% Medicare tax on all their earnings above this threshold.

And if they have investments, they’ll see an additional 3.8% Medicare tax on their “net investment income”, which includes capital gains, dividends, and interest.

It may seem as if the top-earning Americans are hit the hardest with taxes, but the Congressional Budget Office says these citizens will owe an average sum of $130,000 in total despite their pre-tax income averages which are close to $10 million.

I don’t have a job, is it necessary that I have Obamacare?

Certain Obamacare exemptions are based on your household income. If you qualify for an exemption based on low-income, you will not have to pay the tax penalty or enroll in health insurance.

So if you earned less than $10,350 during the year as a single individual, you will not be required to enroll in an Obamacare plan.

Do I have to buy health insurance under Obamacare or am I automatically insured?

Everyone will need to have health insurance coverage or pay a tax penalty for being without it. This means you have to enroll in a plan.

However, you do not have to buy a health insurance plan if you’re on certain Medicare plans with qualifying health coverage, Medicaid, or CHIP. You will also not be charged the penalty fee.

Does Obamacare affect union workers?

As Rob Schwab explains, union workers receive insurance coverage from their union rather than their employer. Unions create self-funded plans that include multiple employers.

Obamacare rules about employers providing minimum essential coverage if they have a certain number of employees means plans could differ from one employer to the next as they negotiate rates for specific benefits.

However, union members are typically only given benefits when they work a certain number of hours or pay a certain amount toward union health coverage.

With the Cadillac Tax aimed at self-funded plans like many union plans, organizations not offering affordable healthcare plans to their employees will be penalized.

Unions rather than union workers will be the ones to suffer for failure to comply with laws … This is good news for union workers, who will not only be able to meet their obligations under Obamacare, but will also potentially enjoy greater benefits at lower rates.

What preventive care is covered by Obamacare?

Now that preventive care is covered by Obamacare, you no longer have to pay for annual checkups, routine screenings, or certain medical tests. Your insurance company will cover the costs associated with these essential health benefits.

Obamacare delivers preventive care benefits for adults which include wellness checkups, immunizations, and certain medications.

There are also specific preventive care benefits for women that cover contraceptive methods, STI tests, and cancer screenings.

Preventive care for children includes checkups, developmental screenings, vaccinations and immunizations, and behavioral assessments.

Who is exempt from signing up for Obamacare?

Certain Americans will not need to sign up for health insurance coverage and they won’t be charged the tax penalty for being without it.

Exemptions are given to American citizens living outside the country, those who cannot afford coverage due to their low-income or financial hardships (like being evicted or declaring bankruptcy), or those who receive health services through other means, such as the Indian Health Services provider.

These are only a few of the most common exemptions. Check the HealthCare.gov website for the full list of exemptions from Obamacare.

How do I find out if my health insurance meets Obamacare requirements?

You can check the HealthCare.gov website to learn if the coverage you have qualifies as minimum essential coverage.

What are the costs associated with implementing Obamacare?

Projections from the Congressional Budget Office estimate that the federal government will need to spend $1.34 trillion over the next decade to implement Obamacare.

In 2016 alone, Obamacare will cost a total of $110 billion.

However, many analysts expect the deficit to decrease by $200 billion as a result of Obamacare’s measures.

Additionally, states receiving 90–100% of their Obamacare funding money to cover the cost of state-run medical facilities will save billions.

Why are some locations not accepting Obamacare?

According to a Physicians Foundation survey, two-thirds of doctors admitted to not accepting health insurance plans offered through the Affordabl’s online insurance exchanges.

That’s because doctors are reimbursed less for seeing patients with Obamacare plans than they are for making appointments with those holding private insurance plans—if they get paid for their services at all.

A glaring problem with Obamacare plans is that 20% of policyholders lose coverage after the first 90 days because they don’t pay their premiums.

If policyholders see a physician during this time, they don’t have to pay for the visit but the insurance company will also not be able to reimburse the doctors as they never received payment either.

Plus, certain practices cannot afford to staff and pay for all the administrative overhead and electronic record keeping requirements under the new Obamacare law so they simply refuse to deal with it.

What Do You Think About Obamacare?

As the health care debate rages on, it’s hard to know exactly where our country stands.

The goal of Obamacare was to provide protection for all American citizens from the growing expenses of health care.

Medical bills are the number one cause of bankruptcy here in the U.S.—more than bankruptcies caused by mortgages and credit card debt.

Obamacare improves the quality of health insurance by mandating coverage for essential health care benefits. It also places controls to limit how the insurance companies charge policyholders premiums.

While Obamacare does provide affordable coverage for millions of Americans who would otherwise not be able to qualify for health insurance, it doesn’t quite reign in the huge costs associated with the healthcare industry as a whole.

Only time will tell if President Trump succeeds in repealing all of the effort former President Obama put forth to bring Obamacare into action.

So how do you feel about Obamacare? Are you waiting for “Trumpcare” to take its place?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.