Nationwide Insurance Review 2026

Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Certified Financial Planner

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel...

Joel Ohman

Updated July 2024

You’ve seen the ads proclaiming that Nationwide Insurance is on your side. Well, we thought we’d deep dive into the company to get the facts about their insurance and how it works.

Given how much the company does and offers, it can be difficult deciding whether

Nationwide’s insurance policies meet your needs – after all, they can cover everything from your car to your pet.

Simply put, Nationwide does have a lot going for it.

The company holds an A+ rating with the Better Business Bureau.

To provide some perspective, that’s a little better than Allstate’s A- rating.

Nationwide is a huge company, so you’ll always have an agent nearby. And as a large company, they offer some pretty impressive discounts and benefits for their customers.

However, some of those benefits come at a price – as in premiums up to 30% higher than their competition.

After reading this review of Nationwide Insurance, you’ll be able to decide whether the insurance company is truly “on your side” when it comes to protecting the things that matter most at a price you can afford.

- Find out how Nationwide’s car insurance plans stack up

- Learn the ins and outs of their home insurance coverage

- Discover what discounts Nationwide offers

Nationwide Insurance company history

Nationwide offers a whole lot of services like banking, retirement accounts and financial planning. For this review, and because it’s how they got started, we will focus on their insurance division, Nationwide Insurance.

As Nationwide tells it, the company began way back in 1925.

A man named Murray D. Lincoln started the Farm Bureau Mutual Automobile Insurance Company and began providing auto insurance for farmers in the state of Ohio.

After taking the country into more states and going nationwide, the company changed its name to – you guessed it – Nationwide in 1955.

Nationwide kept growing and now offers a whole lot more different kinds of insurance than just for Ohio drivers.

One thing separating Nationwide Insurance from other companies is that it’s a “mutual insurance company.”

This means that technically speaking, they are owned by their policyholders, not shareholders.

That means that if the company does well, the profits get passed on to the folks it insures in the form of lower premiums.

When Nationwide does well, the theory goes, your rates get cheaper. It all depends on what— as with other businesses—do they count as profits.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Nationwide Insurance company offers consumers

As one of the larger insurance companies in America, Nationwide Insurance company offers a staggering amount of products.

They categorize all their products and services into four distinct categories. We’ll dive into the main ones and briefly explain what the others can do for you.

Nationwide Insurance Company offers four main insurance products:

Vehicle: This keeps your car, RV, boat or other form of transportation covered in case something happens to it.

Property: These policies protect your home, apartment or condo, as well as the stuff inside it.

Life: A depressing necessity, life insurance policies pay out when you pass away. On a not-so-sad note, they can also be a good way to save money while you’re alive too.

Specialty: Insurance for everything else in life falls into this category, from coverage for your pet’s medical bills to covering canceled travel plans.

There’s a bunch of discounts that will knock a few bucks off your bills for each of these insurance plans. Some of these are simple, like installing a security system inside your house to lower your home insurance rates or bundling several different insurance policies together for a cheaper overall bill.

What people love: Nationwide’s best product.

Nationwide is known best for its car insurance – and not just because of the commercials with that catchy “Nationwide is on your side” jingle. According to the experts over at JD Power, Nationwide clocks in with four out of five stars in overall customer satisfaction for insuring automobiles.

Customer service for car insurance wins at Nationwide

Specifically, JD Power found that their customer service representatives were really easy to work with when folks had to file a claim, and the settlements they paid out were fair. These claims are echoed by the people who left a review on Nationwide’s website. Here are a few excerpts from what their customers are saying:

“They make sure to thoroughly answer all questions to make sure you understand and it has truly been a pleasure working with this office. You guys are great, keep up the good work.”

“I have had Nationwide since I started driving many years ago and have always been very satisfied with the help I get from the local agents at my local Nationwide agency. Whether it be the fact that I have questions about my plan or if I wanted to see how to handle my claim, they always have the answers needed to point me in the right direction.”

You may be asking, what do people not like about Nationwide? We dive into those details when we explore the most common consumer complaints about Nationwide.

How Nationwide sets their rates

Nationwide, like all insurers, makes money when they get a greater amount of premiums paid in than they pay out in claims.

That means your rates for home, auto or life insurance get based partially in part on how much you’re at risk for filing a claim.

For car insurance, Nationwide states these factors affect your rates:

- Your driver record: People who can avoid wrecks or moving violations see their claims stay low.

- Your age: As the CDC explains, younger people get in more car accidents and therefore pay higher premiums.

- The kind of car you drive: If your car costs a lot, your insurer must pay out more if it gets totaled. That means you’ll pay higher premiums for a Ferrari, and lower premiums for a Ford Focus.

- Your location: If you live in a city with bustling traffic or in a natural disaster-prone area, you’re more likely to get in a collision or have your car damaged by the weather – hence the pricier rates.

What Nationwide considers when setting your home insurance rate:

- Your claims history: If you’re frequently filing home insurance claims, Nationwide sees you as a risk to their bottom line and raises your rates.

- The age of your home: Older structures might not be up to the latest building codes, making them pricier to insure.

- Type of structure: If your home is built out of sturdier materials it’s less likely to get damaged, making your premiums go down.

- Security and safety features: Smoke alarms and security systems offer extra protection for your house – protection that lowers your rates.

Your credit score can affect the rate you get from Nationwide

In all cases, Nationwide considers your credit score when assessing your potential premiums.

That’s because of findings over the years like those contained in a 2007 study from the Federal Trade Commission, which noted that folks with lower credit scores cost their insurers more money than those with high credit scores.

If you’re in good financial standing, Nationwide will cut you a lower rate on insurance.

However, each state regulates what factors an insurer can use in setting your rates.

Depending on where you live, some of the items listed above might not affect your premiums.

Check with your local agent, broker or other insurance representative to find out how your state regulates insurance premiums, or use this map with state-specific car insurance info on Nationwide’s website.

Now that you know the broad strokes of what kinds of insurance Nationwide offers and how they price them, you’re well equipped for deciding whether their individual products work for you.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Nationwide property insurance products

Your home is your castle – and castles are usually protected by high walls, drawbridges, and other ways of making sure they stay safe.

While your local homeowner’s association would probably balk if you tried putting a moat around your house, should you choose, you could keep this important asset safe with several different plans offered by Nationwide.

The three types of property insurance offered by Nationwide

The insurance company offers three different categories of property insurance:

Homeowner: If you want to protect the home you own and the belongings inside

Rental: If you are renting and want to protect your belongings from theft or damage. Many apartments also require tenants to have some amount of liability coverage, which covers property damage they may intentionally or unintentionally cause.

Condo: If you own a condo and want protection for your unit and belongings inside

Homeowner insurance

Homeowner and condo insurance can be a bit tricky.

Homeowner insurance policies are made up of separate parts.

There’s dwelling insurance, which covers the actual structure of your house and contents insurance, which covers everything you own inside the home.

Say your $200,000 house containing $50,000 worth of stuff burned down.

Dwelling insurance would cover the house, and contents insurance would cover everything inside.

These two policies can be bought separately or together.

In most cases, you’ll want both, but you can customize these plans to fit your specific situation.

For instance, say you had a million-dollar home with nothing inside it.

In that case, you could get away with buying dwelling insurance, but not contents insurance.

In terms of prices, you’ll pay higher rates for insuring more expensive items or homes.

These prices will also be influenced by whether you live in a risky area like a floodplain or a high-crime neighborhood.

You can also add on extra protections for an additional fee. Nationwide offers an abundance of insurance products, which we explain below.

Critics love that consumers get big discounts at Nationwide when they bundle up their services

If get your home and auto insurance policies through Nationwide, you could get 20% knocked off your rates.

Basic home insurance protections by Nationwide

Here are the different homeowner insurance protections you can mix and match to create the perfect plan for you. Remember, you’ll start with one or both of the two basic insurance packages below, and then be able to add on helpful products depending on what you want to get covered.

Dwelling coverage: This is the home part of home insurance. Dwelling coverage protects the actual structure of your house, including its built-in appliances and any wall-to-wall carpeting.

Contents coverage: Aside from protecting your house itself, make sure the stuff inside it gets insured through contents coverage. Any clothes, furniture or other items can be reimbursed under this type of coverage.

Extra property insurance products by Nationwide

Now that you have basic coverage for your dwelling and/or contents, you’re ready to consider some additional products that Nationwide offers. Choice is their specialty.

Remember, be sure to inquire about extra discounts for bundling up these services.

Brand New Belongings: This is a fancy name for something that insurers have offered for a while: “extended replacement cost coverage.”

The Cogswell Insurance Agency offers a great explanation. Basically standard homeowner’s insurance pays out the cash value of an item.

That means if you bought a TV for $1,000 two years ago, it may only be worth $500 due to its age.

If that TV gets stolen, you only get $500 for its current value.

Extended replacement cost coverage plans like Nationwide’s Brand New Belongings program will reimburse you for the full value of the item.

So if that same TV got scorched in a fire, Nationwide would pay you $500 upfront for the current value of the television.

After you purchase a new one for $1,000 and send Nationwide the receipt, they’d kick the remaining $500 your way to make fully compensate you for that item.

Better Roof Replacement: Say your roof needs replacing after getting damaged in a hailstorm or other disaster. If you add Nationwide’s Better Roof Replacement to your existing coverage, they’d repair your roof with stronger, safer materials, so you’re more prepared for unexpected events.

Replacement cost plus: If you lose your home in a fire or under other covered circumstances, sometimes building a new residence will cost more than your old one was worth. Replacement cost plus coverage will pay additional money in case this happens.

Water backup of sewer: Protecting you from even the grossest of scenarios, water backup of sewer coverage will pay in case your toilet, sink or other pipe starts flooding your house.

Valuables Plus: If you have antiques, valuable artwork or other high-price items throughout your house, this type of homeowners insurance will cover them.

Other structures coverage: Make sure your gazebo, external garage or other structures not connected to your home stay protected. Other structures coverage will pay out in case these different buildings get damaged or destroyed.

Personal liability: If an accident occurs on your property, you could be stuck with a nasty lawsuit. Personal liability insurance covers damages to a person or thing, paying the potential victim restitution so they won’t take you to court.

Medical payments to others: An extension of the type of insurance above, this will pay for the medical or funeral expenses of a person who gets injured on your property.

Ordinance or law insurance: If you’re rebuilding a home that you lived in for a long time, sometimes the money to bring the new house up to code can be quite pricey. Ordinance or law insurance will cover these extra charges.

Flood insurance: This is a separate policy from your home insurance, meaning it has its own deductible. This covers any flood damage to your home.

Earthquake coverage: Just like flood insurance, it’s a separate policy with its own deductible that does just what its name implies. This one’s recommended for residents of California.

Condo insurance by Nationwide

If you own your own condo, Nationwide offers all of the different types of insurance outlined above except for its Better Roof Replacement plan – which you won’t be needing anyways.

Renter’s insurance by Nationwide

Renter’s insurance by Nationwide

Renter’s insurance is simpler than homeowner’s insurance – it just covers the belongings inside your home.

That means if you have $5,000 worth of stuff, you can get a policy that will pay out $5,000 in case all your items get destroyed in a natural disaster.

Besides most of the products outlined above, you can get special add-on products that provide extra coverage as a renter. We explain these products in detail in the following sections.

The other important part of renter’s insurance is liability coverage.

Most apartment complexes will require you to get some form renter’s insurance that includes liability coverage.

This pays out in case you accidentally or intentionally damage the complex’s property.

You won’t see a dime from the liability part of the policy though, as it’s mainly for your landlord’s benefit.

For example, say a pipe bursts and ruins the carpeting in your apartment, as well as your TV worth $500.

Liability insurance would cover the damage to the carpeting, while your renter’s insurance policy would cover the TV.

Neither you or your landlord would have to pay anything for replacing the damaged items.

Nationwide got good marks for their renter’s insurance from Top Ten Reviews.

They found their policies simple to set up and customize. Their rates are pretty expensive for high-crime areas, but overall their prices were at or below average.

Extra protections for renter’s insurance from Nationwide

Credit card coverage for renters: Some landlords are sketchier than others. Credit card coverage will pay up to a selected limit for any unauthorized transactions from your credit card, debit card or personal checks that show up when you pay your rent.

That means if your landlord turned your $500 payment into a $5,000 one and headed out on a cruise in the Bahamas, your insurance will cover this charge.

As an added bonus, credit card coverage for renters will also cover you in case you accidentally pay your rent using counterfeit money (happens to everyone, right?)

Firearms: If something happens to your guns, this special type of insurance will cover them.

Theft extension: Renting an apartment or other cramped space sometimes means keeping a lot of items in your vehicles. If those outside-your-apartment items get stolen or damaged, this type of insurance will cover them as if they were in your residence.

How much does Nationwide property insurance cost?

So many different factors go into setting property insurance premium prices.

Insurance companies will look at the following when putting together a quote:

- the size of the home/condo you own or are renting

- the type of boiler, roof, and other infrastructure of the house

- whether any security devices are installed

- the value of the contents inside

- and what state you live in.

To get an idea of how much you might shell out for homeowner’s insurance, here’s the average annual rate for Nationwide policies for a 2,000 square feet, $200,000 home in Texas, Vermont, and Ohio as collected by ValuePenguin:

- Texas: $1,483

- Vermont: $714

- Ohio: $910

You should note that this figure only covers the cost of insuring the dwelling i.e. the physical home itself. You want to make sure you also insure the contents inside. How much that costs really depends significantly on how much you have.

Roughly speaking, it can cost approx. $1k per year to insure approx. $50k in content values.

For renter’s insurance, here are the annual rates collected by ValuePenguin for a 1,000 square foot apartment covering $100,00 worth of content liability (the value of your content) for Texas, Ohio, and Connecticut:

- Texas: $276

- Ohio: $349

- Connecticut: $301

What are customers saying about Nationwide property insurance?

Here’s a smattering of reviews taken from Nationwide’s website – the good, the bad and the ugly.

A quick turnaround

We placed a claim with Nationwide and we got a fast response from the office and from the adjuster. He came when he said he would; he was very helpful, professional, courteous and fair. We are extremely pleased with all our dealings with Nationwide.

Unexpected high prices

My mother was given a quote for homeowners insurance that used the prices similar homes in the area are selling for around $170k a month later she received an extra bill for $95 because they estimate the replacement costs at $195k.

Worst of the worst case scenarios

It’s been 3 months since my house burned down. The adjuster just ignoring all my call and email. I’m still waiting on her to get start the rebuilding process. Hasn’t hear anything from her in 3 week.

Nationwide vehicle insurance

Nationwide’s most talked about insurance is the one they offer for vehicles.

It is Nationwide’s car insurance that gets the top ratings by JD Power.

The insurance company offers three main types of vehicle insurance:

Liability: If you get in a wreck, this will pay for the other driver’s medical bills and any property damages.

Collision: This insurance pays for repairing your car if it’s ever in a car accident.

Comprehensive: For all your non-collision needs, there’s comprehensive. It pays out if your ride gets stolen, vandalized or damaged in a natural disaster.

Nationwide kills it when it comes to car insurance. JD Power gives them four out of five stars for overall customer satisfaction, so they’ve got a lot of satisfied drivers out there on the road.

Liability coverage by Nationwide

Almost every state requires liability insurance. In case you’re at fault for an accident, liability insurance covers the resulting property or bodily injury damages for those involved – but not for you or your car.

This is one of the most important types of insurance. If you cause an accident where the damage exceeds your liability coverage, you could get sued for any charges over what your policy covers.

Collision coverage by Nationwide

This pays for damages to your car as a result of a wreck. This covers the current cash value of your car.

Say you paid $20,000 for your vehicle two years ago, and its value depreciates by 10% since then.

In case your car gets totaled, your insurance pays out $18,000 for the car’s cash value.

These plans usually have a deductible.

For example, say you have a $500 deductible and get in a wreck causing $1,500 worth of damage. Your insurance will pay you $1,000 after you pay off $400 the deductible.

Nationwide usage of deductibles is standard.

Comprehensive coverage by Nationwide

Comprehensive coverage works just like collision insurance, but it covers everything but wrecks. That includes natural disasters, theft, and vandalism.

Extra insurance coverage for your car and vehicle by Nationwide

Beyond the three types of basic vehicle insurance offered by Nationwide above: liability, collision and comprehensive the insurance company offers a dazzling array of extra protection and insurance service goodies.

These add-ons are not just for show, Nationwide gets praised for its insurance features and discounts for different types of drivers which we’ll explain below.

Given these add-ons can be very specific in nature, you should look over the details of these programs to make sure you’ll actually benefit from them.

Nationwide Insurance scores big points for its “Vanishing Deductible” program

An optional feature offered by Nationwide, the Vanishing Deductible programs offers customers up to $100 off their deductible every year for safe driving.

This decrease maxes out at $500 off your deductible.

That means that after five years of safe driving, you won’t have to pay anything towards a $500-deductible.

Many customers love how Nationwide’s Vanishing Deductible program saves them money.

Here’s how Nationwide explains it:

“Let’s say you have a $500 deductible.

After three years of safe driving with Vanishing Deductible, you’ll earn a $300 credit.

If you have an accident, you will pay just $200 toward your deductible before your insurance starts to cover any damages.

And if you do have an accident, you don’t have to worry about your deductible going all the way back up to $500.

Your Vanishing Deductible reward would be reset to $100.

(NOTE: That means your deductible goes back up to $400 as if you had just driven safe for one year still providing you savings.)”

Sounds great. Right?

Hold your horses.

This program does come with a catch – it costs at least $60 per year, as Mark Chalon Smith of CarInsurance notes.

Mark explains that if you don’t get in a wreck for nine years, you’ve spent more than you could have possibly saved with the Vanishing Deductible program.

This double-edged sword of paying money for a service you don’t need also comes into play with Nationwide’s Accident Forgiveness program.

You can pay extra with Accident Forgiveness to have one accident not affect your rates.

Accident Forgiveness lives up to its name. Basically, if you pay for it, you avoid a rate increase following the first accident you’re responsible for. This goes for every driver on your policy – but only once per policy.

With it, you shell out a few extra bucks every month to make sure your rates don’t go up following an accident.

That means that if your teenage kid on your policy wrecks their car and they’re at fault, your rates won’t go up.

If you’re responsible for an accident after that initial wreck, that second accident will not be forgiven.

It’s only available in some states, but this can be a great option when insuring young drivers at greater risk of getting in an accident.

If you’re a safe driver, you may pay out money for nothing.

There’s a protection for everyone’s vehicle need at Nationwide

You might get hit by an uninsured driver and have to pay your repair charges out of pocket, or want to protect yourself from increased insurance premiums after a wreck. Maybe you want to cover your boat, motorcycle or other type of vehicle.

For those and other situations, Nationwide offers the following plans:

Uninsured motorist coverage

Not every driver has insurance. If you get hit by some dingus that lacks coverage, this type of insurance will make sure their mistake doesn’t cost you any extra money.

Underinsured motorist coverage

Similar to the type of insurance mentioned above, underinsured motorist coverage picks up the slack if another driver’s insurance can’t pay out for all the damages they cause.

Medical payments coverage

This type of insurance is required by some states. Medical payments coverage helps cover any medical costs resulting from an accident no matter who is at fault.

Personal injury protection

The medical side effects of an accident can add up quick – and not just from hospital bills. Personal injury protection covers your medical bills as a result of an accident, as well as defraying the cost of lost wages if a wreck puts you out of working condition for a while.

Roadside Assistance

Nationwide’s Roadside Assistance plan helps you in case you need a jump start for a dead battery, tow or get locked out of your vehicle. If you already have AAA or a roadside assistance plan from a car dealership you may not need this. Otherwise, it’s something to consider.

Towing and labor insurance

Didn’t opt for Nationwide’s Roadside Assistance plan and don’t have AAA? Towing and labor insurance will pay you back for the cost of a tow. However, you can only use it a limited amount of times per year.

Rental reimbursement insurance

If you had to shell out for a rental car due to your car getting put in the shop, rental reimbursement insurance would pay you back. Some dealerships offer a similar service as part of their extended warranties on some cars, so check whether this is something you already have.

Classic car insurance

Got a vintage Dodge Viper you want to keep safe? Nationwide lets you keep it covered through its classic car insurance as long as it meets a few requirements.

- Usage: This can’t be your daily driver, and you only use it for occasional pleasure driving and going to classic car events like meets or club functions.

- Storage: You need to keep your sweet ride in an enclosed space like a garage or barn.

- Regular-use vehicles: Everyone in your household needs a vehicle other than your classic roadster. Motorcycles and public transportation won’t make the cut, so make sure they’ve got cars of their own.

In exchange, you can get your vehicle repaired at the shop of your choice if something happens to it. If your classic car gets completely totaled, Nationwide’s Guaranteed Value program will pay out the full cost of your car with no deprecation.

As an added bonus, Nationwide advertises their classic car insurance rates can be up to 43% lower than standard insurance.

Motorcycle insurance

Nationwide offers insurance for vehicles of the two-wheeled variety as well. While most of their plans for motorcycle insurance fall in the same lines as those for car insurance, there are a few unique kinds of coverage:

- Custom equipment: If you’ve put expensive aftermarket parts on your bike, you may want custom equipment insurance. This will automatically cover $3,000 worth of these additions, and you can purchase additional limits up to $30,000.

- OEM (Original Manufacturers Equipment) endorsement: If your bike is under 10 years old, an OEM endorsement will ensure that any insurance-covered repairs are done with new parts from the original manufacturer. If those parts aren’t available, Nationwide will fork over their fair market value straight to you.

Snowmobile, ATV, personal watercraft and scooter insurance

Live someplace frosty and want your snowmobile covered? Got a smaller motorized vehicle you like to roll around on? Nationwide can help insure those items, offering many of similar plans available for motorcycles or cars for these other types vehicles.

RV insurance

While Nationwide offers the usual coverage for RVs that’s also available for other vehicles, they also provide a few specially designed plans for your home away from home.

- Awning replacement: If your awning no longer functions, Nationwide will provide direct replacement and installation for a new one right at your RV’s location.

- Vacation liability: If you have comprehensive or collision insurance on your RV, Nationwide lets you add on vacation liability insurance. In case you’re off on a vacation and an accident occurs, this type of coverage will pay out up to $10,000 dollars.

- Safety Glass Replacement: Did the windshield of your RV get broken or damaged? This policy will pay for that.

- Replacement cost and scheduled personal effects: You never know when a bear could sneak into your RV and wreck shop, or any other type of natural disaster that could ruin your belongings. This type of insurance pays out to cover the stuff contained in your RV, which cuts down on your need to file a homeowner insurance claim and causing those rates to spike.

Boat insurance

Ah, there’s nothing like being out on the water when you know you’re covered. Once again, all the standard vehicle insurances apply to your seaworthy vessel. However, there’s also the option to add fishing equipment coverage. That ensures replacing your pricey rod and reel won’t leave you reeling in case they get dropped while boarding or departing your insured boat.

How much does Nationwide’s car insurance cost?

Car insurance rates will differ based on the type of car you drive, your driving record and state.

For reference, here are three average annual premiums for liability insurance based the typical driver for each state in Virginia, Georgia, and California.

- Virginia: Nationwide clocked in at $1,064, making it the third cheapest car insurance in the state after Geico and State Farm.

- Georgia: $1,308 will get you a rather pricey policy from Nationwide, which ranks as the eighth-cheapest insurance in Georgia.

- California: Walk away with the cheapest car insurance policy available in this state for just $1,137.

What customers are saying about Nationwide’s car insurance

Taken from Nationwide’s website, here are a few reviews of their car insurance products. Customers tend to vocalize what they don’t like, more often than what they do. We’ve included a few below to highlight the general range of customer feelings about Nationwide Insurance company and services.

Was not happy that Nationwide did not look into the claim further, don’t feel like they really watched out for me. Looking forward to my next renewal with an increase in rates and surcharge due to the claim.

They make sure to thoroughly answer all questions to make sure you understand and it has truly been a pleasure working with this office. You guys are great, keep up the good work.

Agents do not return calls even though the message on their phone says that they try to do so within 1 business day. It’s been two days, two different messages left — no response!

Nationwide life insurance products

Life insurance insures you for a worth in case you die sooner than expected.

It pays out in the event of the policyholder’s death.

Parents (or just the primary breadwinner) often buy life insurance to help make sure that their children or leftover spouse have the financial means to carry on without them.

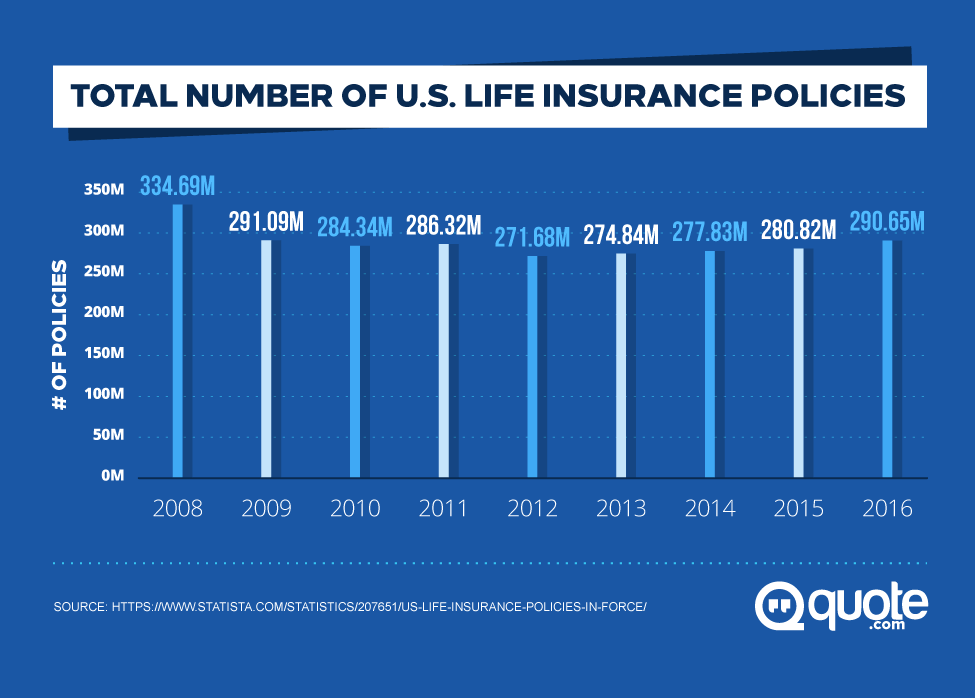

Life insurance is one of the most overlooked kinds of insurance.

Scott Morrow of Lewis & Ellis found that only 46% of middle-class consumers have life insurance policies.

Considering the high price of funerals and the effect of leaving your family without any income, getting a solid life insurance policy—like the ones offered from Nationwide—make a lot of sense.

There are different ways to pay for life insurance and Nationwide is no different than any other insurance company.

- Whole life and universal plans cover you and put the premiums you pay into an interest-bearing account or investment account i.e. it’s saved for you. After a period of time, you can use the money even if you don’t die.

- Term life plans cover you for a fixed period of time. The money you pay is generally less than whole and universal, but you won’t get it back after the term is over.

Investopedia explains that with whole life plans, part of your premium pays off an administrative fee to your insurer for managing the plan, and another part goes into savings where it accumulates interest.

The thing is, you don’t pay taxes on any of the savings in this type of account.

After a set amount of time, you can even start pulling some of this money out and spend it

while you’re still alive and kicking.

Nationwide Insurance offers three different types of life insurance: term, whole, and universal.

Now the classic advice for wealth planning through life insurance is to buy the lower cost term insurance, and invest the money you would have spent on a whole or universal life plan somewhere else.

Retirement expert Mary Beth Franklin makes one major point on why some folks should go with the latter two insurance options:

Most people don’t follow through with investing the money they save. Getting whole or universal life insurance ensures you put that extra money to work.

Whether you buy term or whole or universal life insurance really depends on how active of an investor you are (your money should be actively invested!).

Term life insurance

This type of insurance is the cheapest of the bunch.

You purchase the life insurance for a specified term, typically in 10, 15, 20 and 30-year increments.

Throughout the term of the insurance, you pay a set rate that can’t go up or down. If you pass away during this time period, your beneficiaries get all the proceeds tax free.

The best thing about term life insurance is its price. This is the cheapest of the three life insurance plans Nationwide offers.

However, a lot can happen within 10-30 years. You could get married, have kids or buy a new house. That could alter how much cash you’d want to leave your loved ones.

Once the term of your policy is up, you have to purchase a new one at a much higher rate.

Whole life insurance

Like term life insurance, you pay a set rate during the course of whole life insurance. You get to choose whether those payments are annual, semiannual, quarterly or monthly.

Here’s the cool thing about whole life insurance – they can be paid off, meaning you keep the policy but never make payments on it again.

Your policy will earn a fixed rate of interest, so it keeps growing in value after it’s paid off.

Now the downside: You’ve got to make those payments consistently. Whole life insurance isn’t very flexible with the payment schedules.

The good news is that you can pull cash out of this type of policy, though these withdrawals may be subject to a 10% tax penalty if you’re under 60 years old.

Universal life insurance

This type of insurance isn’t taxed and is tied to a financial index like the U.S. stock market (sort of like a 401(k)). Once again, you can pull cash out of it if need be. It comes in two specific types.

Fixed premium universal life: With this one, your premium is fixed and final.

Flexible universal life insurance: Here, you can change your level of protection and how often you make payments – within certain boundaries.

What customers say about Nationwide life insurance products

Most customers seemed very satisfied with their life insurance from Nationwide – with a few exceptions, naturally. Here are a few reviews collected from Consumer Affairs:

Very helpful, works with me to find the best options for me, can call at any time with questions or concerns. Agent is local and is knowledgeable with the area and the different insurance sources.

One of my best friends is my insurance agent, and he always bends over backwards for me and anyone he insures. Even though I may pay a little bit more, I would never switch.

Nationwide wanted to cancel me for $5.00 I still owed.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Nationwide specialty insurance products

Nationwide also offers insurance for everything short of getting hit by an asteroid. From business insurance to pet insurance, you can get a policy with them.

Their business insurance is particularly loved by critics. Reviews noted that they offer a ton of custom products for business owners, as well as a dedicated help hotline for their entrepreneurial customers.

Small business insurance

For entrepreneurs, Nationwide offers a variety of policies that will protect your investments and keep your business intact in case something happens.

- Business owners policy: This is Nationwide’s one-size-fits-most solution for folks that own a business. It combines property insurance, liability insurance, crime coverage and more into one package.

- Business liability insurance: Accidents happen, but things can get pricey if a customer decides to sue as a result of a slip-and-fall or other mishap. This type of insurance can protect your company in these cases, covering medical expenses, attorney fees and any damages you’re responsible for, among other things.

- Commercial property insurance: This protects your company’s physical assets. It’s an important type of insurance whether you own or lease your building, or even work from home. This will cover everything from the structure itself to your inventory, and most things in between.

- Business auto: Just like you need insurance for your personal automobile, you need insurance for the vehicles used by your company. Nationwide offers several different plans that can meet your needs.

- Commercial crime insurance: Whether it’s an employee taking a few thousand bucks from the safe or a full-blown heist, crime insurance can keep your company afloat if it’s been hit by nefarious actions.

- Business interruption insurance: Sometimes a flood, fire or just the electricity getting disconnected can cause business owners to close their doors for a few days and lose a ton of money. Business interruption insurance can cover your losses during these times.

- Accounts receivable insurance: Sometimes you can’t collect payments from a customer. You might have a permit canceled and become unable to finish a job or your records of who owes who go up in smoke so you can’t track down a debtor. Accounts receivable insurance can cover you during circumstances like these.

- Equipment breakdown insurance: A power surge could short out your accounting firm’s computer network, your restaurant’s refrigerator can break down and leave you unable to fix customers food or many other similar situations could leave your business unable to function. Equipment breakdown coverage will pay for replacing lost income, replacing spoiled stocks or similar side effects as a result of your machines going kaput.

- Cyber liability insurance: If you get hacked, cyber liability insurance can help you with everything from paying legal fees to fight off lawsuits over damages to finding out who broke into your network.

- Workers’ compensation insurance: Your employees are your most important asset. Workers’ compensation insurance will help pay for their medical treatment if they get injured on the job, as well as help you protect your business and assets in other ways.

Identity theft coverage

If your identity gets stolen, your bank account could be drained, or your information spread all across the Internet. Identity theft coverage can give you the tools to protect your information and reimburse you for expenses made by fraudsters.

Personal umbrella insurance

This type of insurance provides an extra layer of protection in the case a serious accident occurs while you’re on the road, on your property or when you’re out of the country. It basically beefs up your liability coverage so that a lawsuit won’t leave you destitute, and also keeps you covered beyond the borders of America.

Pet insurance

Protect your cat, pooch or other pet with this type of insurance. Nationwide offers three different plans for pet lovers:

- Wellness coverage – These plans start at $22 per month and cover:

- – Wellness exams and tests

- – Flea and heartworm protection

- – Vaccinations

- Medical coverage – This will run you $34 or up every month for coverage on:

- – Accidents and illnesses

- – Surgeries and hospitalization

- – Prescriptions

- – Chronic conditions

- – Some hereditary conditions after a one-year waiting period

- Complete coverage

- – For $64 or more per month, you can get all of the features of the two previous plans combined into one.

Group accident medical insurance

If you run a club, amateur sports league or another type of group that meets regularly, Nationwide’s GrouProtector accident medical insurance can keep you and your friends protected in the case of an accident. This type of plan can be customized to cover either one-time or reoccurring event.

Travel insurance

If you’re traveling, you probably need travel insurance. Nationwide offers insurance for going on cruises, single trips or annual travel plans. These can cover you for expenses arising from losing your luggage, canceling your trip or other unfortunate events that may arise.

Farm insurance

Nationwide can insure all types of different agriculture-related items, from your livestock to your equipment.

Wedding insurance

Weddings should be memorable, just not because you lost a lot of money due to the big day. You can get insurance so in case you have to cancel your wedding, all your non-refundable deposits or other various expenses might not come out of your pocket.

Another option is getting liability insurance for your wedding so in case an accident occurs as a result of an open bar policy, any resulting damages won’t break the bank.

Dental plan

Nationwide’s Multiflex Dental Insurance offer either $1,500 or $2,000 in benefits to keep your pearly whites shining bright. Preventative care like cleanings and x-rays get covered 100% up to a maximum of $500 per calendar year.

Legal services and plans

LegalGUARD, Nationwide’s legal plan, is meant to help customers out with their legal or financial concerns. You’ve got two options here – Advantage and Optimum.

- LegalGUARD Advantage provides you with access to a network of attorneys who can help you with most individual or family legal issues. That can be dealing with foreclosure, landlord/tenant issues, moving violations or accidents and other common events requiring legal representation. However, there is a waiting period for selected benefits.

- LegalGUARD Optimum provides all of the benefits of LegalGUARD Advantage, as well as divorce benefits. There’s no waiting period for Optimum plan members.

What customers say about these specialty insurance products

Based on reviews from multiple sources, here’s what experts and customers are saying about these different specialty insurance services.

“Everyone I’ve spoken with there is very helpful and informed of all the ins and outs of business insurance that at first I didn’t really understand. There were many choices of policies I could adapt for my small business which is important to me because I need coverage that I can afford. It was an okay price I mean I would like to be able to get more for my buck but compared to other companies I feel as though I got the best value for my buck.” – FromConsumer Affairs

“Luckily I did not have to use any part of this plan but the peace of mind having it for the price I paid was well worth it at 74 years old you never know when you may have to. It was the least expensive plan I found with the same if not more coverage then the others I researched.” – FromInsure My Trip

Nationwide and Trupanion both offer a comparable level of cover. However, they excel at different things.

Trupanion’s 90% reimbursement model may result in larger payouts; and the way they define a pre-existing condition gives you more leeway in terms of what illnesses they’ll cover…

Percentage reimbursement models often exclude common expenses such as exam fees and taxes. Trupanion is no exception. If you want these expenses to be covered, Nationwide’s schedule of benefits is a better option.

Nationwide’s three tiers also give more flexibility. This is great if you’re on a budget because you can keep costs down by paying only for the cover your pet actually needs. This just isn’t possible with Trupanion’s single plan.” – FromTop 10 Pet Insurance Reviews

Discounts offered by Nationwide

Whether it’s home, auto or other kinds of insurance, Nationwide offers several ways to save. Here’s a list of their most popular discounts.

Saving money on home insurance

Whether you rent or own, Nationwide has some great ways to save on your insurance. Check with your local broker, agent or other insurance representative to see whether your state lets you qualify for these discounts.

- Protective device discount: Installing smoke detectors, fire alarms or security systems could cut your premiums down a few percentage points.

- Claims-free discount: If you haven’t filed a claim in five years, Nationwide will reduce your rates.

- Age of insured discount: Folks over 60 may be eligible for lower premiums on their homeowner insurance.

Discounts on vehicle insurance

Nationwide offers a ton of ways to save on their car insurance plans. Here are all the different discounts they offer. Just know that some of them are only available in certain states. To find out if you qualify for these discounts, use this handy map with state-specific car insurance info provided by Nationwide.

- Family Plan: The Nationwide family plan lets your discounts extend to everyone in your household.

- SmartRide: The SmartRide discount offers you an intriguing proposition: Let Nationwide track how, when and how far you drive, and receive a discount in exchange. Just signing up for the program nets you an instant 10 percent off your car insurance rate, and this discount could increase up to 40 percent based on your driving.

- Safe driver discount: Staying accident-free could cut up to 10 percent off your car insurance rates, depending on where you live.

- Good student discount: Full-time students between the ages of 16 and 24 that maintain a B average could see 15% knocked off their rates.

- Defensive driving discount: If you’re over 55 years old and live in select states, taking a defensive driving course could reduce your rates by a few percentage points.

- Anti-theft device discount: Installing a car alarm or other anti-theft device could save you some money on your premiums, depending on which state you live in.

- Affinity car insurance discount: Some businesses or organizations have cut special deals with Nationwide for their employees or members. Check with an agent to see whether you’re one of them, and how much you could save.

How you can save 20% on any plan

One of the best ways of saving with Nationwide is through their multi-policy discount. Bundling multiple plans together can net you up to 20% off your premiums. Now that’s some serious savings.

Filing a claim and reporting an accident with Nationwide Insurance Company

If your car gets totaled, TV is stolen, or home flooded you’ll need to file a claim.

Here are the steps Nationwide customers go through to get reimbursed.

Nationwide Insurance deductibles work like most insurance companies

One important thing worth noting about your insurance plans – some of them carry what’s known as a deductible. A plan’s deductible is an amount of money you’ll need to pay before your insurance kicks in.

So let’s say you had home insurance with a $500 deductible when a hailstorm caused $2,000 worth of damage. You’d pay the initial $500, and then your insurance would cover the rest.

In order to receive reimbursement, you’ll have to file a claim.

Nationwide offers multiple ways for filing a claim. Here are all your different options when it’s time to get your money’s worth from your insurance, and the process for each different kind of claim.

Ways of filing a claim

- Over the phone at 1-800-421-3535

- Online through their self-service portal

- Using the Nationwide App for Android and iPhone

Reporting an accident and filing an auto claim

- Check to see whether anyone has been injured. If so, call 9-1-1.

- If no one is hurt, contact the police department and file an accident report.

- Call Nationwide’s claims service number, or begin the claim online or using the app.

- Collect contact and insurance information from those involved in the accident, and the names and numbers of any witnesses.

- Photograph any damage from a safe spot.

- Later, speak with a claims agent to provide more facts about the accident, explain your policy, schedule an inspection for the vehicle and arrange a rental car if needed.

- If your vehicle can be repaired, choose a shop through either Nationwide’s preferred providers or your own. However, going with your own mechanic means you may not get repairs guaranteed for the life of your vehicle.

- If your vehicle is totaled, your claims agent will help you determine the actual cash value of your vehicle and provide you with a vehicle valuation report. They can also help you find another car and get back on the road.

- Once your car is repaired or determined to be a total loss, Nationwide will send you a payment settling your claim. This can be directly deposited into your bank account, sent via a check in the mail, or in some cases paid via a debit bank card if you don’t have a bank account.

Filing a home claim

- Be prepared to state your address, telephone number and policy number, as well as the type of property damage claim (wind, water, fire, theft, etc) and a description of the damage.

- Contact Nationwide over the phone, online or using the app. A claims representative will gather facts about the damages to your property, explain your policy and deductible, and help schedule any necessary inspection of the damage.

- Claims for minor damage can usually be handled over the phone, with payment dispensed immediately.

- Substantial damage may require a Nationwide representative to inspect your property. The representative will provide you with a detailed written estimate and assessment of all verifiable damages. In some cases, payment may be received immediately following an inspection.

- If repairs are needed, you may select a contractor from Nationwide’s property repair network or arrange for your own contractor.

- If your home is unlivable while it undergoes repair, Nationwide may be able to help cover your living expenses during this time.

- Once damages have been estimated and reviewed, Nationwide will issue payment under the terms of your policy. This will be a direct deposit, Visa debit card, or check payment.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How the Nationwide app works

Nationwide provides a great app for its customers. Available for iPhone and Android, the Nationwide app allows customers to:

- Pay their insurance bills

- Get information on their insurance card

- Find contact info on the nearest agent

- Collect and exchange insurance information after a car accident

- Begin an insurance claim

- Get a quote, find a policy and pay for renter’s insurance

The app isn’t perfect, as users note. Customers mention the app had some difficulty logging into their accounts. Besides some difficulties connecting with their account, generally, there were quite a lot of people happy with the Nationwide app’s easy-to-navigate interface, filing a claim on the go, and pulling up their insurance card straight from their phone.

Nationwide strengths and weaknesses

Now that you know the products and discounts of Nationwide Insurance, it’s time to evaluate the company as a whole. Here are the strengths and weaknesses of going with Nationwide.

Strengths

- Nationwide is on your side by design: Since Nationwide is owned by policyholders, not shareholders, you see lower premiums when they’re doing well. If they’re making money, the savings get passed on to you.

- The company cares: Nationwide seems committed to being a responsible corporate citizen. For example, they donated $50 million to the Columbus Children’s Hospital back in 2007, which was renamed to the Nationwide Children’s Hospital in thanks.

- One of the best apps out there: The Nationwide mobile app lets you find agents, swap insurance information after a car accident, and so many other options. It’s easy to download, navigate and use.

- They’re huge: Nationwide was number eight on the Insurance Information Institute’s top ten largest P&C insurers. That size means an agent is almost always close by, and the number of products they offer can fit nearly any of your needs.

- Offers Autowatch: Nationwide partners with AutoWatch, a service that lets you see how your car repairs are progressing after an accident. Goodbye wondering when your car will be coming out of the shop.

Weaknesses

- They’re pricey: In general, Nationwide’s car insurance rates came up 30% higher than the competition, according to Eric Stauffer over at Expert Insurance Reviews.

- Tricky marketing practices: This extends to every insurer, but Nationwide is guilty of this practice as well. Their accident forgiveness program isn’t always as good a deal as they let on, and their Brand New Belongings products is just a fancy name on an old product.

- Hard to get in touch: Some customers report their support staff can be hard to reach when trying to file a claim. Unfortunately, this criticism is widespread across the insurance industry, so it’s not just a problem with Nationwide.

The most common consumer complaints about Nationwide

No company is perfect, and Nationwide’s no exception. Customers who have had a bad experience have a lot to say about where this company can improve.

Even with these complaints, the company holds an A+ rating with the Better Business Bureau. And as we mentioned in the intro, that’s a little better than Allstate’s A- rating.

Here are the areas where most people find themselves disappointed with Nationwide’s services, as told by Consumer Affairs:

Difficulty reaching the agent and lack of responsiveness

“The adjuster claimed not to know anything about the collision repair center, but after calling the garage, I came to find out the garage repeatedly in the past few weeks contacted Nationwide adjusters, who kept saying, “not OUR liability”. In other words, they wanted to blame me for NOT paying a $1000 deductible on my policy for someone else’s carelessness, tried to saddle me with a blame of “not informing them”, but HAD been contacted, but scattered away from their responsibility like cockroaches.”

Rate increases without explanation and despite pristine (claimed) driving records

“So, my guess is that the actuary who is creating my rate has no idea where I am. Either way, the $1368 a year increase over the last 4 years finally tipped the scale. Loyalty can only last so long. By the way, we are claim free for 15 years. So they have just been collecting premiums for 15 years! That’s a long time to be collecting money and doing nothing but jacking rates. Pretty disappointing.”

Poor customer service and difficulty reaching adjuster

“Terrible Adjusters!! Terrible Service! They avoids phone calls, gets rude with an attitude and does not return calls or update the client. I have been a customer with them for over 20 years and the treatment is horrible. Once the claim is resolved, I will be switching companies.”

Not responding to claims and denying coverage without explanation

“After calling customer service 3 different times and each told me my renters insurance would not cover my loss, I hired an attorney who said they had to open a claim and he spoke to them and they opened a claim. 3 months later still no word on the claim. We provided them with the information they requested. They haven’t denied but have not made it right. They are ignoring me. My attorney said after 6 months we can take them to court. This is a game!”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Thinking of choosing Nationwide Insurance Company?

If Nationwide sounds like the insurance company that’s right for you, signing up is simple.

- Contact them over the phone at 1-877-669-6877

- Use their website to get started

- Visit an agent in person

Frequently asked questions (FAQ)

Do products or services differ from state to state?

Yes. Different states regulate their insurances in different ways. That means your rates will differ from state to state. That’s why New Jersey has the highest average car insurance rate at $1,334 per year while Idaho sits at $639, according to the National Association of Insurance Commissioners. It also means that not ever discount will be available in every state.

How much does Nationwide’s car insurance increase after an accident or speeding ticket?

It varies. If you get their accident forgiveness insurance, it won’t raise your rates one cent. Other than that, it depends on where you live. CarInsurance has a comprehensive look at how much your rates can spike following an accident or moving violation.

What does Nationwide’s comprehensive car insurance cover?

Comprehensive insurance covers everything outside of a collision. That means it pays out if your ride gets stolen, damaged in a natural disaster or bad weather, vandalized or some other nasty incident.

Does Nationwide Insurance company cover a rental car?

Yes. You just need to add on rental insurance to one of Nationwide’s regular auto insurance policies, and your rental will be covered after an accident.

How do I cancel my Nationwide Insurance company policy?

You can cancel at any time, but you’re going to have to contact one of their customer service representatives. Have your plan information ready, and be prepared for a lengthy spiel about why you should stay with them. Some fees may apply, and make sure you have a new policy ready if it’s something important like home or auto insurance.

Does Nationwide Insurance company cover me in Canada or outside the United States?

If you’re in Canada, your auto insurance carries over. The U.S. Bureau of Consular Affairs recommends you get a special form of proof called a “Canada Inter-province Card” before going so you can prove you’ve got insurance.

If you’re outside of the United States or Canada, you’ll need one of Nationwide’s umbrella policies to be covered. Snag one of them if you’re shipping your vehicle across international borders.

Does Nationwide Insurance company use credit scores?

Yes. Nationwide uses your credit score for determining your insurance rates.

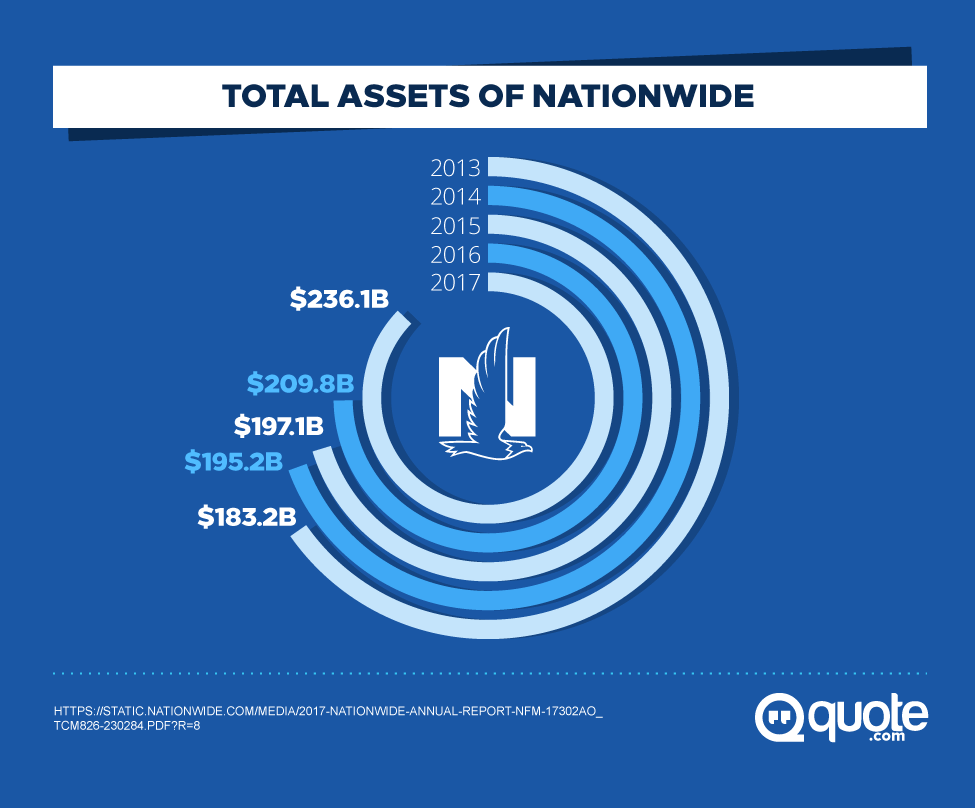

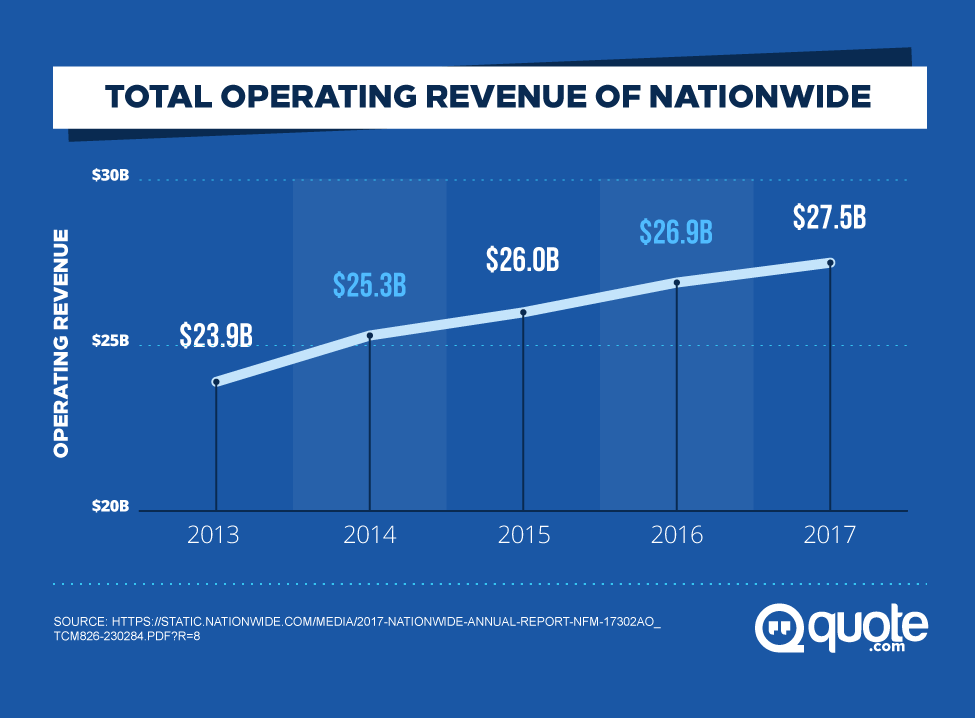

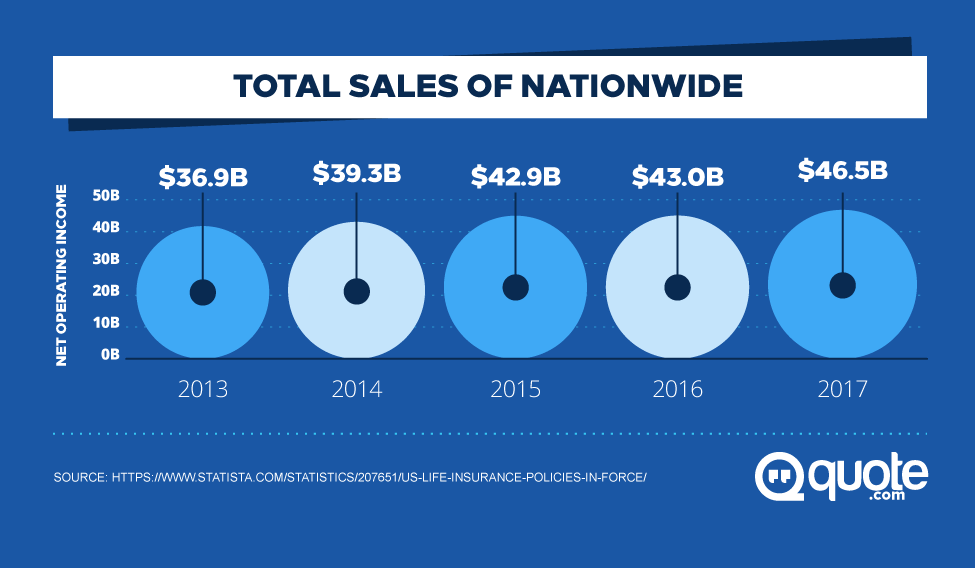

What are Nationwide Insurance’s financial strengths?

Nationwide Insurance is one of the oldest, largest companies operating in the insurance industry today. They’re also not a public company, shielding them from some of the fluctuations of the stock market. They’re probably not going bankrupt anytime soon if that’s what you’re asking.

The verdict on Nationwide Insurance Company

Nationwide offers some pretty compelling insurance options. Their plans can be customized for your every need, and the savings for bundling products together makes getting all your insurance plans through them a competitive deal.

However, their rates can be pretty expensive depending on what state you live in. As noted earlier in this review, their renter’s insurance isn’t affordable if you live in a high-risk area and their car insurance is pretty pricey in Vermont.

The sheer range of products and potential for savings offered by Nationwide makes them one of the first insurers you should check out when shopping around for coverage. Just make sure you compare a few quotes before committing. That way, you’ll know whether Nationwide is really on your side.

Do you have any Nationwide Insurance products? Have they worked out for you? Or have you been burned? Let us know in the comments below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.