How to Finance What Your Health Insurance Won’t Cover

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding co...

Meggan McCain

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Michael Vereecke

Updated December 2023

Having health insurance is supposed to help people sleep better at night.

You pay premiums, which means you’re covered if anyone in your family suffers an illness or injury. Right?

Well, it’s true that health insurance helps to cover massive expenses when a health crisis happens.

But there are many procedures not covered by insurance.

Some insurance policies don’t cover care provided by out-of-network specialists.

Then there’s also the policy fine-print requiring the insured person to pay part of the care costs up to a maximum out-of-pocket amount—before any financial help kicks in.

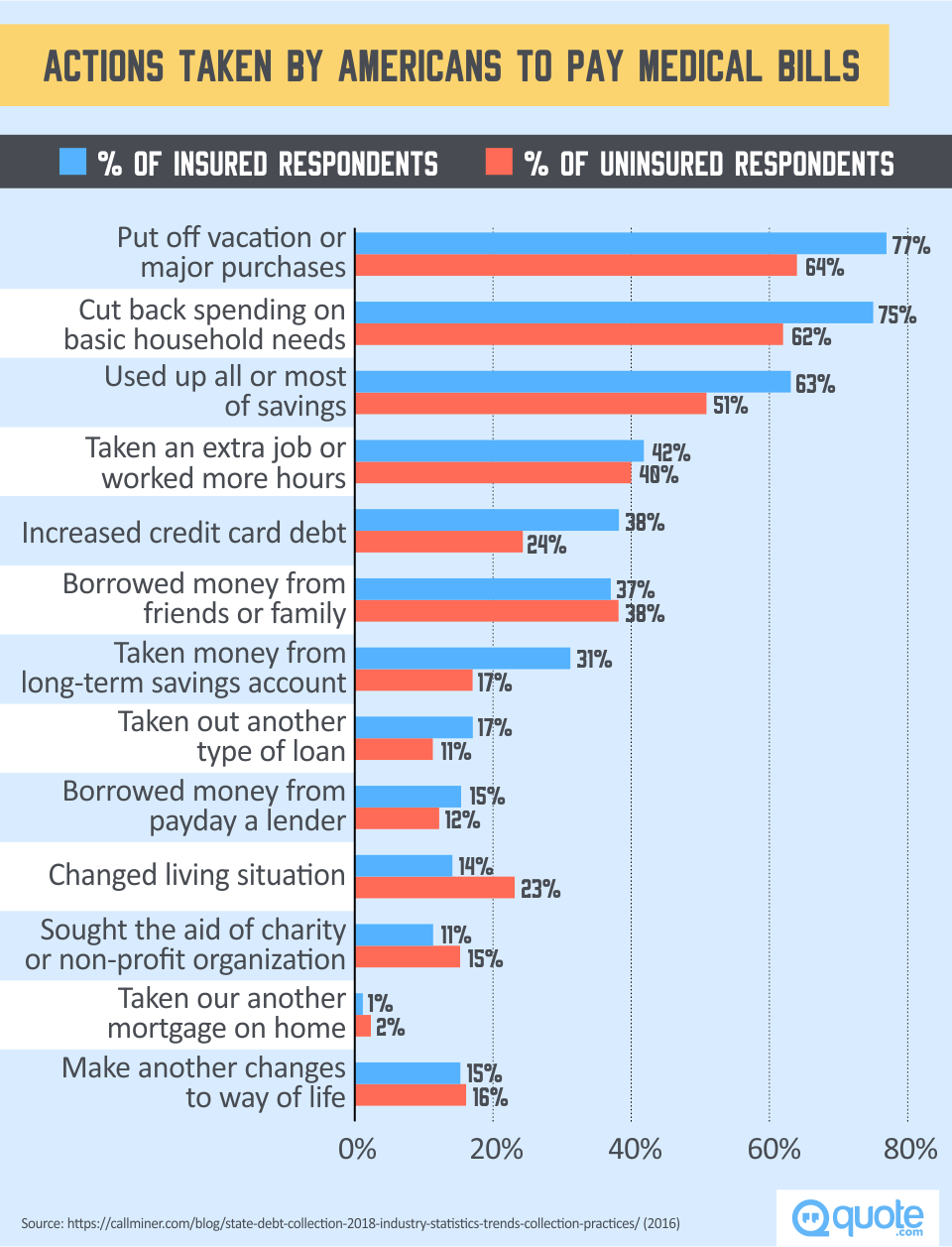

Even though almost 90% of Americans have some form of health insurance, there continues to be an epidemic of medical debt.

According to the Consumer Finance Protection Bureau (CFPB), 43 million Americans have one or more outstanding medical bills on their credit report.

The research also found delinquent medical bills to be responsible for 52% of collection accounts on credit reports.

Medical debt has been cited as the single biggest cause of bankruptcy in the U.S.

In a recent cross-country poll conducted by National Public Radio, 7% of respondents had declared bankruptcy as a result of medical expenses.

Medical bills can financially cripple even the most prepared of families, that’s why I feel so fortunate that my family is generally in good health.

It’s also good to know our health insurance is there when we need it.

Even though we’re healthy and our doctor and ER visits are covered by insurance, the money I spend every year for my family’s medical expenses is still well into four figures.

Fortunately, I always have an emergency fund set aside for these kinds of expenses.

For some, it’s not possible to put aside money for unexpected medical bills.

For others, the emergency fund gets exhausted when a serious illness, injury, or disease drains it quicker than it can be replenished.

When a person can’t pay their medical bills, they often find themselves spending their life fending off tireless agents of collections agencies.

Or declaring bankruptcy, closing the door for many years on any chance to get approved for important types of credit like mortgages and credit cards.

After being hit with an illness, injury, long-term care need, or disease, the last thing a family needs is to endure the trauma and the crisis brought about by out-of-control medical debt and its consequences.

Fortunately, there are ways to finance what your insurance won’t cover.

The costs can also be cushioned so the blow isn’t so hard.

There are practical steps you can take and strategies you can use to avoid, reduce, and deal with medical bills.

Rather than staying up all night wondering how you’re going to pay your portion of your family’s medical debt, you can try these tips and rest and breathe easier.

Pick the Right Health Insurance Policy

Shop around to get the best policy for your situation

Staying on top of medical bills starts with choosing the health insurance policy that will give you or your family the coverage you need with the best possible terms.

The type of policy you choose will depend on things like your pre-existing conditions, overall health, your medication prescriptions, and whether you will require specialist care.

Your choice will also be determined by your budget.

Take a look at your household’s medical bills for the past year and the type of medical treatments and expenses you racked up.

Use that information to make an informed decision on the type of policy that’s right for you.

Depending on where you live, insurance will be offered through a state-run marketplace or you’ll be required to go through the federal marketplace.

Keep in mind that the benefits offered through these two marketplaces may differ.

And there can even be differences from state to state.

If your health insurance is provided by your employer, you don’t need to shop in a marketplace.

Employer-sponsored health coverage usually involves selecting options among the packages available.

Health Maintenance Organizations (HMOs) are low-cost and in-network. If you are looking to keep your out-of-pocket expenses down and you’re OK with having all of your care provided by one network, an HMO is a good option.

Your primary doctor will coordinate all your care with other providers in the HMO network, including medical testing and specialists.

Preferred Provider Organizations (PPOs) offer more provider options. When you choose a PPO policy, you get a discount on care you get from providers within the network.

You are still covered for out-of-network services (but you’ll pay more) and you don’t need a referral to see a specialist.

Exclusive Provider Organizations (EPOs) keep costs down without a referral. When you choose an EPO policy your care has to happen within network (unless it’s an emergency).

Your expenses are kept low when you choose an EPO and there is no requirement for a referral when you go to a specialist (since you have to choose one in-network).

Point of Service (POS) plans cost more but offer the most options. Like an HMO plan, with a POS plan, all care is coordinated by your primary doctor.

The primary care doctor can make referrals to specialists including out-of-network providers.

Like PPOs, when care is provided within the network it’s less expensive.

Many health insurance providers offer choices between these different types of policies.

Make sure your doc is included in the health plan network

If you have a family doctor you’d like to stick with, it’s obviously super-important to make sure they are members of your policy’s network.

For those with no preferences when it comes to doctors, a policy with a larger network is a good pick to allow for more choices.

When we’re talking about keeping your medical bills down, keeping it within a network is an important tip, so choose your health insurance network wisely.

Out-of-pocket costs are what you’re going to pay on top of your premiums

Keeping up with insurance premium payments is relatively easy since they are predictable and the installments are for fixed amounts.

What usually hits people who struggle with medical debt are the high user costs and out-of-pocket costs charged on top of premiums when they actually receive healthcare services.

Get to know some of the health insurance lingo. When you’re searching the marketplace for the best policy for you and your family, there are a few terms you should know (especially if you want to keep costs down):

The deductible is the amount you pay before the insurance kicks in. All health insurance policies will indicate the deductible amount you need to pay before benefits are provided.

For example, if you have a deductible of $2,000 and your bill is for $5,000, you will pay the first $2,000 and your insurance company will pay $3,000.

If your deductible is $2,000 and your bill is for $1,500, then you’ll pay for it all.

Choose a higher deductible for a lower premium. The amount of deductible you choose has a big impact on what you’re charged for premium payments.

The lower the deductible, the more you’ll pay for premiums.

If you’re in good health with no expectations for big healthcare expenses (like planning to have a baby), your annual costs can be kept down by choosing a higher deductible.

If you know you’re going to need to pay for healthcare or prescriptions (for example, if you have a chronic disease like diabetes) choose a lower deductible to save money.

Copayments and coinsurance also add up. In addition to deductibles, health insurance policies also charge user fees for specific treatments.

A copay is a pre-set fee for certain services. For example, your policy could charge a $25 copay for family doctor appointments, a $200 copay for ER visits, and a $10 copay for prescriptions.

Co-insurance is a percentage of the bill. After the deductible is paid, many policies also require the insured person to kick in for a percentage of the remaining costs.

For example, if your co-insurance rate is 18%, and your deductible is $2,000, you’ll pay $2,540 for a $5,000 medical bill (and the insurance company will pay the rest).

Out-of-pocket maximum could save you from financial ruin. The single most important thing to understand when it comes to keeping medical bills down and avoiding collections or bankruptcy is the out-of-pocket maximum.

Every policy has a stipulation for how much the insured person can spend in one year on deductibles, copays, and coinsurance combined.

Let’s say your out-of-pocket maximum is $4,000, your deductible is $1,500, and your coinsurance costs are 20%.

Now let’s say you need an operation costing $20,000.

Your deductible plus your 20% of the remaining $18,500 would equal $5,200.

You’ll save $1,200. Fortunately, since the out-of-pocket maximum on your policy is $4,000, that’s all you’ll pay.

If you need any other healthcare services in the same policy year, the insurer will pay 100%.

Just like with deductibles, lower premiums usually mean higher out-of-pocket limits, and lower out-of-pocket maximums are offset by higher premiums.

If you or your family is healthy and don’t expect to need a lot of care, choosing a higher out-of-pocket maximum makes sense.

If you have major healthcare needs, you’re definitely going to want to keep the out-of-pocket max as low as you can.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Health Insurance Covers

Each policy is different when it comes to what procedures and expenses are covered.

The list of potential procedures covered is long and pretty extensive, but there’s no guarantee your policy will include all of them, so check with your provider to make sure.

Outpatient care doesn’t require a hospital stay. Coverage should include outpatient costs such as day surgeries and rehab sessions.

Since these procedures and services don’t require confinement and hospitalization, they are much less expensive (both for the insurer and for you).

Emergency room care coverage is not optional. When an unexpected injury or sudden illness occurs, you’re going to need coverage.

ER treatment is some of the most expensive care you can get, so it’s important you’re covered for it if you want to avoid a huge bill you can’t pay.

Giving birth shouldn’t break the bank. Maternity and newborn care are incredibly expensive.

The average uncomplicated baby delivery costs over $30,000.

A Caesarian section birth costs over $50,000.

Couples who are ready to start a family should choose an insurance plan with ample coverage, so they don’t find themselves up to their ears in debt when welcoming the newest member of their family.

Mental health requires healthcare expenses too. Whether it’s substance abuse treatment, behavioral health services, or counseling and psychotherapy, taking care of mental health can be a huge expense.

Coverage for prescription meds is just what the doctor ordered. If you require regular, long-term medications (for example, if you take medicine daily for high cholesterol or diabetes), you can choose insurance with prescription coverage.

Recovery can be long-term and expensive. Even after a person has stabilized after an injury, accident, illness, or disease, the road to full recovery can be long (and pricey!)

For people with disabilities or chronic illnesses, care is required for the rest of their lifetime.

Make sure your insurance covers expenses like physical and occupational therapy, psychiatric rehabilitation, and speech-language pathology.

Lab tests don’t come cheap. Technologies like MRIs, CAT scans, and electrocardiograms have revolutionized healthcare.

They all come with major costs, and more run-of-the-mill tests like blood and urine screening add up too.

Since lab testing is involved in almost all medical procedures, your health insurance should cover it.

Prevention and wellness services should reduce the overall cost of care. Coverage for services designed to maintain good health is money well spent since it will decrease medical expenses in the long run.

Services like counseling, screenings, and immunizations, can all be covered by the right insurance policy.

Care for kids is covered. Children’s health insurance often includes extended coverage like dental and vision care.

What Health Insurance Doesn’t Cover

It’s important to look over policy options

Figure out what isn’t covered since these are the costs you’re going to have to pay for yourself.

Travel vaccinations are on you. If you’re preparing for a trip overseas, it’s often recommended you get vaccinated for illnesses like typhoid or yellow fever.

Just be aware these are typically not covered by health insurance policies and chances are you will have to shell out for them yourself.

Alternative therapies aren’t covered. Services like acupuncture, massage therapy, or chiropractic care are unfortunately not covered by standard health insurance policies.

Many workplace insurance plans have extended coverage for these kinds of procedures, so read your policy carefully since you could be benefiting from these services.

You’ll have to foot the bill for cosmetic surgery. Optional procedures like cosmetic surgery are not vital or life-saving, so they’re usually not covered by health insurance.

No support for long-term nursing home care. Even though people are living longer and longer lives, the almost inevitable long-term care offered in nursing homes isn’t covered by health insurance.

Dental, vision, and hearing is your responsibility. Many workplace health insurance plans include coverage for trips to the dentist, glasses, and hearing aids.

But if you’re shopping the marketplace for your own health insurance plan, you’ll discover these are usually not covered.

No coverage for losing weight. Weight loss surgery or treatment can change lives, but it’s something you’re going to have to pay for yourself.

Some preventative tests aren’t covered. Although most preventative tests (like mammograms and colonoscopies) are covered by health insurance, some (like Prostate Specific Antigen screenings) aren’t.

Not all medications are paid for. Make a list of all the medications you take, and research the different medications covered by different insurance plans.

Insurance companies can pick and choose which medications they cover (as long as minimum coverage is met) so don’t assume yours are included.

Infertility treatment is hugely expensive and isn’t covered. Medical procedures that assist a couple in conceiving a child are sadly not covered by your typical insurance.

For example, in vitro fertilization costs over $10,000 per attempt (and often takes more than one try).

How to Cushion the Cost of Medical Bills

You have the power to reduce the cost of care

Learning how health insurance policies work, and what is and isn’t typically covered, should have opened your eyes to the fact that even with coverage, you’ll likely have to pay to receive medical care.

Fortunately, there are some tips and strategies you can apply to avoid becoming another medical debt statistic.

Following these steps will help you reduce, avoid, and deal with medical debt so it doesn’t overwhelm you like it has for so many Americans.

Put money aside for health costs. Although it doesn’t help reduce the upfront costs of care, creating an emergency health savings account can help you avoid needing to access credit to pay medical bills.

The problem with medical costs is they are usually unexpected, so it’s difficult to come up with the cash to pay for them out of your normal household budget.

You’ll feel protected knowing you’re financially prepared in the event of an unexpected illness, disease, or injury.

One great tip or rule-of-thumb to follow is to always have the equivalent of your insurance policy’s out-of-pocket maximum set aside in a separate savings account.

Carefully screen your providers. One story heard over and over among people who are facing overwhelming medical debt is that the healthcare provider they went to wasn’t covered by their plan.

When you’re choosing a provider, screen them to ensure they accept your insurance.

Always double check your insurance information and make sure your health providers have accurate and up-to-date details about your plan.

Go through your bills with a fine-toothed comb. Hospital billing departments have been known to make mistakes on patients’ invoices.

Common errors resulting in inflated medical costs include duplicate billing, charging for tests or services not rendered, and problems with incorrect codes.

Ask for an itemized bill and go over every single line to ensure it truly reflects the services you received.

Find creative ways to reduce the costs of your healthcare. Offering to pay in cash up front, for example, can often result in a reduction of your bottom line.

So try to pay in cash whenever possible.

Some providers will give a 10% discount if you pay online or over the phone.

Inquiring about receiving care via an outpatient rather than an in-hospital format can reduce the costs by thousands.

Shopping around for healthcare providers and comparing costs is also effective.

You can often expect a provider to match a lower price offered by a competitor if you can show it to them.

Save on prescription meds. Your out-of-pocket expenses for medications can be reduced big-time if you follow a few tips.

Ask your doctor for medication samples. Since they receive them for free they can often pass them along at no cost.

Go generic whenever possible. The only difference between a generic drug and a brand name drug is the label (and the price).

Generic drugs are safe, effective, and FDA-approved, so tell your doctor you’d like to go with a generic option whenever possible.

You should also be selective about the pharmacy you choose.

Some pharmacies are more expensive than others, so it pays to ask around and compare prices among various drugstores.

Save on dental. Since dentist bills aren’t usually covered under personal health insurance plans, you should do everything you can to keep the costs down.

Sorry, that doesn’t mean avoiding going to the dentist altogether.

Rather, look online for deals offered by different dentists’ offices.

Another great tip is to find the nearest dental school.

You can usually get routine procedures like cleanings and fillings at drastically lower prices.

Get a second opinion. Always talk to a second provider to get their opinion on your care options.

Sometimes a recommended expensive procedure isn’t necessary at all.

Sign up for a payment plan. Hospitals would much rather get paid over time than not get paid at all (which is what happens if you go bankrupt).

Most providers will give you the option of paying over time, usually at little or no interest, through a fixed monthly payment plan.

Pay less for glasses. Expensive vision carecosts can be reduced by buying your glasses online.

As long as you have a copy of your prescription you can get a perfectly good pair of glasses without visiting an optician.

Even With Health Insurance, Medical Bills Can Go Out of Control

Health insurance isn’t a safeguard against every unfortunate event—but it certainly does help

You did the right thing for you and your family by getting health insurance coverage.

For me, my family is my most treasured possession—without them, there’s not much meaning to life.

So I know, like me, you would do anything for your family.

You’d hate to feel they’re not protected against any possible illness and its associated medical cost.

But it’s a bit of an eye-opener when you realize health insurance policies only go so far, leaving you vulnerable to debt due to the significant costs you’re liable to pay for if you don’t make the right moves.

Fortunately, by using the tips I’ve shared here, you can reduce, avoid, and deal with medical bills in knowledgeable and well-informed ways.

There are too many Americans who are being chased incessantly by collection agencies due to medical debt.

Statistics also show medical debt is the #1 cause of bankruptcy, which is frustrating to me since I know many of those could have been avoided—if only they had access to the information and tools we provide at CreditLoan.com.

So I hope you will use the information you’ve just learned to choose the right coverage and minimize the amount of money you have to pay for your family’s healthcare.

Do you have any experiences or tips when it comes to saving money on medical expenses?

If so, please share them in the comments below!

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.