TrustedID Review

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Certified Financial Planner

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel...

Joel Ohman

Updated December 2023

Let’s be real.

No one, and I mean no one, wants to think about criminals using their personal information.

But, today, it’s a very real possibility.

Maybe even a reality.

That’s why credit and identity-theft monitoring services exist.

Services such as those offered by TrustedID.

What exactly are these services?

Well, credit monitoring alerts you to suspicious activity that shows up on your credit report.

And when someone uses your personal information, identity-theft monitoring alerts you.

I mean, who wouldn’t want to know if a fraudster was applying for credit in their name?

Or using their Social Security number?

But hold on.

Before you decide to sign up, you need to know all of the facts.

And that’s why I’m here—to tell you everything you need to know about TrustedID.

TrustedID Products and Services

The first thing you need to know is that TrustedID Premier through Equifax is no longer available

TrustedID is an US-based, American identity protection company.

It was founded back in 2004.

Then, in 2013, Equifax acquired the company.

It might seem like companies in this market sector are focused on preventing identity theft and other types of fraud.

Unfortunately, that’s not the case.

The truth is that no service can give you an airtight guarantee that your personal information won’t be comprised at some point.

Do you remember LifeLock’s dare back in 2008?

The CEO, Todd Davis, posted his SIN number and said that LifeLock guaranteed his identity could not be stolen.

Over the next two years, it was stolen 13 times!

Nothing is foolproof.

And, unfortunately, Davis had to learn that the hard way.

So, companies like TrustedID know they cannot guarantee the prevention of fraud.

Instead, they focus on helping you become aware of it as soon as possible.

This way you can act to stop it quickly, and minimize the damage.

The Equifax Data Breach

Just last year, Equifax, the parent company of TrustedID, experienced its own data breach.

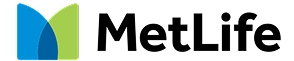

According to the company, hackers stole the personal information of over 146 million US consumers between May–July 2017.

Here’s a chart of the type of data stolen, and the number of consumers affected:

Following the data breach, Equifax gave consumers the option of signing up for TrustedID Premier, for free.

But enrollment for this free service closed on January 31, 2018.

So it’s no longer available to new users.

If you’re interested in what came with the offer, here it is:

Users got copies of their credit report from Equifax and the option to lock the report.

Also, credit monitoring was provided for credit reports from all three bureaus: Equifax, Experian, and TransUnion.

Online scanning for unauthorized use of your Social Security number was included.

As well as identity theft insurance.

Just to see what would happen, I went to the TrustedID website to sign up.

I entered my last name and the last six digits of my Social Security number.

Instead of allowing me to register, the site redirected me to a screen with a clickable orange button labeled “What Can I Do?”

So, I clicked to find out. And here’s what I saw:

I then called the number on the TrustedID website, and a representative who answered said I had just called Equifax.

So I questioned her about TrustedID offerings and found out something interesting.

Equifax is not offering TrustedID products directly at this time

The rep also said that the future of the TrustedID Premier is uncertain.

I then asked about enrolling in another TrustedID service.

The rep told me that she could tell me about Equifax’s programs that were comparable.

I asked, “So, I can’t enroll in TrustedID through you?”

The rep told me that if I wanted to enroll in TrustedID, I would need to contact one of Equifax’s partners.

Such as Comerica or H&R Block.

So we’ll take a look at each of those offerings to help you decide if TrustedID is right for you.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How does TrustedID work?

H&R Block Tax Identity Shield, which is partnered with Trusted ID and Equifax, is designed to protect you against identity theft

In case you didn’t know, there are people out there who will file a tax return in your name.

They do this in an attempt to claim any refund you might be due.

This practice is known as tax identity theft.

To combat this shady practice, H&R Block—along with TrustedID—offers H&R Block Tax Identity Shield.

Here’s what you’ll get with this service:

An IRS identity-protection PIN, tax eFile notification alerts, and access to live identity-theft specialists.

You’ll also get a pre-tax season identity theft scan and identity restoration services.

To sign up for H&R Block Tax Identity Shield, visit an H&R Block Tax Preparation location.

You can have your taxes done and sign up for the protection program.

This does not monitor your credit report or any identity-theft not related to taxes.

The cost for the Tax Identity Shield service is $30.00 annually.

Want to include other people?

It’s an additional $15.00 for each additional dependent.

This price does not include the fees for getting your taxes processed.

What About Comerica?

Comerica IDMonitor offers identity theft protection and credit monitoring for individuals and families

Comerica IDMonitor has three individual plan offerings and three family plan offerings.

We’ll go through each of them so that you can see which one might be right for you.

Here’s what Comerica IDMonitor’s individual plans have to offer you

The Standard plan costs $9.99 per month.

It offers an Equifax credit report and score each quarter.

Just so you know, the credit score you’re given is based on the Equifax credit scoring model.

Which is the Vantage model. Not the FICO model.

What’s the difference?

Vantage is newer, and supposedly better for people with thin or limited credit history.

However, the factors and weighting used by both are very similar, so you shouldn’t see a huge swing between the two.

That being said, most lenders still use the FICO model.

Now, back to the plans:

With the standard plan, you’ll get credit monitoring for the three bureaus.

As well as information on credit score factors, and score simulators.

You’ll also get a fraud alert reminder and $25,000 in identity theft insurance.

The Premium plan is the next step up.

It costs $12.00 per month.

This plan includes everything the Standard plan offers.

As well as monitoring for your Social Security number, credit cards, and bank account.

Plus, you’ll get lost wallet protection and $1,000,000 in identity theft insurance.

The Elite plan is the final plan offering for individuals.

The Elite plan offers all of the features of the Premium plan plus these benefits:

Equifax credit score tracker, identity threat score, and name and address monitoring.

And here’s what Comerica’s IDMonitor family plans have to offer

The Standard family plan is the cheapest at $14.99 per month.

With a family plan, you can register a maximum of two adults and up to four minor children.

The Standard plan offers an Equifax credit report and score each quarter.

It also offers credit monitoring for the three bureaus and credit score factors and simulators.

Plus, you’ll get a fraud alert reminder and $25,000 in identity theft insurance.

The Premium family plan is the next one in the lineup.

It will cost you $19.99 per month.

This plan offers everything that the Standard plan does.

It also offers monitoring for your Social Security number, credit card, and bank account.

You’ll also get lost wallet protection, and $1,000,000 in identity theft insurance.

The Elite family plan is the top tier family offering is.

It comes in at $24.99 per month.

The Elite plan offers everything the Premium plan does.

You’ll also get Equifax credit score tracker, identity threat score, and name and address monitoring.

Take a look at the family plan offerings, so you can compare:

With both types of Comerica IDMonitor plans—individual and family—you can cancel at any time.

But don’t expect a partial month’s refund; it’s not part of the deal.

FAQ

Get the answers you need to frequently asked questions about TrustedID

Q: Will TrustedID sell my information to a third party?

A: The company might share information related to your transactions with third parties and affiliates.

The information would include registration details or whether you actively use a product.

Additionally, TrustedID might share information with non-affiliates to the extent permitted by law.

Q: Why does TrustedID monitor the three credit bureaus?

A: TrustedID monitors all three credit bureaus.

This is because each credit bureau might have different information about your credit.

Not all lenders report to all three bureaus.

Q: What happens when TrustedID has an alert about someone trying to steal my identity?

A: You will receive either an email or a text message alert from TrustedID, depending on your preferences.

You will then be prompted you to log in and verify whether the alert is something to be concerned about or not.

Q: What steps do I need to take once I have been alerted about possible fraud?

A: You’ll need to log into your TrustedID account and check the alerts to see if they are valid.

Equifax cautions that many alerts are related to routine matters you already know about.

If not, contact your bank, creditor, or lender to initiate the appropriate actions.

You’ll also need to call Trusted ID.

Q: Are the authorities notified about the fraud being committed?

A: No. It’s your responsibility to contact the proper authorities to notify them and file a report.

Q: I have frozen all my credit cards and Social Security number. When should I consider removing the freeze?

A: Temporarily remove the freeze when planning to apply for credit or a loan.

Q: Who are the specialists that work for TrustedID? How are they accredited?

A: It depends on which TrustedID product you use.

Accreditation information is not available.

But TrustedID specialists are trained to answer your questions and take action when needed.

Some people report that they’ve had poor customer service experiences, however.

Q: Since Equifax acquired TrustedID, were the customers of TrustedID part of the huge privacy breach?

A: It’s never been confirmed.

But personal information, credit card numbers, and credit dispute documents were accessed.

So, maybe so.

Q: What is the difference between a credit freeze and credit monitoring?

A: A credit freeze puts a lock on your credit report.

A freeze blocks the release of your credit report and score until you lift it.

A freeze can also stop the use of all your sources of credit, such as your credit cards.

Credit monitoring only alerts you if someone tries to access your credit information.

Q: I suspect fraud. Can I still contact TrustedID and will it help me investigate?

A: The free TrustedID Premier program provided to consumers by Equifax is no longer open for enrollment.

If you have another TrustedID product, call the customer service number you were given for assistance.

Q: What technology does TrustedID use to determine that the alert is someone else and not me?

A: TrustedID alerts you when any changes occur to your credit report.

Even changes you initiate.

Q: Can I cancel my services at any time?

A: Yes.

Q: How user-friendly is the app? And does it work for all operating systems (iOS, Android, extra)

A: TrustedID does not currently have an app.

Q: Does TrustedID have promotional codes I can use to purchase their package?

A: No. Not at this time.

Q: How does TrustedID restore my reputation and credit?

A: TrustedID does not claim to restore your reputation or credit.

Q: If I have not received an alert but think I have been a victim of identity theft, should I call TrustedID to confirm with them?

A: Yes.

Q: Does checking my credit history/score via TrustedID impact my score?

A: No.

Q: How do I know I need protection?

A: Protection is a wise idea if your personal information was compromised.

And in the future, someone could attempt to compromise your information.

Q: How does TrustedID help with stopping unsolicited credit checks on me?

A: A credit report freeze will stop unsolicited credit checks from companies you do not already have a relationship with.

Q: Is TrustedID part of Facebook privacy monitor? If so, does it mean that it has given my information to Facebook without my consent or knowledge?

A: No, TrustedID is not part of Facebook privacy monitor.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Advantages

TrustedID offers family plans for up to six people

TrustedID family plans are available for up to six people in a household: two adults and four minors.

So you could choose to cover any people in your home, including an elderly family member.

They would simply count as one of the two adults allowed on your plan.

If you already have two adults listed, you’d have to opt for an individual plan for the third adult.

The ability to choose between individual and family plans is a benefit for some.

There’s a plan available, whether you just need protection for yourself, or for everyone in your family.

The prices are reasonable enough, too.

TrustedID also offers up to $1 million in identity theft insurance.

And the company offers monitoring of your Social Security number in case someone tries to use it.

Another advantage of TrustedID is that it offers monitoring with all three credit bureaus, unlike some other services.

For example, Credit Karma only monitors TransUnion and Equifax, but not Experian.

Disadvantages

Overall, better programs exist for credit monitoring and identity protection

One of the disadvantages is that the standard level of TrustedID service doesn’t monitor public record or criminal data.

It also does not alert you to the use of financially sensitive information.

Like your credit card or bank account information.

Plus, there are free ways that you can protect yourself without having to sign up for TrustedID.

For example, you can easily monitor your credit card and bank statements on your own.

For free.

You can also implement secure practices, like using reliable software and services that protects what’s important to you, including your signature. For instance, with services like Signaturely, your signature is as legally binding as signing documents by hand and it’s faster. This makes signing paperwork easier for all your clients and employees.

You can also get a free copy of each of your credit reports, once per year, through annualcreditreport.com.

You can also call each of three credit bureaus and request a free fraud alert.

Or, if you’re the victim of identity theft, request a free credit freeze on your credit files.

Here are some other examples of ways you can protect yourself from fraud, for free:

- Always use the highest level of password protection offered on your accounts.

- Avoiding using the same password for everything.

- Avoid clicking on links sent to you by email.

- Shred documents with personal information.

- Refuse to give personal information over the phone.

Yes, it’s true that TrustedID monitors for the use of your Social Security number.

But it doesn’t monitor credit card, bank account, email addresses, or health insurance information.

Some other companies do.

TrustedID also does not offer any assistance toward fraud reporting.

And you’ll get no help closing unauthorized accounts.

Although TrustedID offerings do afford some protection, you can get a bigger bang for your buck with a different plan provider.

The Bottom Line

Look elsewhere because there are better programs out there

TrustedID is a real product, but it’s not a product I can recommend.

First, the free option of TrustedID is no longer open for enrollment.

Plus the basic offerings that are out there are not as robust as other offerings you can sign up for.

Even if you did find that a TrustedID higher-level plan would meet your needs, you haven’t heard everything I have to tell you, yet.

Other issues of concern are the system’s reliability and consumer reviews.

When I checked out reviews on ConsumerAffairs.com., a lot are from unhappy consumers.

Some complaints are about false alerts.

These caused a lot of wasted time for people to find out there wasn’t really an issue.

Others focused on not being able to use the system’s features.

Like a clickable link wouldn’t work, or the website was down.

And some consumers even complained about communicating with customer service reps.

Claiming they were either clueless, poor second-language English speakers, or both.

Other complaints come from consumers who had trouble going from the automated system to a live person.

And some were transferred multiple times by live agents without ever connecting with the right person.

Overall, many people find TrustedID to be an unsatisfactory experience.

What do you think?

Do you have any experience with TrustedID?

Share your thoughts in the comments below!

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.