What is Medicare Supplemental Insurance (Medigap)? (2026 Update)

Medicare Supplemental Insurance (Medigap) helps cover out-of-pocket Medicare costs such as copayments, coinsurance, and deductibles not covered by traditional Medicare. There are ten Medigap plans, with Plan A covering basic costs and other plans offering additional coverage. Medigap costs start at $35/mo.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated August 2025

What is Medicare Supplemental Insurance (Medigap)? A Medigap policy covers a portion of your doctor and hospital bills, as well as deductibles, copays, and coinsurance up to the policy limits.

Many people on Medicare choose to add supplemental insurance called Medigap. Officially known as Medicare Supplemental Insurance, these plans fill in the gaps left by Original Medicare Part A and Part B. Monthly Medigap rates start at $35/month but can get as high as $488/month depending on the level of coverage.

Start comparing health insurance plans. Our guide below breaks down the top Medicare Supplement plans so you can pick the best policy at the right price. Or enter your ZIP code to get free Medicare quotes from local companies.

- Medigap policies cover a portion of Medicare costs

- You cannot add Medigap to Medicare Advantage plans

- Medigap coverage starts at $35/mo but costs vary by company

Medicare Supplemental Insurance (Medigap) Explained

What is Medigap? A Medicare Supplement insurance plan generally covers Medicare Part A and Part B coinsurance charges, including deductibles.

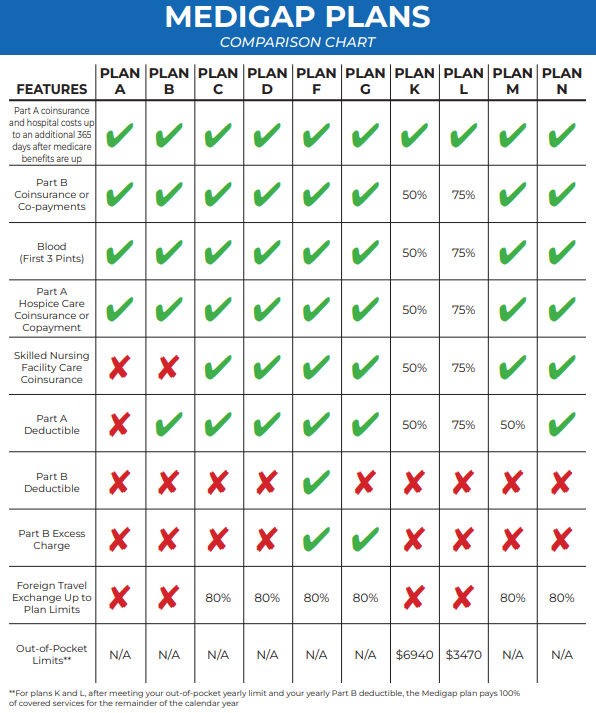

There are ten Medigap plans in all, but Medigap Plan C and Plan F are no longer available after January 1, 2020. Consider Plan D or Medigap Plan G instead.

Comparing Medigap Plans

Each Medigap plan is very similar save for a few key benefits. For example, the most basic plan — Medigap Plan A — covers copayments for both Parts A and B, as well as hospice care and extended hospital stays. Medigap Plan B covers the same plus the Part A deductible.

What are the top five Medicare supplement plans? Since Plans C and F are no longer available, the best Medigap plans now are:

- Plan N: Cheaper than Plan G and covers 100% of Parts A and B except copays.

- Plan G: Closest to Plan F coverage. It doesn’t cover Part B premiums but pays for excess charges.

- Plan D: Same coverage as Plan G but doesn’t cover excess charges

- Plans K and L: Cheapest plans overall but you pay 50% (Plan K) or 25% (Plan L) of Medicare costs.

One of the biggest disadvantages of Medigap plans is that none cover Part B deductibles after January 1, 2020. Learn how to finance what your health insurance won’t cover.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

Breaking Down Medicare Costs

How much does Medicare cost? Compare prices below. While Original Medicare costs remain constant, Medigap premiums will vary by company and region.

Medicare Costs by Plan Type| Medicare Plan | Monthly Premium | Annual Deductible | Out-of-Pocket Max |

|---|---|---|---|

| Part A | $0-$505 | $1,632 | N/A |

| Part B | $174 | $240 | N/A |

| Part C | $0-$200 | $0-$200 | $8,850 |

| Part D | $34 | $0-$545 | $2,000 |

| Medigap | $35-$488 | $0-$2,800 | $3,500-$7,500 |

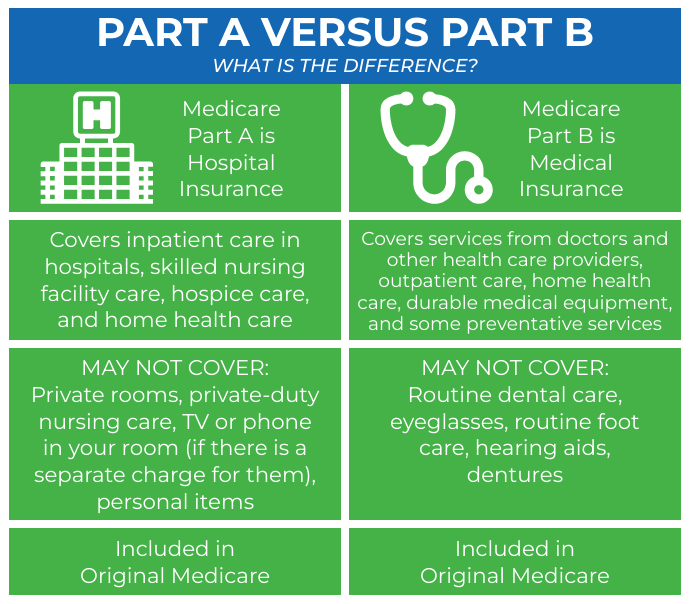

You are still responsible for copayments, coinsurance, and deductibles on Original Medicare. Part B only covers up to 80% after you’ve met the deductible, so you have to cover the remaining 20% yourself. This is where Medigap comes in.

Most Medigap policies do not have a limit on out-of-pocket costs, meaning you could end up spending more than the policy even covers. If you anticipate having a lot of medical bills as you get older, compare Medicare Advantage plans for more comprehensive coverage.

Read More: Millennial’s Guide to Health Insurance

Enrolling in Medigap

Medicare Supplement health insurance is only available when you enroll in Original Medicare Part A and Part B. It is not available with Medicare Part C (Medicare Advantage).

You’ll have the chance to sign up for Medigap during your Initial Enrollment Period (IEP). This starts three months before you turn 65 and ends three months after your birthday. Learn more about how to sign up for Medicare.

Do I really need supplemental insurance with Medicare? Important questions to ask before you enroll in Medigap are:

- Who qualifies for Medigap? Remember, you must already be enrolled in Medicare Part A and Medicare Part B to buy Medigap.

- Is there a reputable health insurance company? You can use the Medicare Plan Finder or contact your State Health Insurance Assistance Program (SHIP) to find insurance companies that offer Medigap policies near you.

- Did you compare Medigap policies? Use our comparison tool to compare different Medigap plans in your state and pick one that best suits your needs based on coverage options, costs, and personal health requirements.

Contact the chosen insurance company to apply. Check out these company reviews to avoid the worst Medicare supplement companies and find affordable Medicare and Medigap coverage:

- AETNA Health Insurance Review

- United Healthcare Health Insurance Review

- CIGNA Health Insurance Review

- Anthem Blue Cross Blue Shield Review

Once approved, you will receive a confirmation letter and your Medigap policy details. Keep these documents in a safe place for future reference in case you need to follow up on a claim.

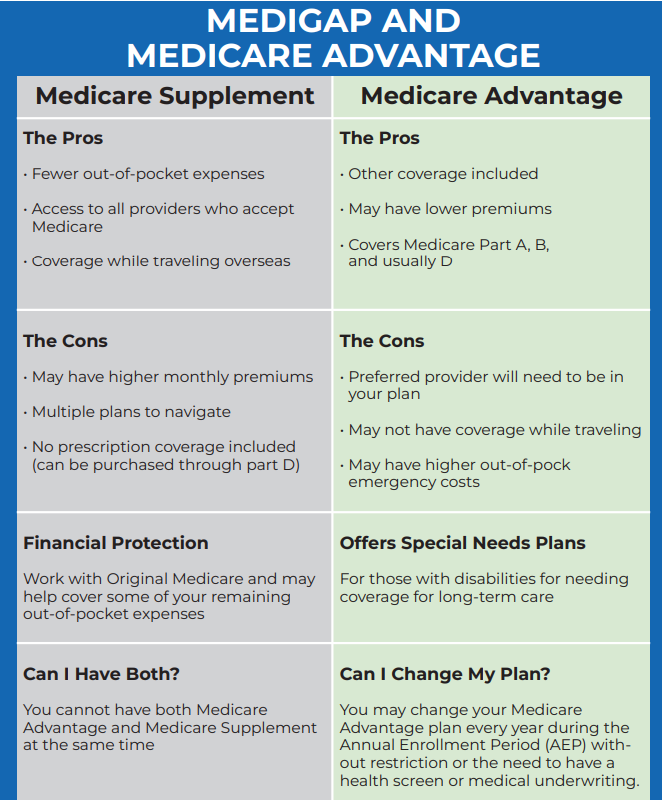

Medigap vs. Medicare Advantage

Medigap and Medicare Advantage may appear to be similar alternatives to Original Medicare, but they are not the same policy. Medigap is supplemental coverage while Medicare Advantage is a private insurance option.

Medigap plans are not Medicare Advantage plans, and you cannot have both a Medigap plan and a Medicare Advantage plan at the same time. However, you can buy Medicare Part D with Medigap since supplemental plans don’t typically offer prescription coverage.

Read More: What’s the difference between Medicare Advantage and Original Medicare?

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

How to Find the Best Medicare Supplemental Insurance

Medigap, or Medicare Supplemental Insurance, is designed to fill the coverage gaps left by Original Medicare (Part A and Part B). It helps cover out-of-pocket costs such as copayments, coinsurance, and deductibles.

Most Medigap policies do not limit out-of-pocket expenses, so high medical bills can still be a concern. Consider your healthcare needs and anticipate potential costs.

As of this year, people with Medicare who pay the highest costs are keeping more money in their pockets, as their out-of-pocket costs are now lowered. And in 2025, total out-of-pocket spending at the pharmacy will be capped at $2,000 for people on Medicare. #SOTU2024

— HHS.gov (@HHSGov) March 8, 2024

You might find a Medicare Advantage plan that matches your lifestyle better. Our expert guide to Medicare will help you find the right coverage.

Like Medicare Advantage, Medigap policies are sold by private insurers and come in different plans with varying benefits and premiums. It’s important to compare plans and prices to find the best fit for your healthcare needs. Enter your ZIP code below to start comparing Medicare plans today.

Frequently Asked Questions

What is Medicare Supplemental Insurance (Medigap)?

Medicare Supplemental Insurance fills the gaps in Original Medicare Part A and Part B coverage. It helps cover copayments, coinsurance, and deductibles.

What is Medigap coverage used for?

The purpose of Medigap is to cover the costs that Original Medicare doesn’t. A Medigap policy can cover a portion of your doctor and hospital bills, deductibles, copays, and coinsurance up to the limits of your plan.

What’s the difference between Medicare Advantage and Medigap?

Medicare Advantage plans are intended to replace your coverage from Original Medicare entirely while Medigap supplements the gaps left by Medicare Part A and Part B. The three main ways Medigap coverage is different than Medicare Advantage are:

- Coverage: Medigap requires Medicare Parts A and B and only covers deductibles, copays, and coinsurance. Medicare Advantage covers medical costs, hospital stays, and additional benefits like dental and vision care.

- Cost: Medigap has higher monthly premiums with lower out-of-pocket costs. Medicare Advantage might cost less per month, but plans have higher out-of-pocket costs.

- Providers: Medigap beneficiaries can see any medical provider that accepts Medicare, but some Medicare Advantage plans limit healthcare to a set of in-network providers.

You must enroll in Original Medicare first to buy Medigap.

What is the difference between Medicare Supplement and Medigap coverage?

Nothing. Medigap is another name for Medicare Supplement Insurance.

Do you really need a Medicare Supplement plan?

If you can afford your out-of-pocket Medicare costs, you might not need Medigap. Depending on your healthcare needs, you may also find that a Medicare Advantage plan better fits your lifestyle.

What is the downside to Medigap plans?

Most Medigap policies do not have a limit on out-of-pocket costs, meaning you could end up spending more than the policy even covers. Medigap also doesn’t cover prescription drugs, so you still need to buy Medicare Part D.

What is a Medicare Supplement Plan G?

Medicare Plan G is a comprehensive Medigap policy that covers Part A and Part B costs, including blood transfusions and Part B excess charges. It also covers up to 80% of medical costs if you’re injured or fall ill while traveling abroad. Plan G does not cover Part B deductibles, and it has no out-of-pocket limit.

Can you use Medigap with Medicare Advantage?

You cannot have both policies at the same time, and it’s illegal for companies to sell you a Medigap policy if you already have Medicare Advantage.

Can you get the same Medigap plan after dropping it?

You can switch back to Original Medicare with Medigap within 12 months of enrolling in your Medicare Advantage Plan. Learn the difference between Original Medicare and Medicare Advantage to save the stress of switching plans.

Which is cheaper, Medicare Advantage or Medigap?

Medicare Advantage and Medigap costs vary by state and company. Use our free tool to compare Medicare and Medigap rates near you.

Which is better, Medicare Advantage or Plan G?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.