The 7 Most Dangerous Threats Facing American Homeowners

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding co...

Meggan McCain

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Michael Vereecke

Updated December 2023

Who wouldn’t want to own a home? For decades, home ownership has been an integral part of the American ideal. From the suburban housing explosion of the 20th century to the ill-advised mortgage boom of the 2000s, our national ambition could well be described as, life, liberty, and the pursuit of real estate.

So, why are rates of homeownership at their lowest point since 1965? Economists’ explanations vary, but most agree on an obvious culprit: cost. After cratering during the recession, home prices are taking off again; sadly, incomes aren’t. That means more folks are renting, instead of putting down roots in homes they fear they can’t afford.

Here’s the good news for current and prospective homebuyers: Buying a home you can comfortably afford is still an excellent investment. That’s especially true as prices trend steadily upward again. But don’t think you can just sit back and watch your home’s value grow. A house is an investment you need to protect.

That means managing risks that could turn your dream home into a financial nightmare. If your mortgage eats up a sizeable chunk of your income every month, you expect serenity at home – not expensive surprises. Unfortunately, most homeowners are clueless about common threats to their precious property and just how much these hidden risks could cost them.

Get caught unprepared and you could end up in homeowner hell. That’s where this guide comes in.

Below, we explore the seven greatest threats facing the personal and financial security of the American homeowner today. This is the most comprehensive guide online to threats every homeowner should understand and solutions every family needs to know.

Let’s get down to the top seven threats menacing American homes – and wallets.

The 7 Most Dangerous Threats to Your Home

Fire

Of course, the threat of fire should be discussed first in nonfinancial terms. In 2014, the latest year tracked by the United States Fire Administration, more than 3,200 people died from fires, and nearly 16,000 suffered injuries. In light of this tragic toll, the best reason to address the threat of fire is the safety of your family.

But even when no one is harmed, fires can cause homeowners some serious pain. The latest stats show fires costing Americans roughly $11.6 billion dollars a year in damages, with $6.9 billion coming from residential fires alone. That includes 379,500 residential building fires in 2014.

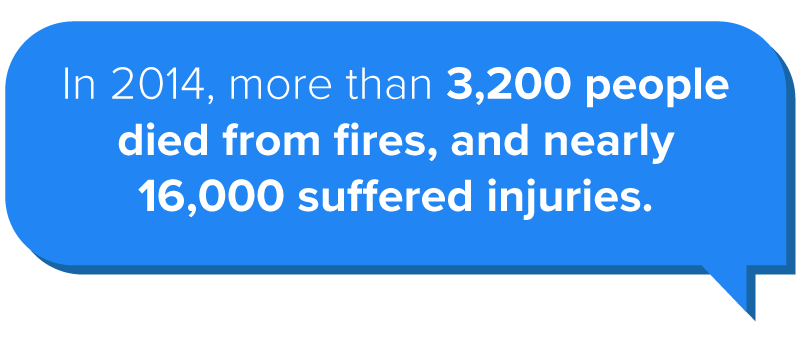

If you don’t think your home could be one of them, think again. These terrible outcomes result from common problems. Here are the top five reasons these fires happen in American homes:

These numbers tell a frightening tale: Small errors and oversights can result in enormous destruction, including entire homes.

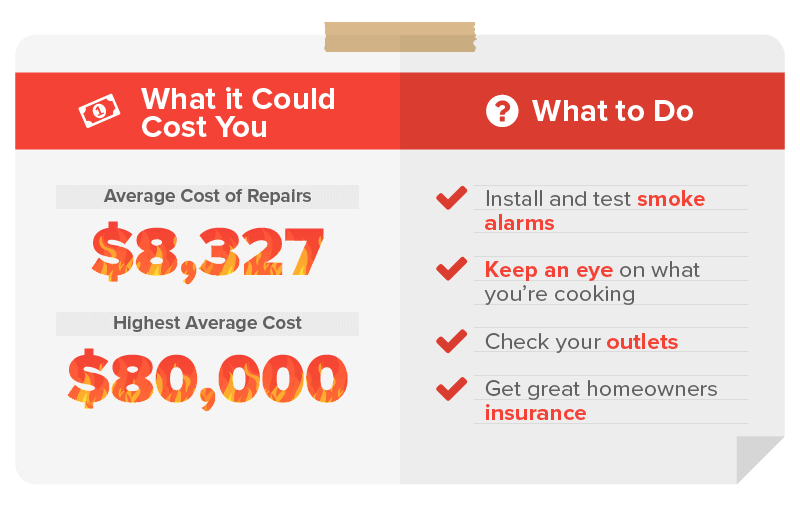

What Fire Could Cost You:

According to HomeAdvisor, the average cost to repair damages to a home resulting from a fire is $8,327.

The highest cost recorded in their data was $80,000.

Those costs could include a number of repairs required to recover from fire damage:

- Structural repairs resulting from the fire’s path

- Water damage (from extinguishing the flames)

- Smoke and soot damage (to walls, furniture, carpet, and more)

What To Do:

Now that we understand the scale and severity of fire’s potential for destruction, let’s cover some constructive tips for keeping your home out of harm’s way. Thankfully, many fire safety tips are often extremely easy – and inexpensive – to implement.

Install and Test Smoke Alarms

- Sure, odds are you already have them. But you many not have enough. The Red Cross recommends at least one on each level of your home, and especially inside bedrooms, where you’ll need them most if a fire starts at night.

- Test them once a month to make sure the battery is still working properly. This should only take a few minutes, and it could be the difference between having a useless ceiling ornament and a device that saves your life.

Keep an Eye on What You’re Cooking

- The leading cause of kitchen fires is unattended cooking. A watched pot rarely burns down a home.

- If you do have a small grease fire, never try to extinguish it with water! That will only make it worse. Instead, cut air off from the fire by putting a lid on it.

Check Out Your Outlets

- Never have more than one appliance that produces heat plugged into the same outlet. That’s a recipe for sparking.

- Make sure major appliances, such as a fridge or microwave, are plugged directly into the wall. Extension cords are not the answer.

Get Great Homeowners Insurance

- No matter how careful you are, there’s a chance a fire might devastate your home. Rest assured you won’t be paying for the repairs. Quote can help you get the coverage you need at a price you’ll like.

Flooding

Fortunately, the prevalence of fires has declined in recent years. Sadly, the same can’t be said of our next major threat: flooding.

In 2016, America experienced the highest number of floods ever recorded. If flooding is an intensifying problem, it’s certainly not a new one. According to the National Weather Service, flooding has cost Americans an average of $7.96 billion in damages per year over the last 30 years on record. That financial damage isn’t the only reason homeowners should take notice – on average, flooding claims the lives of 82 Americans every year.

To make matters worse, flood damage doesn’t always end once the water is gone. Mold can set in on a range of building materials, most often in dark places, such as in basements, beneath carpets, and between walls. These issues can be difficult and costly to find, let alone fix.

If your home is affected by a flood, you might not have much power to mitigate the damage. Here’s what getting caught in a flood might mean for your family’s budget.

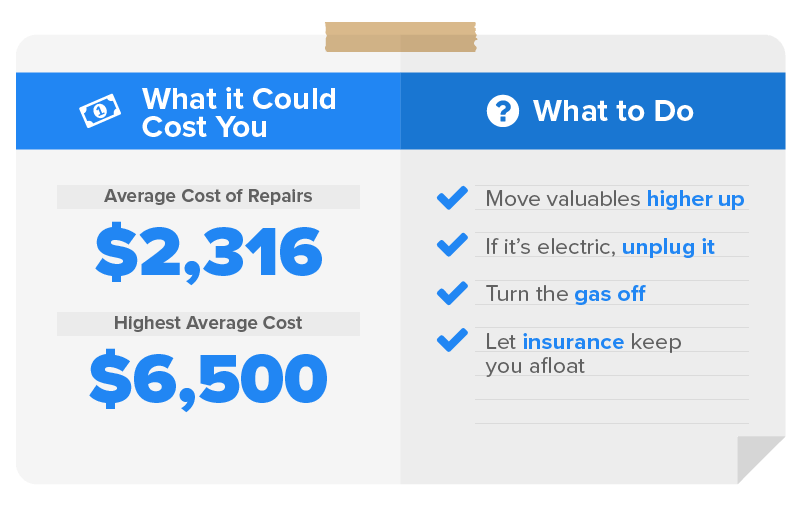

What Flooding Could Cost You:

According to HomeAdvisor, the average cost to repair damages to a home resulting from a flood is $2,316

The highest cost recorded in their data was $6,500.

Those costs could include a number of repairs required to recover from flood damage:

- Structural repairs resulting from the water’s path

- Removal of mold and other health and safety issues

What To Do:

Unfortunately, preventative measures have minimal value in the face of an overwhelming flood. But even if your home is completely flooded, here are some techniques that can often make a bad situation better:

Higher is Better

- Move your outdoor furniture and most important items to the highest possible point in your home. It’s simple physics and could save you thousands if the water stops short of your top floor.

If It’s Electric, Unplug It

- It may seem obvious that electric current and water shouldn’t mix. But it’s easy to forget for appliances we always leave on otherwise. If instructed to do so by authorities, cut your electricity off entirely.

Get the Gas Off

- In some cases, gas has caused explosions in residential settings affected by floods. If you’re leaving your home, cut it off. You won’t be using it for a while.

Let Insurance Keep You Afloat

- We already mentioned the virtues of homeowners insurance above. But many homeowners policies skip the protections you need in the event of flooding. Consider supplementing your homeowners insurance with a flood insurance policy, lest your home’s value get washed away.

Pests

Unlike our first two threats, pests don’t take dozens of lives every year. But they can certainly make life at home pretty uncomfortable and eat away at your prized investment – literally.

Take termites, which cost American homeowners over $5 billion dollars annually. They’re difficult to detect until major damage is done, and associated repairs typically aren’t covered by standard homeowners insurance. That means a huge repair bill could surprise you at any time, and you won’t have help covering it.

But pest problems don’t end with infestations of the “structural” variety. In recent years, American homeowners have increasingly encountered an equally vicious foe: bedbugs.

Once considered common only in apartment buildings, bedbugs have now begun to affect thousands of single-family homes. As a result, 20 percent of Americans now say they know someone who has had encountered bedbugs, or they’ve found them in their own houses.

These insects can render your home uninhabitable in just weeks, and you may find yourself replacing pricey items such as mattresses, furniture, and prized clothing in the push to purge your home of these itchy invaders. Unless you can find a generous friend to risk taking you in, you’re also looking at hotel bills for at least part of the three weeks it takes to resolve a typical infestation.

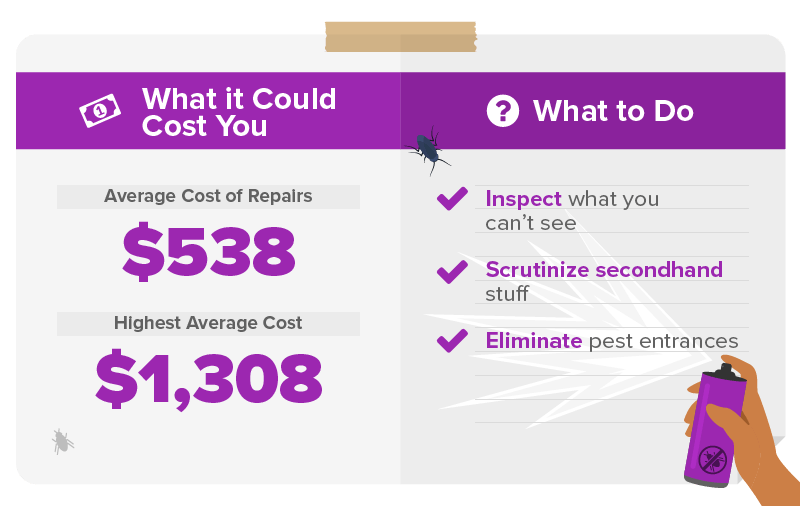

What Pests Could Cost You:

According to HomeAdvisor, the average cost to repair damages to a home resulting from termites is $538.

The highest cost recorded in their data was $1,308.

Those costs could include a number of repairs required to recover from pest damage:

- Full fumigation of your home

- Full inspection of your home for termite presence and damage

As infestations vary widely by species and severity, there’s no hard and fast rule when it comes to extermination prices. But you can count on it to cost you hundreds.

What To Do:

Every pest poses a different problem, but some basic recommendations can protect you from multiple species taking up unwelcome residence in your home.

Inspect What You Can’t See

- Unfortunately, only trained professionals can make you aware of a termite issue in your midst, before real damage occurs. Many companies offer free or low-cost inspections, with no obligation for further services if they uncover an issue.

Scrutinize Secondhand Stuff

- We all love a steal on used goods that seem to be in fine condition. But pause before that consignment shopping spree. Furniture, mattresses, and even clothing can serve as a vehicle for bedbugs to enter your home. Give secondhand items a thorough inspection, or your attempt to be thrifty could cost you hundreds in extermination fees.

Eliminate Pest Entrances

- Small exterior fixes, especially in places such as your home’s foundation, don’t always seem like necessary expenses. But small investments in exterior upkeep can pay huge dividends in preventing the cost of repairing issues once bugs breach your walls.

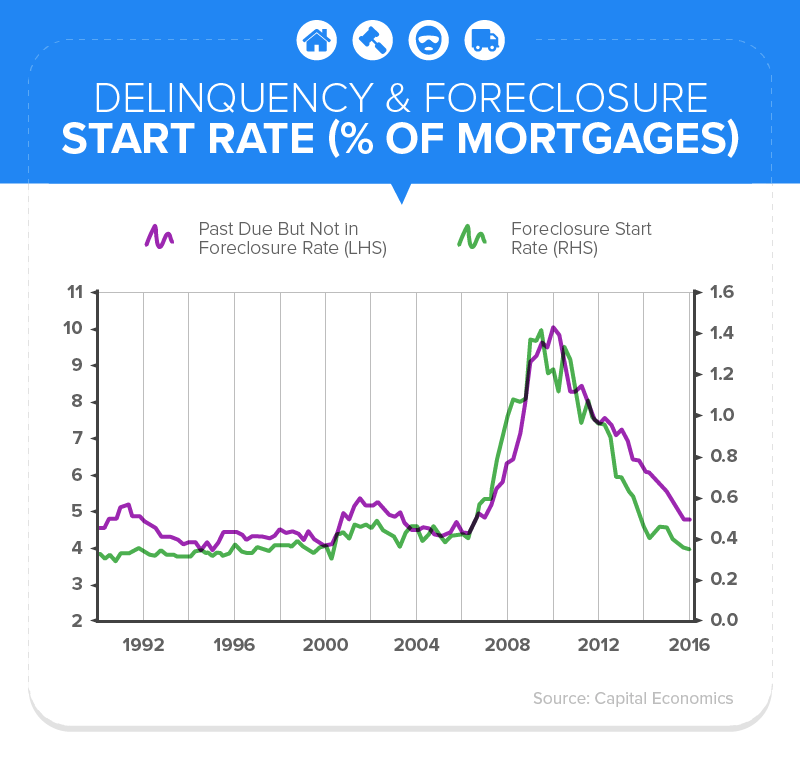

Foreclosures

After a long recovery, our nation’s recession seems to be reaching a close. Mercifully, the trend of foreclosures that precipitated and accompanied the crash has reversed as well. Current rates resemble levels seen in the 1990s, following their terrible peak in 2009.

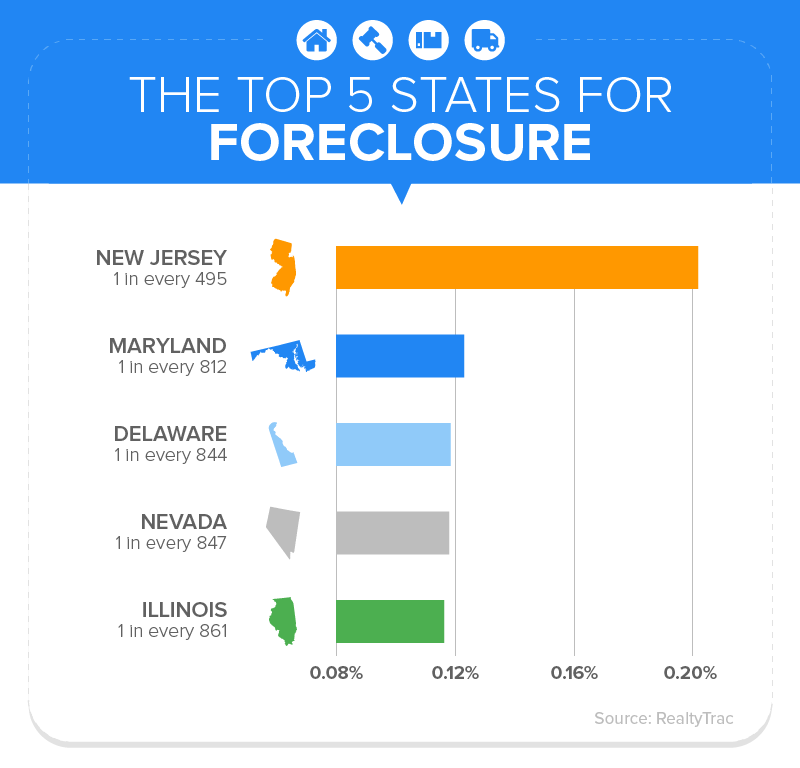

But for many Americans struggling to make ends meet, that news doesn’t translate to an easier time keeping their homes above water. According to RealtyTrac, one in every 1,588 homes is in foreclosure currently. In some states, the rates are far higher:

The recession has taught most Americans the high costs of buying a home with too little capital. Still, if your family’s financial circumstances change drastically, your mortgage commitment will likely not accommodate your needs. From major illness to loss of employment, the unexpected can still strike fear in the heart of homeowners.

If the worst occurs and you face losing your home, just how bad could it be?

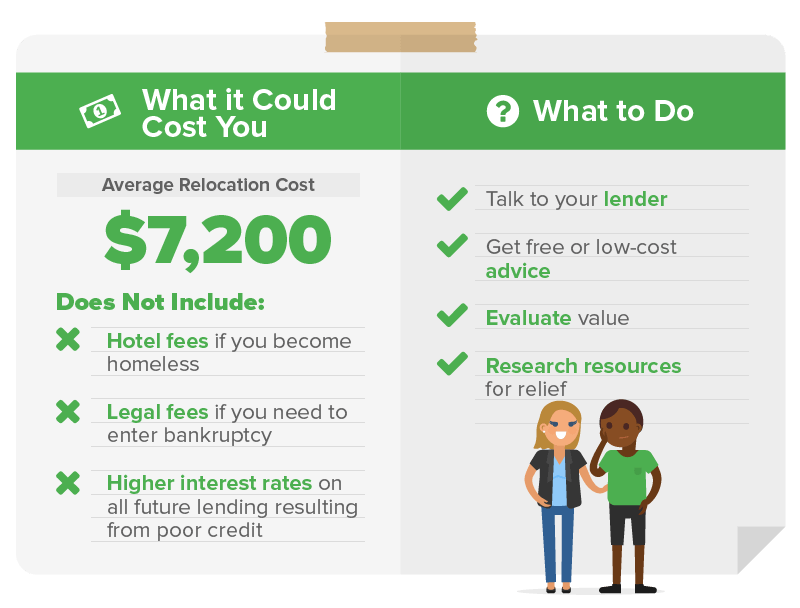

What Foreclosure Could Cost You:

Certainly, every circumstance presents nuances that might make projecting an average cost difficult. But according to the Urban Institute, the average costs related to foreclosure are $7,200 for the homeowner. That steep price does not include myriad other liabilities, such as:

- Hotel fees if you end up homeless

- Legal fees if you need to enter bankruptcy

- Higher interest rates on all future lending resulting from poor credit

Depending upon how long your foreclosure crisis extends due to legal action, you could face mounting penalties and lawyer’s fees of thousands of dollars a month.

What To Do:

Clearly, the best preventative measure possible is avoiding an investment you can’t afford. But that sage advice doesn’t help you much when an emergency plunges you into financial jeopardy you never thought you’d face. Here are some tangible steps that could help if you’re fighting foreclosure.

Talk to Your Lender

-

- Addressing the problem proactively with your lender can seem like a harrowing prospect. Aren’t these the people who want to take your home? But actually, foreclosing on a home is massively expensive for lenders, with costs in the neighborhood of $50,000. That means the bank might actually find negotiating a reduced monthly payment over a longer period to be an attractive alternative. You’ll never know if you don’t open this essential line of communication.

Get Free or Low-Cost Advice

- From the right sources, of course. First and foremost, the U.S. Department of Housing and Urban Development offers counseling and guidance specifically to help homeowners walk back from the brink of foreclosure. They’ll help you explore your options, and acquaint you with your rights, at no (or low) prices.

Evaluate Value

- Get a competent real estate agent or home value estimator to evaluate your home’s current value. Selling your home could be your way out, even if what you get is less than what you paid for it. Your lender might be more than happy to take what they can get if a buyer will supply a reasonable price. If you are facing foreclosure, there are steps you can take to sell your home quickly. The first thing you should do is make sure you have a solid marketing plan. You need to create a list of potential buyers and target your home to the right audience. You can also work with a real estate agent to help get your home sold as quickly as possible.

Resources for Relief

- A surprising number of government programs exist to mitigate or avoid the risk of foreclosure. From programs designed to suspend mortgage payments during times of crisis, such as unemployment, to regionally targeted programs for areas hit hardest during the depression, these options are well worth looking into.

Burglary

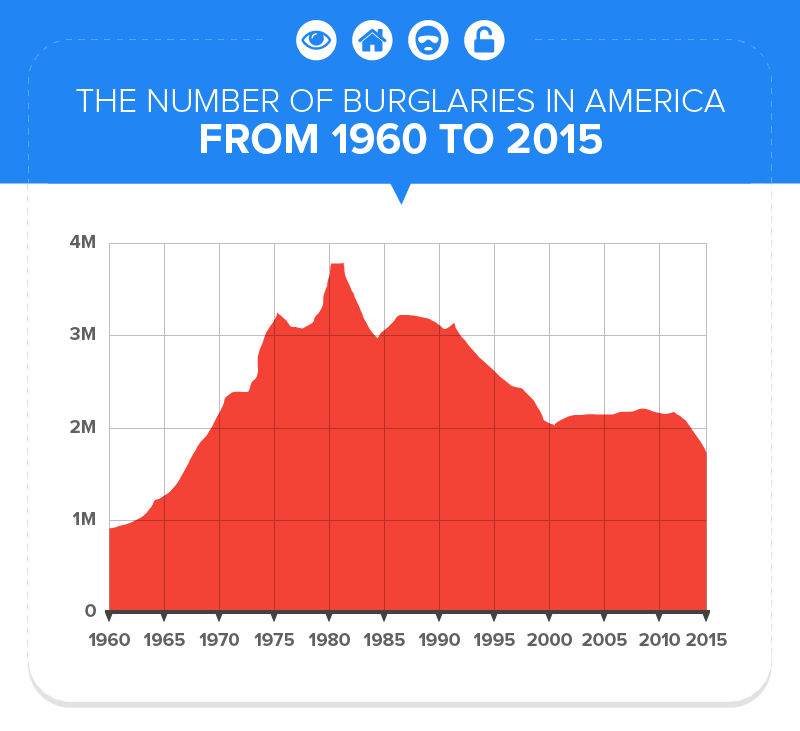

Thankfully, our next major threat is also trending in an encouraging direction: Burglary totals have declined nationwide in recent years. 2015, the most recent full year the FBI has on record in their uniform crime archives, saw just 1,579,527 burglaries – an almost 30 percent decrease from 2006 estimates.

But don’t consider America’s burglary problem solved; while we’re moving in the right direction, there’s still reason to be proactive about protecting our homes.

It’s hard to celebrate nearly 1.6 million instances in which American’s property was subject to unwarranted or forcible entry or theft, even if that total does represent an improvement. For one thing, the improvement is uneven: Many Southern states still see burglary rates higher than 700 per 100,000 people, whereas the national rate is 491.4. Sadder still, burglaries cost Americans roughly $3.6 billion in 2015.

Additionally, a recent UNC Charlotte study found that 88 percent of convicted burglars cited reasons involving drugs as their primary motive for committing a burglary. With opiate addiction in America surging, homeowners may contend with a new wave of property crime as a result.

Few experiences are more traumatizing for homeowners and their loved ones than returning home to evidence of an intruder. A happy home can be tainted by a lingering sense of violation, resulting in emotional costs that are hard to quantify. Still, how much financial damage will you suffer if your home falls victim to burglary?

What Burglary Could Cost You:

According to the FBI, the average burglary results in $2,316 in stolen property, money, and damages.

But that total could be far greater if you keep large amounts of money or valuable jewelry around the house. Of the convicted burglars interviewed in the UNC Charlotte study, 79 percent said they were looking for cash, while 68 percent noted jewelry as a target.

The FBI’s estimates don’t include a number of potential related costs beyond the value of stolen goods or property damage. These ancillary costs could include:

- Hotel bills if you stay elsewhere until you feel safe to return to your home

- Replacing or upgrading locks around your home

What To Do:

Security measures are as old as mankind’s first homes, but new technologies are changing how Americans protect the places they live. With cameras beaming footage of our homes straight to our smartphones, it’s easier than ever to stay aware of intruders. But you don’t need to make your home a digital fortress to rest easy at night. Here are some basic tips every homeowner should implement:

Be Alarmed

- 60 percent of burglars said they wouldn’t consider victimizing a home with evidence of a visible alarm system. The real value of a security system lies in its ability to protect you through prevention.

Lock It Up

- This is an obvious tip, but the numbers indicate it bears repeating. The majority of burglars enter through unlocked or minimally protected windows and doors. According to the FBI, 35.5 percent of burglaries did not involve forcible entry. Double-check your windows and doors before you leave your home.

Neighbors Can Be Saviors

- Nothing signals an empty home like newspapers and mail piling up on your doorstep. Offer to keep your neighbor’s porch clean next time they go on vacation. When it’s your turn to take some time away, they’ll likely do the same.

Insure To Be Sure

- Most homeowners insurance covers damages inflicted by burglary, as well as the value of stolen items. While it won’t restore your sense of security, insurance will make up for the financial damage criminals inflict. Just make sure your policy reflects the true value of what you stand to lose. We can help with a customized quote.

Soaring Insurance Costs

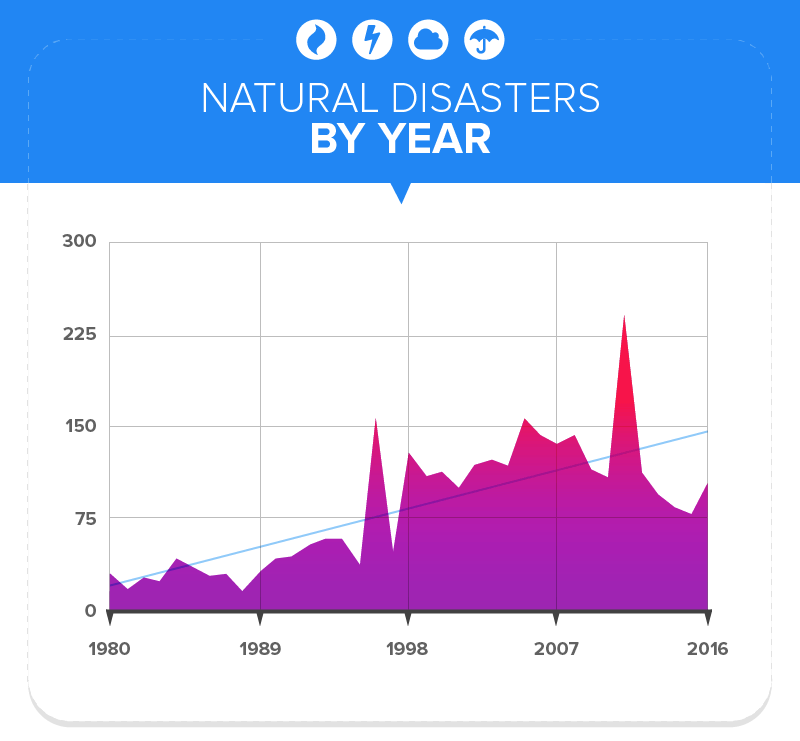

Remember when we explored the risks of fires and floods, and suggested an appropriate insurance policy could put your mind at ease about those risks? Well, we’re not the only ones wary of those risks.

For years, insurers have been paying out more in claims that they’re taking in from premiums. That’s because natural disasters, such as the increased rates of flooding described above, have slammed insurers with more frequency and severity than they anticipated.

Low home insurance rates are predicated on the rarity of natural disasters. And that assumption isn’t panning out. While yearly totals vary, a troubling trend is clear:

As a result, insurers are hoping to prevent losses from payouts by hiking up premiums. According to the Insurance Journal, homeowners insurance costs increased 36 percent from 2003 to 2010. That trend continued with a 7.6 percent increase in 2011 and a 5.7 percent increase in 2012.

While recent industry data is quite scarce, there’s no disputing the trend working against the American homeowner. But for the same reasons premiums are rising, the prospect of going without insurance is a non-starter. Additionally, many mortgage lenders require homeowners insurance, even if you were thinking about rolling the dice and going without it.

What Soaring Insurance Costs Could Cost You:

While every home is subject to a number of factors that dictate rates, the National Association of Insurance Commissioners estimates the average home insurance costs to be $1,085 per year.

That’s especially problematic because the Federal Reserve Bureau estimates annual premiums should fall between $300 and $1,000 per year. For states such as Florida that are particularly prone to natural threats, premiums can top $2,000 annually.

What To Do:

Strategies to reduce insurance costs will hinge on your needs, location, and home. But here are some tips any homeowner can use to get those rates moving in the right direction, or at least keep them flat.

Bundle Up

- We’re all about shopping for the best combination or coverage rates from any provider. But if you already have auto insurance you like, then bundling it with your home insurance could cost you less than getting good rates on each from independent providers.

Lower Premiums With a Higher Deductible

- If you agree to pay a larger amount whenever you do file a claim, you can create significant savings in all the months you don’t. For instance, if your deductible is $500 higher, you might save 25 percent on annual premiums. That pays for itself in about two years without a claim.

Do What Earns Discounts

- Many providers offer discounts for best practices that homeowners are considering anyway. From installing a security system to stormproofing your windows, many practical decisions will be rewarded by insurers. But don’t count on them to ask about it. Let them know what you’re already doing to protect your home, and ask what else you can do to push down your premiums.

Compare Quotes

- Every insurance company will offer you a different rate, even for essentially identical types of coverage. Because the details of your identity and home are integral to their pricing, you can’t find their rates online or elsewhere. That can make the process of comparing your options exhausting. Let Quote’s comparison tool do that work for you.

Rising Electricity Prices

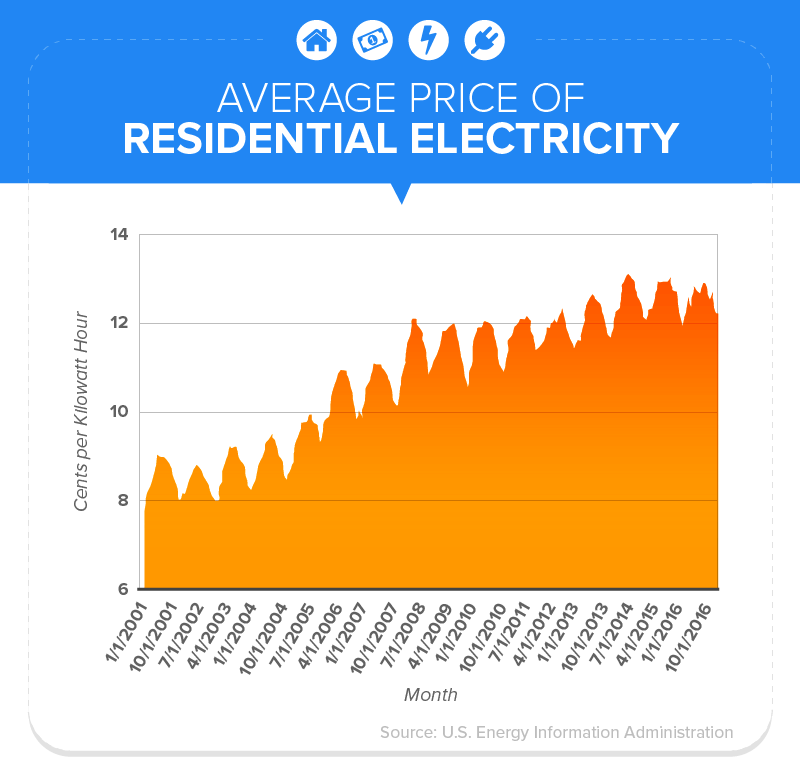

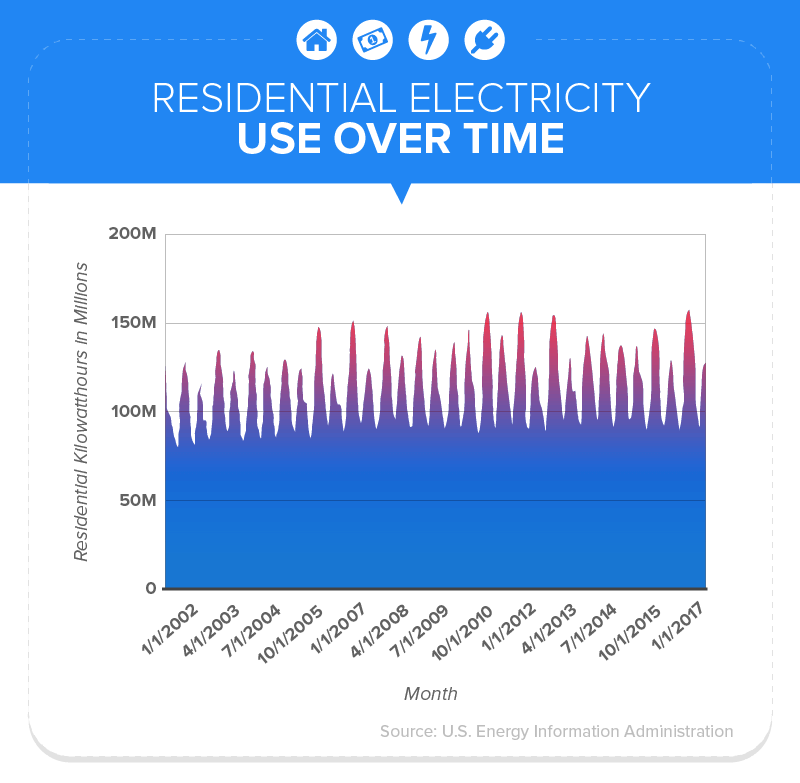

Our final (and possibly most formidable) financial threat facing the American homeowner is hidden in plain sight. We don’t fear electricity entering our homes; rather, we can’t stand being without it. With current at the core of our modern lifestyle, we rarely question the cost at which we use it. But a troubling trend in spiking electricity prices suggests we should.

According to the Department of Energy, homeowners paid just 7.73 cents per kilowatt hour on average in January 2001. In January 2017, that cost was 12.22. So, what’s the big deal about 4 ½ cents?

The average American home uses 10,812 kilowatt hours of energy per year. Multiply that 4 ½-cent difference by 10,812 and you get roughly $485 more in electricity costs per year.

With these spikes in prices, the average monthly electric bill reached more than $114 per month in 2015. That’s $1,368 a year. That price tag hurts for many homeowners, and those rates are only projected to get worse.

Why the peaking prices? A likely suspect would be demand: We’re using more devices than ever, so electricity would accordingly be more coveted, right? In fact, the numbers tell a different tale. While we’ve seen a modest increase in electricity usage, it pales in comparison to the pricing surge.

Next suspect: the source. The price of fossil fuels is surely tied to electricity prices, right? If they go up, so will your monthly bill. Actually, natural gas and coal prices have declined and remained steady respectively.

So why are electricity prices skyrocketing? Some cite government regulations aimed at eliminating carbon emissions as a source of costs for electricity producers, which are being passed on to the consumer.

If that’s the case, American consumers are paying a price for sustainable initiatives. But financial stability doesn’t have to be at odds with sustainability. What if you could profit from the green energy revolution personally?

What To Do:

Sign Up for Solar Savings

Solar technology once seemed like the power source of the future. But with energy prices moving ever upward, solar panels are a cost-saving solution you need in the present.

If you’re a homeowner, you already understand the value of an upfront investment that’s smart in the long run: It’s why you bought a home in the first place. So why not apply the same thinking to powering your home, and invest in a sustainable financial future? With electricity costing you more every year, the return on your investment will increase as well.

What’s better than avoiding rising electricity prices? Capitalizing on record-low costs to install solar. According to the Solar Energy Industries Association, the price of solar has gone down by 60 percent over the last decade. On top of that, the federal government offers a 30 percent tax credit on your solar installation.

Not convinced yet? Let’s do the math on how much you could actually save.

The Investment

The Payoff

- Currently, the national average for solar savings over a 20-year period is $20,080. That’s more than $1,000 a year, or a 70.8 percent return on investment.

But remember, that ROI only promises to grow in the coming years, as electricity prices continue to climb. In some states, the savings could be even greater. Check the average 20-year returns for these sun-blessed states:

- Florida: $33,284

- California: $34,260

- Hawaii: $64,769

Want to find out how much solar could save you? Use our customized quote tool to get a personalized price to invest in protection from rising electricity prices. It’s truly an investment that keeps on giving.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.