10 Best Car Insurance Companies in 2026 (Check Out These Providers)

The best car insurance companies are provided by State Farm, Geico, and Progressive, which offer competitive rates starting at $65/month. These providers excel with comprehensive coverage, tailored options for young drivers, low rates, and advanced online tools to find the best fit for your needs.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding co...

Meggan McCain

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Michael Vereecke

Updated February 2026

Amica, Nationwide, and USAA are the best car insurance companies. State Farm is the top pick for excellent customer service and tailored policies for young drivers.

[head_page_categoriesx=”4″]

Amica rewards policyholders with annual dividends regardless of driving record, and USAA has the best car insurance for military members, starting at $65 per month.

Our Top 10 Picks!: Best Car Insurance Companies| Company | Rank | Claims Satisfaction | Safe Driver | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 647 / 1,000 | 20% | Young Drivers | State Farm | |

| #2 | 709 / 1,000 | 15% | Customer Service | Amica | |

| #3 | 759 / 1,000 | 10% | Military Families | USAA | |

| #4 | 638 / 1,000 | 10% | Online Tools | Progressive | |

| #5 | 629 / 1,000 | 18% | Accident Forgiveness | Allstate | |

| #6 | 628 / 1,000 | 12% | Comprehensive Coverage | Nationwide | |

| #7 | 622 / 1,000 | 20% | Rideshare & Delivery | Farmers | |

| #8 | 622 / 1,000 | 15% | Low Rates | Geico | |

| #9 | 616 / 1,000 | 20% | New Car Replacement | Liberty Mutual |

| #10 | 613 / 1,000 | 17% | Hybrid Vehicles | Travelers |

Finding the best auto insurance for you depends on your driving history and whether you need liability vs. full coverage insurance. Compare the top 10 auto insurance companies now to find the right provider.

- Amica is the top pick for high customer satisfaction ratings

- USAA and Geico are the cheapest car insurance companies

- Amica also has the biggest multi-policy discount of 30%

Get the right car insurance at the best price by entering your ZIP code and shopping for coverage from the top insurance companies in your state.

Compare the Best Car Insurance Rates by Company

USAA has the lowest monthly car insurance rates of the providers in our ranking, starting at $32 per month for liability insurance coverage.

However, USAA only sells coverage to military members, making Geico and State Farm the best auto insurance companies with low rates for most drivers.

Car Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $95 | $195 | |

| $85 | $180 | |

| $93 | $198 | |

| $75 | $170 | |

| $90 | $185 |

| $88 | $190 | |

| $78 | $175 | |

| $87 | $195 | |

| $98 | $198 | |

| $65 | $160 |

Full coverage usually costs more since it offers more protection. However, USAA and Geico are the cheapest options, starting at just $84 a month.

Full coverage bundles liability, collision, and comprehensive insurance, protecting you for damages you cause to others and repairs to your own car.

So, it’s important to consider your coverage needs before buying a policy. Check out our review of State Farm vs. Farmers, Geico, Progressive, and Allstate auto insurance for a closer comparison.

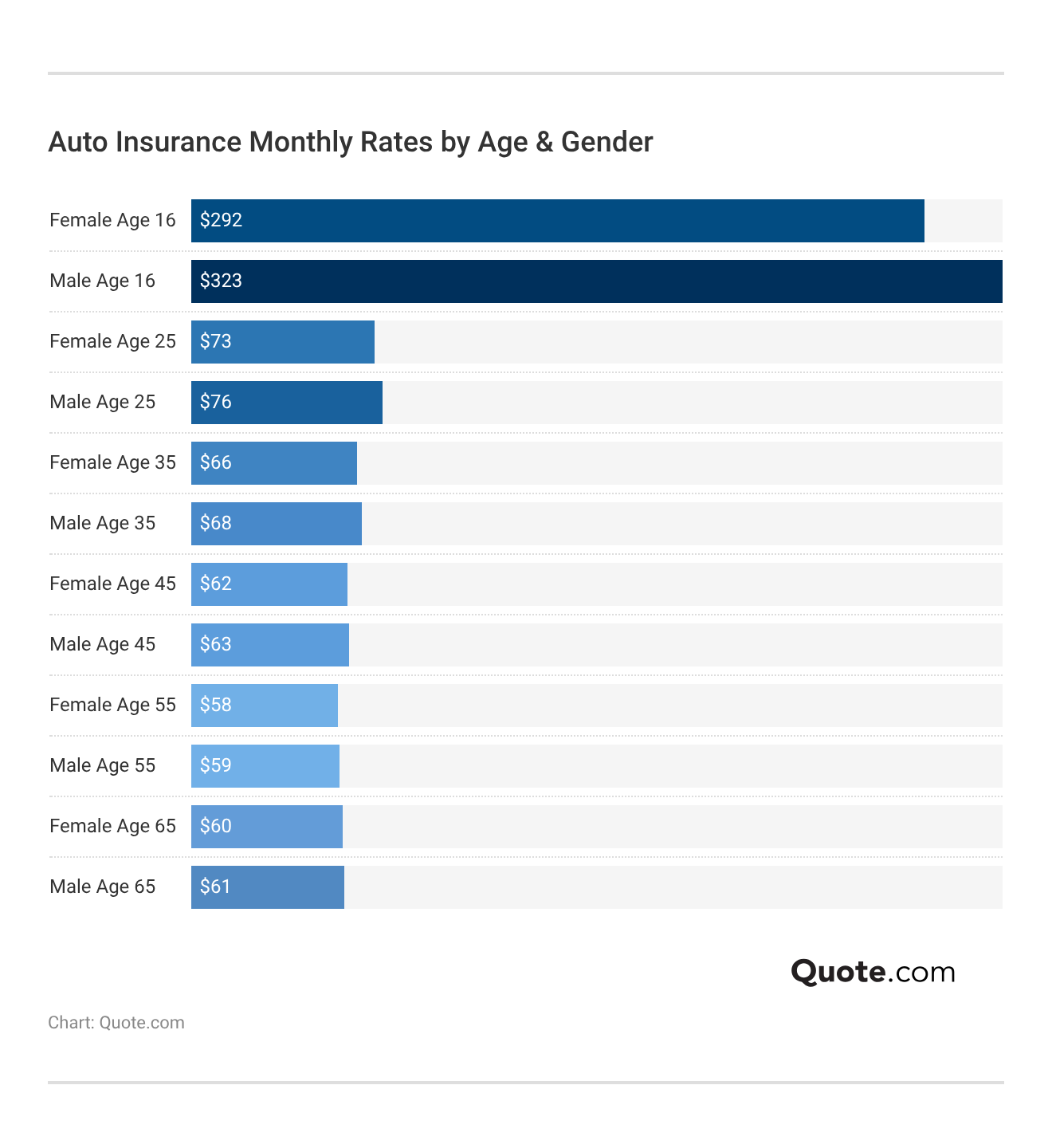

You’ll also find rates vary by factors like age and gender. Insurers often see younger drivers as higher risk, while men are statistically more likely to get in accidents.

Depending on your driving history, the best auto insurance for good drivers may not be the right fit for someone with accidents or DUIs on their record.

All insurance companies weigh risk differently, so the cheapest option for one driver may be more expensive for another.

[table “1182” not found /]State Farm and USAA have the best car insurance after a speeding ticket, accident, or DUI, followed by Progressive.

Geico remains competitive, but drivers with a DUI conviction pay three times as much as drivers with a clean driving record.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

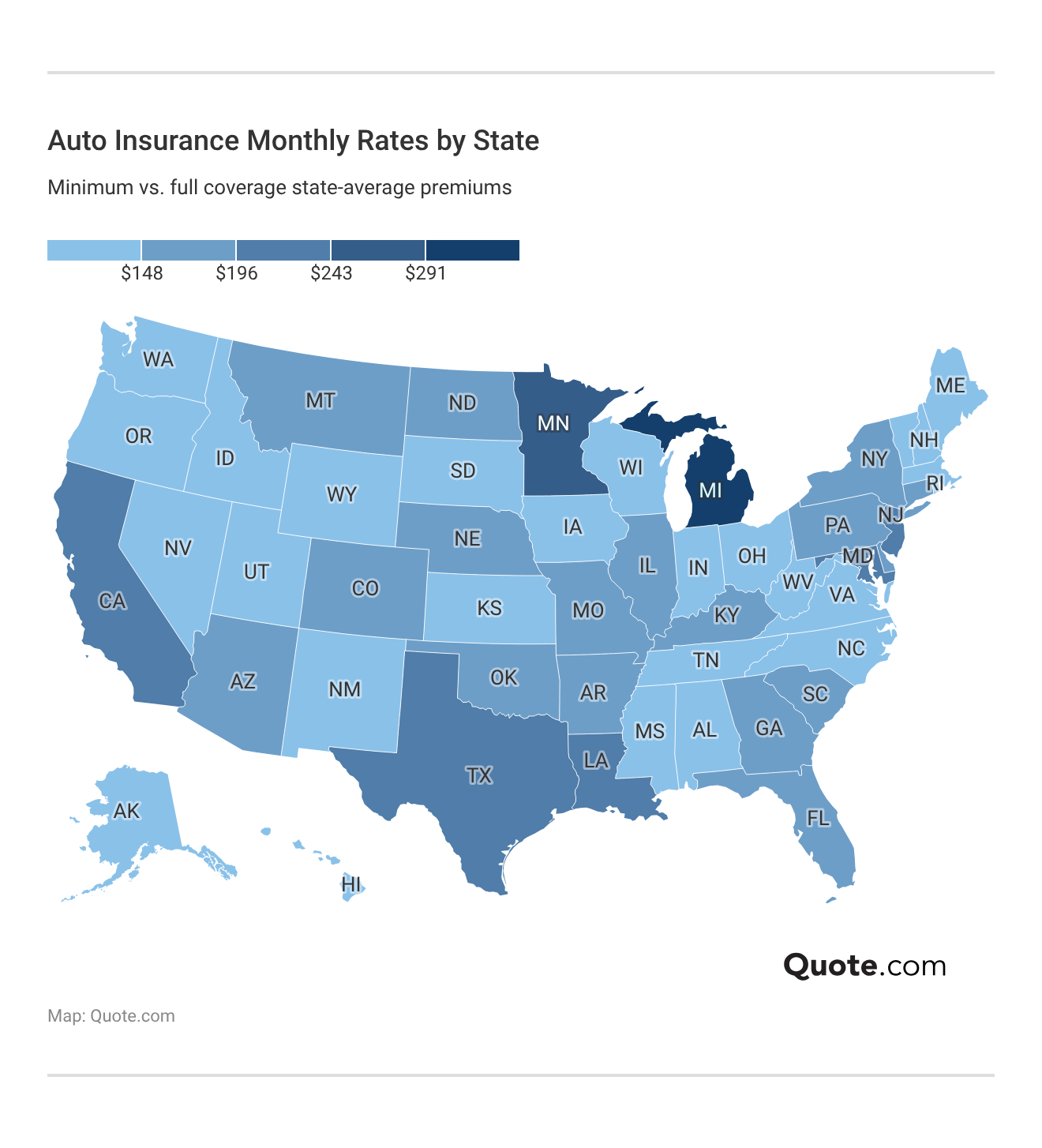

Best Car Insurance Companies by State

Rates and coverage options vary by location, so the top car insurance companies in the U.S. may be different from the best in your state.

In some areas, smaller regional companies may provide lower rates or deliver better service than well-known national providers.

For example, The Hanover offers coverage in various states across the Northeast and Midwest. They’re best known in Massachusetts, where the company was founded.

At Quote.com, we ranked the best car insurance providers in each state. See which ones stand out for coverage and value in your state:

Compare Car Insurance by StateTypes of Car Insurance Coverage Explained

Every state requires some level of liability auto insurance, while car loans and lease agreements will require full coverage.

If you buy full coverage insurance, your policy will be eligible for add-ons that enhance your protection on the road and reduce your out-of-pocket costs.

List of Common Auto Insurance Coverages| Coverage | What It Covers |

|---|---|

| Liability | Damage or injuries you cause to others in an accident |

| Collision | Repairs or replacement of your car after a crash |

| Comprehensive | Non-crash damage like theft, weather, vandalism, animals |

| Uninsured/Underinsured Motorist | Injuries or damage from uninsured drivers |

| Medical Payments (MedPay) | Medical bills for you and passengers after an accident |

| Personal Injury Protection (PIP) | Medical expenses and lost wages after a crash |

| Gap Insurance | Difference between car value and loan if totaled |

| Rental Reimbursement | Rental car costs while your car is repaired |

| Roadside Assistance | Towing, jump-starts, flat tires, lockouts |

| Custom Equipment | Aftermarket parts or upgrades not in standard policies |

Roadside assistance is the most popular add-on, available at every company. This coverage kicks in to pay for towing, tire replacement, gas delivery, and more if your car breaks down and leaves you stranded.

Another common add-on is new car replacement, which provides a brand-new version of the same make and model if your car gets totaled within the first few years.

Top Auto Insurance Add-On Coverage Options

Top Auto Insurance Add-On Coverage Options| Insurance Company | Gap Insurance | New Car Replacement | Rideshare Coverage | Roadside Assistance | Vanishing Deductibles |

|---|---|---|---|---|---|

| ✅ | ✅ | ✅ | ✅ | ❌ | |

| ❌ | ✅ | ❌ | ✅ | ✅ | |

| ✅ | ❌ | ✅ | ✅ | ✅ | |

| ❌ | ❌ | ✅ | ✅ | ❌ | |

| ✅ | ✅ | ❌ | ✅ | ❌ |

| ✅ | ✅ | ❌ | ✅ | ✅ | |

| ✅ | ❌ | ✅ | ✅ | ✅ | |

| ❌ | ❌ | ✅ | ✅ | ❌ | |

| ❌ | ✅ | ❌ | ✅ | ✅ | |

| ✅ | ✅ | ❌ | ✅ | ❌ |

However, availability varies from company to company. Speak with an insurance representative to discuss coverage options before buying coverage.

The best auto insurance for you will depend on your coverage needs, so always compare before you buy (Learn More: How to Get Multiple Auto Insurance Quotes).

How to Choose the Best Car Insurance for You

When selecting from the best auto insurance companies, a myriad of factors influence the final decision beyond just the price.

Before deciding on a car insurance company, consider these four key factors to find the best auto insurance company for you.

- Coverage Options: From basic liability to comprehensive coverage, the breadth and flexibility of policy options play a pivotal role in whether you can save more money on car insurance.

- Customer Service: The responsiveness and support provided by the insurance company can greatly impact the overall satisfaction, especially when claims arise.

- Claims Process: A streamlined and transparent claims process reduces hassle and ensures timely support during stressful times.

- Financial Stability: The insurer’s ability to fulfill its financial obligations reflects its long-term reliability and trustworthiness.

The goal is not just to find affordable car insurance but to select a policy that provides adequate protection tailored to your specific needs.

For example, while one company may have the cheapest rates, another may have stronger customer service and discount options that provide greater value.

Choosing the right company involves evaluating premiums, coverage options, and support from top-rated providers.

Enter your ZIP code now to compare car insurance quotes in just 2 minutes and find the most affordable coverage for your needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Proven Tips to Lower Your Car Insurance Rates

The best car insurance companies in the U.S., such as Allstate, Amica, and Farmers, provide a wide variety of ways to save, including with usage-based, multi-policy, safe driver, and loyalty discounts.

Safe drivers can also significantly benefit from usage-based auto insurance (UBI), which tracks driving habits for additional discounts.

Top Auto Insurance Discounts

Top Auto Insurance Discounts| Insurance Company | Anti-Theft | Bundling | Low-Mileage | New Car | Safe Driver |

|---|---|---|---|---|---|

| 10% | 25% | 30% | 15% | 18% | |

| 18% | 30% | 25% | 10% | 15% | |

| 10% | 20% | 10% | 12% | 20% | |

| 25% | 25% | 30% | 10% | 15% | |

| 35% | 25% | 30% | 8% | 20% |

| 5% | 20% | 20% | 15% | 10% | |

| 25% | 10% | 30% | 10% | 10% | |

| 15% | 17% | 30% | 15% | 8% | |

| 15% | 13% | 20% | 8% | 17% | |

| 15% | 10% | 20% | 10% | 10% |

For instance, Progressive provides Snapshot usage-based discounts, and drivers with clean records can sign up for usage-based auto insurance with Drive Safe & Save from State Farm.

However, some insurers may increase your rates if you drive poorly while enrolled, so usage-based insurance is not right for everyone.

Companies like Travelers and USAA cater to specific needs, with discounts for hybrid and electric vehicles and military personnel.

However, you may be wondering what else you can do to lower your rates. Consider the tips below to help you get the cheapest car insurance rates possible.

- Evaluate Your Coverage Needs: To determine the level of coverage you need, consider factors such as your vehicle’s value, your driving habits, and your financial security in case of an accident.

- Reassess Annually: Your insurance needs may evolve due to changes in your personal life, driving patterns, or even adjustments in your state’s insurance regulations.

- Shop Around: Don’t settle for the first quote you get. Each company has its own method of assessing risk and calculating premiums, which means prices can vary significantly.

Don’t forget to ask about other discounts you may qualify for. Our top pick, State Farm, offers 15% savings for drivers with a car less than two years old.

Knowing the best time to buy a new car can further enhance your overall experience when buying a car insurance policy.

Look for more opportunities to save through various discounts, such as multi-car policies, anti-theft device installations, and a claim-free history. Read our guide on the best anti-theft auto insurance discounts to learn more.

Top 10 Auto Insurance Companies in the U.S.

These top 10 auto insurance companies offer competitive rates, excellent service, and comprehensive coverage options.

However, Amica stands out by providing low prices, great discounts, and personalized customer service. See why we chose these top providers below.

#1 – Amica: Top Pick Overall

Pros

- Top-Tier Customer Service: Amica is frequently recognized among car insurance companies for its exceptional customer service and client satisfaction.

- High Claims Satisfaction: Based on our Amica insurance review, the company is known for high claims satisfaction rates, making it a reliable choice.

- Dividend Payments to Policyholders: Unlike other car insurance companies, Amica is a mutual company and returns annual dividends to drivers.

Cons

- Higher Cost: Amica’s premium rates can be higher than average among car insurance companies, reflecting its premium service quality.

- Limited Availability: Amica’s services are not available in every state, which might limit options for some customers compared to other nationwide car insurance companies.

#2 – Nationwide: Best for Comprehensive Coverage

Pros

- Extensive Coverage Options: Nationwide offers broad and comprehensive coverage options, making it a leader among car insurance companies.

- Customizable Policies: Explore our Nationwide insurance review to learn about its significant policy customization for tailored coverage.

- Inclusive Coverage Add-ons: Includes various riders and add-ons for comprehensive protection, setting it apart from other car insurance companies.

Cons

- Higher Premiums: Comprehensive coverage from Nationwide may come with higher premiums compared to more basic plans from other car insurance companies.

- Complex Policy Choices: The wide array of options can be overwhelming for those looking for basic liability-only coverage from other car insurance companies.

#3 – USAA: Best for Military Families

Pros

- Tailored Services for Military: USAA is renowned among car insurance companies for its services designed for military personnel and their families.

- Exceptional Customer Support: USAA stands out among car insurance companies for its high customer satisfaction and support.

- Competitive Pricing: Compare quotes in our USAA insurance review, where monthly rates for minimum coverage start at $65.

Cons

- Limited Eligibility: USAA’s services are exclusive to military members and their families, which limits accessibility compared to other car insurance companies.

- Lacks In-Person Support: USAA does not have as many local agents to provide personalized service when compared to other auto insurance companies like State Farm or Allstate.

#4 – Liberty Mutual: Best for New Car Replacement

Pros

- New & Better Car Replacement: Liberty Mutual excels among car insurance companies with its better car replacement add-on for vehicles less than a year old.

- Broad Coverage Options: Read our Liberty Mutual insurance review for its wide range of coverage options and customizable add-ons.

- Customizable Discounts: Provides numerous discounts for teachers, young drivers, seniors, and drivers with multiple policies.

Cons

- Higher Monthly Rates: Out of the ten best car insurance companies, Liberty Mutual is often the most expensive,

- Inconsistent Customer Service: Customer service quality can vary, which may impact satisfaction levels compared to other car insurance companies.

#5 – State Farm: Best for Young Drivers

Pros

- Competitive Rates for Young Drivers: State Farm is recognized among car insurance companies for offering cost-effective policies tailored to younger drivers (Learn More: Cheap Auto Insurance for Teens).

- Extensive Agent Network: Explore our State Farm insurance review to see why it’s known for its broad agent network and personalized service.

- Resourceful Online Tools: State Farm offers educational resources that help young drivers understand their policies better.

Cons

- Increased Premiums After Claims: State Farm may increase rates more significantly than other auto insurance companies after claims.

- Limited Policy Customization: Compared to other car insurance companies, State Farm offers fewer customization options, which may not meet all needs.

#6 – Farmers: Best for Rideshare & Delivery Drivers

Pros

- Innovative Coverage Solutions: Farmers provides flexible policies for rideshare and delivery drivers, or those who work from home. See everything you need to know about Farmers for policy options.

- Extensive Agent Network: Maintains a vast agent network that facilitates personalized service, a significant plus among car insurance companies.

- Long List of Discounts: Farmers offers more discounts than the best auto insurance companies on this list, including usage-based and loyalty savings.

Cons

- Potentially Higher Premiums: Customization and comprehensive coverage through Farmers can lead to higher premiums compared to other car insurance companies.

- Variable Customer Experience: Customer experience can vary greatly depending on the local agents where you live.

#7 – Geico: Best for Low Rates

Pros

- Low Premiums: Geico stands out among car insurance companies for its consistently low rates, making it attractive for budget-conscious drivers.

- Efficient Online Services: Geico is recognized for its streamlined online quote and mobile claim processes.

- Usage-Based Discounts: Safe drivers earn additional discounts when tracking their habits with Geico DriveEasy. Read everything you need to know about Geico to learn how it works.

Cons

- Basic Customer Service: Geico’s customer service ranks below other companies, especially for claims satisfaction.

- Generic Policy Offerings: Geico’s policies can be quite generic and are missing key add-ons, like gap insurance.

#8 – Allstate: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Allstate is notable among car insurance companies for offering accident forgiveness policies, helping to prevent premium increases after an initial accident.

- Multiple Discount Options: Offers a variety of discounts that enhance affordability among car insurance companies. Find a list in our Allstate Insurance review.

- Robust Coverage Options: Allstate stands out among car insurance companies for its comprehensive policies and extensive coverage options.

Cons

- Higher Premiums: Generally, Allstate has higher premiums than some other car insurance companies.

- Complex Policy Management: Some customers find managing their policies through Allstate more complex compared to other car insurance companies.

#9 – Travelers: Best for Hybrid Vehicles

Pros

- Incentives for Eco-Friendly Vehicles: Travelers is noted among car insurance companies for offering discounts and incentives for hybrid and electric vehicles.

- Extensive Policy Options: View our Travelers auto insurance options and see how its comprehensive coverage makes it a flexible choice.

- Competitive Pricing: Known for competitive pricing, especially beneficial for owners of hybrid vehicles within the car insurance companies market.

Cons

- Complex Claims Process: Some customers find the claims process complex and time-consuming compared to other car insurance companies.

- Less Accessible Customer Support: Customer support can be less accessible during peak times, which could detract from the overall experience with this car insurance company.

#10 – Progressive: Best for Online Tools

Pros

- Innovative Online Tools: Progressive is noted among car insurance companies for its advanced online tools, which help drivers stay on budget.

- Flexible Policies: Known as one of the more flexible auto insurance companies, with usage-based insurance, rideshare coverage, and SR-22 filings.

- Competitive Discounts: Get a full list of discounts in our guide to everything you need to know about Progressive Insurance.

Cons

- Variable Customer Service: The quality of customer service at Progressive can vary.

- Higher Rates for High-Risk Drivers: Progressive charges more than the best car insurance companies after an accident or DUI.

Find the Best Car Insurance Company Today

State Farm, Amica, and USAA may be the best car insurance companies, but the right provider for you will depend on your coverage needs, driving record, and location.

Each provider offers unique benefits, discounts, and coverage options, so compare car insurance companies before you switch.

It’s essential to consider customer service reputation and claim settlement ratio. Companies like State Farm often receive high marks for customer satisfaction, which can be a crucial factor if you ever need to file a claim.

See which car insurance company has the best rates and claims satisfaction in your state with our free quote comparison tool.

Frequently Asked Questions

What are the criteria for a company to be ranked among the best auto insurance companies in the USA?

The best auto insurance companies in the USA are evaluated based on factors such as customer satisfaction, claims processing efficiency, financial stability, and competitive pricing. Companies that achieve high auto insurance rankings and ratings and offer the best auto insurance rates are typically listed among the top providers.

How can I find the best auto insurance quotes?

To find the best auto insurance quotes, use online comparison tools like “at quote” which allow you to compare policies from various auto insurance top companies based on your specific driving profile and coverage needs.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

What determines the average monthly car insurance rate?

The average monthly car insurance rate is influenced by factors such as the driver’s age, driving history, the type of vehicle insured, geographical location, and the level of coverage. Companies that consistently offer the best auto insurance policies often provide tools to estimate these costs accurately.

For an in-depth exploration, consult our detailed guide titled “How Self Driving Cars Work,” for a complete overview.

Which companies are known for offering the best auto insurance for good drivers?

Companies that offer the best auto insurance for good drivers often include discounts for clean driving records. Some of the best auto insurance companies for this demographic include those with high ratings in auto insurance reviews and those known for competitive pricing and rewarding safe driving.

How do auto insurance companies with the highest customer satisfaction maintain their ratings?

Auto insurance companies with the highest customer satisfaction maintain their ratings by providing excellent customer service, quick and fair claims resolutions, and maintaining transparency in their policy offerings and pricing. Consistent positive reviews and high customer retention rates contribute to their high standings in auto insurance rankings.

Why is it important to compare auto insurance best companies before choosing a policy?

Comparing auto insurance best companies helps ensure that you receive the most comprehensive coverage at the most competitive rate. It also allows you to assess the service quality and customer satisfaction levels of different insurers.

To deepen your understanding, delve into our thorough resource on insurance coverage titled “How to Compare Car Insurance Companies,” and gain valuable insights.

What features should I look for in the best auto insurance policy?

The best auto insurance policy should include comprehensive and collision coverage, liability insurance, and provisions for medical payments. Additional features such as roadside assistance and accident forgiveness can also be beneficial, depending on individual needs.

For detailed information, refer to our comprehensive report titled “Traffic Collision Reconstruction,” for further insights.

What makes a company the best auto insurance company?

A combination of affordable rates, comprehensive coverage options, excellent customer service, and positive insurance reviews and ratings makes a company the best auto insurance company. Transparency in pricing and ease of claims processing are also important factors.

Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

How can I reduce my average cost per month for car insurance?

To reduce your average cost per month for car insurance, look for discounts such as multi-car, good driver, and loyalty discounts. Choosing a policy from auto insurance companies with highest customer satisfaction that also offer competitive pricing is key.

To enhance your understanding, explore our comprehensive resource on insurance titled “Ultimate Guide on the Best Time to Buy a New Car,” for more details.

How do average US car insurance costs compare to other countries?

Average US car insurance costs tend to be higher than in many other countries due to factors like higher numbers of uninsured drivers, more expensive healthcare costs, and extensive legal requirements for coverage. Comparing these costs can provide insight into the value provided by the best automobile insurance companies in the US.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.