Good2Go Insurance Review

Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding co...

Meggan McCain

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Michael Vereecke

Updated July 2021

Auto insurance is important for a bunch of reasons.

Most obviously: it’s mandatory in nearly every US state.

That means for most of us insurance is a necessary evil.

You hate paying it.

You hope you never need to use it.

But if you do ever get into an accident, you’ll probably be thankful you have it.

Even in areas where it isn’t required, it’s still highly recommended.

Getting into a serious accident without insurance can leave you liable for enough expenses to easily bankrupt you.

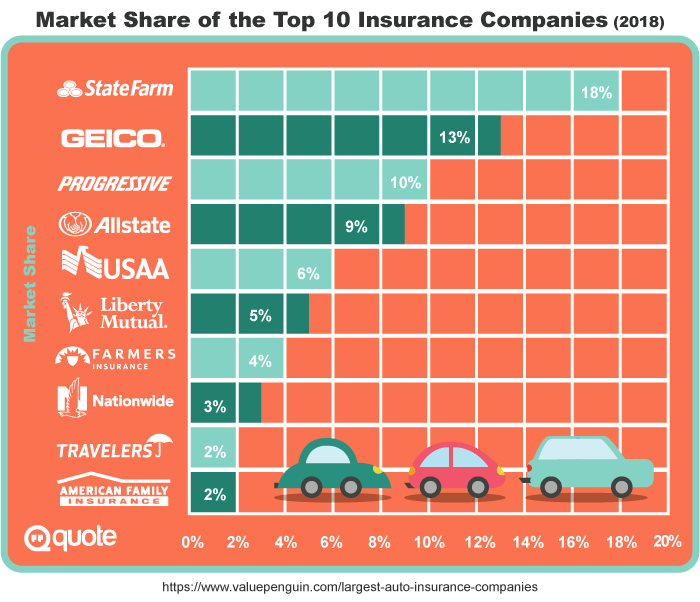

But maybe you don’t want to go with any of the major insurance companies like Geico, State Farm, or Nationwide.

There can be a bunch of reasons for this.

Maybe you can get a lower rate elsewhere.

Or maybe you’re looking for a company that offers one-on-one service.

Maybe you even want specialty coverage that larger insurance companies don’t provide.

Whether a smaller insurance company will be the right option for you depends on your own individual needs when it comes to your insurance.

Good2Go Insurance

What is the company all about, and what services does it offer?

Good2Go Auto Insurance started off more than 25 years ago. The main idea behind the company is that getting car insurance shouldn’t be difficult for drivers.

Good2Go is an insurance agency. However, it doesn’t provide your insurance itself.

Instead, it offers auto insurance underwritten by several different companies.

In fact, it currently offers its auto insurance through nine underwriting companies across different states.

The company offers collision and comprehensive auto coverage. It also provides minimum limit car insurance if you are looking for the lowest price possible.

Good2Go tries to make it easy for drivers to get behind the wheel with proper insurance.

By offering convenient payment plans and low down payments, it aims to fit any car owner’s budget.

It’s all part of the company’s mission to make it easy for all drivers to get insured and get on the road with minimal hassle.

Why should you choose Good2Go?

It’s cheap. You can get just the minimum insurance coverage needed to legally drive in your state and avoid fines.

Thousands of Good2Go customers get the insurance they need every month without breaking the bank.

It’s easy. Good2Go doesn’t ask any unnecessary questions.

Just provide it with the essential information it needs, and it’ll set you up with the best options to get you driving.

It’s fast. You can get a free quote through its website in less than a minute.

Good2Go is proud to offer the fastest online quote in the auto insurance industry.

It knows that getting coverage shouldn’t be a long process that takes up your whole afternoon.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Insurance

Some details about car insurance laws and requirements by state

I mentioned the term “minimum insurance” earlier, but you might not be 100% clear on exactly what that means.

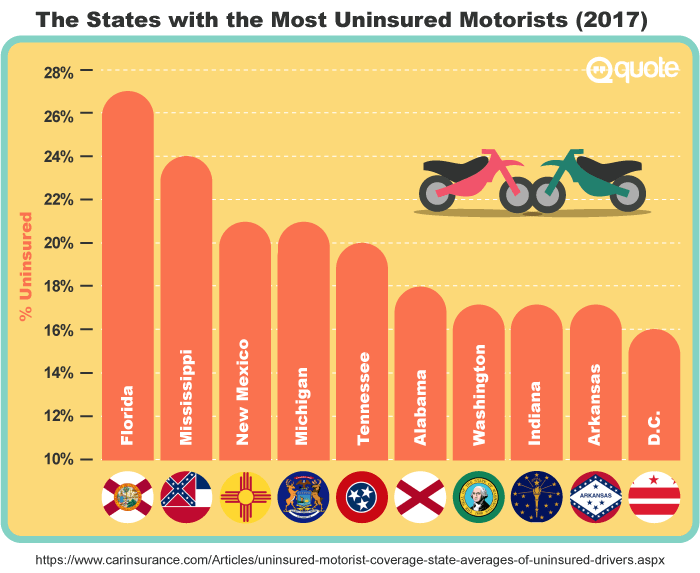

Almost every US state requires drivers to have auto liability insurance. The only exception is currently New Hampshire.

Requirements for auto insurance vary widely from state to state.

That’s why it’s important to have an insurance company that can help you meet those standards regardless which state you reside and drive in.

Good2Go works hard to provide a policy that fits your individual state’s requirements.

There are a couple of types of liability that car insurance generally covers:

Bodily injury. This can be for one person in an accident or all persons injured in a crash. State minimums for bodily injury coverage range from $5,000–$100,000.

Property damage. This covers damage to your car, collisions with other vehicles, or damage to other buildings or property.

A few states may require other additional insurance as well. This includes personal injury protection (PIP) and uninsured motorist coverage.

If you have a more expensive vehicle, you probably want to go beyond just the minimum to get adequate protection and the peace of mind that goes with it.

Collision and comprehensive coverage can give you extra peace of mind. It protects you in various cases of untoward events such as natural disasters and theft.

Driving without insurance just isn’t worth it.

You can get your driver’s license and registration suspended.

Your vehicle could get confiscated.

You can get fined $100–$1,000. Plus, additional reinstatement fees.

You could even be required to complete community service or jail time!

Minimum car insurance can cost as little as $20 per month, so there’s really no excuse to be driving uninsured.

What I Think

My personal views on minimum insurance, and auto insurance in general

Full disclosure. I have comprehensive auto insurance.

I personally don’t think I would feel safe driving with just minimum auto insurance.

My financial advisor suggested early on that we have an auto insurance policy that covers almost any accident imaginable.

Part of the reason is that my wife and I both drive higher-end vehicles.

You don’t want the person you get into an accident with to assume they’ve hit the jackpot just because you drive a new Cadillac.

But the main reason I don’t use minimum insurance is because I want to avoid all the liability to other people and things other than my own car.

I’ve heard too many horror stories about the personal lawsuits that can result from auto accidents.

If someone gets injured because of an accident you were at fault for, the costs can be enormous.

Say you hurt someone so badly that they can never work again.

If they sue you, you might be responsible for paying their lost wages and medical expenses for the rest of their life.

There have been auto accidents that have resulted in lawsuits of hundreds of thousands of dollars or more.

That’s way more than a basic insurance policy will ever pay out, and enough to personally bankrupt you as a result.

Of course, you can make your own choice. The risk you’ll be in a very serious accident is low, especially if you’re a careful driver.

But an accident can happen in just a momentary lapse in concentration or distraction, and have consequences that will affect the rest of your life.

That might sound a bit extreme, but that’s enough reason for me to get auto insurance that’s far beyond the minimum requirement.

I’ll gladly pay extra for my insurance each month for that peace of mind.

Discounts

How you can get your insurance costs even lower

Good2Go Auto Insurance understands how important saving money is for you.

On top of offering you the minimum legal insurance, it also has a number of discounts you can take advantage of.

You can use them to get your monthly insurance costs even lower.

Defensive driving course. Taking one of these courses will give you a basic overview of traffic laws, driving techniques, car maintenance, and more.

Passing a state-certified course will get you a discount of between 5–15%.

Good drivers. If you have a good driving record, don’t you think you should get rewarded?

Having a minimal number of traffic violations and avoiding accidents can mean extra insurance savings for you.

Some providers even now place a small device in your car to gather data about your driving habits.

This can lower your monthly insurance costs even further.

Being a good driver can save you up to a whopping 35% off your insurance.

Student drivers. Car insurance is expensive for young people.

Teens get labeled as at-risk drivers which can make their insurance premiums go through the roof.

But many insurance providers will offer student discounts for maintaining good grades.

Discounts range from 5–20%.

Homeownership. You can get a discount on car insurance just by owning your own house.

You don’t even necessarily need to have home insurance with the company to take advantage of it.

Simply provide proof of your homeownership with a mortgage coupon, property tax records, or a homeowners insurance declaration page.

It can save you an extra 5–10%.

Multi-vehicle. Insuring more than one car on a single policy can save you money on your car insurance.

If more than one of your family members owns a car and you insure them together, you might qualify for a discount of 10–25%.

Paid in full discounts. You can get a discount on your car insurance by paying your entire annual policy up front at the beginning.

You can save 5–10% by doing this.

As an added bonus, you don’t need to worry about dealing with monthly statements or worry about being late on a payment for the next 12 months.

Renewal discounts. Loyal customers get rewarded with an average 3–5% discount for remaining active customers over specific periods of time.

Discounts can start as little as six months after the beginning of your plan, and might continue to happen the longer that you stay a customer.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

High-Risk Insurance

How do I know if I’m a high-risk driver and what does it mean for my insurance?

High-risk drivers have a hard time finding affordable auto insurance.

It’s unfortunate because many factors that determine if someone is high-risk are basically out of your control.

But because they statistically make you a more risky driver, you’ll pay higher rates for car insurance.

There are some obvious things that fall under the high-risk classification that you’d expect. It’s no surprise that a driver who has received a DUI/DWI charge is considered high-risk.

They’re more likely to cause an accident and pay higher premiums as a result.

If you’ve had your license suspended for any reason, you’re also considered high-risk.

Other drivers who can be considered high risk include:

- A newly licensed driver.

- A young or teen driver.

- Someone with no prior auto insurance coverage.

- Elderly drivers (70 years or older).

- Those who live in a high-risk area.

- Drivers with multiple traffic violations.

- People involved in car accidents.

- Even those with poor credit history!

Luckily, Good2Go specializes in high-risk auto insurance.

The company knows having your car is essential for basic daily tasks like getting to work and running errands.

So it helps high-risk drivers find a minimum limit plan that’s right for them.

Getting A Quote

Finding the lowest down payment on minimum limits car insurance in under a minute

Getting a quote through Good2Go is straightforward.

It asks for pretty much the same information you’d expect from any insurance company.

This includes your ZIP code, vehicle information, and primary driver information.

Based on your responses, Good2Go provides you with a list of auto insurance carriers.

More insight

What sets Good2Go insurance apart from other companies?

Like any insurance company, Good2Go has its strengths and weaknesses.

One of the best parts of using its service is that it offers multiple auto insurers to pick from.

This is since Good2Go doesn’t provide insurance itself.

Instead, it acts as an insurance agency and connects you to the best companies for your requirements.

Good2Go is an excellent option for drivers who only want to pay for the minimum legal amount of insurance. It’s also great for high-risk drivers, or those with few other options.

There are some weaknesses though.

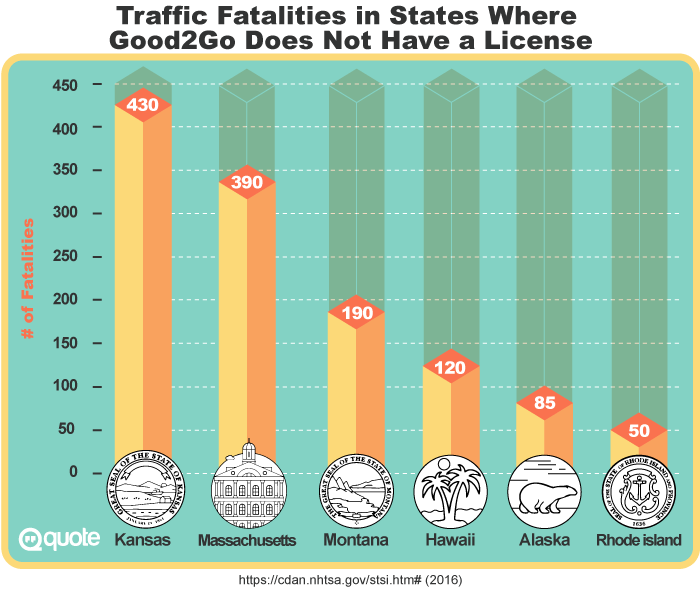

Good2Go currently isn’t available nationwide.

It currently isn’t licensed to operate in Alaska, Kansas, Hawaii, Massachusetts, Montana, or Rhode Island. If you live in any of these states, you’ll have to look elsewhere.

Another downside is that the “view your quote” button on their website doesn’t actually bring you to a quote.

It takes you to a specific insurance company’s website where you often need to redo the entire process.

When doing quotes through Good2Go, you’re also consenting to have your information shared with multiple different insurance companies.

People who use the service often complain about getting unsolicited marketing phone calls and emails after entering their information on the website.

Customer reviews for Good2Go are lower than average.

Some people leave 5-star reviews, but there is also a large number of 1-star reviews for the company online.

One of the biggest complaints people have is unresponsive customer service.

This is because of a restricted schedule and limited time and day that Good2Go is open to taking calls.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Claims

How to report a car insurance claim through Good2Go

If you get involved in an auto accident, you can report it to Good2Go 24/7.

You can call them at 1-888-925-6547 to file your claim.

Their regular business hours are Monday to Friday from 8 am to 7:20 pm EST.

An automated system can collect necessary information outside of regular business hours.

You can also file an insurance claim online at any time via their website.

Either click the Manage My Policy link under your account or email them at claimservice@good2go.com.

A representative will follow up to review the details with you within one business day.

Good2Go does not provide any public information on how long you can expect your claim to take to get assessed and approved. It simply gives a generic answer that each claim is unique, so the process will vary.

Even if your damage doesn’t exceed your deductible amount, you must still report all accidents to your insurance company.

A deductible is the part of your loss that you as the driver must pay before your insurance company pays.

For example, let’s say you have coverage of $3,000 and a collision deductible of $500.

In this case, if you get into an accident and your car sustains damage with a repair cost worth $3,000, you’d pay $500 first, and your insurance company would pay $2,500.

Deductibles typically apply even if you weren’t at fault for the accident.

When choosing a plan, a higher deductible will usually lower your monthly premium.

But it also means you’re on the hook to shoulder a bit more in case of an accident. So driving safely and defensively is always highly advised.

I’d recommend you choose a deductible amount that you can easily pay for in case of a crash.

Sometimes the damage might appear to be under your deductible. But there can be hidden damages that could increase the expected cost of repairs.

It’s also good to report it since although you may seem not at fault for the accident, but the other party may later file a claim against you anyway.

You can choose who will repair your vehicle. Your Good2Go claim representative can recommend pre-approved repair shops in your city.

FAQ

Frequently asked questions about Good2Go auto insurance

My Verdict

Thinking of going with Good2Go car insurance? Here’s what I think.

Auto insurance isn’t just a good thing to have. In most states, it’s the law.

Good2Go is an insurance agency that can help provide a fast, cheap, and easy insurance policy for your vehicle.

It offers a number of discounts for students, good drivers, and people who meet other criteria.

It’s also a good choice for high-risk drivers.

Good2Go specializes in minimum legal insurance. That means getting you just the level of insurance that your state requires to get you on the road.

While I personally believe in spending a bit more for comprehensive auto insurance, I can understand that Good2Go fills an important niche.

It allows people to get on the road who otherwise may not be able to afford car insurance. It’s also a fine choice for those with low-value cars.

For example, if your car is only worth a few thousand dollars or less.

You might just intend to scrap your current ride and buy a new car if it requires significant repairs after an accident.

You don’t care if it gets dinged a bit here and there.

In that case, you might not want more than basic car insurance.

If you want to learn more about Good2Go auto insurance, you can contact them 24/7 at 855-MINIMO1 (955-646-4661).

What type of auto insurance do you currently have?

Do you invest more in a comprehensive policy or do you skimp on auto insurance as much as legally possible?

Let me know your own take on auto insurance in the comments below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.