American Family Insurance vs. Travelers: The Auto Insurance Showdown

Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding co...

Meggan McCain

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Michael Vereecke

Updated October 2024

When it comes to finding the right car insurance—it’s about more than just saving money.

It’s about finding the best car insurance company in your area that offers a solid balance of the protection you need along with attentive service and affordable pricing.

Sounds simple enough on the surface, right?

In this guide, we’ll take a closer look at two popular auto insurance companies: American Family, also known as AmFam, and Travelers Insurance.

Whether you’re comparison shopping or trying to narrow down your decision between these two well-known brands, our guide will present the facts and customer reviews of American Family and Travelers Insurance to help you make a more informed decision.

Let’s take a closer look:

What Type of Insurance Products Does Each Company Offer?

Both American Family and Travelers offer your typical auto insurance lines, including comprehensive insurance, liability/underinsured/uninsured motorist insurance and collision insurance, but they also offer insurance coverage beyond the basics.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travelers Auto Insurance Coverage Options

- Gap insurance – This protects your car lease or loan in the event that your car is totaled before the lease is up or before it is paid in full. In this case, gap insurance kicks in and pays off the remainder. Without this insurance, you would have to foot the bill for the difference between the loan balance and the car’s value when it was totaled.

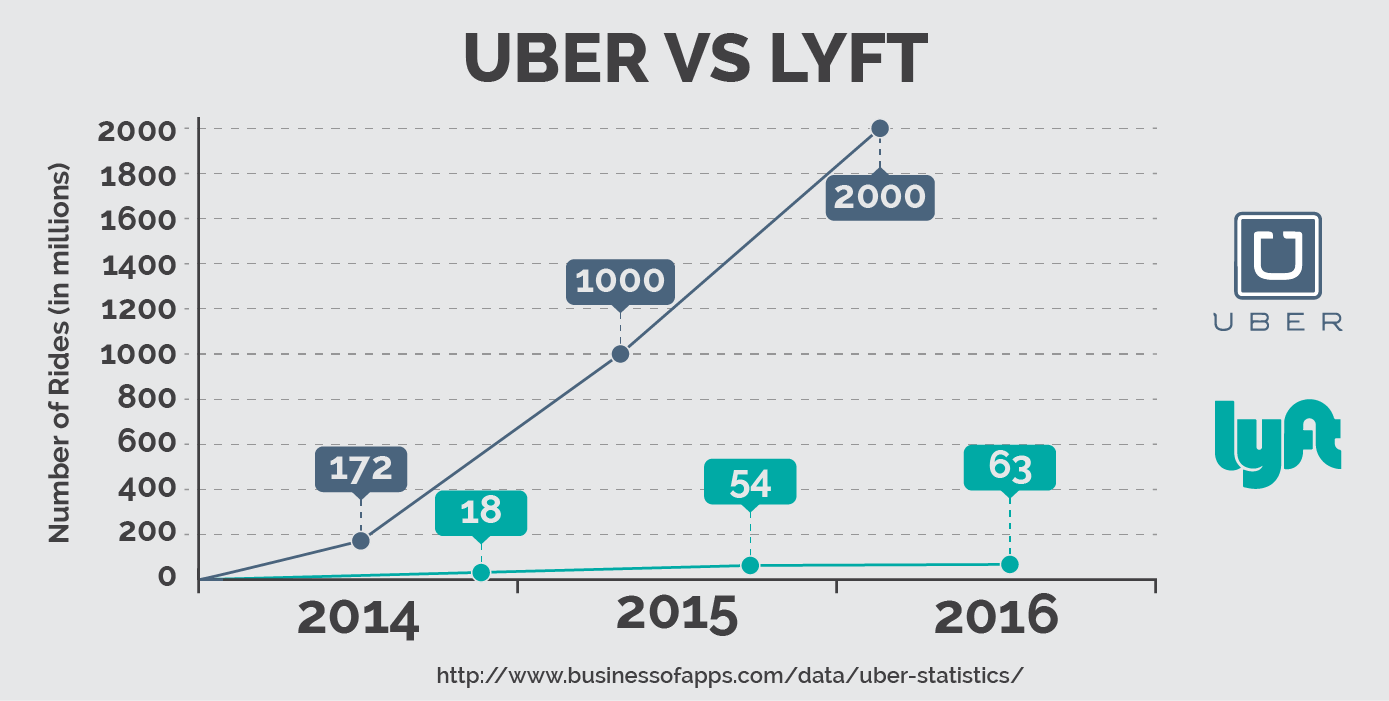

- Ride-Sharing Insurance – Thanks to the popularity of services like Uber and Lyft, Travelers customers in Illinois and Colorado can opt for ride-sharing insurance. The ride-sharing companies usually pay for some liability in the case of an accident when drivers are on the way to pick up or drop off a passenger, but not in between rides. This is where ride-sharing insurance can help.

- Intellidrive – Although not available in every state, Intellidrive is an app that collects metrics based on how you drive—including location, time of day, average speed, acceleration and braking, and number of miles driven. Currently, the program is only available to users in Minnesota or Nevada. Intellidrive requires a smartphone and tracks your driving behavior—with a discount for safe driving habits.

American Family Auto Insurance Coverage Options

Along with typical car insurance policies, American Family also offers gap insurance and ridesharing insurance. In addition, they also provide the following additional options:

- Accidental death and dismemberment – an insurance option which pays in the event that an accident causes death or limb dismemberment, regardless of who is at fault.

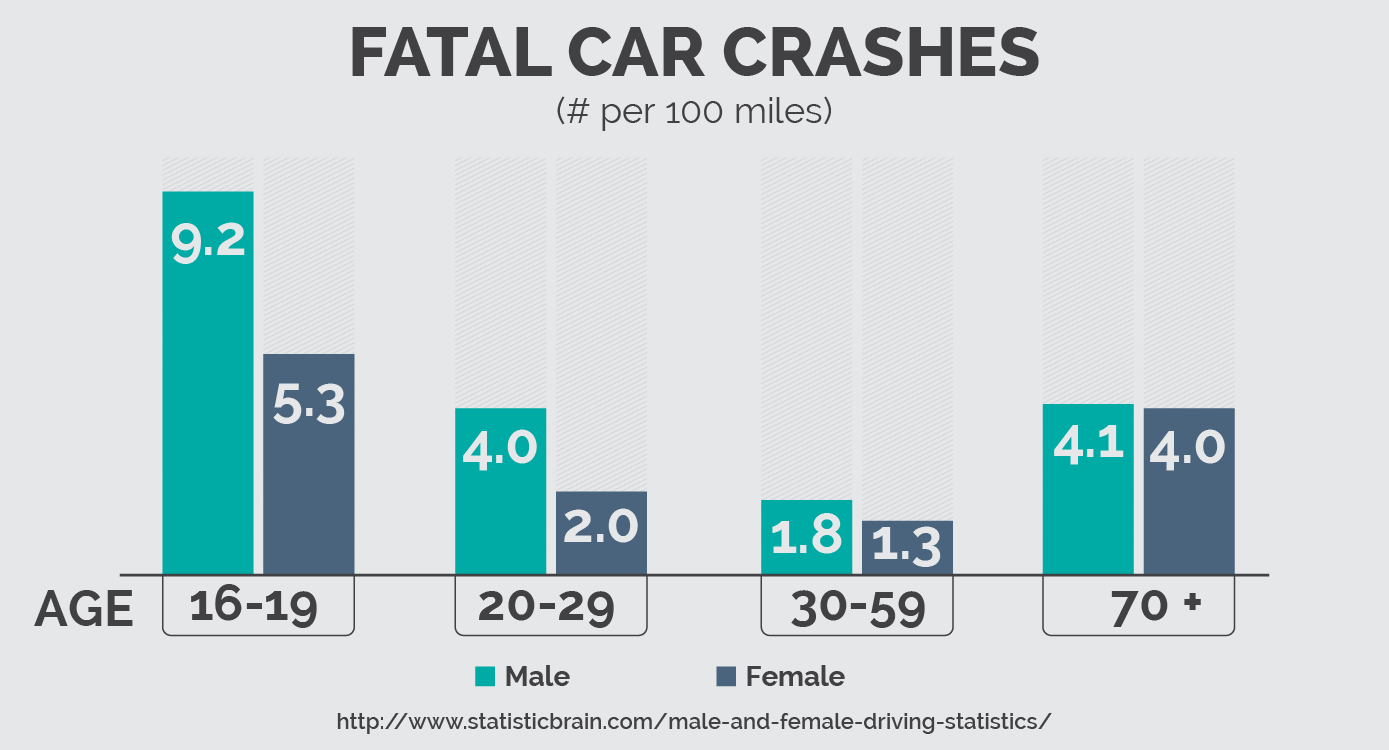

- Teen Safe Driver – Similar to Travelers’ Intellidrive app, this mobile app is part of a program that helps teens learn safe driving habits. As long as their smart phone is in the car, it tracks their driving and scores their rides as well as providing feedback. The company claims that the app is smart enough to tell who’s at the wheel, but if it does happen to log one where someone else is driving, you can delete that log. Once your teen driver completes a year or 3,000 hours in the program, parents can get up to a 10% discount on their car insurance.

Some policies may also offer extras, including things like breakdown insurance, which you’ll want to evaluate as to how necessary it is given your vehicle, its age/condition and other factors.

What Are the Different Rates for Each Company?

The rates for American Family and Travelers Insurance vary considerably depending on many factors.

The amount of insurance you need, the vehicle you’re insuring, the state you live in, how many drivers are on the policy, ages of each driver and so on.

The best way to get rates is to request a quote for your specific situation.

It costs you nothing and only takes a few minutes—and you’ll get a more personalized quote that fits your needs and situation.

Of course, understanding how car insurance companies price their policies can also help you better learn how companies like Travelers and American Family actually set their rates.

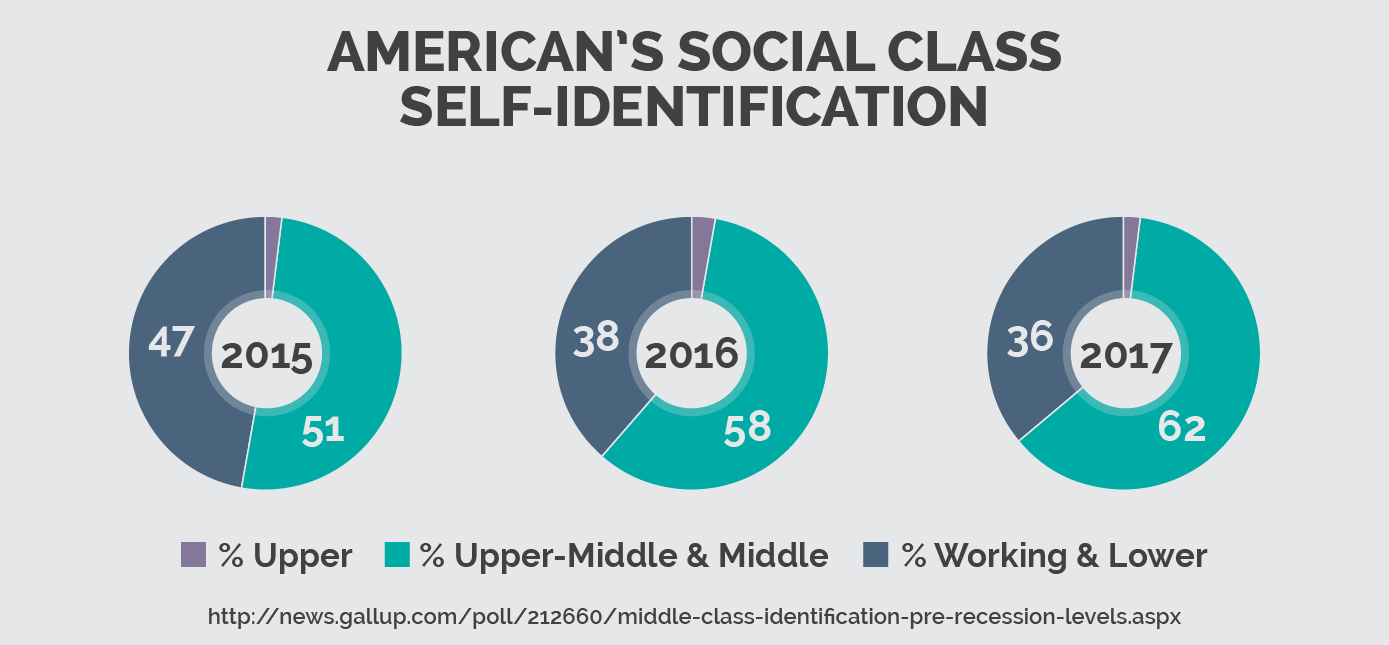

For example, you may be surprised to learn that your high insurance rates can be due to your race or even your socioeconomic status.

This may sound blatantly discriminatory, but there are concrete reasons why insurance is priced this way.

For example, there are a number of markers that insurance companies use in order to help gauge risk—and risk is the primary indicator of whether or not a rate goes up or down.

Where you live, your driving record, the vehicle you drive and its safety or anti-theft features—all of these things contribute to how much or how little of a risk you are.

Even things like your education level, or whether or not you’re married, can contribute to how much you pay for insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Available Discounts for Each Company’s Policies?

Both companies offer a wide range of discounts

Oftentimes you may even be eligible for discounts that don’t appear here, such as a discount for installing an anti-theft device on your vehicle.

Be sure to ask about any additional discounts you may be eligible for when requesting your free quote.

American Family Car Insurance Discounts

There are several discounts for which you may qualify

- Multi-vehicle discount – if you insure more than one vehicle with American Family, you may qualify for a reduced premium on your cars and trucks.

- Loyalty discount – The longer you’re an American Family customer, the more you can save.

- Early Bird discount – You may qualify for a discount if you have a car insurance policy with another carrier, and get a quote from American Family at last seven days before the policy goes into effect.

- Multi–product discount – If you have, for example, home and auto insurance with American Family, you’ll enjoy a discount.

- “Steer into Savings” discount – You could get a discount from American Family if you switch to them from a competitor.

- Auto safety equipment discount – Depending on the state you live in, if your vehicle has factory-installed air bags or other safety equipment, you could get up to a 30% discount on your policy.

- Defensive driver discount – Depending on the state you live in, if you are 55 years or older, you could get a 5-10% discount if you complete an approved defensive driving course.

- Good driving discount – Drivers who practice safe road habits and go without any moving violations, claims or accidents can get a reduced rate premium in certain states.

- Low mileage discount – If you drive less than 7,500 miles per year, you may qualify for additional savings through American Family’s low mileage discount program.

- Good student discount – Students who maintain good grades could enjoy savings on insurance premiums.

- Teen Safe Driver discount – A free program that parents can enroll their teen driver in, the Teen Safe Driver program helps young drivers make better choices behind the wheel, and could get their policyholders a discount on their policy.

- Away at school discount – If you’re a student under the age of 25 who is more than 100 miles away at college and haven’t taken a car with you (or if you have a child who fits these criteria), you can save money.

- Young volunteer discount – If you’re under the age of 25 and you complete 40 hours or more of volunteer work in a year for a non-profit organization, you could save money on your policy.

- Generational Discount – If your parents are American Family customers and you’re between the ages of 18-24, you could get a generational discount.

- KnowYourDrive Discount – KnowYourDrive is a program available in certain states that evaluates your driving and gives you tips on staying safe on the road. You may be able to earn discounts of up to 40% on your car insurance.

Travelers Insurance Auto Discounts

No shortage of possible discounts here either

- Safe Driver Advantage – The safe driver advantage offers a discount to drivers who have no accidents, violations or major comprehensive claims in their households.

- Paid-in-Full Discount – Customers who pay their car insurance premiums in full can receive up to a 5% discount

- Multi-Car Advantage – Insuring more than one car with Travelers entitles customers to a multi-car discount

- Early Quote Advantage – Like American Family’s Early Bird discount, users who plan ahead and obtain a quote from Travelers before their current auto insurance expires may enjoy an early quote advantage.

- Multi-Policy Discount – Combining Travelers car, home and boat insurance can give customers savings of up to 15% on each policy.

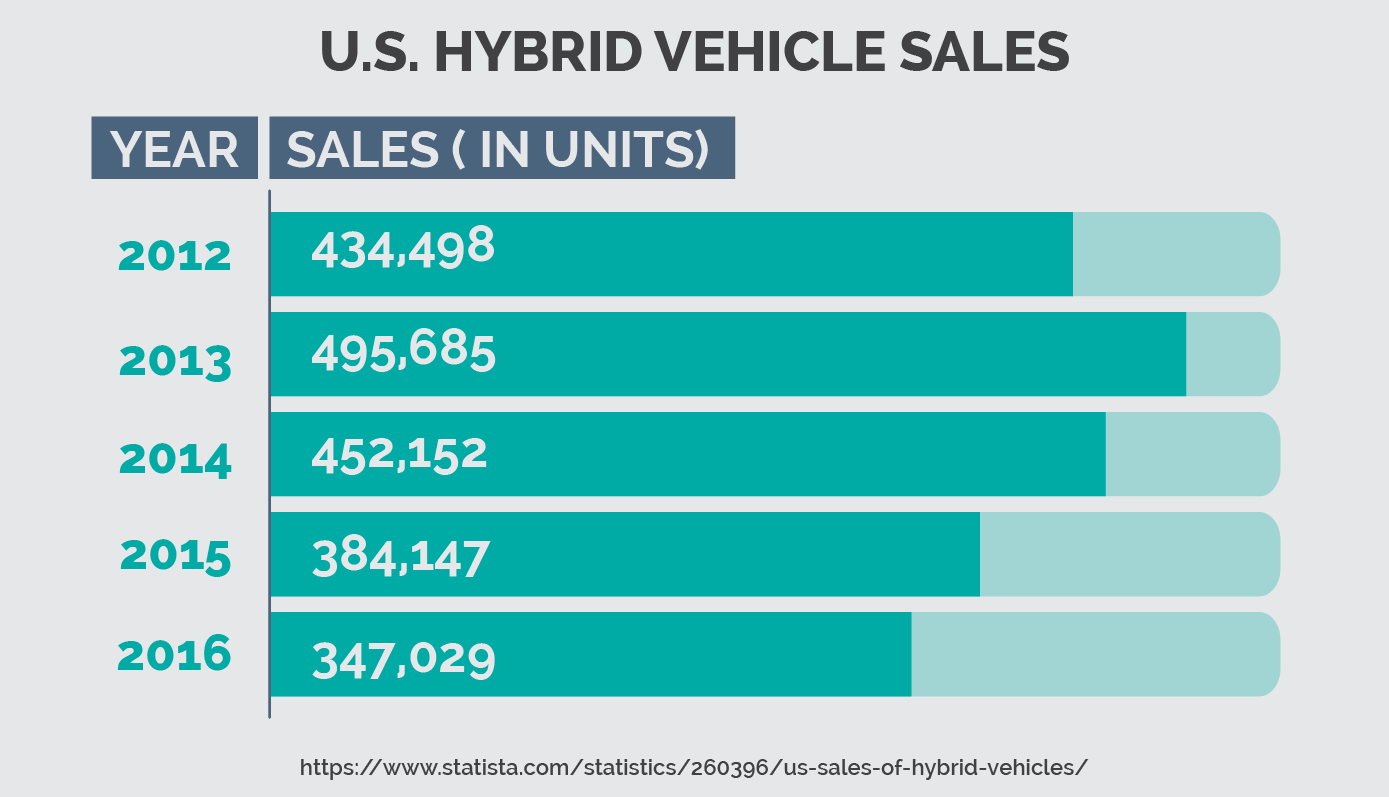

- Hybrid Vehicle Discount – Get up to 10% off your insurance for a hybrid vehicle.

- Good Student Discount – Students with a A/B average can qualify for a discount by keeping their good grades.

- Driver Training Discount – Drivers under the age of 21 who complete an eligible driver training course may qualify for this discount.

- Student Away at School Discount – Policy holders with a dependent under the age of 25 who goes to a school 100 or more miles away may be eligible for this discount.

- Home Ownership Discount – Policy holders who own their home or condominium may be eligible for this discount.

- Accident Forgiveness – There’s no surcharge for the first accident for customers who have been with Travelers for four years or more and have had no major incidents for five years.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Features and Benefits Are Available From Each Company?

Convenient payment options, free online quotes and more

In addition to the multi-policy discounts and features noted above, both companies offer a variety of additional perks.

Both companies are also looking toward incorporating apps (although this is currently only available in certain areas) which monitor your driving and evaluate you accordingly.

This showcases the insurance carriers’ push to tie driving habits and therefore rates to a specific driver rather than lumping all drivers into a typical “risk pool” based on what they drive, their background, where they live and so on.

You can likely expect more carriers to adopt this more personalized approach in the future—so it’s certainly something worth thinking about now.

Be sure to ask your agent when you apply for a free quote if they offer an app or other way to quickly file a claim or get assistance if you need it.

You’d be surprised at how this can come in handy when you’re in the midst of an accident and thinking about insurance paperwork is the LAST thing on your mind!

What are the payment options for each company?

Plenty of ways to make your payments

Both American Family and Travelers insurance offer multiple convenient options to pay for your coverage.

American Family offers autopay, which allows you to set up automatic funds transfer online (also known as paperless billing) and qualify for a discount when you do.

You can also get a discount if you pay your policy in full.

Travelers also offers similar payment options, including paying your bill online, by mail or by phone (using voice recognition).

Can You Get a Free Quote From One or Both Companies? How?

Easy, fast and yes … Free!

Getting a quote from either American Family Insurance or Travelers Insurance for your car insurance needs is easy and hassle-free.

You can go directly through our website to obtain a no-obligation quote and comparison shop between the two providers to determine which may be right for your specific needs.

Getting a customized quote in this way is better than looking for generic car insurance rates online, since it’s more tailored to your vehicle, the state you live in, others on your policy (such as teenage or college-aged drivers) and more.

And remember, obtaining a free quote from both of these companies costs you nothing except a few minutes of your time. Save time and money by getting your quote online.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Can You Get Multiple Policies From One or Both Companies?

Discounts are available for combined policies

Car insurance companies as a whole are generally the same across the board in terms of the policies they offer, although some, like Travelers, have embraced a more forward-thinking approach in offering discounts for hybrids, for example.

The best way to find out which company is right for your specific needs is to get a free quote and ask about what discounts you’re eligible for.

Saving money and being able to file a claim and contact an agent near you are also points to take into consideration.

Both American Family and Travelers Insurance offer multiple types of policies, including home, boat and motorcycle insurance.

You can get multiple policies from both companies and are actively encouraged to do so, as it may save you money by bundling your policies under one company—plus give you a central way to manage your account, view claims, and so on.

What States do Each Company Serve and Are There Any Restrictions?

Available in many states but certain specific rules may apply

Both companies only serve specific states and depending on where you live, certain programs may or may not be offered.

The best way to know for sure is to reach out for a free quote online and determine what programs, discounts and other features are available in your area.

For reference, each company serves the following states:

American Family

- Arizona

- Colorado

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Minnesota

- Missouri

- Nebraska

- Nevada

- North Dakota

- Ohio

- Oregon

- South Dakota

- Utah

- Washington

- Wisconsin

Travelers Insurance

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maine

- Maryland

- Massachusetts

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington, DC

- Wisconsin

It’s worth noting that even if the carrier you’re looking at isn’t available in your state, both companies are growing and expanding and may offer coverage where you live soon.

What Have Other Customers Said About the Customer Service of Each Company?

J.D. Power ratings and online complaints should be taken into consideration

To get an accurate idea of how companies are reviewed, it’s important to consider things like J.D. Power ratings and any complaints that have been made against them according to data from the NAIC or National Association of Insurance Commissioners.

American Family’s customer service ratings are better than average for car insurance and the company itself generally has fewer complaints than similarly-sized companies.

Travelers’ customer satisfaction ratings are average or better, and the company also has fewer complaints than other companies of a similar size.

Of course, many customers comment on being involved in accidents with other vehicles insured by these respective companies, only to find that the claims are still under investigation months later.

Other customers claim that the companies try to lure you in with deceptively low prices only to raise them suddenly and without explanation.

Still, overall the reviews compared to the size and breadth of the companies and their representation in each state can still be said to be above average.

The best way to know beyond reading online reviews is to consult with your local agent as well as ask any friends, family or colleagues who are insured with each respective company what their experience has been.

What Have Other Customers Said About Each Company and Their Policies?

Customer complaints often impact other types of insurance beyond car insurance—such as homeowners insurance.

It’s important in this case to understand fully what your insurance does and does not cover, as well as what to do if you have been denied car insurance.

In some cases, customers have even had their plans, or the options they’ve included, suddenly canceled when they used them “too much”.

Or they discovered that their agent misinformed them—or didn’t inform them at all—of a certain rider or option they needed in order to get coverage in a specific incident.

Here again, every customer is different, which is why it’s so important to get a quote online and discuss your concerns with an agent where you can document the chat and print out the results.

It’s worth noting that despite the overwhelmingly poor reviews you may read online, every customer and every situation is different.

Even though a particular instance may seem skewed, you’re only reading the review on the part of the user who feels victimized—the insurance company may be simply following the rules and regulations laid out in the user’s policy.

Seeing only one side of the story can lead to a much greater imbalance as far as reviews and reputation are concerned.

So what’s the bottom line?

Which insurance company really gives you the best policies and services for your money?

Well, provided that you live in a state serviced by both American Family and Travelers, and you’re seriously considering choosing between the two, it may help to go ahead and get a quote for both.

With just some basic information, you can get a quote directly online that’s tailored to your specific needs, your vehicle(s), the drivers of those vehicles and much more.

In addition, by getting a quote online from both companies, you can easily comparison shop between the different features and any optional extras as well as any discounts you may be eligible for.

It’s worth noting that both companies pull ahead of each other for different reasons.

For example, American Family insurance offers a generational discount if your parents have been policyholders with them, and you’re striking out on your own and in need of affordable insurance.

Travelers, on the other hand, has earned its reputation for offering insurance on cutting-edge products and services like hybrid cars.

It’s also worth noting that you can save quite a bit on your policy by bundling things like your home and car insurance with the same company.

These, in addition to other discounts, can add up quickly in your favor, so it’s a smart idea to get an online quote and determine just how much savings you may be entitled to—it could surprise you!

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.