Best Auto Insurance for DoorDash Drivers in 2026

Erie, USAA, and State Farm have the best auto insurance for DoorDash drivers, with rates starting at $126 per month. These providers are great for usage-based savings and offer specialized rideshare insurance for food delivery. Get a quote today to find the cheapest insurance for delivery drivers.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Michael Vereecke

Updated January 2026

The best auto insurance for DoorDash drivers comes from Erie, USAA, and State Farm, with rates starting at just $126 per month. Erie stands out for its high claims satisfaction score, which shows drivers are satisfied with their coverage.

- DoorDash drivers must carry a rideshare or commercial insurance policy

- A personal car insurance policy won’t cover you while delivering for DoorDash

- Erie excels in claims handling, and USAA is best for military rideshare drivers

Meanwhile, USAA is great for military families looking for low rates, strong coverage, and car insurance discounts. Its user-friendly mobile app also makes it easy to manage your policy, file claims, and pay premiums.

Our Top 10 Company Picks: Best Auto Insurance for DoorDash Drivers| Company | Rank | A.M. Best | Safe Driver Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | 20% | Cheapest Rate | State Farm | |

| #2 | A | 20% | Local Agents | Farmers | |

| #3 | A | 20% | Customizable Policies | Liberty Mutual |

| #4 | A+ | 18% | Add-on Coverages | Allstate | |

| #5 | A++ | 17% | Accident Forgiveness | Travelers | |

| #6 | A++ | 15% | Delivery Driver Coverage | Geico | |

| #7 | A+ | 12% | Usage Discount | Nationwide |

| #8 | A | 10% | Online App | AAA |

| #9 | A++ | 10% | Military Savings | USAA | |

| #10 | A+ | 10% | Innovative Tools | Progressive |

This guide compares top companies to help drivers find the right coverage at the lowest price. Find the cheapest car insurance for DoorDash drivers by entering your ZIP code and comparing quotes in just minutes.

Cost of Car Insurance for DoorDash Delivery Drivers

Erie has the best car insurance for DoorDash drivers because it offers a good mix of low prices and competitive discounts. On top of affordable insurance that covers all phases of DoorDash delivery, Erie also offers several ways to save through discounts for bundling, safe driving, and owning a home.

Auto Insurance for DoorDash Drivers: Monthly Cost by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $135 | $195 |

| $148 | $214 | |

| $143 | $210 | |

| $137 | $198 | |

| $139 | $222 |

| $138 | $201 |

| $156 | $234 | |

| $126 | $192 | |

| $151 | $226 | |

| $130 | $188 |

State Farm has the cheapest rates for DoorDash drivers. USAA is the second cheapest at $130 monthly, but it’s only for military families, so it won’t work for most DoorDash drivers.

Driving record will also affect your DoorDash car insurance rates. Insurers look at your history of accidents and violations to determine your risk level, which impacts the cost of your coverage.

[table “1463” not found /]In addition, age also significantly impacts your car insurance rates. Young drivers generally pay higher premiums because insurance companies see them as higher risk due to less driving experience.

Meanwhile, older drivers and seniors qualify for lower rates if they have a good driving record.

While no one provider has the lowest price, they offer real value by making it easier for DoorDash drivers to stay protected and on the road.

Read More: Ultimate Guide on the Best Time to Buy a New Car

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Personal Auto Insurance Works With Delivery Driving

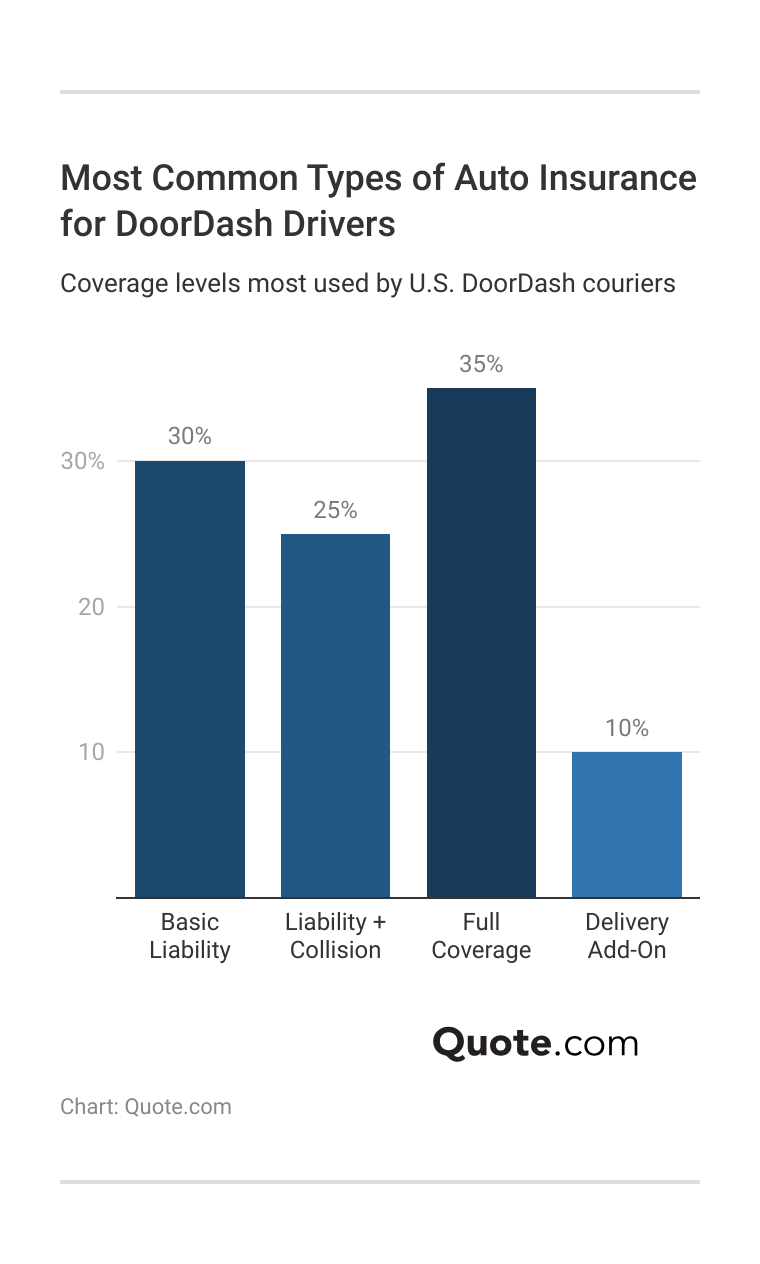

Most personal car insurance policies won’t cover delivery driving for DoorDash, Uber Eats, or similar services since food delivery is considered commercial use and carries a higher risk of accidents.

To get covered, delivery drivers need a rideshare insurance add-on, which extends a personal policy to cover gaps while delivering for DoorDash. In some cases, commercial insurance may be a good option if DoorDash is your primary source of income.

Many delivery drivers are surprised to find their insurance not covering DoorDash accident claims because they're considered commercial use.

Michelle Robbins Licensed Insurance Agent

Your DoorDash insurance claim could get denied after an accident if you use your car to deliver for the service without rideshare coverage, leaving you responsible for all repair and medical costs.

Comparing auto insurance companies is the best way to find the protection you need for food deliveries without overpaying. Use our free quote tool to compare rates from top insurers in just 2 minutes or less.

Insurance Coverages Every DoorDash Driver Needs

If you drive for DoorDash, a standard car insurance policy might not cover you adequately while you’re working.

Most personal insurance plans don’t protect you during deliveries, which is why it’s important to understand the types of coverage that can keep you fully protected on the road.

- Liability Coverage: Covers damage or injuries you cause to other people or vehicles while driving.

- Collision and Comprehensive Coverage: Helps pay for damage to your car from accidents, theft, weather, or hitting an animal.

- Uninsured/Underinsured Motorist: Protects you if another driver doesn’t have insurance or enough to cover the damage.

- Medical Payments or PIP: Helps pay for your medical bills if you’re hurt in an accident, no matter who was at fault.

- Rideshare or Delivery Coverage: Adds extra protection when DoorDash’s limited insurance doesn’t apply, like when waiting for orders.

In addition, rideshare or delivery coverage adds protection when DoorDash’s limited insurance doesn’t apply, like when you’re waiting for an order.

Rideshare coverage is typically an affordable add-on, while commercial insurance may be needed for full-time drivers.

You can check your insurance coverage in the DoorDash Dasher app or by contacting your personal insurer.

If you’re using your personal vehicle for deliveries, rideshare, or commercial insurance is essential since most personal policies exclude work-related driving.

Without it, your insurer could deny claims, leaving you responsible for repairs, medical bills, or liability costs.

DoorDash drivers should ask their insurer if delivery use is fully covered to avoid surprise claim denials.

Adding the right coverage to your policy helps protect your car, your income, and your ability to keep delivering.

DoorDash only covers certain parts of your shift, so adding delivery driver insurance to your own policy is the best way to avoid gaps.

Read More: Traffic Collision Reconstruction

Proven Tips to Cut Your DoorDash Car Insurance Rates

You can get the best auto insurance for delivery drivers by picking companies that offer more specialized DoorDash car insurance discounts.

State Farm, Farmers, and Liberty Mutual give drivers several ways to lower their monthly rates. State Farm offers discounts to good students and safe drivers.

| Company | Multi-Car | Bundling | Good Student | Loyalty | Safe Driver |

|---|---|---|---|---|---|

| 25% | 15% | 14% | 12% | 10% |

| 25% | 25% | 25% | 15% | 18% | |

| 20% | 20% | 15% | 12% | 20% | |

| 25% | 25% | 15% | 10% | 15% | |

| 25% | 25% | 12% | 10% | 20% |

| 20% | 20% | 18% | 8% | 12% |

| 12% | 10% | 10% | 13% | 10% | |

| 20% | 17% | 35% | 6% | 20% | |

| 8% | 13% | 8% | 9% | 17% | |

| 10% | 10% | 10% | 11% | 10% |

The top three DoorDash auto insurance companies give safe drivers the biggest DoorDash driver discounts of up to 20%.

You can also lower premiums through usage-based programs, like State Farm Drive Safe and Save and Liberty Mutual RightTrack.

Nationwide and Progressive are also strong choices if you’re a safe driver, since both companies also offer programs that track your driving habits and reward you with lower prices.

AAA gives discounts for accident-free driving and safe driving, and it offers discounts to young drivers who complete driving programs.

Even if a company’s starting rate is a little higher, these discounts can help bring the price down and give DoorDash drivers better value overall.

Read More: 26 Hacks to Save More Money on Car Insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top 10 Car Insurance Companies for DoorDash Drivers

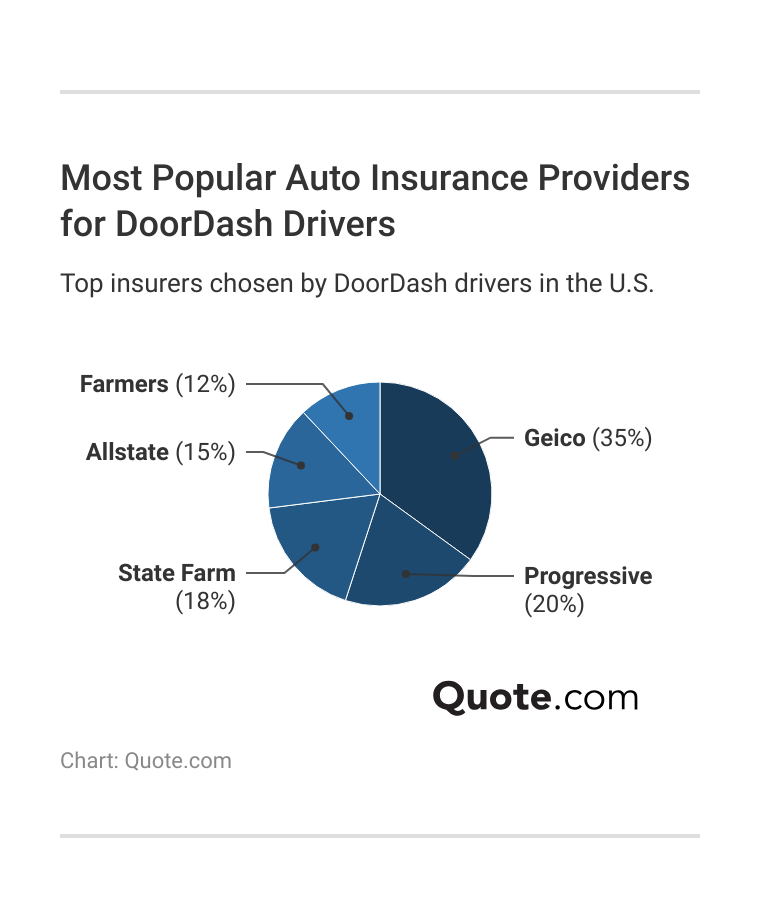

Erie, USAA, and State Farm have the best car insurance for DoorDash delivery drivers, starting at just $126 per month for liability insurance coverage.

Meanwhile, Farmers is a great option if you’re looking for local agent support for your rideshare insurance policy.

Comparing coverage options, rates, and discounts from top-rated providers is the best way to find the most affordable and reliable DoorDash driver insurance for your needs.

See exactly why we chose these companies below.

#1 – Erie: Top Pick Overall

Pros

- Claims Satisfaction: Erie has the highest score for customer satisfaction of all the providers in our ranking.

- Add-Ons: Rideshare drivers enjoy various add-on options with Erie, such as roadside assistance and equipment breakdown coverage.

- Good Financial Standing: Erie has an A+ rating from A.M. Best, indicating you can trust them to pay out claims.

Cons

- No BBB Accreditation: Erie doesn’t have BBB accreditation.

- Not Available Nationwide: Erie is only available in 12 states.

#2 – USAA: Best for Military Drivers

Pros

- Military Savings: DoorDash drivers in the military get exclusive low rates and extra discounts.

- Low Rates: Minimum coverage starts at $130 per month, cheaper than most other options for eligible DoorDash drivers.

- Great Customer Service: USAA is known for fast claim payouts and friendly service, helping DoorDash drivers after accidents. Learn more in our USAA review.

Cons

- Not for Everyone: Only military families can get a policy, so some DoorDash drivers won’t qualify.

- Limited Rideshare Coverage: USAA car insurance for DoorDash drivers doesn’t cover all phases of rideshare or delivery driving.

#3 – State Farm: Best for Big Discounts

Pros

- Cheapest Minimum Rate: State Farm rideshare insurance is the most affordable for delivery drivers at just $126 per month for minimum coverage.

- Big Discount Options: State Farm DoorDash insurance is eligible for multiple discounts, including safe driver, bundling, and multi-car.

- Helpful Local Support: According to our State Farm auto insurance review, this company’s local agents can help DoorDash drivers quickly adjust policies or file claims.

Cons

- Limited Digital Tools: The app is basic, and some DoorDash drivers may find it hard to manage everything online.

- Discounts Can Vary: Some discounts may not apply if the DoorDash driver doesn’t bundle or own a home.

#4 – AAA: Best Online App

Pros

- Easy-to-Use App: AAA’s mobile app lets DoorDash drivers file claims, pay bills, and get roadside help in minutes.

- Helpful Extras: As per our AAA review, it has plans that come with perks like towing and battery jump-starts, useful for busy DoorDash drivers.

- Strong Coverage Options: DoorDash drivers can get good protection starting at $135 per month for minimum coverage.

Cons

- Must Buy Membership: DoorDash drivers have to pay for an AAA membership before buying a policy.

- Limited Availability: AAA auto insurance for DoorDash drivers is not available in every state.

#5 – Farmers: Best Local Agent Support

Pros

- One-on-One Help: Farmers offers local agents who can help DoorDash delivery drivers pick the right coverage or file a claim.

- Multiple Discounts: DoorDash drivers can save with good driver, bundling, and defensive driving course discounts.

- Great Claims Support: Customer satisfaction is high with Farmers insurance claims for DoorDash drivers. Browse our guide on everything you need to know about Farmers Insurance.

Cons

- Higher Cost Than Others: Farmers isn’t the cheapest — DoorDash drivers may find better value elsewhere.

- Limited Tech Tools: The mobile app doesn’t offer as many features for managing policies on the go as other DoorDash car insurance companies.

#6 – Geico: Best Delivery Driver Coverage

Pros

- Delivery Driver Insurance: Geico’s delivery driver insurance covers you before, during, and after active orders, filling gaps left by personal policies.

- Online Tools: DoorDash drivers can quote, buy, and manage their policies from a phone or computer. Read our guide to learn everything you need to know about Geico.

- Competitive Price: Geico DoorDash insurance starts at $137 per month for minimum coverage, lower than most big-name insurers.

Cons

- Hard to Get Help in Person: Most support is online or by phone—may not work well for DoorDash drivers who prefer local help.

- Fewer Specialized Perks: Geico lacks benefits like accident forgiveness unless drivers pay extra.

#7 – Allstate: Best Add-on Coverages

Pros

- Lots of Add-Ons: According to our Allstate auto insurance review, DoorDash drivers can choose extras like accident forgiveness, new car replacement, and roadside help.

- Good Discounts: Discounts for full payment, safe driving, and bundling help DoorDash drivers cut costs.

- Affordable Entry Plan: Minimum coverage for DoorDash drivers begins at $148 per month.

Cons

- Higher Base Rates: Even with discounts, Allstate’s pricing is still above average for most DoorDash drivers.

- Limited Savings for Low Mileage: DoorDash drivers who don’t drive a lot won’t see special savings here.

#8 – Safeco: Best for Cheap Rates

Pros

Cons

#9 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: First accidents won’t raise rates, which helps DoorDash drivers keep coverage affordable.

- Solid Bundling Options: As per our Travelers auto insurance, DoorDash drivers can save by combining auto and home or renters insurance.

- Industry Experience: As one of the most established names in insurance, Travelers is a reliable insurer for DoorDash drivers with an A++ financial rating.

Cons

- Expensive for Basic Plans: $151 a month is more than most competitors for minimum coverage for DoorDash drivers.

- App Features Are Basic: The app lacks advanced claim and tracking tools for DoorDash drivers.

#10 – Progressive: Best for Budgeting Tools

Pros

- Innovative Tools: The Progressive “Name Your Price” tool lets DoorDash drivers pick just the coverage they need to drive a personal vehicle for work.

- Usage-Based Programs: DoorDash drivers can try usage-based tools like Snapshot for possible discounts. Gain more insights on everything you need to know about Progressive Insurance.

- Strong Online Support: Quotes, claims, and policy changes can be handled fast through Progressive’s website or app.

Cons

- Highest Entry Price: Progressive DoorDash insurance starts at $156 per month, the highest minimum coverage rate for DoorDash drivers on this list.

- Service Can Vary: Some DoorDash drivers report slow claim responses and poor follow-up.

Find the Best Auto Insurance for DoorDash Drivers Today

The best auto insurance for DoorDash drivers combines low prices with the right delivery coverage and helpful features. Discounts make a big difference for DoorDash drivers, and many companies offer savings for safe driving, bundling, and more.

Choosing a policy that fits your driving habits and budget can help you stay protected while keeping costs down (Read More: What to Do If You Can’t Afford Your Auto Insurance). Comparing top providers is the easiest way to get the car insurance you need to drive for DoorDash without overpaying. Enter your ZIP code to find where you can get a better deal.

Frequently Asked Questions

What is the best insurance for delivery drivers?

Erie, USAA, and State Farm are the top picks for delivery driver insurance due to strong coverage options, flexible policies, and helpful discounts. Get fast and cheap auto insurance coverage today with our quote comparison tool.

Does DoorDash offer insurance for drivers?

DoorDash offers $1 million in liability coverage for its delivery drivers while actively on a delivery. However, you’ll still need a personal car insurance policyfor complete protection.

Does DoorDash verify auto insurance?

Yes, DoorDash insurance requirements include carrying valid car insurance, meaning you may be asked for proof during the signup process or at any time after.

Can I use my personal car insurance for DoorDash?

No, you need a policy that covers delivery driving, as standard car insurance typically does not cover accidents that occur while you’re working for DoorDash.

What kind of insurance do I need to be a DoorDash driver?

You must carry rideshare or commercial insurance coverage to work for DoorDash since personal policies don’t cover commercial use.

Do insurance rates go up if you DoorDash?

Yes, your rates may go up if your insurer adds business-use coverage to your policy to reflect the increased driving risk.

What is a good option for insurance for an independent delivery driver?

Look for companies that offer delivery add-ons or hybrid policies, such as Geico, State Farm, Progressive, and Liberty Mutual.

Read More: Cheapest Car Insurance

How expensive is DoorDash insurance?

Rates for DoorDash drivers vary by provider, but minimum coverage starts around $126 per month with State Farm and goes higher with other companies.

Does Progressive cover DoorDash?

Progressive offers delivery driver insurance through its rideshare or business-use add-on, which drivers must request and add to their policy.

Does State Farm cover DoorDash drivers?

Yes, but you must tell State Farm you deliver for DoorDash so they can add the right coverage; regular personal insurance alone may not cover accidents during deliveries.

Check out the 17 best tips to pay less for car insurance to save now.

Does Geico cover DoorDash drivers?

Can I use a rental car for DoorDash?

Can I write off my car insurance if I DoorDash?

What driving record does DoorDash require?

Is DoorDash considered rideshare for insurance?

What happens if I get in an accident while DoorDashing?

Will my insurance go up if I drive for DoorDash?

Can I write off my car insurance if I DoorDash?

What disqualifies you from doing DoorDash?

Does DoorDash pay for gas?

Do I need to tell my insurance company that I deliver for DoorDash?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.