Allstate® Insurance Review

Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding co...

Meggan McCain

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Michael Vereecke

Updated November 2023

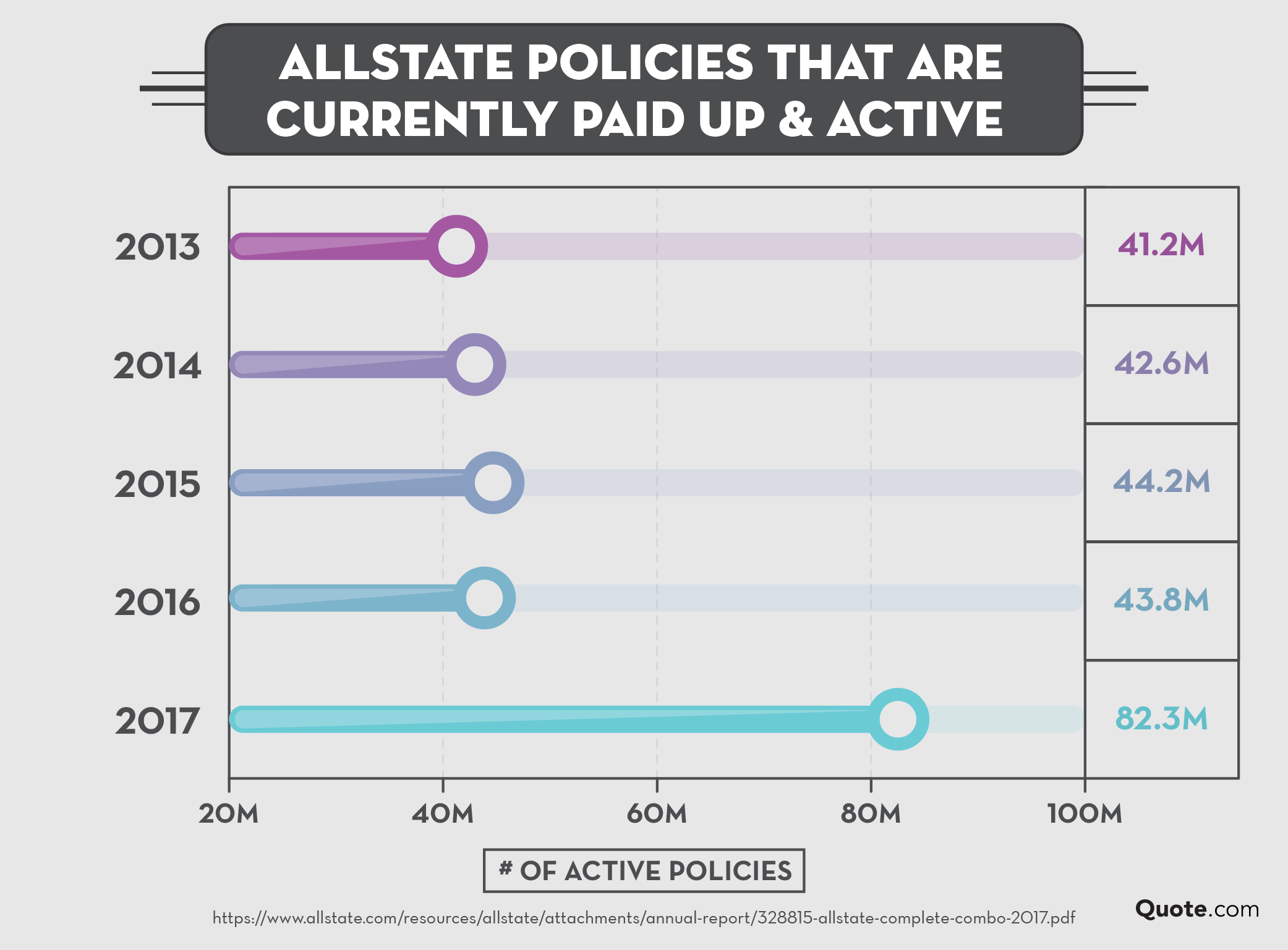

The Allstate Corporation is currently the largest personal line insurer in the United States and the second largest global underwriter. Aside from serving customers in the United States, it extends its personal line services to customers in Canada as well. With more than 14,000 agents, Allstate is also the country’s biggest publicly held insurance company. However, does the company size reflect on the quality of the service? For anyone who are currently looking to purchase new insurance policy, this article will provide you with a non-biased review of Allstate based on our thorough research and data compilation from industry rankings, expert ratings, and customer reviews.

Overview

Allstate holds an A+ rating from the Council of Better Business Bureaus. It is the largest insurance company in the United States, and the third largest auto insurance providers in America (60% of all their policies are auto insurance policies). It covers a wide array of insurance services as well as financial products. As of 2016, Allstate has a customer base of approximately 840,000 customers and provides auto and/or home insurance coverage to 16 million households (these traditional home and auto policies accounts for more than 85% of the entire company’s total premiums with other less common policies being motorcycle, RVs, and boat insurance). Allstate is offered throughout the country, Puerto Rico, Guam, the US Virgin Islands, and Canada. With 10,400 exclusive agencies and 24,400 licensed sales professionals that can be reached locally, through banks and other institutions, on the phone, or online, the company has a focus on California, New York, Florida, Texas, and rural areas of the United States.

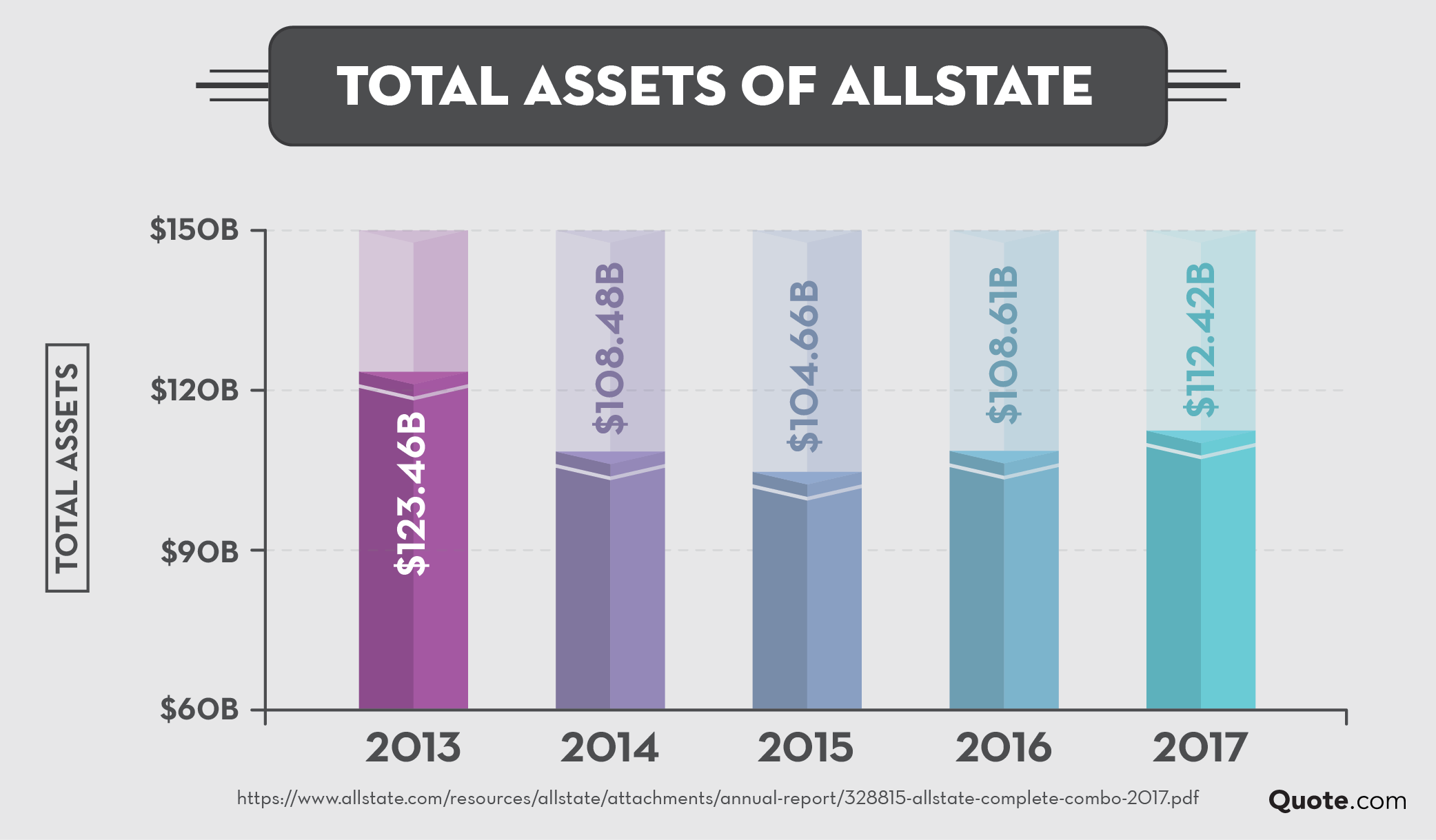

Financial Strength and Performance Information

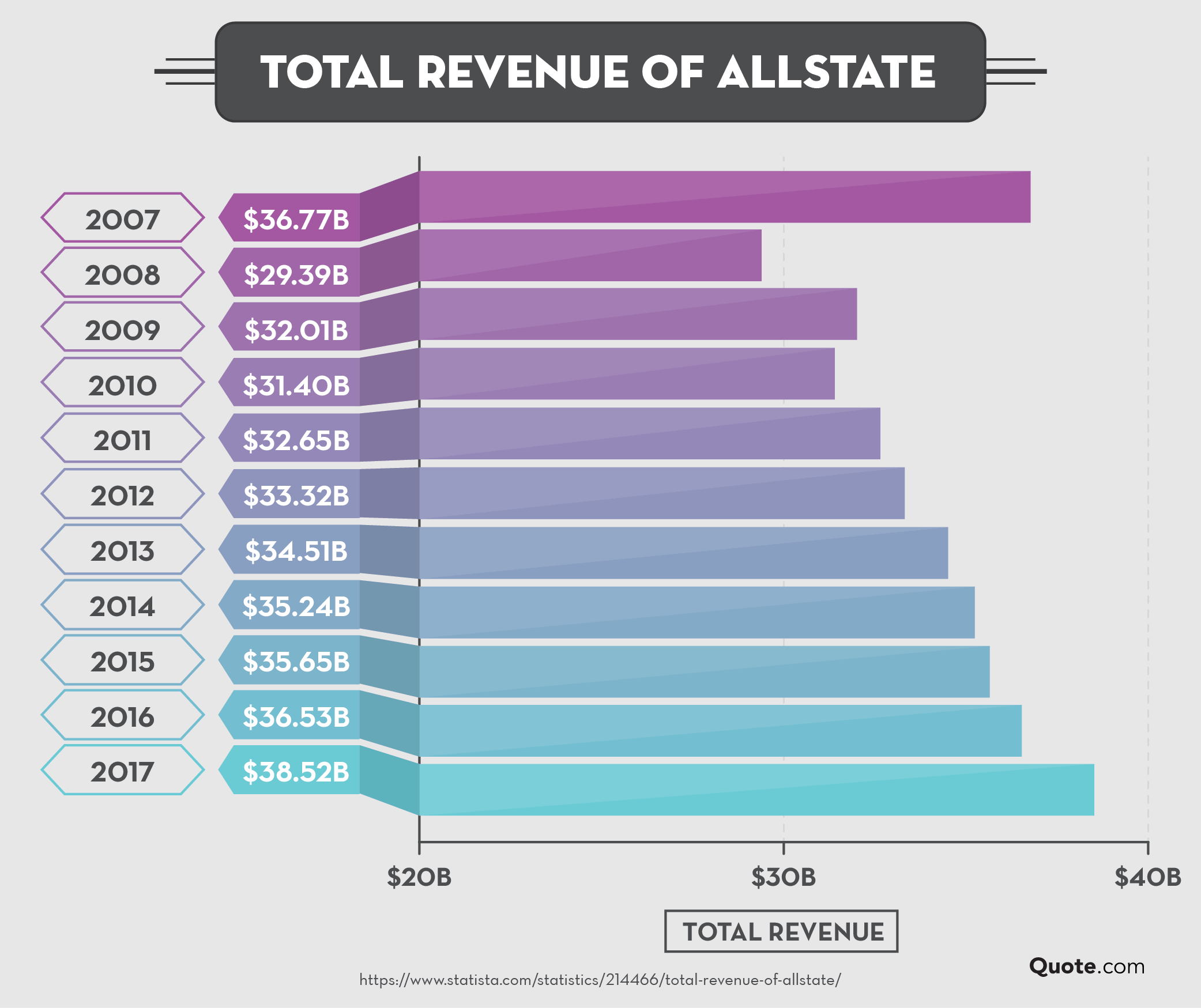

Allstate has a small gradual increase in revenue in the past 5 years. In 2015, the company has stated a 1% increase in its revenue to 35.6 billion dollars from increased auto and homeowners premiums. However, the net income has actually declined 24% because of higher volume of property liability claims and expenses. And in order to encourage returning customers, it has decreased the cost for reinsurance programs. As a result, the revenue from the reinsurance sector has risen by 12% to 3.6 billion dollars. As of 2016, Allstate has gained acquisition of SquareTrade, an extended warranties service for electronic devices and appliances. This expansion will greatly increase the products offered by the provider.

History and Origin

Based in Illinois, Allstate is the country’s largest publicly held personal lines insurer. However, the company first began as a brand name for something entirely different. In 1925, Sears had a national naming competition to decide on their new car tires brand name. Amongst 2 million submissions, “Allstate” became the trademark and promoted Sears retail store to another level of success. In 1930, the idea of Allstate insurance company arose during a bridge game between insurance broker Carl L. Odell and Sears owner Wood. The idea of selling auto insurance by method of direct mail intrigued Wood and he passed the pitch to the Sears board of directors. Allstate Insurance Company officially began business on April 17, 1931, offering auto insurance via direct mail and Sears catalog (the same way Sears sold all its merchandise to public). Â On May 17, William Lehnertz became Allstate’s first policyholder and paid $41.60 for a 12-month policy on his 1930 Studebaker automobile. At the time, Allstate paid the claims on the spot when a customer walked into the one-room office at the Sears store. By the end of 1931, Allstate had 4,217 active polices, a premium volume of $118,323, 20 trained employees, and suffered a $76,000 loss from claims. In 1934, a direct sales location opened in a Chicago Sears store and changed the sales method from direct mail to agent representation to better serve the customers. Since the establishment, Allstate has always been a pioneer in the industry. For over 80 years, Americans have known it as one of the longest standing and trusted insurance providers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Products Offered by Allstate

The insurer carries a wide range of insurance products and investment products. For insurance services, there are policies for auto-related coverage (e.g. person and business vehicle, motor home, motorcycle, boat, off-road vehicle, and other recreational vehicle), home-related coverage (e.g. theft loss, flood protection, and earthquake protection), renters and property owner package, business package, life, and supplemental health insurances. As for investment products, the company provides college saving plans, annuities, individual retirement accounts (IRA), and mutual funds.

Insurance Products

Auto insurance

Allstate prides itself on their flagship auto insurances ranging from policies for liability, comprehensive, collision, personal injury protection, medical payments, personal injury protection, personal umbrella policy, and uninsured and underinsured second party coverage, and sound system equipment reimbursement. Their premium policies also include car rental reimbursement, towing service, and repair and labor coverage. In addition, for individuals who are classic car fanatics, this provider offers a specialized coverage for antique and classic vehicles; modified vehicles; and customized vehicles. Please note that the policy details may differ slightly depending on your residing state. Your monthly payment can also differ depending on your residing location (whether you live in the city or in a remote town), your previous driving records (whether you have a clean history of car accident, driving violation, and DUIs), and your age (males between 16 to 25 years old may be required to pay a higher monthly premium). However, you may be eligible for a number of bonus and discount price if you meet the requirements of their various programs.

Drivewise Program

This program requires you to install a small device in your car or download an app on your smartphone to trace your driving habits. In doing so, you will receive rewards and rebates for driving safely.

Anti-lock Brake Discount

You are eligible to receive 10% discount off your policy if your car is equipped with anti-lock brakes.

Passive Restraint Discount

You are eligible up to 30% if your car contains factory-installed air bags and motorized seatbelts.

Anti-theft Device Discount

You can save up to 10% off your policy if your car is equipped with anti-theft device.

New Car Discount

You can save as much as 30% off your policy if you are the first owner of your car that is less than 2 years old.

Utility Discount

You are eligible to save up to 15% off your policy if your utility vehicle is made prior to model year of 2002.

Farm Vehicle Discount

You are eligible to save up to 10% off your policy for your vehicle used for ranch and/or farm work.

Economy Car Discount

You can save up to 10% off your economy car coverage premium.

Good Payer Discount

You can receive up to 5% if you good paying history and have not receive a non-payment in the past 12 months.

Early Signing Discount

You can receive up to 10% if you sign up for a policy 7 days before the coverage becomes effective.

EZ Pay Plan Discount

You can receive a 5% discount when you set up automatic withdrawal payment option.

FullPay Discount

You can receive a 10% discount if you pay your policy in full.

eSmart Discount

You can save up to 10% if you sign up for ePolicy online service.

Auto/Life Discount

You can receive a discount if you purchase both an auto insurance and life insurance from Allstate.

Multiple Policy Discount

You can receive a discount package deal if you purchase an auto insurance along with a renters or home coverage policy.

Good Student Discount

Single, full-time students who are under the age of 25 years old and receive great grades can be rewarded with up to 20% discount off their policy.

Resident Student Discount

If your child is attending a school that is at least 100 miles away from your home, you can receive up to 35% off your policy premium.

Senior Discount

10% discount can be given to individuals who are 55 years old or older and are retired.

Premier Discount

Subscribers who have been driving 3 years without any accidents or violations can save up to 22% off their premiums.

Premier Plus Discount

Subscribers who have been driving 60 years without any accidents or violations can save up to 35% off their premiums.

Defensive Driver Discount

Individuals who are 55 or over, have completed at least 6 hours of defensive driving tutorials, have no violations, and have not incurred any at-fault claims can save up to 10% off their policies.

Safe Drivers Discount

Demonstrating safe driving habits can earn you as much as 45% off your auto insurance.

TeenSMART Discount

Teenagers can earn up to 10% off the policy if they successfully finish the TeenSMART driver education program.

Motorcycle Insurance

Even though Geico has been known to be the most well known motorcycle coverage provider, Allstate does have very comprehensive policies for motorcycles that include: bodily injury liability coverage, medical payments, property damage liability coverage, collision coverage, personal injury protection, comprehensive coverage, towing and labor, uninsured and underinsured second party motorist bodily injury, rental reimbursement, motorcycle and off-road vehicle transport trailer damage, loan and lease gap, and optional or added equipment coverage. Similar to the automobile plans, there are numerous discounts and add-on programs available such as New Motorcycle Replacement, First Accident Waiver, Genuine Parts Guarantee Repair Program.

Motorhome Insurance

Motorhome insurance can be tricky because it is both a vehicle and a home. To ensure that you, your guests, and all your belongings are protected, the programs include services:

- Bodily injury liability

- Collision coverage

- Comprehensive coverage

- Medical payments coverage

- Personal injury protection coverage (PIP)

- Second party uninsured and underinsured motorist coverage

- Towing and labor costs coverage

- Rental reimbursement coverage

- Property damage liability

- Contents coverage

- Sound system coverage

Depending on your eligibility, you may qualify for senior discount, multi-policy discount, and transfer discount (switching from another insurance provider to Allstate).

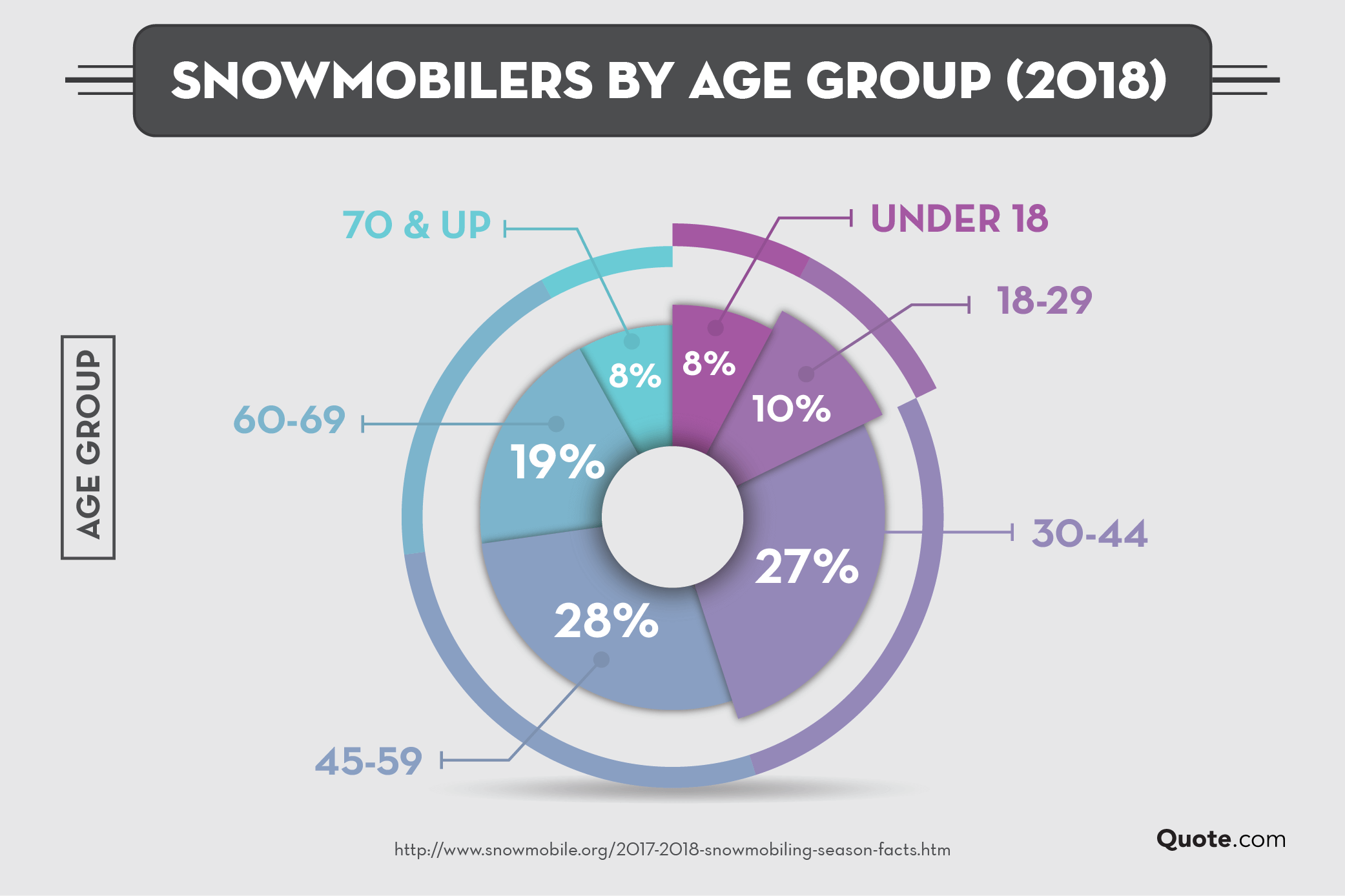

Snowmobile Insurance

Almost all home and automobile policies from insurance providers provide enough coverage for snowmobile. As claimed on their official website, you can receive full protection services for as little as $13 a month. The services included are:

- Property damage liability

- Bodily injury liability

- Comprehensive coverage

- Collision coverage

Depending on your eligibility, you can receive lowered premium from these discount programs:

- Safety Course Discount

- Easy Pay Plan Discount

- Full-pay Discount

- Multi-policy Discount

Recreational Vehicle Insurance

In order to protect your off-road recreational vehicles (ATVs, UTVs, gold carts, go-karts, dune buggies, and trail bikes), Allstate offers property damage liability, bodily injury liability, comprehensive coverage, and collision coverage plans starting as low as $12 a month. Similar to the snowmobile insurances, you can be rewarded with lowered premium from these discount programs:

- Multi-policy Discount

- Safety Course Discount

- Full-pay Discount

- Easy Pay Plan Discount

Boat Insurance

If you are an owner of a boat, the company boasts that they can offer for as little as $20 a month:

- Watercraft liability coverage

- Watercraft Medical Payments coverage

- Property coverage

- Emergency services which include towing, labor, and the cost of delivering oil, fuel, or even battery

- Uninsured Watercraft coverage

- Repair cost

- Agreed value option

- Additional boat equipment such as anchors, navigation gear, and life jackets

- Boat trailer coverage

- Personal effect coverage

Like all other plans, you may be eligible for various discount programs such as the multi-policy discount, easy pay plan, homeownership discount, full-pay discount, and boat education discount.

Home insurance

When it comes to home insurance, Allstate provides a standard structure coverage and personal property coverages, renter’s insurance, and landlord policies. These plans can be applied to houses, apartments, condos, and mobile homes. On top of these basic protections, you can also purchase liability protection and guest medical protection to cover medical expenses for anyone who is injured on the property. Depending on whether you have installed a security system and protection devices, you may be eligible for a discount on your home insurance plan. If you are over 55 years old and retired, you are also eligible for a discount. If you decide to purchase both auto and home insurance from Allstate, you will receive a bundle discount price for both policies.

HostAdvantage Program

One of the unique features of Allstate is their HostAdvantage home-sharing program. If you are one of the growing number of homeowners who rent out your home via online web services such as Airbnb or Vacation.com, this policy will cover up to $10,000 of damage or stolen personal item costs each time you rent out your home. This added coverage costs about 50 dollars annually on top of your current home insurance plan. As of August 2016, the HostAdvantage home-sharing program is available in 6 states: Utah, Tennessee, Michigan, Illinois, Colorado, and Arizona. However, due to the high popular demands from homeowners of other states, Allstate is in the works to expand the program to other states.

Condo and Townhouse Insurance

Although your complex may have a master policy, it will only cover the common areas and exterior building damages. To protect your residential area and all your belongings, the condo/townhouse insurance offers these services:

- Personal property coverage

- Building property protection

- Loss assessment coverage

- Guest medical coverage

- Reimbursed living expenses

- Identity restoration coverage

If you are the owner of a new constructed condo or townhouse, you can receive a lower premium. You may also benefit from senior discount, protective device discount, and multi-policy discount.

Landlord Insurance

When it comes to rental property investment, the owners have to worry about not only the property but also the income source. To make sure that you are fully protected, Allstate offers these landlord insurance services:

- Burglary coverage

- Vandalism coverage

- Dwelling protection

- Other structures protection

- Fair rental income coverage

- Rental property under construction

- Building code coverage

Renters Insurance

For renters who are not covered by the landlord’s insurance policy, the renters policy offers personal property coverage, reimbursed living expenses, scheduled personal property for expensive belongings, liability coverage, guest medical coverage, and identity restoration coverage. Depending on your eligibility, you may receive a lower premium if you qualify for these discounts:

- Easy Pay Plan

- Safe home Discount

- Multi-policy Discount

- Senior Discount

- Claim-free Discount

Pet Insurance

Instead of purchasing a pet insurance from another provider, now you can bundle up a pet health insurance with the other coverage. The optional Wellness Rewards plan provides these services:

- Annual prevention checkup

- Routine care and vaccinations

- Dental cleanings

- Cancer therapy services

- Emergency treatments for accidents, illnesses, and diseases

- Diagnostic tests, laboratory work, x-rays, and MRIs

- Medications

- Treatments related to genetic conditions (please note that your pet should not show signs or symptoms of these conditions prior to enrollment)

- Alternative therapies including homeopathic medicine, acupuncture, and hydrotherapy

- Treatments and medications related to chronic and recurring conditions such as allergies, thyroid problems, and diabetes

In order to qualify for a new policy, your pet must be under 14 years old. If your pet is older than 14 years old, your pet can only be qualified for an accident-only plan that includes these services:

- Doctor examination and specialist fees

- Emergency care and hospitalization fees

- X-rays, ultrasounds, CT scans, and MRIs

- Chiropractor fees, acupuncture services, and holistic medicine

- Physical therapy and hydrotherapy

- Surgeries and laparoscopies

Life insurance

Although Allstate is not known to be one of the biggest life insurance provider, it does offer a full range of term and permanent insurance products via their affiliate companies:

- Term Life covers you for 10 to 30 years. It is the most affordable policy available without a medical exam. It is a great option for individuals who have certain health issues or wish to skip the medical examination. The downside of the term life coverage is that there is no adjustable premiums and build cash value options. In addition, the benefit is offered in somewhat small fixed amounts of $50,000, $100,000 or $150,000.

- Permanent Life is available for lifetime coverage. Depending on your needs, you have 2 options to choose from: universal life and whole life coverage.

- Universal Life: This is a great option for individuals who wish to get lifetime life insurance coverage and start building tax-deferred cash value. This option also allows you to change your plan and premium to your needs.

- Whole Life: This option allows you to build tax-deferred cash value and receive lifetime life coverage. Although you cannot adjust your premium, you are guaranteed to the same payments and coverage over time.

| Policy Length | Builds Cash Value | Adjustable Premiums | |

| Term Life | 10-30 Years | No | No |

| Universal Life | Lifetime | Yes | Yes |

| Whole Life | Lifetime | Yes | No |

Estate planning products, fixed survivorship life, business succession planning products, and variable survivorship life family protection insurance, term life, universal life, variable universal life, long-term care and supplemental health

Event Insurance

If you have invested a significant amount of money to plan a special event, you may want to purchase a coverage plan to compensate your loss as a result of cancellation or postponing due to unforeseen accidents, extreme weather, illnesses, or even problems with the vendors. The Allstate event insurance provides services for event cancellation coverage and event liability coverage for events such as corporate functions, retirement parties, anniversary parties, business meetings, non-profit functions, engagement parties, and weddings. Please note that the policies cannot be applied to certain special events such as animal shows, color runs, gun shows, bachelor and bachelorette parties, remote location functions, events with more than 500 guests, and sporting events. Before deciding to purchase an event insurance, please consult with an agent to ensure that your event can be insured.

Supplemental Health Insurance

Many people do not have enough benefits through their work-covered health insurance. To compensate this problem, you can purchase a supplemental health insurance coverage through various health insurance providers. Although Allstate does not provide full health insurance policies, they do write a variety of supplemental health products to offer extended coverage to cover the rest of your medical bills and protect you from any long-term care because of accident, debilitating critical illnesses such as cancer, and disability.

Business Insurance

Although less marketed, the provider does have an extensive list of policies catered to small business owners who are in professional firms, health & medical, and food & beverage businesses. Depending on your needs, your agent can help you customize a bundled coverage plan that includes business property, liability, and commercial auto coverage.

Financial Products

If you are making plans for your savings or retirement, Allstate offers several financial plans that can help you save up for any future plans:

Annuities:

These long-term investments allow you to invest your money towards your retirement savings with tax-defer benefits.

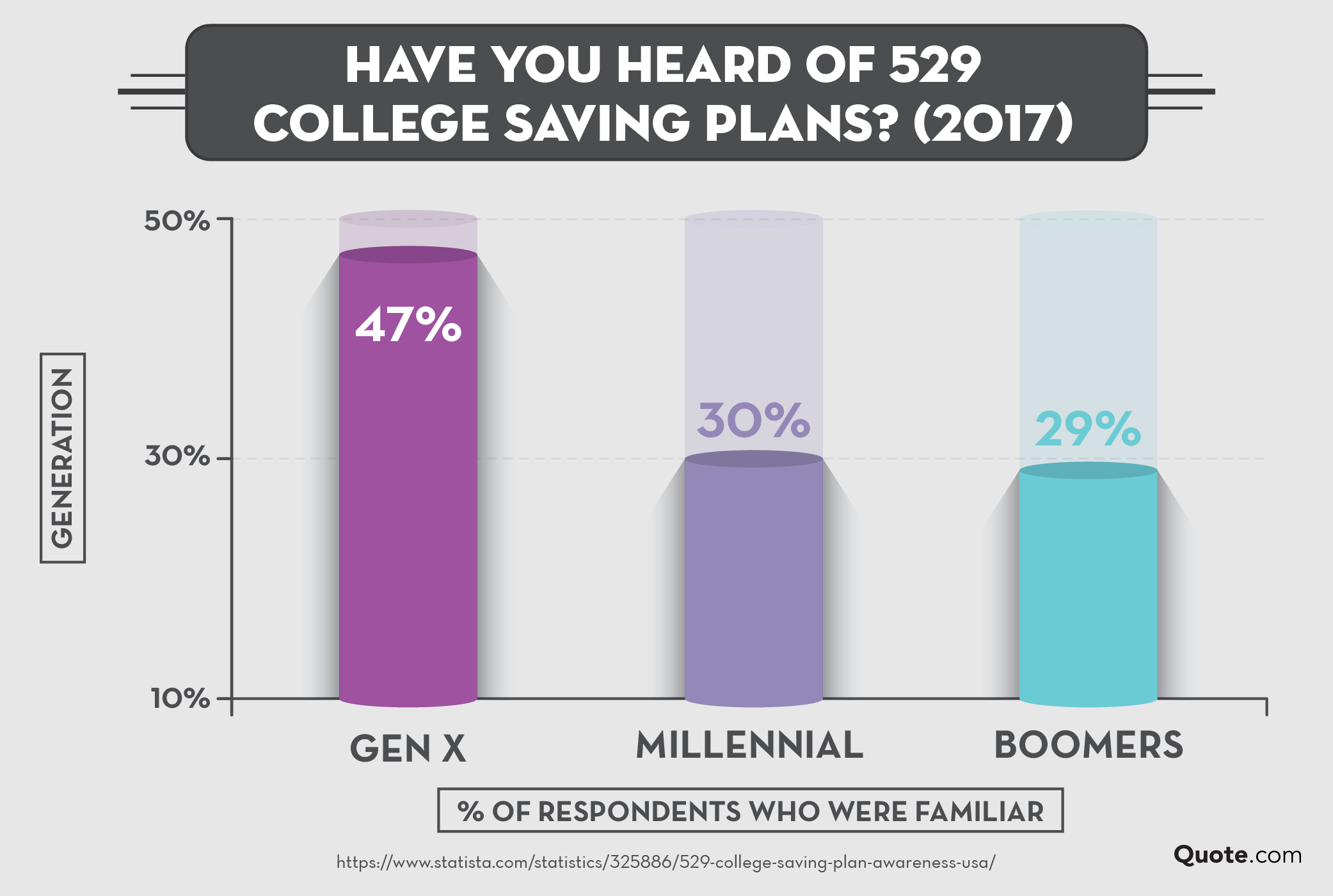

529 College Savings Plan:

You can put away your children’s college funds with these investment plans offered by different partner companies from each state.

Mutual Funds:

You can put your money as long-term investments with these relatively save plans being managed by partnered financial advising companies.

Individual Retirement Accounts (IRAs):

Depending on your needs, you may be interested in putting your money into traditional IRAs, Rollover IRAs, and Roth IRAs.

Allstate Personal Umbrella Policy

A personal umbrella policy (PUP) offers additional liability coverage on top of your regular homeowners and/or auto insurance. It kicks into active mode once your liability limits have been reached under these circumstances:

- You are out of the country and you have reached the limits of your travel insurance.

- You are being sued over an incident and you need to hire an attorney for assistance.

- You are experiencing wage loss due to court appearances as a result of incident settlements.

Although it offers an extra layer of liability protection for you and your family members, you must understand that a personal umbrella policy does not cover everything:

- Your personal properties are not covered if you are responsible for causing damages.

- Business losses that are related to damage of the business property or operation loss.

- Damages and liability costs that result from intentional illegal and harmful actions are not covered by the PUP plan.

- Any liabilities that are connected to an oral and/or written contract are not covered by your PUP plan.

If you have any questions or concerns about personal umbrella policy, it is best to contact an agent or the Allstate hotline for assistance.

How to file Allstate Insurance Claims

It is easy to file a claim with Allstate. One of the biggest highlight is that Allstate is available at your service 24/7. Here are the different ways you can file your claim and monitor the claim process:

- Visit your local agent’s office to file your claim and supply the evidence information.

- Phone 1-800-ALLSTATE (1-800-255-7828) to file and track a car insurance claim with the help of a phone agent.

- Log into your online account to file a claim, upload the evidence information, and track the progress.

- Use the Allstate Mobile App on your smart devices to get help with the Accident Toolkit gadgets and file your claim.

Auto Insurance Claim Process

For individuals who have never file an auto claim, it can be intimidating. To allow better understanding of the claim process, here are the general process steps:

Step 1: Gather evidence and useful information.

To make the process as straightforward as possible, take down as much information as possible immediately at the accident. Write down all the parties’ license number, plate number, and insurance policy number. Take pictures of your vehicle and other parties’ vehicles to support your claim. Record a voice recording of what happened at the accident, when did the event occurred, and where the event occurred. If there are any witness to the accident, try to gather their information as well. And if you are hurt in any way, see a medical professional as soon as possible and receive a copy of the doctor’s note. The more useful information you provide the provider, the faster the claim process will be for you.

Step 2: Filing a claim.

File your claim as soon as possible after the accident. You will be given a claim number. Write down the number for easy reference and tracking in the future. Once your claim report is filed, the claims department will assign your case to an adjustor to process all the information, review your coverage to determine your available options, take statements from both parties, examine any police reports available, and may even request to personally check the damages.

Step 3: Damage investigation.

Depending on the accident, a mechanical professional may be needed to inspect your vehicle to assess the damages and determine what repairs and replacements are needed. This way, the professional can provide you and the provider with a close estimate of the auto bodywork.

Step 4: Estimate review.

Once you and your provider receive an estimate of the damage from the professional, a claims adjuster from the provider will contact you by phone to discuss your settlement and reimbursement based on your term, provisions, and coverage.

Step 5: Settle your claim.

After you discuss with the claims adjuster about your case, you will have an option to repair your car or receive a reimbursement of money equivalent to the damages. Please note that if you choose the repair option, the provider will pay the designated repair shop directly. If your repair shop discovers more internal damage, your provider will also pay for those repair and replacement fees. However, if you choose the “cash out” option, the provider will give you a settlement check send you a check in the mail or through direct bank deposit. If you then choose to repair your vehicle at a repair shop of your own choice, and they discover more repair is needed, you will be responsible for the fee. Your provider will not reimburse you for the extra repair and replacement. So before you finalize your option, please understand carefully of the details. In a straightforward claim where the other party is totally at fault, the insurance company will pay for all damages up to your policy limits and applicable deductibles.

How long will my car insurance claim take?

Because every claim has a unique scenario and many issues to consider (e.g. whether one party is at fault, whether the evidence provided by the parties differ, whether the other party is denying claims or even refusing to cooperate), the time to process your claim may differ. But as explained earlier, the more information you gather to support your side of the story, the quicker your provider claim team can reach a conclusion.

Take Advantage of the Convenient Auto Glass Claims

With Allstate, you can easily repair or replace your damaged windshield and glass by calling the Glass Claim Express 1-800-626-4527 or filing a claim with the online service. In general, repairing the damage is much cheaper than replacing the whole glass surface. However, even if the crack or damage is within the size of a dime, you should still repair the nick as soon as possible to prevent the crack from spreading.

How can I file claims other than auto?

Filing for other insurance claims is quite similar to the auto insurance claim process. The only difference is that you will be assigned to a claim team member who is specialized in the policies and benefits pertaining to the claim category. And similar to an auto claim, you are required to gather as much information as possible to get the most benefits from your coverage. Photos, videos, witness statements, police statement, and any other evidence of your damage and loss will make your loss estimation much more precise. Once your adjuster completes the evaluation process and offer you the settlement options, they will also guide you through the rest of the reimbursement process.

How can I cancel my policy?

According to the provider policy, you can cancel a policy in 2 ways: 1) Call the provider customer service hotline 800-255-7828, or 2)Contact your local Allstate agent. Please note that you MUST send in a formal cancel declaration to complete the cancelling process. Until you have send in the form, you will still be active for your plan.

Can I cancel my policy any time?

Yes, you can cancel your policy with the provider at any time. Allstate does not have a cancellation penalty fee policy, so you will not be charged a fee for the process. And if you have already paid your policy in full, they will refund you for remainder of the policy back without any penalties.

Allstate’s Strengths

Are you searching for an insurance company that provides plenty options and possibilities? Here are the best features of the provider:

- Keep Up with Technology

The company has always placed an emphasis on keeping up with the technology so that customers can file claims and gain access to an agent 24 hours a day, 7 days a week. Moreover, to make sure all the services are always available within reach, the company’s Android and iOS Apps are some of the best-designed programs in the industry. The main App allows customers to pay their monthly premium online, file and track claims, send photos, videos, recordings, and documents to speed up the evidence submitting process, and view policy documents. It also enables customers to contact an agent or roadside assistance by clicking the help button. The App also has some great perks such as letting individuals know on any vehicle recalls, monitoring driving habits, and helping customers locate their parked vehicles or the nearest gas stations through GPS tracking. Aside from the main App, there are also other Apps available to educate customers about safer driving and theft prevention so that they can actively prevent accidents from happening.

- Emergency National Catastrophe Team Services

Out of all the insurance services, the auto insurance sector is probably the top if not greatest strength of Allstate. As one of the largest insurance providers in the United States, Allstate has a huge team of agents and adjusters to handle claims on a daily basis. And they have a National Catastrophe Team ready 24/7 to immediately deal with major natural disaster events such as tornadoes, floods, hurricanes, and earthquakes. These 800 on-call members can be sent on moment notices to any location to assist their customers during these events.

- Customer Satisfaction Guarantee

This guarantee allows customers to try out the service for 6 months. If for any reason you are not happy with the service, they are willing to refund you the money equivalent to 6 months of your premium payments. They will go as far as refunding you the premium even if you filed a claim and received a reimbursement from your claim.

- Claim Satisfaction Guarantee

This guarantee allows customers to give constructive feedback on their claim settlements. If you are not completely satisfied with your claim, you can send a letter to the company within 180 days of the accident. Depending on your justification, the provider may refund you a credit amount that equals to as much as 6 months’ worth of your monthly premium for your vehicle.

- One Stop for Your Needs with Lots of Add-on Options

Time is money. For customers who have a busy working schedule, getting a bundled plan can save you both time and money. Instead of dealing with individual companies and negotiating a deal with each agent, letting one company to handle all your insurance can make life simpler when it comes to purchasing and renewing plans. Instead of paying your monthly premiums individually, you only need to pay one lumped premium. Although some policies offered by Allstate can seem more expensive than plans from other companies, you can receive a great deal if you purchase all your insurance with them. If you are not completely satisfied with certain plans, there are so many add-on options available for you to customize a plan to suite your needs.

- Awesome Rewards and Savings

Allstate underwrites the most auto insurance discounts in the United States insurance industry. Safe driving programs, bundling discounts, going paperless and signing documents online discounts are just some ways to save. The company also offers some unique savings. Senior safe driving habit discounts and good student discounts are some of the exclusive benefits. By racking up the eligible discounts and savings, you will be surprised by how much lower your premiums become.

- Rewards for Save Driving

The company truly values prevention over damage repair. So if you drive safely and actively secure your belongings from theft and damage, you will be rewarded by discounts and prices:

Vanishing Deductible Program:

$100 will be taken off your deductible for every year you go without a single accident. You can receive up to $500 off as a maximum deductible reward.

Drivewise Program:

If you allow the provider to monitor your driving habits via the installed device or the mobile App, you may be rewarded with a lower monthly premium, points that can be used to redeem gift cards and gifts on the company website.

Safe Driving Bonus Checks:

You will be rewarded at the end of every policy period you do not have an accident. You can receive a money rebate equivalent to 5% of your annual premium.

- First Time Forgiveness Add-on Option

Accidents do happen. Instead of penalizing good drivers over a rare mistake, the company forgives first violation ticket and accident over a set duration of time so that their rates can remain the same. Although some insurance companies offer similar add-ons, these benefits usually do not kick into effect until the customer has subscribed to the company’s policy and rack up several years of accident-free driving record. For Allstate, the first-time forgiveness add-on immediately becomes active on the day you sign up for your policy.

- Special Coverage for Ridesharing Service Workers

For individuals who work in the ridesharing industry such as Lyft, Uber, and carpooling services, the parent companies rarely stick to their word about completely covering you in cases of accidents. At the same time, many insurance companies do not have enough coverage for both you and your passengers in the effect of an accident. Allstate has just the unique plan for such purpose.

- Tons of Helpful Tools and Resources

Sometimes self-help tools can be a great way to receive customer service. The Good Hands Network is a great search tool to help you finding Allstate’s trusted mechanics and repair shops. Their “Bumper to Bumper Basic” web tool can help potential customers find coverage to meet their needs. For individuals who hate talking with a representative, this tool can give you all the answers you need. Also, the Star Driver App is a great education tool to teach both teenage drivers and their parents of ways to drive safely and avoid accidents. This program has proven to be one of the most successful education tools of Allstate. Surveys have indicated that ever since the introduction of this program, teenage traffic fatality rates has dropped 48%.

- Strong Financial Standing

Allstate has always been graded with superior long-term stability ratings from A.M. Best rating company. This score means that it is highly likely that the company will pay out your claims and your earnings from their investment plans. With a long history in the industry, it is one of the biggest players in the United States insurance industry and will very likely to continue to be a reliable, successful company. If you worry that Allstate is linked to Sears and may be affected by the tanking company, do not fear. As of 1931, Allstate and Sears had split their ways and became independent companies. So it is safe to say, Allstate is here to stay.

- Flexible Options for Roadside Assistance

You get to pick from 2 choices of purchasing a yearly membership or a per-use membership (known as Good Hands RescueSM). So depending on your needs, you can choose the option that best suites your driving habits. And if you do choose the yearly Motor Club membership, you can enjoy a 25% deduction on your next year membership if you ever experience a roadside assistance situation where the help does not come within 30 minutes of the scheduled time.

Great Startup Plan for Students and Young Drivers

Auto insurers weigh in numerous factors when they calculate your premium rates. These factors include age, sex, driving record, vehicle brand and age, address, education level, and credit history. Although each insurance company has its own unique algorithm to calculate the rate based on risk factors, they usually view young student drivers as the highest risk customers. However, for Allstate, they actually welcome young drivers customers. And if you do well in school and get great grades, you will receive a discount on your premium rate.

Some positive reviews of Allstate:

”

I’ve been with Allstate for over 35 years. I left for a year and went back as soon as I could. They have always taken care of my family. Whether it was an auto policy or homeowners or renters before we purchased our home they went the extra mile in taking care of the issues.”

“Good no hassle customer service based on past claims. Easy renewal with good explanation of additional products/services that are offered. Adequate responses from questions during policy renewal process.”

“I’ve had Allstate home and auto coverage for 25+ years. Have had a few claims on both. Car accident claims, both at fault and not, were handled quickly, professionally, and paid fairly. Home claims were handled quickly and fairly as well. Most recently we had hail damage to the roof from a storm. Allstate adjuster came out, inspected, estimated the repairs, and printed a check for the full amount (less deductible) on the spot. Overall, they’re not the cheapest, but my experience with their customer service has been excellent.”

“Excellent. We have home and auto. We receive the rewards checks like the ads indicate. The rates are comparable, and our agent is a local person who is quite helpful.”

“Excellent service because we have an excellent agent. I appreciate her detailed service and consideration. Not happy with the huge prices for earthquake insurance in California.”

Allstate’s Weaknesses

Every company has its strengths and weaknesses. Before you decide to purchase a plan from Allstate, you should consider these factors:

-

Not the Most Affordable Price on Market

Having superior financial strengths and offering so many customizable add-on options, Allstate is definitely not known to be the most affordable insurance policy provider. As we all know, any time you need to customize something to your special needs, you always have to fork out an extra fee. So the more customizing add-ons you need, you should expect to see the policy rates go up drastically.

-

Not for All Customers

This company see their customer market as individuals who have good credit history, view their time as more precious than finding a great deal, and actively take initiative to prevent accidents. So if you do not have good credit history or have several accidents and/or tickets under your belt, you will find your policy to be much more expensive than policies from other companies.

-

Accident Forgiveness Can Be a Dud

If you are a good driver who actively engages in defensive driving habits, you are very unlikely to be the one at fault for causing an accident. If you are involved in an accident, you are most likely to be the non at-fault party. So adding the accident forgiveness option does not give you more value to your coverage. If anything, it is almost a gimmick that charges you more each month.

-

Not Everyone Can Qualify for Discounts

Although there are so many discount and reward programs, they are mostly aimed at good drivers, individuals with great insurance score, and individuals of certain age groups (e.g. seniors and students). So similar to the accident forgiveness option, these bonuses and rewards usually benefit those who are already receiving the lowest rate. In a way, it is like handing a rich person a discount for a product and charging full price for people who are on a budget. However, there are exceptions to the rule. If you are a student or new driver who have no accident history, you will be in for a pleasant surprise.

-

Mixed Customer Reviews

Even though the provider has superior financial strength, it does not mean they are very willing to pay for all the claims. At the same time, even though they boast the size of their claim teams, many customers complain about the slow response rate, the frequent chance of not receiving the full reimbursement, and the claim adjusters unwilling to pay for the claims. According to the J.D. Power’s rating survey, Allstate scores a 3 out of 5 in their service score. Although the score is regarded as “above average”, it is definitely not what customers want to hear. As a matter of fact, there has been a collective outcry back in 2008 about the company’s “boxing gloves” tactics to handling customers’ claims. Instead of treating customers fairly, they would intentionally pay out less and deny any errors. Customers have no choice but to fight every decision until the company gives in or simply give up and accept the lessened reimbursement. According to the American Association for Justice survey, Allstate is listed as one of the 10 worst insurance companies in the United States.

Sketchy customer service happens to customers with good driving habits as well. They find that the company likes to skip out on their Safe Driver Bonus unless they actively contact the customer service and demand the bonus rebate. In a way, they hope that customers will either forget about such company bonus policy or forego the bonus due to their busy lifestyle. Some customers also share the experience of being denied the Safe Driving check because another at-fault party has damaged their vehicle in the 6-months period. So if you want to keep receiving that bonus check, it means you have to have absolutely no claims in your record.

-

Troublesome Deductible Process

If you file a claim, you are required to pay your deductible up front no matter whether you are at fault or not. If you are not at fault, you will not be reimbursed the deductible until the claim adjuster agrees with all your evidence and the at-fault party insurance provider to pay out the claim. Although there are some other providers that use the same business practice, there are also providers that will not charge you the deductible up front or even allow you to fix your vehicle before they make a final decision about who is at fault. So if you are one of the individuals who have a tight budget to balance, this may really become a problem to front the deductible when you desperately need the money to repair your vehicle.

-

Rewards and Bonuses Do Not Live Up to Hype

All the programs, add-ons, and bonuses sound like you are going to rack up some amazing savings. The truth is that many of these programs require paying an extra premium. Many customers have found that even if you get the rebate checks for being a safe driver, you are very unlikely to actually recoup a significant rebate to cover that additional premium cost.

-

Constant Solicitation in Future

The online quote system seems like a dream come true. You can simply type in all your information, choose your plans, and finish off the process with a short confirmation talk with an agent. If you already know what you want, the whole process can truly be short and straightforward. BUT once the company has your personal information, they will keep haunting you with their phone calls, emails, and physical mail promotions and advertisement. Even when you switch to paperless bills, the unwanted mail will keep coming to your mailbox. They never take No as a No.

-

Cancellation Hell

Similar to the constant spam mail situation, the agents are taught by the company to keep your business no matter what it takes. If you want to cancel your coverage, you will have to go through a long phone conversation of constantly justifying why you no longer require their service. Even after the agent finally understand there is no way for you to keep your policy, you still need to send in an official statement along with your signature to declare that you wish to stop your coverage from Allstate. In the meantime, you will need to constantly check to see if they are keeping your policy active and try to bill you for another month of premium.

Some negative reviews of Allstate:

“Requested an auto insurance quote back in spring 2013 (they were by far the worst quote so I declined). Every 3-4 months someone from Allstate would email, call or mail me despite repeated requests to remove me from their lists. They even made 2-3 credit inquires; neither of which that I had authorized.”

“If you are looking for an insurance company that is out of reality, then choose “ALLSTATE”. I had 2 cars insured with them, then when they started offering home insurance in the State of Massachusetts this year I transferred my home policy with them. Just to add to my surprise, I received a letter from indicating they’ve cancelled the home policy without a notice because there’s some peeling paint in the back of the house that was caused by the zillion storms we had this past winter, and therefore; they couldn’t insure my house.”

“My mother is 92 years old and a heart patient. She cannot go up the stairs and she uses a walker. We have been without bathroom facilities on the first floor for five weeks. Allstate denied my request to send an adjuster down when these damages first occurred. The adjuster tried to minimize the damages. The amount of money Allstate is willing to give does not cover the cost of replacing the damaged items, not to mention the cost of labor.”

“After 20 years with Allstate with no claims, currently 2 houses and 3 cars, Allstate is treating me like garbage. I just got hit by a hit-and-run driver leaving $3700 worth of damages and Allstate will pay only 2,900 which is below $3800 on the car cash value. I’m paying full coverage premium, Allstate won’t pay for the collision repair.”

“I’m sorry to say that I believe this review to be skewed – Allstate frequently has secret new policies they do not inform their policyholders about until the policy holder has a problem and requires the help from Allstate. Claims are fought against the policyholder, and the value of a claim to be paid is 50-90 LOSS to the policyholder. Try repairing roof damage or replacing windows at the cost of Allstate’s low-balling adjusters. It truly is pathetic for an insurance company to rake in the millions from policyholders but deny them coverage when they truly need to file a claim against damage. Hail coverage, wind coverage, tornado coverage, all the acts of nature/God/whatever that the policyholder has no control over, Allstate refuses to pay. Apparently, Allstate doesn’t feel that extensive storm damage to a ROOF and WINDOWS demands a fair adjustment. It would have cost us triple the amount to repair damage, and Allstate gave us 1/4 needed to repair. Thanks, Allstate, for requiring high premiums but refusing to pay when your policyholders need you most. Oh, and don’t even think about claiming more than twice in a 10 year period, you’ll be cancelled just for asking about a claim.”

FAQ

Do Products and Services Differ From State to State?

Although policies are available to all 50 states in the United States and all provinces in Canada, not all policies are created the same. Due to the discrepancies amongst each state’s legislation regarding minimal insurance coverage, the policies may slightly differ to comply with the local law. For example, because each state has a different set of law regarding insurance, you can expect a discrepancy of premium depending which state you live in. According to the 2016 survey, here is a list of the average premium cost for all 50 states and the District of Columbia:

So if you are living in Michigan, you can expect to pay a lot more than the rest of the United States for an auto insurance policy.

In addition to cost difference, some policies may only be available in specific states due to specific concerns relating to natural disasters. So if you are moving to another state, make sure that your transferred policy covers all your needs. If you have any doubts or questions, contact an agent on the phone before you begin your move.

How many customers does Allstate have?

Allstate has 20 million customers from the United States and Canada. Of the 50 states, California, Texas, New York, Florida, and New Jersey have the most customers subscribing to their policies.

How much does Allstate insurance go up after an accident and/or speeding ticket?

The answer depends. If this is the first time you have an accident or receive a speeding ticket, you will be given a free pass and your rate will not go up. However, after the first time forgiveness is used, you can expect an insurance rate increase. In general, you can expect your insurance rate to increase with these scenarios:

Policy Rate Increase Due to Speeding Ticket History |

|

| 1st Ticket | No change due to first time forgiveness rule. |

| 2nd Ticket | You can expect an increase between $100 to $150 on your annual premium. However, if you are in the high-risk driver category, your policy may increase by several hundred dollars. |

| 3rd Ticket | You can expect an increase between $150 to several hundred dollars increase as this is your third offense. |

| 4rd Ticket | The repeated offense can kick you into the high-risk driver category and you can expect an increase between $200 to $1,500 on your policy. In extreme cases, the provider may even refuse you of any coverage. |

| Policy Rate Increase Due to Accident Frequency History | ||

|---|---|---|

| Accident Fault | Damage Involved | Rate Increase |

| Not at fault | Any | No change |

| At fault | Below $2,000 | $0-300 annually |

| At fault | More than $2,000 | $300-$600 annually |

| At fault | Human injuries involved | $400-$800 annually |

| At fault multiple times | More than $2,000 | $1000 or more. May even result in policy cancellation. |

What does comprehensive insurance cover with Allstate?

It includes coverage due to falling objects, damage from animal, windshield and window damages, theft and vandalism, and damages related to storms and natural disasters (e.g. earthquakes, floods, hurricanes, and tornadoes). Note that there is a deductible for comprehensive coverage. You will need to meet your deductible limit before the provider cover the rest of the damage. Depending on your chosen plan, the deductible amount may range between $0 to $1,000.

Does my Allstate insurance cover a rental car?

The answer depends on your chosen policy. If you have purchased a rental reimbursement coverage along with your auto insurance, the option will pay for your car rental during the time your vehicle is being repaired or if your vehicle is stolen or damaged to a point where it is not drivable. The best thing about the reimbursement coverage is that there is no deductible limit. It simply kicks into action as soon as you meet the requirement.

Does my Allstate car insurance cover me in Canada or anywhere outside the USA?

If you are driving your vehicle across the Canada border as a tourist, your policy will continue to cover you. However, because the Canada insurance data input system is slightly different from the United States system. At the same time, if you do not the correct proof of insurance in Canada when you get pulled over by a Canadian police officer, the officer has the rights to give you a fine. To avoid running into such problems, you will want to apply for a Canada Inter-province liability card from the provider. This service is free and will save you from a lot of hassle.

Does Allstate insurance use credit scores?

The answer is yes. When an agent quotes you the premium on a policy, they will give you a price based on your insurance score. Your insurance score is based on several history records:

- Your previous insurance history (any lapse in coverage, late and/or missed payments, “high-risk” factors…etc.)

- Your credit history (how credit score and how long is your credit history)

- Your current credit card balance and history

- Number of credit accounts you have

- How many hard credit score inquiries you have

- Any foreclosure, collection, bankruptcies in your credit history

According to the company’s policy, the agent can review your history for the past 5 years to access whether you are a “high-risk” customer. Those individuals who have great credit history and insurance history will receive a lower premium than others who only have fair credit and insurance history. However, do not be discouraged if you do not have a good insurance score. You can still be able to lower your premium with the number of bundle programs and rewards.

How user-friendly is the Allstate website and phone app to use?

According to the Google Play reviews, the Allstate Mobile App has received a 4.2 out of 5. Most of the reviewers have found the app easy to use and makes payment very convenient. However, for users who have an older smart device, the program may become very slow and experience compatibility issues. Other reviewers find that their website is very user-friendly and “contains a wealth of information”. For people who avoid paying their premiums by smart devices, the website payment option is easy to use.

What are Allstate’s financial strengths?

According to the A.M. Best rating company, Allstate holds a superior score for its insurance products, life insurance products, and assurance company annuity products as of 2016. Their score has been held at A+ for many years and has been noted as having the second strongest claim pay back reputation in the insurance industry in the United States.

| Allstate Financial Strength Rating | ||

| Insurance Products | Life Insurance Products | Assurance Company Annuity Products |

| A+ | A+ | A+ |

The accident is not my fault. Will I still have to pay my deductible?

It depends on the coverage plan you have purchased. If you have the basic coverage plans without any add-on coverage, you will be required to pay a deductible EVEN when you are not at fault for the accident. However, when Allstate recovers the damage payments and your deductible fees, you will receive a reimbursement along with the damage and repair costs. If the provider is unable to recover your deductible, you still have the option to chase after the fee by contacting the at-fault party provider or even go through the legal process should you feel the need.

What happens if I total my vehicle?

Even if you have totaled your vehicle, file your claim as you would for any other car accident situation. A claims adjuster will go through the evidence, review the repair and replacement estimation, and check the market cash value of your car. If the repair cost exceeds your vehicle’s worthy, the adjuster will declare your vehicle as a total loss. In such case, the provider will reimburse you the actual cash value of your car up to your policy limits, but minus your deductible cost.

What if the actual repair cost is more than the adjuster’s estimation?

This depends on whether you choose to repair your vehicle with one of Allstate’s repair shop or with your own preferred repair shop. If you choose to repair your car at a Good Hands Roadside Network autobody shop, the technicians will directly negotiate with the provider concerning the additional damages. However, if you choose your own repair shop, the technician will have to contact the provider to discuss about the additional damage costs.

Will my insurance premium rate increase if I do file a claim?

Your insurance premium rate increase is dependent on several factors. Usually when you file a claim and you are not at fault for the accident, you would not get an increase on your premium rate. However, if you are at fault for the accident, the claim may increase your premium rate depending on your coverage policy and whether you have purchased the first-time forgiveness add-on. If this is your first at-fault accident and you have the first-time forgiveness add-on option, you will be happy to know that your premium rate will not increase. However, if this is not your first time at-fault accident, you are very likely to see an increase in your premium rate. If you are concerned in any way about how much your premium rate can increase, talk to your agent.

Interested? How to Get in Touch with an Agent

With the recent technology advancement, you can get in touch with an agent in many ways:

- You can visit your local Allstate office to meet with an agent. Please note that the premium may be slightly higher if you purchase a policy from an agent in person because they may include a service fee.

- You can purchase a policy by calling 1-800-ALLSTATE. The agents on the phone are all very knowledgeable of all the policy details and can often give you the best bundle price and bonuses.

- You can get in touch with an agent by accessing the online website allstate.com

- You can also find an agent by using the smart devices with the Allstate app.

Conclusion

When you purchase an insurance policy, there are numerous of factors you should consider. Even though it may be tempting to make your decision based on the premium rate, you should really consider whether the plan will sufficient cover you in cases of accidents. At the same time, you should make sure that the insurance provider is a well-established company that has a strong financial strength rating and a great customer satisfaction grade. When choosing a plan, you must look past all the advertisement gimmicks and attractive promises, and investigate the reviews from other customers. This process will truly minimize the claim filing headaches in the already stressful situation and get back to your life as quickly as possible.

As one of the oldest insurance providers in the United States and holding a superior grade in financial strength, Allstate has one of the biggest lists of products available in the insurance market. These products claim to allow customers to customize the plans to suite their needs. And although they have never marketed themselves as affordable coverage, they do give a competitive rate against the other insurance providers. Many individuals who are long-term auto insurance customers have raved about the great customer service and claim process.

On the flip side, as of 2008 and forward, there has been an increasing amount of negative reviews concerning the combative techniques agents and adjusters use to drag on paying claims, low-balling claim estimations, skimp on reward checks, refusing to end overage, continue to bill customers after end of service, and even discourage lawsuits against at-fault party. Along with continuous rate hikes and premium rate increase due to at-fault claims, these are the reasons why many individuals have switch over to other competing insurance companies such as Geico, Farmers, and Progressive.

GOOD FOR:

Safe drivers, young drivers with no accident history, and drivers with great credit history.

BAD FOR:

Drivers who want a cheap policy, drivers who have a history of at-fault accidents and violation tickets, and drivers with only fair credit history.

Check out our video review of Allstate below:

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.