The Life Insurance Guide: How to Get the Best Plan Possible for the Lowest Premium

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding co...

Meggan McCain

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Michael Vereecke

Updated October 2024

Understand How Insurance Works

Educate yourself so you can pick a policy that protects your family

Speaking the language of life insurance. Before diving into how you can save money on the right plan for your family, let’s quickly go over the different types of plans available.

Term life insurance. Term life insurance is the simplest kind of life insurance.

The policy remains in effect for a certain term, typically between 10-30 years.

During the period term insurance is in effect, you pay an unchanging monthly premium.

If you pass away while the term insurance policy remains in effect, your policy pays out a set amount of money to your beneficiaries.

This payout is known as a death benefit.

Whole life insurance. Whole life insurance is a little more complicated than term life insurance.

Like term life policies, whole life insurance has a guaranteed death benefit and premiums that remain the same throughout the life of the policy.

Unlike term life insurance, whole life is a permanent life insurance policy.

That means its coverage isn’t limited by a set term–as long as you pay a set premium, your policy remains in effect.

Whole life insurance works like an investment. Whole life insurance policies include a cash-value component, which grows as you pay your premiums.

This cash value is tax-deferred, meaning you don’t pay taxes on any value it generates.

You can borrow against this cash value at a set interest rate for expenses including long-term care, but not paying back this loan cuts down on the death benefit your policy pays out.

Ending your policy lets you collect all of its cash value at once.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Six tips that help you get great coverage with low premiums

Let’s jump into tips for how to get the best life insurance for the lowest monthly premium.

Get covered today. Premiums for both term and whole life insurance rise as you get older.

Getting insured as soon as possible can help you lock in a low rate, according to Chris Walters of Policy Genius.

Watch for price breaks. Some insurers offer discounts for buying higher amounts of coverage, as told by the Insurance Information Institute.

These discounts mean a life insurance company could charge you less for $300,000 worth of coverage than you would pay for $275,000 worth of coverage.

Choose a policy requiring a medical exam. While most policies require a medical exam to determine their premiums, some life insurance companies advertise simplified plans that let you sign-up without visiting a doctor.

These kinds of life insurance plans can cost as much as three times more than policies requiring an exam.

If you’re young and healthy, choose a policy that requires a medical checkup.

Get healthy first to save upfront. Maintaining a healthy lifestyle can slash your premiums.

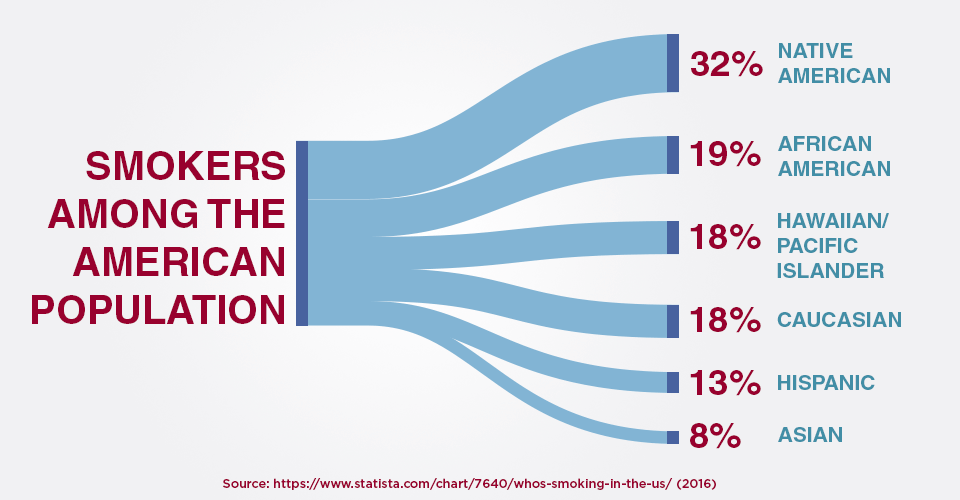

One of the best moves you can take is quitting smoking. Non-smokers can pay four times less than smokers.

Pick the right policy. You should choose the right kind of life insurance that protects your family’s financial well-being and assists with your estate planning.

Go over your income, assets, and debt to determine whether you need a term life policy that can cover the basic needs of your loved ones or a whole life policy that can provide a lasting legacy.

Get the coverage you need. Get a policy that pays out 15 times your current salary if you want to make up for your lost income.

Make sure you factor in any existing debt when deciding on how much coverage you require as well, so get a handle on how much you owe on your mortgage, credit cards, student loans, or tax liens.

Avoid high premiums and poor protection by watching for these six life insurance pitfalls

The complicated nature of life insurance means you can easily make a mistake when picking out your policy

Avoid this by knowing where people usually go wrong when figuring out how to get the best life insurance for the lowest monthly premium.

Watch out for rookie life insurance agents. Inexperienced life insurance agents may not know the discounts, fees, and methods for calculating premiums of various life insurance companies.

That means they could recommend the wrong life insurance plan for your needs.

Rethinking life insurance investment advice. When it comes to using life insurance as an investment vehicle, the common advice is that you should opt for cheaper term life insurance over whole life and invest the difference.

The problem is that most people don’t invest those savings.

Opting for whole life insurance may be a smart idea if you struggle with regularly putting money aside for retirement, estate planning, or your potential long-term care needs.

Review your medical records. Many people forget to check their medical records for any errors before applying for life insurance.

Not catching these mistakes can lead to your life insurance company charging you unnecessarily high premiums.

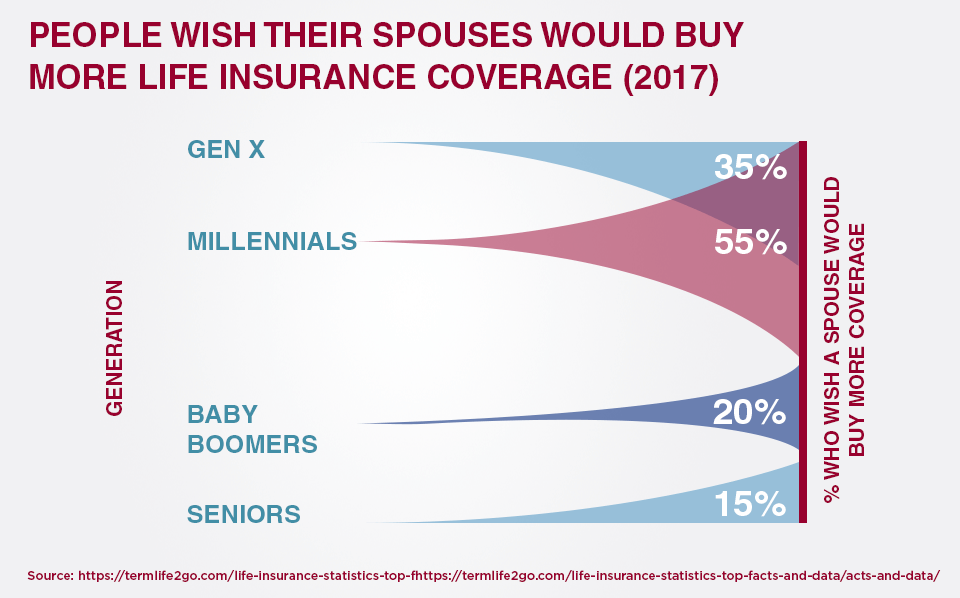

Know your needs will change. You may need more life insurance after major life changes like buying a home, getting married, or having kids.

Not increasing your coverage after reaching these or other milestones could mean your loved ones may face financial hardships in the event of your passing.

Choose a long enough term. Shorter terms mean cheaper premiums with life insurance, but these short-term savings can cost you in the long run.

For instance, those hoping to provide for young children shouldn’t opt for a five-year plan, as the coverage will run out before the kids are in high school.

The choice then becomes either renewing the policy at a higher rate or leave the family without financial protection due to letting it lapse.

Carefully consider affinity discounts. Some groups or organizations offer affinity discounts with certain life insurance providers.

However, the fees and costs for membership in these organizations could cost you more than you actually save.

For instance, say a lawyer with a $200 monthly premium received a 10% discount for membership in a legal society that charged $40 monthly dues.

The $20 rate reduction from their insurance company would be canceled out by the $40 membership fee, costing them $20 more every month.

Choose a life insurance company based on its availability, kinds of coverage, and history

Consider these basic criteria when looking for an insurance company

They’re available. Look whether a company offers life insurance throughout the United States without any membership restrictions that may prevent you from getting a policy.

That’s why some quality providers like USAA didn’t make the cut on our list below, as they only offer insurance for military members and their families.

They’re flexible. Some companies specialize in providing one type of life insurance, like how Primerica focuses on term life insurance policies.

This can limit your options with the company if your life insurance needs change.

All of the insurers on our list offer more than just term life plans, ensuring you can find the right kind of life insurance for your needs.

They’re established. If you sign up for a life insurance policy with a 30-year term, you want to know your provider will be around for the next 30 years.

Pick a company with a long history in the insurance market.

This is why newer companies, which may offer an innovative approach towards life insurance and are on solid financial footing, aren’t explored in this list.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

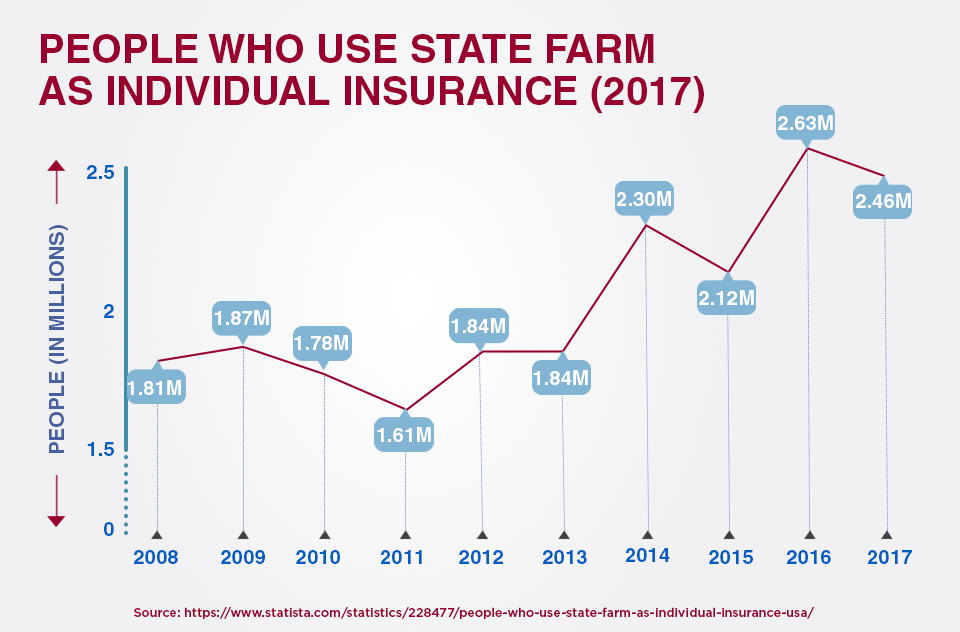

State Farm is great for healthy people who prefer going through an agent

Great at customer service. State Farm is one of the top-ranked life insurers for customer service.

Its agent-driven approach ensures that your loved ones will be speaking with a representative face-to-face if they ever have to collect on your policy, rather than dealing with an impersonal contact center over the phone.

Stringent health requirements. You need to be in good health if you want to qualify for the lowest premiums from State Farm.

The company has some pretty strict requirements for who qualifies for their lowest rates.

Multiple options for insurance. In addition to life insurance, the company also offers auto, home, and health insurance.

This can be great for those looking to bundle their policies and save.

Why you may need State Farm

You should consider State Farm for life insurance if you:

- Are in good health, with low blood pressure, cholesterol, and no serious preexisting conditions

- Know your beneficiaries will value a personal connection with an agent

People love State Farm for its customer service

Top marks for customer interactions. State Farm came out as the highest-ranking insure for customer service, according to the 2017 U.S. Life Insurance Study from J.D. Power.

Helpful agents. Filing a life insurance claim can be an extremely stressful time for those you care about.

That’s why State Farm provides a valuable service by having the agent connected with your policy help your beneficiaries through every step of the process.

People hate State Farm because of its strict health requirements

High premiums for less-than-perfect health. The health requirements for getting the lowest premiums from State Farm are out of the ordinary.

For instance, while most companies will grant you the best rate if your cholesterol is under 300, State Farm requires it to be under 175.

Not the best automatic payment system. State Farm is currently unranked by the Better Business Bureau, but a few customer reviews on its page mention trouble with their automatic payments.

Here’s what customer Lisa S. had to say:

“My family has been with State Farm for over 20 years and due to numerous issues we canceled our insurance and went with another company; however, State Farm made an auto withdraw from our account the next month and when we called to complain we were told it would take 3 months for a refund and we are still waiting for the refund and it has been 3 months.”

The question everyone is asking

“Can I convert my State Farm term life policy to a whole life policy?”

Yes. Like most insurance companies, State Farm allows you to convert your term life policy to a whole life policy.

However, it only allows such a change if you’re below 75 years old.

If you like State Farm, you may want to check out Amica Mutual

Another company with good agents. Like State Farm, Amica offers a personal, agent-centered approach to selling and servicing its policies.

The company also offers home and auto insurance but not health insurance.

Check to see whether its rates and services may be a better fit for you than State Farm.

You can visit Amica’s website to receive a quote.

The smartest way to apply

Online, in person, or over the phone. You can apply for a life insurance policy over the phone by calling 877-733-7333, by visiting State Farm’s website, or by visiting one of their agents in person.

Buy through an agent for the best service. You’ll only have an agent attached to your policy if you purchase life insurance through one of State Farm’s individual agencies.

If you purchase directly from the company by calling or going online, you’ll be missing out on the personalized customer service that makes this company so compelling.

Get an exam before the exam. Since State Farm has such strict health requirements to qualify for its lowest premiums, consider getting a check-up from your doctor before applying.

That way, you can know whether your cholesterol and other factors are within State Farm’s range for the lowest rates.

Banner Life Insurance is good for older individuals and those with pre-existing conditions

Banner Life Insurance, a subsidiary of Legal & General America, offers some of the most customizable life insurance options currently on the market.

It also offers policies specifically geared towards an older population, something not seen at many life insurance companies.

Why you may need Banner Life Insurance

Banner Life Insurance could meet your insurance needs if you:

- Are in good health and are looking for low rates

- Have a pre-existing condition

- Are over 75 years old and shopping for a term life policy

People love Banner Life Insurance because of its accepting policies

Favorable underwriting. Banner Life accepts many people that other life insurers may turn away.

This includes those with diabetes, former smokers, sleep apnea, or other conditions.

Accepts elders. The cutoff age for Banner’s term life insurance policies is 95.

That’s a solid 20-30 years higher than other companies.

Low rates for good health. The company offers extremely competitive rates for healthy individuals.

People hate Banner Life Insurance for its long wait times

Long time to get approved. Banner takes much longer than other insurers to approve policies.

Its thorough underwriting process takes a while, but it’s part of the reason why Banner can offer such low rates.

Difficulty signing up. Even though Banner holds an A+ from the Better Business Bureau, there were a few complaints that seemed to frequently pop up.

Customer Johnna H. mentioned she had a hard time signing up:

“One of the employees told me they needed a form sent back to them. After explaining I have sent the forms back on several occasions, the employee told me they do not need the form. A week later, another employee emailed me telling me they need the form sent to them!”

The question everyone is asking now

“Does Banner Life Insurance offer its policies in New York?”

Not directly.

William Penn, another subsidiary of Legal & General America like Banner Life, offers policies in New York.

If you like Banner Life Insurance, you may want to check out Assurity Life Insurance

Also good for seniors. Those past the age of 65 can find a term life policy worth up to $25,000 at Assurity Life Insurance.

While this is usually only enough to cover a funeral or other final expenses, it’s more than other companies offer those in this age bracket.

The smartest way to apply

Online or with an agent. You can get a quote from Banner online, or by contacting an independent life insurance agent offering its products.

Pay annually, not monthly. Banner offers lower rates for customers that pay their life insurance premiums on an annual basis.

Choosing this option can lower how much you pay.

Northwestern Mutual is excellent for offering well-designed whole life insurance

Northwestern Mutual provides a comprehensive suite of life insurance and financial planning services.

Additionally, the company’s whole life insurance policies pay dividends that can lower your premiums or provide a nice annual boost to your bank account.

Why you may need Northwestern Mutual

To tell whether you should go with Northwestern Mutual for life insurance, decide whether you:

- Want a policy that pays dividends

- Are looking for a wide range of flexible life insurance products

- Would also like additional financial planning services

People love Northwestern Mutual because it pays dividends

Policies that pay you. Since Northwestern Mutual is a mutual insurance company, some of its policies pay what’s known as a dividend.

That’s because Northwestern Mutual is technically owned by its policyholders.

Just like how public companies pay stockholders a dividend, Northwestern Mutual pays its policyholders an annual dividend.

This money can be either deposited into your bank account or applied towards your premiums to lower your rates.

Great whole life insurance. Northwestern Mutual offers some of the best whole life insurance policies available.

Couple that with its financial planning services and you can design a plan for leaving a lasting legacy for your beneficiaries.

Flexible policies. Northwestern Mutual’s CompLife policy mixes the low rates of term life insurance with the cash value of whole life insurance.

That means you could get the benefits of both kinds of life insurance through one policy.

People hate Northwestern Mutual for its poor digital services

Not much on the web. Northwestern Mutual’s digital presence is lacking.

Its website doesn’t contain many resources for picking the best policy.

Also while the app holds a 4.2-star rating on Google Play and 3.1 on the iTunes store, many found its functionality to be limited.

Hard to contact. While Northwestern Mutual holds an A+ from the Better Business Bureau, some customers found it odd that the customer service hotline only operates during weekdays.

One customer, James, wrote:

“I just find their customer service hours unduly restrictive for today’s world and a global client base.”

The question everyone is asking now

“Does Northwestern Mutual guarantee dividends on its policies?”

No. However, the company has paid them out every year since 1872.

If you like Northwestern Mutual, you may want to check out Mutual of Omaha

Also pays dividends. Mutual of Omaha is another insurer offering dividends just like Northwestern Mutual.

If the prospect of receiving a payout is a big selling point for you, it’s worth your consideration.

Fewer options. One area where Northwestern Mutual has an advantage over Mutual of Omaha is the breadth of its policies.

Mutual of Omaha offers fewer types of life insurance, which may mean it may not be able to accommodate your needs.

To see whether the Mutual of Omaha may be a good fit for you, get a quote using its website.

The smartest way to apply

Call or speak with an adviser. To start your life insurance application with Northwestern Mutual, visit its website or call 866-950-4644.

Check your policy for dividend eligibility. Not all of Northwestern Mutual’s policies make you eligible to receive dividends that can reduce your premiums.

If you’re certain you want to qualify for this yearly payout, check with a representative to see which life insurance coverage offer dividends.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Metlife is good for those who need insurance now

MetLife is one of the largest insurance companies on the market today.

While it carries many of the same types of coverage as its competitors, the company offers many products that can get you covered faster than other companies.

Why you may need MetLife

To tell if MetLife is the right option for your life insurance, see whether you:

- Need insurance fast and don’t want to undergo a medical exam

- May have a pre-existing condition

- Want a policy for your children

People love MetLife for its guaranteed acceptance policies

Acceptance guaranteed. MetLife offers many life insurance options with guaranteed acceptance.

Its guaranteed acceptance whole life insurance policy won’t refuse coverage for health reasons if you’re between 50-75.

Even though these policies only pay out between $2,500-$20,000, this money can come in handy for taking care of final expenses.

Get a policy fast. Simplified issue term life insurance policies from MetLife don’t require a medical exam and begin almost immediately.

While the company typically pays out under $100,000, this can be useful for those who need life insurance fast.

Strong policies for children. MetLife offers some great whole life policies for those looking to insure their children.

These policies provide lifelong protection, guaranteed premiums, death benefits, and future insurability options.

People hate MetLife because of its limited coverage for simplified issue term life insurance

Not the best coverage. One drawback of those speedy simplified issue term life insurance plans is that they don’t provide much coverage.

Most healthy people should opt for one of its plans requiring a medical exam for cheaper premiums and higher coverage amounts.

Poor communication. MetLife only has a C- from the Better Business Bureau.

This is due to complaints from customers like Jennifer K., who reports that MetLife struggled to get her important documents relating to her insurance.

“After two attempts (2 years) of passing up the inflation adjustments (because I did not live at the place they were sending the letters), they have forever barred me from having an inflation adjustment, so now my long-term care policy will diminish to very little value at the time I might actually need it.”

The question everyone is asking now

“How can I get a simplified issue term life insurance policy from MetLife?”

Since these policies don’t require a medical exam, MetLife sells them over the phone at 1-800-638-5433 and at its website.

Just answer a few questions, and you’ll know whether you’re approved fast.

If you like MetLife, you may want to check out Prudential

Another big company. Like MetLife, Prudential has been in the insurance field for over a hundred years.

Speedy insurance. Prudential also offers simplified issue term life policies that don’t require a medical exam and go through a fast-track approval process.

Its MyTerm policy provides up to $250,000 in coverage, which is more coverage than what MetLife offers.

You can apply for insurance on Prudential’s website.

The smartest way to apply

Over the phone or through an agent. You can apply for a policy from MetLife over the phone at 1-800-638-5433 or by using its website to locate a life insurance agent.

Answer honestly. Don’t try to cover up or leave out any health conditions that may affect your life insurance policy.

This isn’t likely to lower your premiums and can delay, or even eliminate your eligibility for life insurance from MetLife.

Lincoln Financial is strong for its wide range of services and low rates for certain groups

Lincoln Financial provides a solid range of insurance and financial planning solutions.

If you want an insurer that can help you navigate allocating your money into life insurance and other areas, or you fall into certain groups that often face higher insurance rates, this company could be for you.

Why you may need Lincoln Financial

To find out whether Lincoln Financial could serve you well, determine if you:

- Want a life insurer with a wide range of financial products

- Occasionally smoke cigars

- Fall into certain high-risk groups

People love Lincoln Financial because of its low rates for specific high-risk groups

Cigar smokers can apply. If you occasionally puff on a cigar or pipe, you can still qualify for the lowest rates from Lincoln Financial.

However, cigarette smokers will still face higher rates.

Certain other groups that other insurers classify as high risk can also find good rates at Lincoln.

Solid range of services. The company has a strong showing in life insurance and other financial planning products.

People hate Lincoln Financial because of its high premiums

A little pricey. Life insurance premiums from Lincoln Financial are typically higher than those from other companies.

However, the website notes that healthy people are frequently offered competitive rates.

Claims take a while. Lincoln Financial holds an A+ Better Business Bureau rating.

However, customer Fred C. noted in his review that the company struggled to process a claim quickly.

“The Lincoln policy required twice as many papers to be filled out, required notarized signatures, kept losing signed documents that we sent to them, kept requiring more things to be done though we had already done them, and took 2 weeks longer to pay their settlement than another policy which was for 3 times the amount of the Lincoln Policy.”

The question everyone is asking now

“Other than cigar smokers, who else can get a low rate from Lincoln Financial they may not find elsewhere?”

The company is good for people with high-risk conditions or jobs.

These groups can include veterans with PTSD, cancer survivors, and those who may experience mental health issues.

If you like Lincoln Financial, you may want to check out Northwestern Mutual

Remember them? Lincoln Financial isn’t the only company offering a wide range of financial planning and life insurance options.

Northwestern Mutual, a company covered earlier in this guide, also provides many of the same options as Lincoln.

Visit its website to see if Northwestern Mutual may be a better fit for your needs than Lincoln.

The smartest way to apply

Online, over the phone, through an agent. You can use the Lincoln Financial website to apply online or locate an agent to visit with about getting a policy.

Alternatively, you can call 800-487-1485.

Put down the pipe before applying. Even though Lincoln Financial offers lower rates for cigar and pipe smokers, plan on abstaining from tobacco and other nicotine products for at least four days before applying.

The company tests for nicotine during medical exams for its policies, and having it in your system may make you look like a habitual rather than recreational smoker.

Thinking about how to protect your loved ones after you’re gone isn’t the happiest topic in the world, which can make life insurance hard to shop for.

By knowing some of the best tips for choosing and saving on a policy that fits your needs, you can make getting a life insurance policy that much easier.

Do you use life insurance?

How has the company worked out for you?

Any great tips (or nightmares) to share with the rest of us?

Let us know in the comments below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.