Cheapest Car Insurance in 2026 (Test)

This is a simple placeholder sentence created for testing purposes. This is a simple placeholder sentence created for testing purposes. This is a simple placeholder sentence created for testing purposes.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Certified Financial Planner

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel...

Joel Ohman

Updated September 2025

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe best for the cheapest car insurance are USAA, Geico, and State Farm, renowned for their exceptional value and comprehensive coverage. These providers can help you save money on car insurance while still offering robust protection.

These providers distinguish themselves with competitive pricing, robust local agent networks, and extensive discount opportunities, making them excellent choices for diverse drivers. Notably, their minimum coverage rates start at $22 per month.

Our Top 10 Company Picks: Cheapest Car Insurance

Company Rank Monthly

RatesUBI Best For Jump to Pros/Cons

#1 $22 30% Military Personnel USAA

#2 $30 25% Safe Drivers Geico

#3 $33 20% Local Agents State Farm

#4 $37 30% Industry Experience Travelers

#5 $39 $231/yr Budget Shoppers Progressive

#6 $43 15% Loyalty Rewards American Family

#8 $44 25% Vanishing Deductible Nationwide

#7 $53 30% Insurance Discounts Farmers

#9 $61 30% Comprehensive Coverage Allstate

#10 $68 30% Multiple Policies Liberty Mutual

Navigating auto insurance involves balancing cost and coverage quality to ensure protection without overpaying. Comparing top companies helps drivers secure the best deals and safeguard their vehicles against potential risks.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- USAA leads with competitive rates starting at $22/month

- Assess coverage needs to avoid overpaying or under-insuring

- Cheapest plans offer savings but require careful evaluation. a;sldfjk asdl;fjk adlakfjl;ksajdf woeurcj ldasjfl;akjdf adslfkjasdl;fj ;asldfj asdfljkaf

#1 – USAA: Top Overall Pick

Pros

- Targeted Discounts: According to our USAA insurance review, it offers some of the cheapest car insurance specifically for military families.

- Dedicated Military Support: Provides significant discounts that can lower the cost of premiums substantially.

- Exceptional Service: Known for exceptional customer service that helps military families access the cheapest car insurance options.

Cons

- Limited to Military Families: Only available to military personnel and their families, which limits accessibility to the cheapest car insurance for others.

- Higher Non-Military Rates: Non-military members might find it difficult to access the cheapest car insurance rates if not eligible for military discounts.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Extensive Discounts

Pros

- Wide Range of Discounts: Based on our auto insurance research, it offers a variety of discounts that lead to cheaper car insurance rates.

- Streamlined Cost-Saving Technology: Utilizes technology to provide cheaper car insurance through tools like online quote comparisons.

- Efficient Claims Processing: Known for fast claims processing, helping customers maintain low costs and avoid overpaying.

Cons

- Variable Customer Service: Customer service quality varies, which can impact the efficiency in managing the cheapest car insurance.

- Basic Coverage Options: Some customers may find coverage options too basic when seeking the cheapest car insurance that also meets all their needs.

#3 – State Farm: Best for Local Agents

Pros

- Local Agent Deal Support: Provides personalized service to help find the cheapest car insurance rates through local agents.

- Safe Driver Savings: Within our State Farm insurance review, we found it offers competitive discounts for safe drivers, potentially lowering premiums significantly.

- User-Friendly Mobile App: Facilitates management of policies and claims, supporting the ongoing affordability of car insurance.

Cons

- Variable Regional Rates: Rates may be higher in some regions, making it harder to find the cheapest car insurance.

- Reliance on Discounts: Without qualifying for discounts, customers might not get the cheapest car insurance rates available.

#4 – Travelers: Best for Financial Standing

Pros

- Financially-Driven Stability: Known for stability that can lead to more consistent, cheaper car insurance rates.

- Flexible Discount Options: In our Travelers auto insurance evaluation, we noted that it offers multiple discounts that help customers secure cheaper car insurance rates.

- Cost-Effective Customization: Allows extensive customization to tailor coverage and potentially lower costs.

Cons

- Comprehensive Premiums: More comprehensive options may come at a higher price, impacting affordability.

- Complexity of Choices: The range of options available can complicate the process of finding the cheapest car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Competitive Rates

Pros

- Flexible Rate Structures: Utilizes advanced pricing models to offer some of the cheapest car insurance rates.

- Wide Driver Eligibility: Explore our guide on everything you need to know about Progressive insurance, which offers competitive rates widely, including to those with less-than-perfect records.

- Discounts for Additional Savings: Provides multiple discounts, further lowering the cost of already cheap car insurance.

Cons

- Inconsistent Service Impact: Inconsistent customer service might impact the overall cost-effectiveness of insurance.

- Renewal Cost Fluctuations: Some customers report unexpected rate increases, potentially affecting the long-term affordability of their car insurance.

#6 – American Family: Best for Flexible Coverage

Pros

- Customized Cost Reduction: Discover our comparison of American Family insurance vs. Travelers, showing how it offers customizable plans that can be tailored to provide the cheapest car insurance rates.

- Loyalty-Driven Insurance Savings: Long-term customers can benefit from loyalty discounts that further reduce the cost of their car insurance.

- Broadly Affordable Acceptance: Welcomes a broad range of drivers, often offering more competitive, cheaper rates across various demographics.

Cons

- Variable Premiums Increase: The flexibility in coverage options might lead to higher premiums, impacting the overall affordability of the cheapest car insurance.

- Complex Policy Management: Managing highly customizable policies can be complex, potentially leading to difficulties in maintaining the cheapest rates.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Deductible Shrinks Costs: Offers a vanishing deductible that can reduce the cost of premiums over time, contributing to cheaper car insurance.

- Coverage Maximizes Efficiency: Provides a variety of coverage options that can be optimized for cost efficiency, leading to cheaper car insurance.

- Reliable Financial Stability: View our Nationwide insurance review to see how Nationwide’s financial strength ensures reliable and consistently affordable pricing.

Cons

- Initial Premiums High: Features like vanishing deductibles might come with initially higher costs, potentially making it less affordable compared to other cheapest car insurance options.

- Choices Impact Affordability: The broad range of options might confuse customers, potentially leading to less optimal decisions regarding the cheapest car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Customizable Policies

Pros

- Tailored Customization Options: Offers highly customizable policies that can be tailored specifically to reduce costs, facilitating the cheapest car insurance.

- Agents Secure Best: See our detailed analysis of Farmers vs. USAA, highlighting how local agents are available to help customers navigate options and secure the cheapest car insurance deals.

- Discounts Reduce Premiums: Customers who bundle various types of policies can achieve significant savings, securing cheaper car insurance rates.

Cons

- Complex Customization Costs: The depth of customization available can sometimes result in higher costs if not carefully managed to maintain the cheapest car insurance.

- Regional Rate Variability: Premiums can vary widely depending on the location, which may impact the affordability of the cheapest car insurance in certain areas.

#9 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Savings Options: Offers extensive coverage options that can be adjusted to maintain affordability while securing comprehensive protection.

- Broad Discount Savings: In our Allstate insurance review, we found that a variety of discounts are available that help reduce premiums, making it easier to find the cheapest car insurance.

- Robust Agent Network: The widespread agent network helps in negotiating the best, cheapest car insurance deals.

Cons

- Comprehensive Coverage Costs: While offering comprehensive options, these can come at a higher cost, potentially impacting the quest for the cheapest car insurance.

- Complex Policy Hinders: The variety and complexity of available policies can complicate achieving the cheapest car insurance rates.

#10 – Liberty Mutual: Best for Multi-Policy Discount

Pros

- Substantial Multi-Policy Savings: Significant savings are available when multiple policies are bundled, offering some of the cheapest car insurance rates.

- Flexible Budget Coverage: With our Liberty Mutual insurance review, you can find flexible coverage adjustments ensuring that customers can find options that suit their budget while remaining cost-effective.

- Extensive Discount Opportunities: A wide range of discount programs is available that can drastically reduce premiums, ensuring cheaper car insurance.

Cons

- Higher Base Rates: Initial rates might be higher, which could challenge customers looking for the cheapest car insurance without qualifying for multiple discounts.

- Complexity Overwhelms Discounts: While many discounts are offered, understanding and utilizing them effectively to maintain the cheapest car insurance can be complex for some customers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Test 1

This guide offers a concise comparison of monthly car insurance rates from top insurers, detailing both minimum and full coverage options. In our auto insurance visual guide, USAA stands out with the lowest rates, charging $22 for minimum and $59 for full coverage, making it highly appealing for budget-conscious consumers.

On the other end, Liberty Mutual lists the highest rates at $68 for minimum and $174 for full coverage, providing a broad spectrum of options for potential policyholders.

Car Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $110 | $145 | $150 | |

| $105 | $132 | $145 |

| $115 | $158 | $155 | |

| $95 | $120 | $135 | |

| $100 | $142 | $140 |

| $102 | $130 | $142 | |

| $98 | $138 | $138 | |

| $90 | $127 | $130 | |

| $112 | $150 | $152 | |

| $85 | $110 | $125 |

This guide serves as a crucial tool for individuals aiming to find the best balance between cost and coverage, ensuring they select the most suitable insurance plan according to their financial capacity and coverage needs.

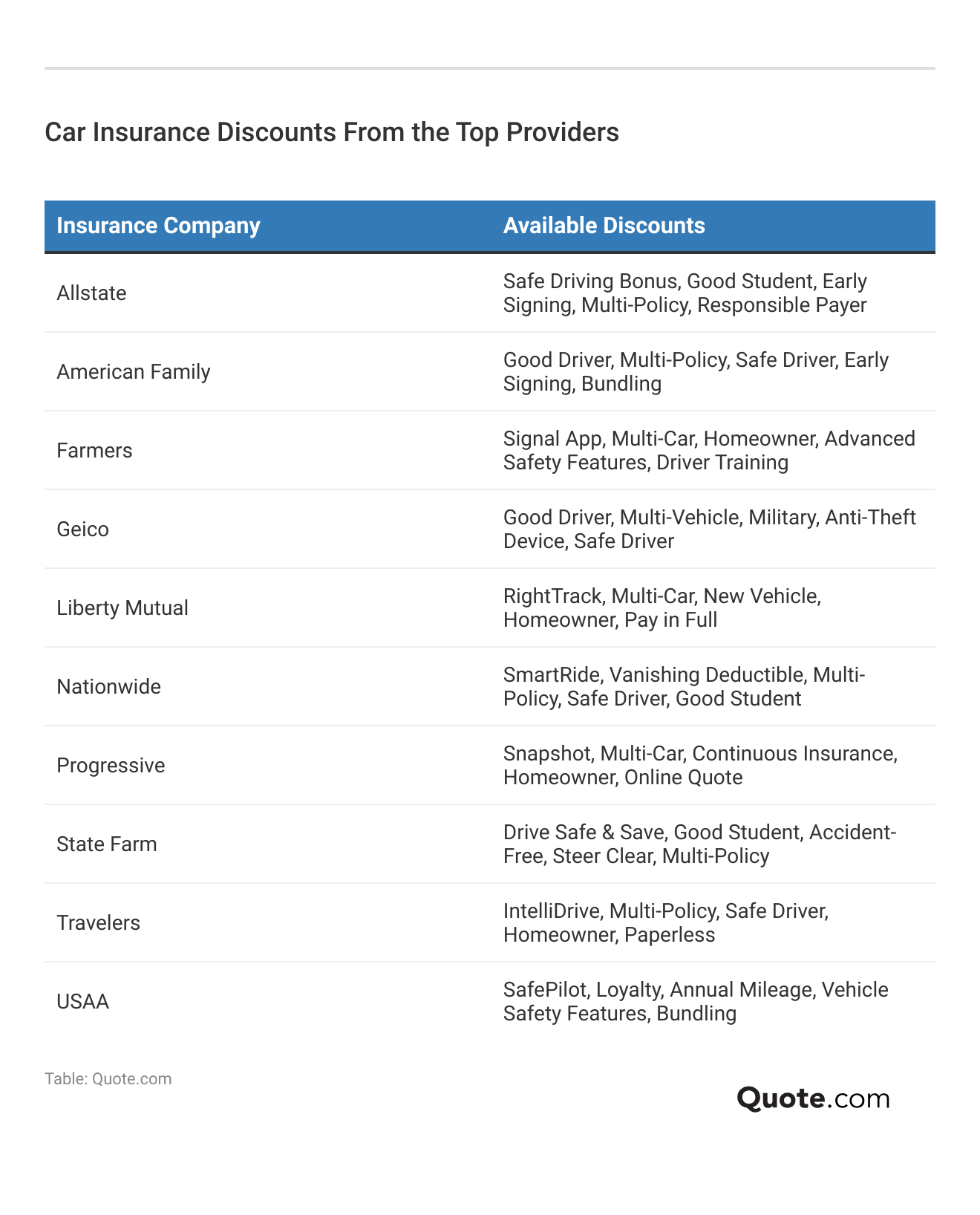

Discover car insurance discounts from premier insurers to optimize your savings. Top providers such as Allstate, American Family, and Farmers offer a mix of discounts including multi-policy, safe driving, and early signing. Liberty Mutual, Nationwide, and Progressive also provide savings through unique programs like RightTrack and SmartRide, and discounts for homeowners and safe drivers.

State Farm, Travelers, and USAA cater to diverse needs with discounts for good students, accident-free records, and military service. Evaluate these options to significantly reduce your car insurance premiums.

Test 2

Navigating the auto insurance landscape demands a nuanced approach to balancing cost efficiency with adequate coverage. Learn how to compare car insurance companies to make optimal selections in the insurance market, characterized by their appealing price points, substantial discounts, and extensive agent networks.

By prioritizing insurers that offer tailored services and a range of discount opportunities, drivers can find policies that align with their financial constraints without compromising on coverage.Scott Young Managing Editor

The ability to compare various providers helps ensure that one secures the best possible deal, effectively shielding against diverse risks without overpaying. This approach is crucial for drivers to achieve a practical, cost-effective insurance strategy that caters comprehensively to their unique driving needs.

Prudent Pathways: Unlocking Ultra-Affordable Car Insurance

Explore the art of securing cost-effective car insurance with our guide on smart tips and strategies. Choosing the right insurer involves more than just comparing price tags; it requires understanding the full value of what each provider offers. Top insurers are distinguished not only by their competitive rates but also by catering to specific demographics with additional perks and extensive discount opportunities.

data-media-max-width=”560″>

With $280 million more returned, totaling $800 million, auto policyholders see an additional 20% credit on premiums extended to a third month. https://t.co/nlUBCuEIIw pic.twitter.com/OL9Bnouxat

— USAA (@USAA) May 1, 2020

Their strong local agent networks enhance personalized service, making them popular choices among drivers. This guide stresses the importance of comparing insurance quotes and utilizing available discounts to lower premiums without sacrificing coverage. It also addresses is it bad to cancel car insurance, providing insights on the potential consequences and considerations involved.

From bundling policies to earning rewards for safe driving, there are numerous ways to reduce costs. Whether you’re a newcomer to car insurance or a seasoned driver considering a change, our strategies are designed to help you navigate the insurance landscape effectively, ensuring you secure the best deals while maintaining comprehensive protection for your vehicle.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigate the Savings: Your Definitive Guide to Affordable Car Insurance

This essential guide delves into securing economical car insurance, featuring top insurers known for their exceptional value and comprehensive coverage.

These companies stand out not only for their affordability but also for their robust local agent networks and extensive discount options, making them excellent choices for a wide range of drivers. This guide helps you compare quotes, understand coverage essentials, and discover how to maximize your insurance savings.

Whether you’re looking to minimize premiums or maximize protection, our detailed analysis can help you find the best insurance strategy, especially if you cannot afford auto insurance.

Final Insights on Choosing Affordable Car Insurance

Securing the right car insurance requires careful consideration of various factors including price, coverage levels, and available discounts. By comparing the offerings from top insurers, consumers can find plans that not only fit their budget but also provide robust protection, helping them save more money on car insurance.

This balance is crucial in ensuring that one’s insurance investment is both cost-effective and comprehensive. Ultimately, choosing the right car insurance is about understanding your needs and ensuring you have adequate coverage to protect against potential risks while driving.

Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code below to begin.

Frequently Asked Questions

Where can I find affordable auto insurance?

You can find affordable auto insurance through comparison websites, local agents, and directly from insurers that offer affordable auto insurance plans and affordable auto insurance quotes.

For more information, check out our comprehensive resource titled “Ultimate Guide on the Best Time to Buy a New Car” for more details.

Can I get affordable auto insurance online?

Yes, many insurers provide affordable auto insurance online with affordable car insurance free quotes available on their websites.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

What are the benefits of affordable car insurance?

Affordable car insurance offers comprehensive coverage at lower costs, ensuring you get affordable comprehensive car insurance without sacrificing protection.

To learn more, delve into our comprehensive resource titled “Hacks to Save More Money on Car Insurance” for further insights.

How can I obtain affordable car insurance quotes?

You can obtain affordable car insurance quotes by visiting insurance comparison websites or requesting an affordable insurance quote directly from providers.

What is the difference between affordable car insurance and affordable cheap car insurance?

Affordable car insurance typically offers a balance of cost and coverage, while affordable cheap car insurance focuses primarily on the lowest price, which may offer limited coverage.

Which are some of the most affordable car insurance companies?

Companies like USAA, Geico, and State Farm are known for providing affordable car insurance plans and affordable car insurance quotes.

For a thorough understanding, refer to our detailed analysis titled “State Farm vs Farmers, Geico, Progressive, Allstate: The Best?” for more information.

Around how much is car insurance for a new driver?

The cost varies, but new drivers can often find affordable low cost auto insurance by shopping around and comparing auto insurance cheapest rates from different companies.

Is it possible to get affordable online car insurance quickly?

Yes, many insurers offer affordable online car insurance with immediate affordable insurance quotes, making it easy to secure coverage fast.

Find cheap car insurance quotes by entering your ZIP code below.

How do I get affordable vehicle insurance with anti-collision coverage?

Look for affordable vehicle insurance plans that include anti-collision locker quotes to ensure your policy covers collision damages.

To expand your knowledge, refer to our comprehensive handbook titled “Traffic Collision Reconstruction” for further details.

How do I compare auto insurance cheapest rates effectively?

Use online tools to compare affordable auto insurance quotes and affordable car insurance plans from multiple insurers to find the best rates and coverage for your needs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.