Anthem® Insurance Review

Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding co...

Meggan McCain

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Michael Vereecke

Updated November 2023

If you’re looking for reliable, reputable information and reviews on Anthem BlueCross BlueShield health insurance – look no further. Our in-depth guide answers the most common questions about Anthem BlueCross BlueShield while providing detailed information on their services, policies, strengths and weaknesses.

If you’re looking for a new insurance company, or if your employer has switched to Anthem BlueCross BlueShield and you want to know what to expect, this review will help you better understand the basics. Read on for all the details.

What is Anthem?

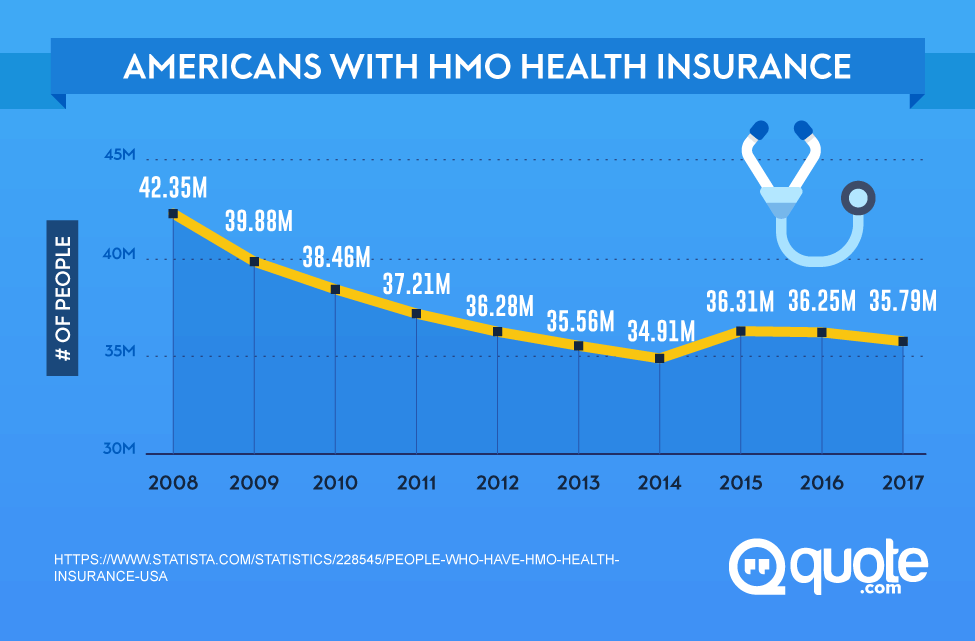

Anthem was formed when Anthem, Inc. and WellPoint Health Networks Inc. merged in 2004, creating one of the largest health benefits companies in the U.S. They provide a wide range of health care plans through their affiliates as well as specialty products, including life insurance, disability insurance, dental, vision, behavioral health and long term care insurance as well as flexible spending accounts.

History and origin

Back in 1992, Blue Cross of California created WellPoint Health Networks, a for-profit healthcare management system. During this time, Anthem was a separate company. Over the years, both WellPoint Health Networks and Anthem merged and acquired a wide range of related health companies, including many BlueCross BlueShield companies across various states where they now operate as a merged company under the WellPoint brand and offered under the Anthem name.

What are the products/services offered by Anthem Insurance?

Anthem-affiliated healthcare products and services comprise a wide range of health-related insurance plans including:

- PPOs – Preferred Provider Organization – a network of providers who have elected to accept the aforementioned insurance. You can see any doctor or specialist outside of this network, however your benefits will be better and your payment lower if you stay in-network. You do not need to see a primary care physician in order to determine the course of action for your treatment.

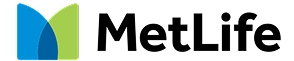

- HMOs – Health Maintenance Organization – HMOs are made up of a network of providers much like POs, except care is only covered within the network. HMOs typically have more restrictions on coverage than other types of plans, including requiring you to see your primary care physician to obtain a referral to see a specialist. Some HMOs do not have this restrictions. By choosing to see doctors within your network, you will pay a lower premium and a low (or no) deductible.

- Medicaid and Medicare Plans – Low cost and combined coverage for children and adults. Medicare plans include Medicare supplement plans, Medicare advantage plans, prescription drug coverage and more.

- Health Savings Accounts – HSAs are a type of savings account that can be used together with a higher deductible insurance policy where money can be used tax-free to help pay for medical expenses.

- Dental, Vision, Employer/Group Plans, Individual Health Insurance and Related Services, including COBRA administration.

What is covered by the insurance?

The coverage you obtain through Anthem BlueCross BlueShield will depend entirely upon which type of health insurance product you choose, the state you live in and many other factors. It is impossible for any single guide to cover the extensive options available from Anthem BlueCross BlueShield plans.

There are both traditional and more modern health insurance plans available, as well as hybrid plans, such as the Blue Access HAS PPO which combines a PPO plan with the cost savings of a high deductible health insurance plan and a tax-advantaged health savings account. If you’re looking to save money, there are also plans such as the Essential PPO which covers more costly care including emergency room visits and surgery.

There are individual and group plans as well as prescription drug plans, Medicare and Medicaid plans. Dental, Vision, FEP and Behavioral Health programs are also available.

What are the policies offered?

In order to get the most accurate information on policies available in your area, as well as rates, you should get a quote. This will not only provide you with a wide range of policies that offer flexible and affordable coverage that fits your needs, but also take into account specifics that can affect your rate, such as your health and lifestyle, where you live and so on.

You’ll find that Anthem BlueCross BlueShield offers a number of HMO and PPO plans along with combination plans that borrow from various features to allow you to choose a plan that more realistically meets your needs and budget.

What are the rates of the policies offered?

The amount you’ll pay for your Anthem BlueCross BlueShield insurance will depend on the coverage you want, as well as the deductible you choose. For example, one plan for a 27 year old non-smoker costs around $54 per month, although it has a high deductible. Another plan for the same person costs $102 per month and provides improved coverage with a more reasonable $2,500 deductible.

You’ll need to carefully weigh your options in terms of how much you can reasonably afford to spend on premiums versus deductible and how much coverage that affords you. Should you have any questions, you can speak with agents via the site’s Live Chat option to get answers to more complex questions.

How do I know which policy is the best fit for me?

Since there’s no “one size fits all” answer when it comes to health insurance, we recommend you take the time to look through all of the plans thoroughly while weighing the costs and the benefits carefully. Should you have any questions, the Anthem BlueCross BlueShield website is easy to navigate and features live chat with actual agents who can answer your questions and help direct you toward the plans that are available for your specific needs in your local area. It costs you nothing to get a quote, so take a closer look and don’t be afraid to comparison shop different plans to help you find the right fit.

Canceling your Anthem Insurance Policy

Whether you’re moving, changing jobs or you’ve had another important life change or event, sometimes you need to cancel your insurance policy. In order to cancel your Anthem BlueCross BlueShield policy, you’ll need to notify the company.

For group insurance, an employer can either complete a Member Change Form or fill out the relevant cancellation information as part of the Group Bill you receive. If insurance is ending for a member of the group because of:

- A member of the group divorces (if their former spouse was terminated)

- An employee has died (even if the dependents are electing to choose COBRA coverage)

- An employee or spouse and/or dependent(s) become ineligible for coverage

- An employee leaves the group

- A dependent child reaches the age limit of the group or marries

- A dependent dies

You should notify Anthem right away. The company recommends submitting the termination details before the effective date since it reduces the chance of the group having to pay claims for services rendered after the member was terminated. You can notify them before or during the month the termination is effective or request a specific date for insurance to be canceled. Requests should be received within 60 days of the termination date, according to Anthem.

Should you encounter any issues, it’s recommended that you fill out Anthem’s customer service form. You can also contact Group Administrator and Sales Support at 1-800-421-1880 for HMO plans and 1-800-451-1527 for all other plans, Monday through Friday from 8:00am-6:00pm Eastern Time.

Can you cancel it at any time?

You can cancel your Anthem BlueCross BlueShield insurance plan at any time by following the steps above. You can also email help@anthem.com although customers

Anthem Insurance strengths

Although it is a relatively young company as far as insurance companies go, Anthem brings a number of formidable strengths to the forefront, choosing to focus on a broad range of plans and products, endeavoring to create something for everyone. Here are their most notable strengths:

Affordable health insurance

Many of Anthem’s individual and group health insurance plans are considered reasonable as far as plan prices and premiums go. This puts insurance within the reach of even limited budgets, a feature that is a must-have for many people in this day and age where healthcare costs can often lead to bankruptcy.

Once you become a member, you enjoy many discounts

Anthem policyholders enjoy a wide range of discounts on a number of products and services. For example, members can save money on pet health insurance, groceries, beauty and skin care, medical weight loss programs and much more. For many members, this generous discounts can make a significant improvement in their health and wellness, as well as in the wellness of those they care about.

LiveHealth Online resource allows you to connect with a doctor live

The LIveHealth Online system from Anthem BlueCross BlueShield is an easy way to reach out to a board certified doctor any time of the day or night from your computer or mobile device. Common conditions treated over the LiveHealth Online system include coughs and colds, minor rashes, allergies, fever, flu and more. The LiveHealth Online app is available on both Apple and Android devices.

To use the LiveHealth Online system, simply sign up, choose a doctor, ask them questions or let them assess your condition live and if needed (depending on physician judgment and state regulation) provide a prescription.

A wide range of versatile plans

Anthem has one of the largest variety of plans, ranging from HMOs to PPOs to HSAs and everything in between. Their flexible health insurance plans can help you narrow down the right choice for yourself and your family. And should you have any trouble navigating the alphabet soup of acronyms and health care plans, live agents are always a call or click away.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Anthem Insurance weaknesses

No insurance company is perfect, and it’s important to know about the drawbacks before you make your decision. With Anthem BlueCross BlueShield, you should know:

Anthem BlueCross BlueShield operates only in the following states:

- Colorado

- Nevada

- Connecticut

- Indiana

- Kentucky

- Maine

- Missouri

- New Hampshire

- Ohio

- Virginia

- Wisconsin

Most insurance providers operate in many more states, offering benefits to a much larger population as a whole. The fact that Anthem BlueCross BlueShield operates in so few states makes its benefits limited nationwide as a whole.

Does not have much selection for family plans

If you’re looking for a comprehensive plan for your family, you may find better, more competitively priced family insurance plans from other providers. Despite its versatility and the wide number of plans offered, Anthem simply falls short when it comes to family plans.

Less than stellar customer reviews

Customers often report having difficulty getting Anthem to pay on claims in a thorough and timely manner. They also state that it’s difficult to reach customer service for simple things such as customers not showing in the system, or getting claims resolved. Oftentimes, customers who were asked for Anthem BlueCross BlueShield reviews comment on having to spend hours on hold.

How to file an insurance claim with Anthem

Both medical and behavioral health claims made by participating network providers are submitted by the provider directly to Anthem BCBS. If you see a provider that is not in the network and need to submit your claim to Anthem for processing, please click here to go to a non-network claim form or submit claim forms to:

Anthem Blue Cross Blue Shield P.O. Box 105187 Atlanta, GA 30348-5187

Should you have questions about your claims, contact Anthem BlueCross BlueShield directly at 1-866-645-4135 from 8am-8pm Eastern Time, Monday through Friday.

What Do Customers Have to Say about Anthem’s Products and Services?

Anthem customers are generally pooled into the Anthem program because they are either the only provider in the policyholders’ area, or they are the provider chosen by the user’s employer. The overwhelming user sentiment is that if they had a choice, they would not recommend Anthem simply because of the company’s cost-saving measures, the questionable claims processing and cumbersome customer service.

Overall, many customers feel that Anthem has a lot of work to do in order to improve its customer support. They are of the general opinion that there are comparable plans offered by other companies which are more affordable and offer more benefits – particularly for families.

What are the most common complaints about Anthem Insurance?

Customers typically complain about the company’s customer service failing to recognize them in the system, losing IDs, balking at paying claims and other common customer support issues.

Do products/services offered differ from state to state?

Many health insurance companies, despite being under a single brand umbrella, offer different services and products in different states, as well as different plans. Anthem is no different. If you are in the market for a new health insurance plan, the options that are available to you will depend on where you live, among other things. Be sure to get a no obligation quote risk free to see what kinds of benefits you can enjoy as an Anthem customer.

FAQ

It’s understandable to have some questions about Anthem BlueCross BlueShield, even after reading an in-depth guide like this one. We’re happy to provide answers to the most common questions we’ve received about Anthem BCBS all in one place.

Thinking of going with Anthem Insurance – Our verdict

For the sheer variety of plans and products available, it’s hard to beat Anthem Blue Cross Blue Shield. What’s more, they’ve invested a considerable amount of money into ensuring that their technology and the resources available to policyholders is second to none. To hear customers tell it, however, they’d wish the company would have invested more in actually processing claims and providing attentive, helpful customer service. Many of the plans for families are few and far between – which represents a huge chunk of the health insurance-seeking population.

Simply put, although there are a wide range of plans available, there are simple more options with more benefits at better prices for everyone from other insurance providers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.