Erie ® Auto Insurance vs. MetLife ®

Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding co...

Meggan McCain

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Michael Vereecke

Updated July 2021

The Winner

MetLife is a better option by a slim margin

Deciding on a clear winner between these two companies was difficult, but Erie Auto was hindered by its limited service area.

Serving only 11 states compared to MetLife Auto’s 50 states, Erie lacks the reach necessary to be a serious competitor to MetLife.

MetLife excels in claims resolution and digital services, while Erie lags behind in both categories.

However, Erie does have a better customer service reputation than MetLife and lower average costs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why You Should Consider These Companies

Though both companies provide auto insurance, MetLife serves a larger area and this size is reflected in its discount structure, while Erie focuses more on the individual.

Both fall in the middle of the auto insurance marketplace

While the two companies have a wide gap in terms of their service area, neither one can compare to the giants in the industry like State Farm, Progressive, and Geico.

You’re an ideal customer for MetLife Auto if you belong to one of its affiliated groups

MetLife Auto Insurance is just one of a total of nine companies that operate under the MetLife banner.

The company as a whole is one of the largest providers of insurance in the United States.

The most notable policy rate discounts are found in MetLife’s affiliated group rates.

If you belong to a major company like Bank of America, or are a member of the PTA, you may qualify for a rate reduction.

You’re an ideal customer for Erie Auto Insurance if you qualify for multiple personal discounts

Despite its small national size, Erie Auto Insurance is the second largest automotive insurer in Pennsylvania.

It gives a number of personal discounts that MetLife does not.

If you live in one of the 11 states the company serves and can qualify for several of these discounts, you’ll see notable savings on your rates.

The Winner’s Strengths

MetLife provides coverage options that many other companies do not and serves all 50 states, but can be difficult to reach when needed.

However, once you are able to get through to a customer service agent, you can expect a fast resolution of your claim.

MetLife is a better option because it is more available

All other considerations aside, MetLife Auto Insurance is available in all 50 states.

Erie Auto Insurance is only available in 11 states.

MetLife Auto Insurance also offers uncommon coverage options that make it ideal for customers who may want to customize their policies with some special additions.

People love the company because of the deductible savings benefit

Every year you remain accident-free, your deductible goes down by $50.

This greatly benefits and rewards perpetually-safe drivers, and the overall rates for MetLife fall somewhere in the middle of the spectrum.

Customers find it strikes a good balance between affordability and service.

MetLife pays claims quickly. Several customers report their claims and repairs getting handled within less than a week.

Customers appreciate a fast resolution to their claim, especially when they know how much paperwork is involved.

The primary complaint about it is a lack of customer service

MetLife does many things right, but it can be difficult to reach a customer care representative on the phone.

Multiple customers report wait times between three and six hours to reach an agent during peak times, and this problem is compounded by a limited number of business hours.

Counterargument

Erie is a great company with a lot of strengths, but its limited service area makes it viable only for the people who live in select regions.

If the company were to expand its services nationwide, it would serve as a more formidable competitor to MetLife.

Erie has affordable rates, multiple discounts, and accident forgiveness

Erie may only offer coverage in 11 states, but if you live in one of those states it may be the better choice for you.

If you’re looking for lower overall premiums and deductibles, Erie tends to beat out MetLife head-to-head.

The company is one of the most popular auto insurance companies in the 11 states where it is available.

People love the company for its rate lock-ins

Unstable auto insurance premiums can cause undue amounts of stress, but Erie avoids this with the ERIE Rate Lock feature.

This prevents your rates from changing (even if you file a claim) until you make predetermined changes to your policy, like adding or removing a driver or vehicle.

It also enables you to make a change to your policy and see your premium adjusted based solely on that specific change.

Erie covers injuries to your pets. Everyone knows that our four-legged friends are like members of the family, but if they’re injured in an accident, few insurance companies pay for their veterinary bills.

Erie actually provides pet coverage for injuries that happen in the event of a collision.

The main complaint about it is the limited service area

If you want service from Erie, you’ll need to live in one of the following states: Illinois, Pennsylvania, Maryland, Tennessee, New York, North Carolina, Virginia, Ohio, West Virginia, or Wisconsin.

The reason for all this limitation is that there are simply better and worse states for car insurance, and it’s a good idea toknow which states to avoid.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How the Services Compare

MetLife Auto and Erie Auto both excel in different areas.

If you belong to a number of groups, MetLife may have the more favorable rates.

But if you live in one of the states Erie serves, it is worth getting a quote from them to find out what their price may be.

They both provide affordable insurance with potential for numerous discounts

It’s been said that automotive insurance is likepaying for a service you later have to pay to use.

Your premiums help pay for the repairs you’re hoping you will never need.

These companies help soften the blow by providing affordable rates on premiums and deductibles while also providing numerous discounts and other coverage options that make you feel paying for insurance more worthwhile.

On a side note, both companies provide boat insurance, motorcycle insurance, and RV insurance aside from auto insurance.

The good and bad about MetLife’s services

MetLife lets you get a quote online in just a few minutes, and the company offers large numbers of company and group discounts.

If you’re a member of any major organization, or work for a large company, you may qualify for significant savings on your premiums each month.

On the other hand, MetLife has a less-than-stellar reputation when it comes to customer service.

Getting in touch with someone who can help can take hours, and even if you’re lucky enough to finally reach someone on the other end, customers report that many agents seem unorganized and confused about what they can or can’t do.

MetLife premiums average $1,668 annually for a 25-year-old driver. These rates can be reduced through a few discounts, but compared to many other auto insurance companies, MetLife’s discount options are limited.

The most significant savings come from group affiliations. Working for an affiliated company, or being a member of one of MetLife’s preferred groups, can net excellent rates on auto insurance.

MetLife doesn’t charge a deductible for glass repair. If you’re driving down the highway and a rock flies up and cracks your windshield, you can fix it without paying a deductible—a standard MetLife auto insurance policy.

The good and bad about Erie’s services

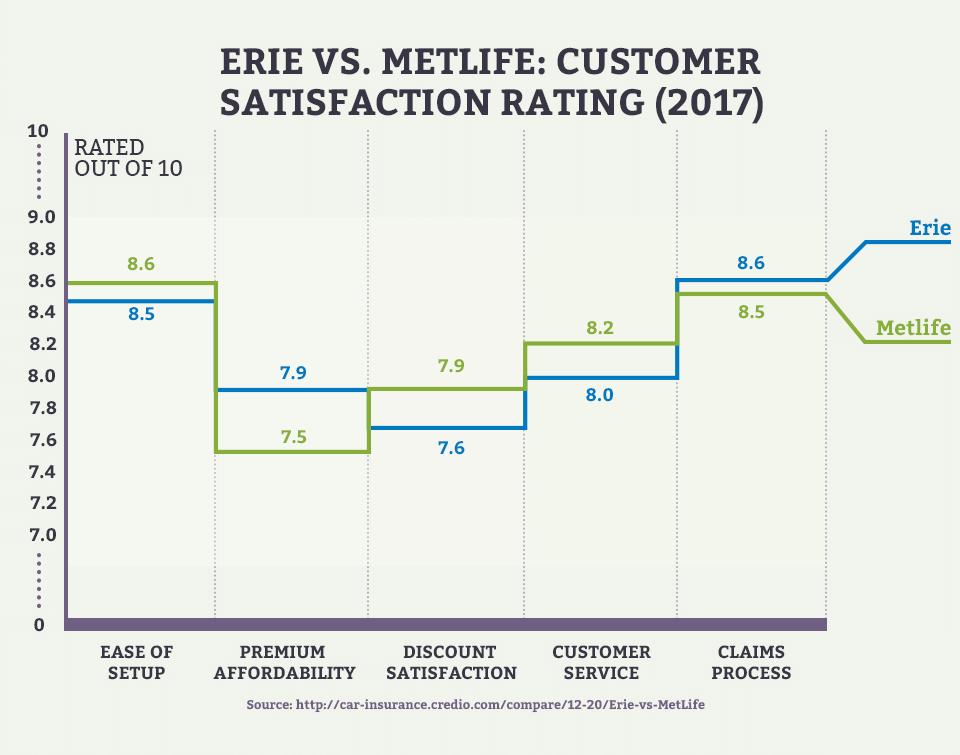

Erie has a great customer service reputation and netted 5 out of 5 in JD Power’s overall purchase experience evaluation.

The company also offers lower individual rates on policies than MetLife.

The tradeoff is that Erie is not widely available to all consumers.

Customers also say the company can take a long time to handle a claim while also being difficult to reach when you want to find out the status of your car’s repairs.

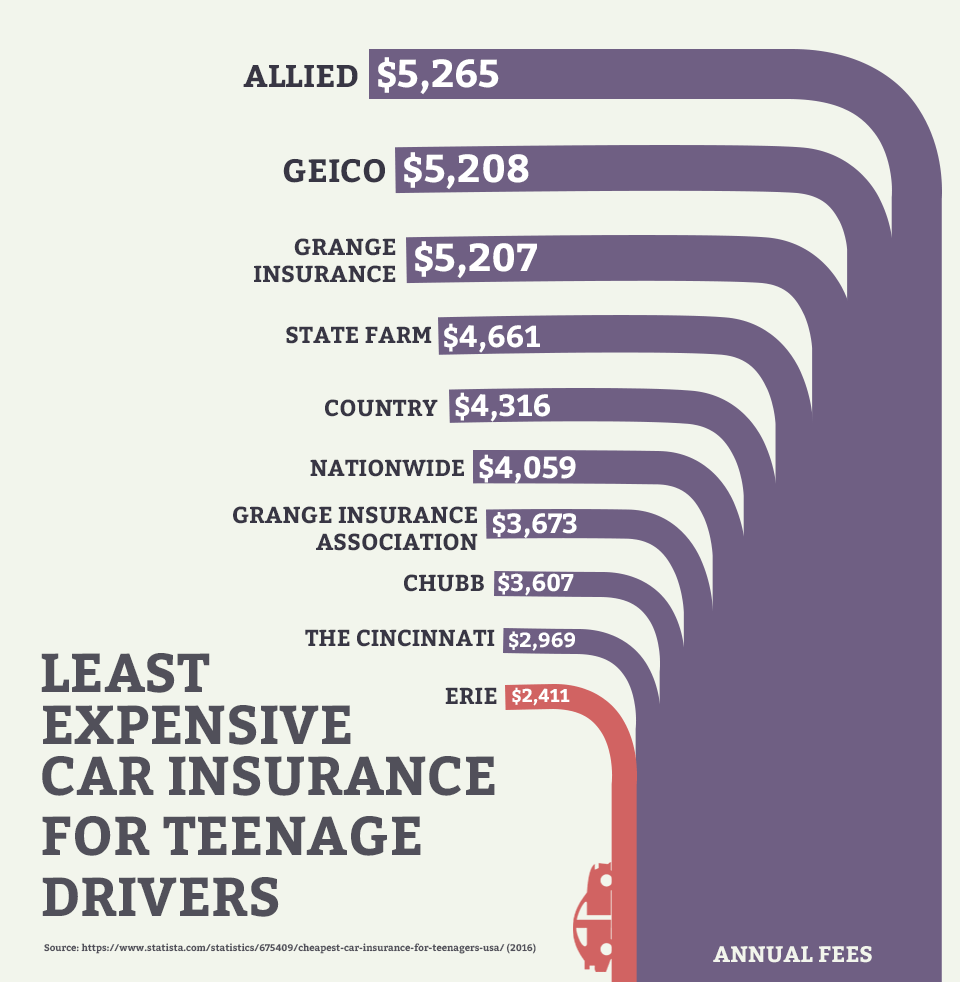

Erie provides Teen Driver Insurance. Insuring a young driver is expensive.

While getting a license is exciting, it’s also the most dangerous time for young people to be on the road—they’re inexperienced and don’t know how to respond to certain situations the same way a road-savvy adult would.

Erie provides discounts to help offset the cost of insuring a young driver like Youthful Driver Discounts, Youthful Longevity Discounts, and Driver Training Discounts.

Erie also protects your pets. Erie provides built-in pet coverage. If your pet is injured in an accident, Erie will pay up to $500 per pet, to a maximum of $1,000.

Your personal items are covered. Most people think about auto insurance and how it helps cover car damage and bodily injury, but your personal possessions can be damaged in an accident too.

Personal item coverage provides up to $350 in coverage for personal items inside an insured vehicle.

Rewards and Bonuses

They both have potential for discounts … but Erie takes the win

Erie Auto Insurance’s limited area helps to keep costs lower and creates the potential for more personalized service.

In addition, Erie offers a number of potential discounts for individual policies.

MetLife provides significant discounts for group affiliations such as the PTA, Bank of America, and many others.

MetLife provides numerous group discounts but lacks many personal discounts

The company provides personal discounts for:

- Deductible Savings Benefit

- Defensive Driver Discount

- Superior Driver Discount

- Multi-policy Discount

- Good Student Discount

MetLife also provides MetRewards, a program that can save 20% on your policy costs if you have no claims or violations for five years.

However, the most significant savings come from being a member of the company’s many qualifying groups.

These policies continue to function even if you leave the group.

Despite the potential for savings, MetLife lacks many of the other discounts that its competitors provide.

Unless you are a member of one of the qualifying groups, you may not be able to save as much on your policy premium payments each month as you would like.

Erie lacks strong group discounts but gives numerous personal discounts

What Erie doesn’t have in the way of group discounts the company more than makes up for in personal discounts:

- Safe Driving Discount

- Multi-Car Discount

- Reduced Usage Discount

- Anti-Lock Brake Discount

- Anti-Theft Device Discount

- Annual Payment Plan Discount

- Multi-Policy Discount

- Young Driver Discount

Some of the discounts can save as much as 30% depending on where you live.

However, the company lacks the affiliations that MetLife has.

There are few to no group discounts offered to Erie customers.

Benefits

Though both companies offer auto insurance, the individual features and benefits are where they truly shine.

Erie’s Rate Lock and MetLife’s New Car Replacement are the two most notable ones out of their respective list of features.

MetLife will replace your car if it’s totaled

If you wreck your car within the first year of owning or it within the first 15,000 miles, you can have the entire vehicle repaired or replaced with a brand-new car—and no deduction for depreciation.

Erie guarantees your rate won’t change because of filing a claim

Normally, filing a claim would affect your insurance rate.

Erie Rate Lock protects you from rate hikes until you make certain changes to your policy.

You’ll need to add or remove a driver or a vehicle before you see any change in your policy, even if you do file a claim.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Costs and Fees

Erie has slightly lower rates

Although Erie’s rates are lower overall, customers of both companies can save money on their premiums by paying annually.

MetLife customers save an average of $536 per year with group discounts, while Erie customers save as much as 20–30% by stacking discounts.

Customer Service

I’ve always believed that “good business is personal.”

But while excellent customer service is great, you have to remember you rarely communicate with your insurance company, except when you’re filing a claim.

Because of that, MetLife is the better option due to fast claim resolution times.

No one wants to be without a vehicle because their insurance company takes too long with paperwork.

Erie has consistently high customer service reviews across the board

Erie is known for its excellent customer service, while customer service is one of MetLife’s largest complaints.

In Forbes’ list of insurance companies with the highest J.D. Power customer satisfaction ratings, Erie comes in at eight while MetLife comes in at ninth place.

MetLife lags behind in customer service but excels at claims handling

MetLife customers complain about the length of time it takes to reach someone by phone, while others report poor attitudes on part of the customer service agents.

However, the company is known for the speed at which claims are resolved and paid out.

Erie has above-average customer service ratings but takes time to process claims

Erie has high ratings from numerous evaluation agencies about its customer service, but customers report long claim resolution periods.

Other customers report difficulty when trying to reach a customer service agent regarding a claim.

Key Digital Services

Both companies provide quick and easy online quotes

When it comes to getting a car insurance quote, no one wants to have to pick up the phone until they’re ready to talk specifics.

Both MetLife and Erie Auto Insurance give potential customers the ability to get online quotes with minimal hassle and time.

MetLife has multiple apps to help users track their driving and insurance

There are three main apps from MetLife: My Journey, MetLife Infinity, and MetLife US.

My Journey tracks driving for a usage-based insurance program. The app can detect mileage, time of day, driving habits like hard braking and acceleration, whether you’re using the phone while driving, and even the road type and conditions.

It awards points at the end of each trip on a scale from 1–100, with 100 being the perfect sore.

MetLife Infinity lets you upload photos, videos, and documents. This app can be particularly useful in an accident.

You can use it to upload video and photographic documentation of the damage to both vehicles and roadway conditions.

MetLife US is your insurance-on-the-go app. This app lets you submit accident claims, check your auto insurance policy summary, pay bills, and much more, all from your phone.

Erie lacks an online app but has a website full of utility

What Erie doesn’t have in smartphone apps it more than makes up for with its feature-packed website.

The Erie website lets you find a nearby agent, pay your bill, file a claim, and find a repair shop.

The Erie website also contains a blog with information about improving safe driving, travel, and day-to-day life.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Takeaway

When it comes to digital services, MetLife comes out head and shoulders above Erie with not one, but three smartphone apps.

FAQ

MetLife is a better choice than Erie for automotive coverage

MetLife’s availability to customers in all 50 states sets it apart.

No matter how many positives Erie has going for it, the lack of nation-wide availability is a shortcoming that cannot be overlooked.

A company can’t thrive without enough customers—something that MetLife has in droves.

But that’s not to say that MetLife is perfect.

The company has problems with customer service, but the fast claims resolution helps to offset the inconvenience a bit.

We’d happily recommend MetLife, but if you live in one of the states served by Erie Insurance, get a quote from both companies to find out first-hand which of the two is the better option for you.

We know finding the right insurance can seem complicated at times.

That’s why Quote.com is here to help—guiding you to the insurance you need for the lowest price possible, allowing you to save $500 or more on annual premiums.

Are you insured by either Erie or MetLife?

Any personal story you have that supports or contradicts our review?

Let us know in the comments below!

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.